Life insurance proceeds can be a crucial financial resource for beneficiaries, but their impact on Medicaid eligibility is a complex issue. When an individual passes away, their life insurance payout can significantly affect their estate and, consequently, their Medicaid status. Medicaid is a needs-based program, and the rules surrounding the inclusion of life insurance benefits in income calculations can vary. Understanding these nuances is essential for beneficiaries to navigate the complexities of estate planning and ensure they receive the necessary healthcare support without inadvertently losing Medicaid benefits. This paragraph sets the stage for a detailed exploration of the relationship between life insurance proceeds and Medicaid eligibility.

| Characteristics | Values |

|---|---|

| Life Insurance Proceeds and Medicaid | Life insurance proceeds are generally not considered income for Medicaid purposes. |

| Exempt Status | Proceeds from a life insurance policy are typically exempt from being counted as income when determining Medicaid eligibility. |

| Exception for Large Payouts | However, if the life insurance payout exceeds a certain threshold, it may be considered an asset and could affect Medicaid eligibility. |

| Asset Limits | Medicaid has strict asset limits, and large life insurance payouts might push an individual over these limits, potentially disqualifying them for benefits. |

| State Variations | The rules regarding life insurance proceeds and Medicaid can vary by state, so it's important to check local regulations. |

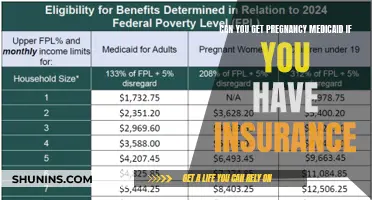

| Income Thresholds | Medicaid income limits vary by state and family size, and life insurance proceeds are often exempt from these calculations. |

| Impact on Benefits | The proceeds from a life insurance policy are usually not used to determine the amount of Medicaid benefits received. |

| Planning Considerations | Individuals should consider their life insurance policies and Medicaid eligibility to ensure they receive the necessary healthcare coverage. |

What You'll Learn

- Tax Implications: Life insurance payouts are generally not considered taxable income

- Medicaid Rules: Proceeds may affect Medicaid eligibility, especially if the policyholder is a beneficiary

- Exempt Assets: In some states, life insurance can be exempt from asset consideration for Medicaid

- Payout Options: Single-sum or periodic payments can impact Medicaid qualification

- State Variations: Medicaid rules vary by state, affecting the treatment of life insurance proceeds

Tax Implications: Life insurance payouts are generally not considered taxable income

Life insurance proceeds can be a crucial financial resource for beneficiaries, but understanding their tax implications is essential, especially when considering their impact on Medicaid eligibility. When it comes to taxation, life insurance payouts are generally not considered taxable income, which means they are not subject to income tax. This is a significant advantage for policyholders and their beneficiaries, as it provides a tax-free source of financial support.

The reason life insurance payments are exempt from taxation is rooted in the nature of the policy itself. Life insurance is designed to provide financial security to beneficiaries upon the insured individual's death. The proceeds from the policy are typically paid out as a lump sum or in regular installments, and this amount is intended to cover various expenses, such as funeral costs, outstanding debts, and living expenses for the beneficiaries. Since the funds are intended for these specific purposes, they are not treated as general income, which is subject to taxation.

This tax exemption has important implications for Medicaid eligibility, a government-funded healthcare program for individuals with limited income and resources. Medicaid has strict income and asset limits to determine eligibility, and understanding how life insurance proceeds fit into these criteria is crucial. In most cases, life insurance payouts are not considered countable income for Medicaid purposes, which means they do not directly impact a beneficiary's eligibility for the program. This is because the funds are typically used for non-income-producing purposes, such as funeral expenses or long-term care, which are not factored into the Medicaid income assessment.

However, it's important to note that there are some exceptions and considerations. If the life insurance policy is owned by a trust or an entity other than the insured individual, the proceeds may be subject to different tax treatments. Additionally, if the policy has a cash value component, the accumulation of cash value may be considered an asset and could impact Medicaid eligibility. It is always advisable to consult with a tax professional or financial advisor to fully understand the tax implications and how they may affect Medicaid status.

In summary, life insurance payouts are generally not taxable, providing a valuable financial resource for beneficiaries without the worry of income tax consequences. This aspect of life insurance is particularly relevant when considering Medicaid eligibility, as it ensures that the proceeds can be utilized for essential expenses without directly impacting one's eligibility for healthcare assistance.

Village Medical at Walgreens: Unlocking Insurance Coverage

You may want to see also

Medicaid Rules: Proceeds may affect Medicaid eligibility, especially if the policyholder is a beneficiary

When it comes to Medicaid eligibility, the proceeds from a life insurance policy can play a significant role, especially if the policyholder is a beneficiary. Medicaid is a federal and state-funded program designed to assist individuals with limited income and resources in accessing healthcare services. One of the key factors in determining eligibility is the assessment of an individual's assets and income.

Life insurance proceeds, upon receipt, can be considered an asset and may impact a person's eligibility for Medicaid. The rules surrounding this are specific and can vary depending on the state. In general, if the policyholder is the beneficiary of a life insurance policy, the proceeds received upon their passing could potentially be counted as an asset for Medicaid purposes. This is because the insurance payout is typically considered a form of financial resource that could be used to support the beneficiary's financial needs.

The impact of life insurance proceeds on Medicaid eligibility is crucial to understand, especially for those who are planning their long-term care or have recently experienced a significant life event, such as the passing of a loved one. If the policyholder was receiving regular payments from the life insurance policy, these payments might be considered income and could affect the individual's eligibility for Medicaid. However, it's important to note that the rules can be complex and may vary based on the state's specific guidelines.

For example, in some states, if the life insurance policy was owned by the deceased individual, the proceeds may be exempt from consideration as an asset if certain conditions are met. These conditions often include the policy being owned for a specific period, the beneficiary's relationship to the policyholder, and the amount of the proceeds. On the other hand, if the policy was owned by the beneficiary, the proceeds may be subject to a higher scrutiny, and the state's rules regarding asset and income limits will apply.

Understanding these Medicaid rules is essential for individuals and their families to make informed decisions regarding their healthcare and financial planning. It is advisable to consult with a legal or financial advisor who specializes in Medicaid eligibility to ensure compliance with the specific regulations in your state. They can provide tailored guidance based on your unique circumstances, helping you navigate the complexities of Medicaid eligibility and the impact of life insurance proceeds.

Medical Insurance vs. Health Insurance: Understanding the Difference

You may want to see also

Exempt Assets: In some states, life insurance can be exempt from asset consideration for Medicaid

In certain states, life insurance proceeds can be considered exempt assets when determining eligibility for Medicaid, a federal and state-funded health care program for low-income individuals. This means that the value of the life insurance policy, upon payout, may not be counted as a resource or asset in the individual's estate, potentially helping them qualify for Medicaid benefits. The specific rules regarding exempt assets vary by state, and it's essential to understand these nuances to ensure proper planning and eligibility.

The concept of exempt assets is crucial in Medicaid eligibility because it allows individuals to protect certain resources while still meeting the income and asset requirements. Life insurance can be a valuable tool in this context, especially for those who have recently purchased a policy or are considering doing so. By understanding the rules, individuals can make informed decisions about their life insurance policies and their overall financial planning.

For instance, in some states, life insurance proceeds may be exempt if the policy was owned by the individual for a certain period, such as two years. This means that if the individual passes away within that timeframe, the proceeds would not be considered an asset in their estate, thus not affecting their Medicaid eligibility. Additionally, the amount of the policy may also play a role, as larger policies might have different treatment under the law.

It's important to note that the rules surrounding exempt assets and life insurance can be complex and may change over time. Therefore, consulting with a legal or financial professional who specializes in Medicaid planning is advisable. They can provide personalized guidance based on the individual's specific circumstances and help navigate the often-confusing world of healthcare and financial planning.

Understanding the nuances of exempt assets, including life insurance, is a critical step in ensuring that individuals can access the healthcare they need without losing their assets or facing financial hardship. With proper planning and knowledge, individuals can make the most of their life insurance policies while maintaining their eligibility for essential Medicaid benefits.

Vision Care Coverage: Uncovering Insurance Options for Eye Health

You may want to see also

Payout Options: Single-sum or periodic payments can impact Medicaid qualification

When a life insurance policyholder passes away, the beneficiary receives a payout, which can significantly impact their financial situation, especially in relation to Medicaid eligibility. The payout options available can either help or hinder one's chances of qualifying for Medicaid, a federal and state-funded program that provides healthcare coverage to low-income individuals. Understanding the different payout structures is crucial for beneficiaries to make informed decisions.

The two primary payout options are a single-sum payment and periodic payments. A single-sum payment is a lump sum, which is a one-time, full payout of the policy's death benefit. This option provides a substantial amount of money to the beneficiary, which can be a double-edged sword. On the positive side, it offers immediate financial support, allowing the beneficiary to cover immediate expenses and plan for the future. However, this large influx of cash can also make it challenging to qualify for Medicaid. Medicaid eligibility is primarily based on income and assets, and a single-sum payment can significantly increase a person's financial resources, potentially pushing them over the income threshold.

In contrast, periodic payments, also known as an annuity, provide a series of regular payments over a defined period. This option is often more manageable for beneficiaries as it spreads out the financial impact. Each payment is typically smaller, making it easier to budget and plan. Moreover, the structured nature of periodic payments can be advantageous for Medicaid qualification. By receiving a series of smaller payments, the beneficiary's overall financial resources may be perceived as less substantial, potentially keeping them within the income limits set by Medicaid.

The key difference in impact on Medicaid qualification lies in how the payout is structured. A single-sum payment can lead to a temporary increase in income and assets, which may disqualify an individual for Medicaid, especially if they have no other sources of income. On the other hand, periodic payments can provide a more consistent and manageable financial stream, reducing the likelihood of exceeding Medicaid's income limits. It is essential for beneficiaries to carefully consider their financial situation and future needs when choosing a payout option, as this decision can significantly affect their long-term healthcare coverage and financial stability.

In summary, the choice between a single-sum and periodic payment can have a substantial impact on Medicaid qualification. While a single-sum payment may provide immediate financial relief, it can also complicate eligibility for Medicaid. Conversely, periodic payments offer a more gradual financial impact, potentially preserving Medicaid eligibility. Beneficiaries should seek professional advice to understand how different payout options align with their financial goals and Medicaid qualification requirements.

Chlamydia Treatment: Affordable Options Without Insurance

You may want to see also

State Variations: Medicaid rules vary by state, affecting the treatment of life insurance proceeds

Medicaid eligibility rules are complex and can vary significantly from one state to another, particularly when it comes to the treatment of life insurance proceeds. The rules governing how these proceeds are considered in the Medicaid application process can have a substantial impact on an individual's financial situation and their ability to qualify for this essential healthcare program.

In some states, life insurance payments made to the deceased's beneficiaries are treated as a resource and can affect Medicaid eligibility. For instance, if a policyholder named a beneficiary as the sole recipient of the policy, the proceeds may be considered an asset of that beneficiary, potentially impacting their financial status and Medicaid eligibility. However, certain states have specific provisions that allow for the exclusion of life insurance benefits from the calculation of income and resources for Medicaid purposes. These states recognize the value of life insurance as a safety net and an essential financial tool, especially for those with limited financial means.

On the other hand, other states have more stringent rules, where life insurance proceeds are considered income and can significantly reduce an individual's eligibility for Medicaid. This means that the entire amount of the life insurance payout may be counted as income, potentially disqualifying the recipient from receiving Medicaid benefits. These states often have strict guidelines to prevent individuals from manipulating their financial situation to gain eligibility for Medicaid.

The variability in state laws highlights the importance of understanding the specific rules in one's state. For instance, in some states, the amount of life insurance proceeds that can be excluded from the Medicaid application process is limited, while in others, the entire policy value may be exempt. Additionally, the timing of the payout can also play a role; some states consider proceeds received within a certain period as exempt, while others may require the policy to be owned for a specific duration before the proceeds are excluded from the eligibility calculation.

Navigating these state-specific variations can be challenging, and individuals should seek guidance from their state's Medicaid agency or a qualified financial advisor to understand how life insurance proceeds will be treated in their particular jurisdiction. This ensures that individuals can make informed decisions about their insurance policies and financial planning while also maintaining their eligibility for necessary healthcare assistance.

Unveiling the Mystery: What Medical Records Do Insurance Companies Access?

You may want to see also

Frequently asked questions

Life insurance proceeds are generally not considered income for Medicaid purposes. Medicaid guidelines typically do not require the reporting of life insurance benefits as income, as they are often intended to provide financial support to the beneficiary upon the insured individual's death. However, there might be specific state regulations, so it's advisable to check with your state's Medicaid office for any unique requirements.

Yes, in some cases, life insurance proceeds can be considered an asset by Medicaid. If the policyholder or the beneficiary is receiving the proceeds, it may impact the eligibility for Medicaid benefits. The amount and duration of the proceeds can be factors in determining eligibility. It's important to consult with a financial advisor or Medicaid specialist to understand how these proceeds might affect your Medicaid status.

Yes, there are exceptions. For instance, if the life insurance policy was owned by the insured individual and the beneficiary is not a spouse or dependent, the proceeds might be considered an asset. Additionally, if the policy has a cash value or the proceeds are substantial, it could impact Medicaid eligibility. It's crucial to review the specific circumstances and seek professional advice to navigate these complexities.