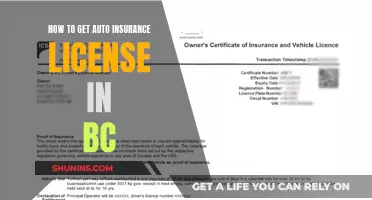

If you're renting a truck, it's important to know whether your existing auto insurance policy will cover you or if you need to purchase a separate rental truck insurance policy. ICBC offers rental vehicle coverage that includes Third-Party Liability, Enhanced Accident Benefits, Underinsured Motorist Protection, Collision, Comprehensive, and Loss of Use coverages. This coverage is available for vehicles rented in Canada and the USA, with a daily rental rate of up to $300 CDN per day in Canada and $250 USD per day in the USA. You can also purchase ICBC's Rental Vehicle coverage separately for $10 per day. It's important to note that there may be some limits to the cost and type of vehicle that the ICBC Rental Vehicle policy applies to, so it's recommended to check with your Autoplan broker or review the Autoplan Insurance brochures before renting a vehicle.

| Characteristics | Values |

|---|---|

| Type of coverage | Third-Party Liability, Enhanced Accident Benefits, Underinsured Motorist Protection, Collision, Comprehensive, Loss of Use |

| Cost | $10 per day |

| Maximum daily rental rate covered | $300 CDN per day in Canada, $250 USD per day in the USA |

| Additional packages | RoadStar, Roadside Plus |

| Substitute transportation | Substitute vehicle, reimbursement for taxi or public transportation fares |

What You'll Learn

ICBC's Rental Vehicle Coverage

This coverage is good for Canada and the USA. It costs $10 per day and is included in the ICBC RoadStar and Roadside Plus packages. Before renting a vehicle, it's recommended that you contact your rental company to ensure they'll accept the Autoplan Rental Vehicle Policy. Most companies do, but some may ask for a larger deposit if you don't buy their coverage. They may also want proof of your Autoplan coverage.

If your vehicle is being repaired and you need a rental vehicle, you may qualify for reimbursement of rental costs. Talk to your claims representative about how to arrange this.

Auto Insurance: Is It Tax Deductible?

You may want to see also

RoadStar and Roadside Plus packages

ICBC's RoadStar and Roadside Plus packages are two of the company's most popular coverage packages, offering valuable protection at home and while travelling. The two packages are often confused with each other due to their similar-sounding names and coverages. However, there are some key differences to note.

RoadStar Package

RoadStar is the less expensive option between the two but still offers extensive coverage. It includes:

- Vehicle travel protection: Covers alternate transportation costs if your vehicle is unusable due to an accident, theft, vandalism, or other covered perils. The coverage limit is up to $100 per day, up to $500 total for most vehicles, with higher coverage for motorhomes.

- Rental Vehicle Coverage: Provides protection for rented or courtesy vehicles, including third-party liability, collision, comprehensive, underinsured motorist protection, and loss of use coverage. The coverage is available in Canada and the USA and applies to established rental companies.

- Third-Party Liability: Up to $1,000,000 per occurrence.

- Collision Coverage: With a $300 deductible.

- Comprehensive Coverage: With a $200 windshield deductible and a $300 deductible for other damages.

- Underinsured Motorist Protection: Up to $1,000,000 per person.

- Loss of Use Coverage: For a rental vehicle, this provides $25 per day, up to a maximum of $250.

- Lost income coverage for the rental company if the vehicle is unusable due to a collision or comprehensive claim.

- Lock Re-Keying Coverage: Reimburses up to $500 for lock re-keying costs if your keys are stolen.

Roadside Plus Package

Roadside Plus offers higher coverage limits and includes everything covered by RoadStar, plus some additional benefits:

- Loss of Use Coverage: The daily limit remains the same, but the maximum coverage amount is higher at $750.

- Third-Party Liability on Rental Vehicles: Roadside Plus doubles the coverage limit to $2,000,000.

- Lock Re-Keying Expenses: This package offers twice the coverage limit ($1,000) compared to RoadStar.

- Travel and Accommodation Expenses: Roadside Plus provides double the coverage for these expenses compared to RoadStar.

- Emergency Roadside Expense: Covers up to $50, twice a year, for incidents like locking your keys in your car, flat tires, or a dead battery. It covers labour costs but not parts.

- Theft Deductible Waiver: If your vehicle is stolen or shows signs of an attempted theft, your deductible will be waived.

- Family Worldwide Transportation: Covers travel and living expenses for immediate family members to join you at a hospital if you sustain life-threatening injuries in a crash.

- Destination Assistance: Provides up to $100 to make alternative arrangements if you can't use your vehicle due to a collision, theft, or vandalism.

Both packages offer significant benefits, and the choice depends on individual needs and preferences. It's important to review the specific details and eligibility requirements of each package to determine which one suits your circumstances best.

Canceling a USAA Auto Insurance Claim

You may want to see also

Loss of Use coverage

To be eligible for Loss of Use coverage, you also need to have Collision, Comprehensive, or Specified Perils coverage. You can also get Loss of Use coverage as part of the RoadStar or Roadside Plus packages, which include other popular coverages. The amount paid for rental vehicles is limited to vehicles of a similar size to your own, and you are reimbursed up to your total purchased Loss of Use limit. If a daily Loss of Use limit applies, any amount over this limit will need to be paid to the rental company.

Drivers under 21 may not be eligible to rent a vehicle from most rental companies, but Loss of Use coverage will still cover expenses for taxis or public transit. It is recommended that you speak with an Autoplan Broker about the benefits of Loss of Use coverage and how it might apply to your specific situation.

ICBC's Rental Vehicle coverage includes Loss of Use coverage and is valid in Canada and the USA. This coverage is available for eligible rental vehicles with a daily rental rate of up to $300 CDN per day in Canada and $250 USD per day in the USA. It can be purchased separately for $10 per day or as part of the ICBC RoadStar or Roadside Plus packages.

Launching Your Own Auto Insurance Company

You may want to see also

Third-Party Liability

- Non-vehicle property damage

- Injury costs and vehicle damage caused to the other driver(s) and/or passengers while driving outside of British Columbia in jurisdictions where the law permits the other driver to sue

- Damage to the contents inside the other driver's vehicle

It's important to note that the costs of a crash can often exceed $200,000, and you may be responsible for paying the difference. In such cases, ICBC offers Extended Third-Party Liability coverage, which increases your protection up to a limit of $5 million. This optional coverage can provide additional peace of mind and reduce your financial risk if you're found responsible for a crash.

ICBC's Rental Vehicle coverage can be purchased separately for $10 per day, or it may already be included in your ICBC RoadStar or Roadside Plus package. This coverage includes Third-Party Liability, as well as Enhanced Accident Benefits, Underinsured Motorist Protection, Collision, Comprehensive, and Loss of Use.

Liberty Mutual Auto and Home Insurance: The Benefits of Bundling

You may want to see also

Enhanced Accident Benefits

ICBC's Rental Vehicle Coverage includes Enhanced Accident Benefits. This means that all British Columbians injured in a crash on or after May 1, 2021, will have access to the medical care and treatment needed to recover, regardless of who is responsible for the crash. This includes early access treatments, which are available within the first 12 weeks following a crash.

ICBC works with a wide range of healthcare providers, disability advocates, and other stakeholders to ensure the value and effectiveness of the care and recovery available under Enhanced Accident Benefits. The benefits include funding for evidence-based treatments that are reasonable, necessary, and medically advisable, as well as support for seamless and timely access to care. The level of intervention and involvement is customized to meet the unique needs of each customer.

In addition, ICBC's Enhanced Accident Benefits also cover expenses related to activities of daily living, such as performing yard work, community outings, and transfers requiring two or more people or a patient lift. Transportation, lodging, and meal expenses incurred while receiving medical treatment are also covered.

It is important to note that there may be some limits and exclusions to the Enhanced Accident Benefits, and customers should refer to the ICBC website or their Autoplan broker for more detailed information.

Auto Liability Insurance: Protecting Passengers, Too

You may want to see also

Frequently asked questions

Your ICBC auto insurance may cover rental vehicles, but it depends on the type of insurance you have. ICBC's RoadStar and Roadside Plus packages include rental vehicle coverage for eligible rental vehicles where the daily rental rate is up to $300 CDN per day in Canada and $250 USD per day in the USA. You can also purchase ICBC's Rental Vehicle coverage separately for $10 per day.

ICBC's Rental Vehicle coverage includes Third-Party Liability, Enhanced Accident Benefits, Underinsured Motorist Protection, Collision, Comprehensive, and Loss of Use. It covers rental vehicles in both Canada and the USA.

No, you have options when it comes to rental car insurance. You can purchase rental car insurance through ICBC or your broker, which is often more affordable than what the rental company offers.

Before booking a rental vehicle, ask your Autoplan broker what coverage you have. You may be surprised to learn that you're already covered through your existing ICBC car insurance policy or extension/private auto insurance options.

If your vehicle is being repaired and you have Loss of Use coverage, you may be entitled to rent a substitute vehicle or be reimbursed for taking taxis or public transportation. This coverage is included in the RoadStar and Roadside Plus packages.