In British Columbia, all vehicles are required by law to have a basic level of car insurance, known as Basic Autoplan. ICBC (Insurance Corporation of British Columbia) offers commercial insurance for fleets, non-fleet commercial vehicles, drivers of fleet or business vehicles, and insurance for peer-to-peer vehicle rentals. To obtain a driver's license in BC, individuals must go through the ICBC, which provides driver licensing, insurance, and claims services.

| Characteristics | Values |

|---|---|

| Basic Level of Insurance | Basic Autoplan |

| Additional Protection | BCAA Optional Car Insurance |

| Discounts | Drive less than 10,000 km per year |

| Discounts | Combine Home and Car Insurance |

| Renewal Options | Online |

| Renewal Options | By Phone |

| Renewal Options | In-Person |

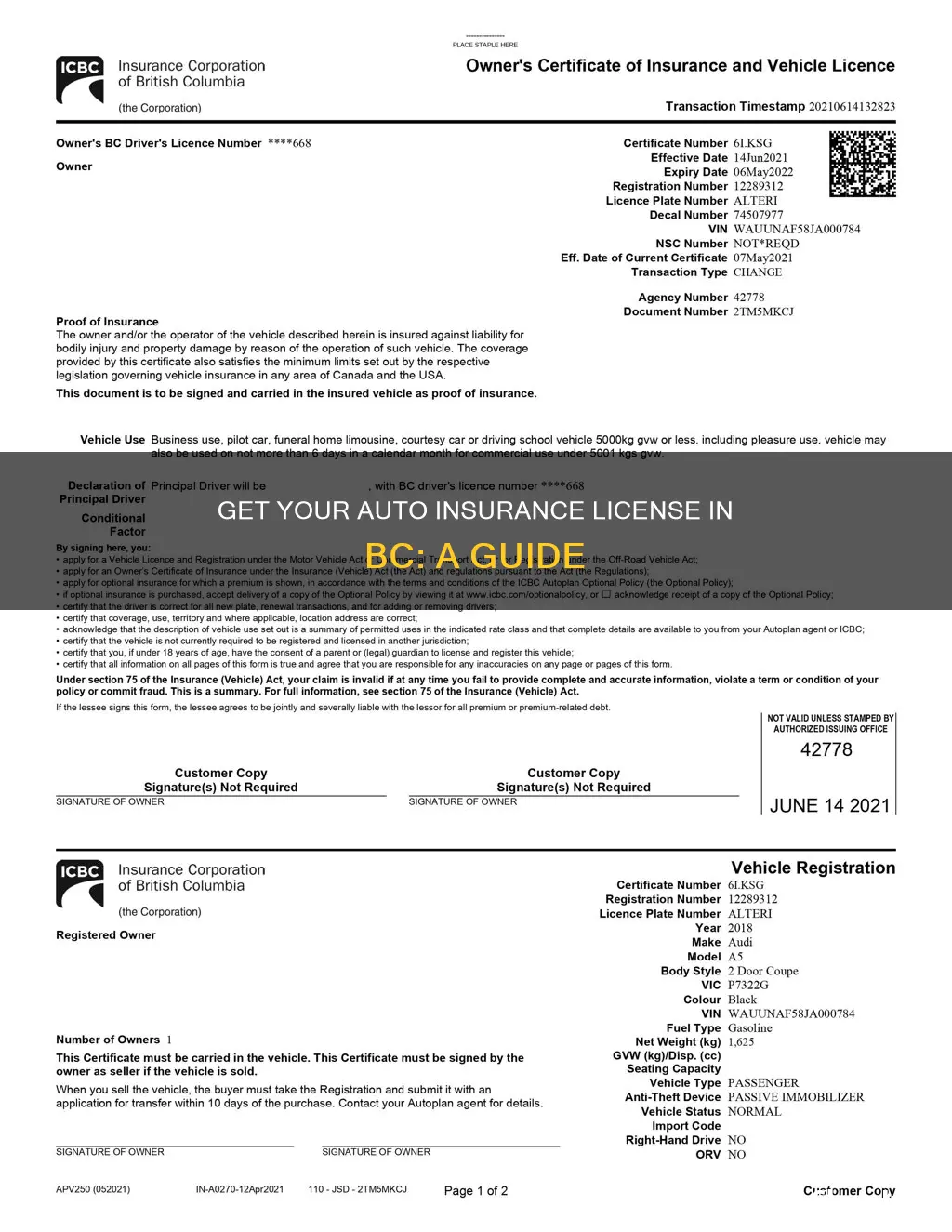

| Required Documents | Owner's Certificate of Insurance |

| Required Documents | Vehicle Registration |

| Required Documents | Commercial Vehicle Inspection Report |

| Required Documents | Vehicle Inspection Report |

| Required Documents | Secondary Manufacturer Label |

What You'll Learn

Basic Autoplan insurance

In British Columbia, all vehicles are required by law to have a basic level of car insurance, known as Basic Autoplan. This insurance is provided by the Insurance Corporation of British Columbia (ICBC). Basic Autoplan insurance is mandatory coverage for any vehicle owner in the province. It offers a basic level of protection for those who own and drive a motor vehicle in British Columbia.

Basic Vehicle Damage coverage is also included in your Basic Autoplan insurance. This covers repairs to your vehicle up to $200,000 when the other driver is responsible. If your vehicle is worth more than $200,000, you can discuss additional coverage options with your Autoplan broker. If you are at fault for a crash and want coverage for repairs to your vehicle, you will need to add Collision coverage as an optional extra to your Basic Autoplan policy.

Insurance Claims: Can They Be Undone?

You may want to see also

ICBC insurance renewal

If you're eligible for online renewal, you can log in using the BC Services Card app on your mobile device or your online banking credentials through the Interac® verification service. After logging in, confirm your coverage and policy details, update your information, and pay for your policy. Finally, print your insurance documents, which you are required to keep in your vehicle at all times.

If you prefer to renew your ICBC insurance in person, you can visit any Autoplan broker's office in British Columbia. For renewal over the phone, contact any Autoplan broker, and they will guide you through the process.

Before renewing your ICBC insurance, it is recommended to gather the necessary information, including your renewal reminder, insurance documents, and the birth date and B.C. driver's license number of any additional drivers you plan to add to your policy. Additionally, if you are seeking a usage-based discount, you will need your vehicle's odometer reading.

It is important to note that outstanding debts or fines with ICBC or the provincial government, including provincial violation tickets, penalty point premiums, and Autoplan debt, must be paid before renewing your ICBC insurance.

The Rich and Auto Insurance: Playing by Different Rules?

You may want to see also

Driving licence types

In British Columbia, there are different types of driver's licenses for different vehicles. Here is a breakdown of the various license classes and what they allow you to drive:

Class 1 License

A Class 1 driver's license permits you to operate any motor vehicle or combination of motor vehicles, except for motorcycles. The minimum age to obtain this license is 19. With a Class 1 license, you can drive:

- Any motor vehicle or combination of vehicles

- Excluding motorcycles

Class 2 License

A Class 2 driver's license allows you to operate a range of vehicles, including:

- Special activity buses or special vehicles

- Any combination of vehicles where the towed vehicles exceed 4,600 kg, provided they don't have air brakes

- Any motor vehicle or combination of vehicles that requires a Class 4 license

- All vehicles in Class 4 and 5

Class 3 License

A Class 3 driver's license enables you to operate:

- A mobile truck crane

- A tow car and its recovered vehicle

- All vehicles in Class 5

- Motor vehicles with three or more axles, except for buses used for their intended purpose

- Combinations of vehicles where the towed vehicles do not exceed 4,600 kg, or exceed 4,600 kg without air brakes

Class 4 License

With a Class 4 license, you can operate:

- All vehicles in Class 5

- Ambulances, taxis, and special activity buses

- Buses with a seating capacity of up to 25 people, including the driver

- Limousines, ride-hailing services, and special vehicles for people with disabilities

Class 5 License

The Class 5 license is the most common type and allows you to drive:

- Cars, vans, trucks, construction vehicles, and utility vehicles (up to 2 axles)

- Motorhomes (may exceed 2 axles)

- Trailers or vehicles up to 4,600 kg

- Limited-speed motorcycles, mopeds, and all-terrain vehicles (ATVs)

- Three-wheeled vehicles, excluding three-wheeled motorcycles and motorcycle/sidecar combinations

Class 6 and 8 Licenses

A Class 6 or 8 license permits the operation of:

- All-terrain vehicles (ATVs)

- Motorcycles, all-terrain cycles, and similar vehicles

Class 7 License

Similar to a Class 5 license, a Class 7 license allows you to operate:

- Two-axled motor vehicles, except for special activity buses and ambulances

- Motorhomes, even those with more than two axles

- Limited-speed motorcycles, mopeds, and all-terrain vehicles

- Two-axled vehicles with towed vehicles up to 4,600 kg

Professional License Classes

License Classes 1-4 are considered professional and are required for operating vehicles such as buses, taxis, and large trucks.

Navy Federal Auto Insurance: What You Need to Know

You may want to see also

Vehicle registration

To register a vehicle in British Columbia, you must first register it with ICBC. This serves as the official record of your vehicle and identifies you as its owner. The process and documents required vary depending on where the vehicle is currently registered.

If you are buying a vehicle that is already registered to another person or company in BC, you must go to your local Autoplan broker to complete the transfer of ownership and update the registration.

If you are bringing a vehicle to BC from another province or territory, you will, in most cases, need the following:

- The vehicle's current registration

- The Certificate of Title (if your vehicle is from Nova Scotia)

- A "passed" vehicle inspection report from a designated inspection facility in BC

- Required ID

- A signed and dated bill of sale (if the vehicle is not registered in your name)

Take these documents to an Autoplan broker to register, license, and insure the vehicle.

If you are bringing a vehicle to BC from Alberta, Saskatchewan, or Manitoba, it may be exempt from the BC pre-registration safety inspection under the New West Partnership Trade Agreement. The vehicle must be:

- 3,500 kg or less

- Four years old or less (current year inclusive) or five years old or more and have passed a provincial vehicle safety inspection in the previous jurisdiction within the last 90 days

- Owned by a new or returning resident of BC

- Registered in the previous jurisdiction by the same owner(s) making the application in BC

If you are bringing a vehicle to BC from outside Canada, you can register, license, and insure it at an Autoplan broker after you have imported the vehicle.

There are some cases in which vehicle registration is not required. The BC Motor Vehicle Act allows for the following exemptions:

- Out-of-province motor vehicles and utility trailers used for touring purposes for up to six months

- Out-of-province motor vehicles and utility trailers (except for commercial vehicles) used for non-touring purposes

- Students or members of the armed forces (an exemption permit is still required)

Auto Insurance Brokers: How Much Do They Earn?

You may want to see also

Mandatory insurance coverage

In British Columbia, all vehicles are required by law to have a basic level of car insurance, known as Basic Autoplan. This insurance is provided by the Insurance Corporation of British Columbia (ICBC). Basic Autoplan insurance includes up to $200,000 of Basic Vehicle Damage coverage, $200,000 in Third-Party Liability, up to $1 million in Underinsured Motorist Protection, and Inverse Liability Protection.

Basic Vehicle Damage coverage provides up to $200,000 in repairs when the other driver is responsible for the accident. If your vehicle is worth over $200,000, you can talk to your Autoplan broker about additional coverage options. If you are at fault for the crash and do not have Collision coverage, you will be responsible for the repair costs. Third-Party Liability coverage provides protection in the event that you are sued by another driver. This coverage is particularly important if you are driving outside of the province or in situations where local laws do not allow you to claim against the person who caused the crash.

Underinsured Motorist Protection (UMP) provides coverage for you and members of your household in the rare event that you are injured in an accident but are not entitled to Enhanced Accident Benefits, and the responsible driver does not have sufficient insurance to cover the damages. Inverse Liability Protection is similar and covers you in parts of Canada or the US where local laws do not allow you to claim against the person who caused the crash.

In addition to the mandatory Basic Autoplan insurance, there are several optional coverage types available to provide additional protection for your vehicle and situation. These include Unlisted Driver Protection, Extended Third-Party Liability, Loss of Use coverage, Rental Vehicle Coverage, and New Vehicle Protection.

Strategies to Negotiate a Fair Auto Insurance Claim Settlement

You may want to see also