Navigating the complexities of driver insurance can be challenging, especially when it comes to understanding the nuances of no-fault coverage. In this context, many drivers wonder if New Mexico (NM) offers no-fault driver insurance, a policy that covers damages and medical expenses regardless of who is at fault in an accident. This introduction aims to shed light on the availability and implications of such insurance in NM, providing essential insights for drivers seeking comprehensive protection.

What You'll Learn

- Insurance Requirements: New Mexico's driver's license rules and insurance mandates

- No-Fault Coverage: Understanding no-fault insurance and its benefits in New Mexico

- Claims Process: Steps to file a claim under no-fault insurance in NM

- Coverage Limits: New Mexico's limits on no-fault insurance coverage

- Cost Factors: Factors affecting the cost of no-fault insurance in New Mexico

Insurance Requirements: New Mexico's driver's license rules and insurance mandates

New Mexico, like many states, has specific insurance requirements for drivers to obtain and maintain a valid driver's license. Understanding these rules is crucial for all drivers in the state to ensure compliance and avoid legal issues. Here's an overview of the insurance requirements and the no-fault insurance system in New Mexico:

Insurance Coverage Mandates: New Mexico law mandates that all drivers must carry a minimum level of liability insurance. The state requires a minimum of $25,000 for bodily injury coverage per person and $50,000 for bodily injury coverage per accident. Additionally, $10,000 of property damage coverage is also mandated. These requirements ensure that drivers can financially protect themselves and others in the event of an accident. It's important to note that these are the minimum standards, and drivers are encouraged to carry higher coverage limits to better protect themselves financially.

No-Fault Insurance in New Mexico: New Mexico operates under a modified no-fault insurance system. This means that regardless of who is at fault in an accident, each driver's insurance company will pay for their own medical expenses and a portion of their lost wages up to the policy limits. The no-fault system aims to streamline the claims process and reduce the number of lawsuits arising from minor accidents. However, it's important to understand that there are exceptions to this rule. If the injuries sustained are considered severe, the injured party may still have the right to sue the at-fault driver for additional compensation.

Obtaining a driver's license in New Mexico requires proof of financial responsibility, which is typically demonstrated by providing evidence of auto insurance coverage. When applying for a license, drivers must submit an SR-22 form, which is a certificate of insurance. This form confirms that the driver has the required liability coverage. The SR-22 is typically required for a period of three years and can be obtained from the insurance company or through a licensed insurance agent.

Drivers in New Mexico should also be aware of the penalties for driving without insurance. Operating a vehicle without the mandated insurance coverage can result in fines, license suspension, and even arrest. It is essential to maintain valid insurance to avoid these legal consequences.

In summary, New Mexico's driver's license rules include strict insurance requirements to ensure financial responsibility on the roads. The state's no-fault insurance system provides coverage for medical expenses and lost wages, with some exceptions for severe injuries. Drivers must obtain and maintain the necessary insurance coverage to operate legally on New Mexico's roads.

Auto Insurance Policy Changes: Where and How to Modify Options

You may want to see also

No-Fault Coverage: Understanding no-fault insurance and its benefits in New Mexico

New Mexico, like many other states, has implemented a no-fault insurance system, which can be a bit confusing for drivers who are not familiar with the concept. No-fault insurance is a type of coverage that focuses on the financial responsibility of the insurance company towards its policyholders, regardless of who is at fault in an accident. This system aims to streamline the claims process and provide financial protection to drivers and their passengers after a collision, regardless of who caused the accident.

In New Mexico, the no-fault insurance system is mandated by state law, which means that all drivers are required to carry this type of coverage. The primary purpose is to ensure that medical expenses and other related costs are covered promptly, reducing the financial burden on individuals involved in accidents. This system is particularly beneficial in situations where multiple parties are involved in a minor collision, as it prevents lengthy disputes over fault and facilitates quicker compensation.

Under no-fault insurance, policyholders can file claims for certain expenses, including medical bills, lost wages, and rehabilitation costs, up to a specified limit. This coverage kicks in regardless of who is at fault, making it a safety net for drivers and their families. For instance, if you are involved in a minor fender-bender with another driver, you can file a claim with your insurance company to cover your medical expenses and any related costs, even if the other driver was at fault.

One of the key benefits of no-fault insurance in New Mexico is the protection it offers to drivers in minor accidents. Since the system focuses on providing financial assistance to policyholders, it encourages drivers to seek medical attention promptly after an accident, even if they believe they are not at fault. This can lead to better health outcomes and faster recovery, as timely medical care is essential.

Additionally, no-fault insurance can help reduce the overall cost of insurance premiums in New Mexico. With the no-fault system, insurance companies can offer competitive rates as the risk of major financial losses due to fault disputes is minimized. This benefit extends to all drivers in the state, making no-fault insurance a valuable component of New Mexico's auto insurance landscape. Understanding this coverage is crucial for drivers to ensure they are adequately protected and can navigate the claims process with confidence.

Auto Insurance Costs in West Virginia: What to Expect

You may want to see also

Claims Process: Steps to file a claim under no-fault insurance in NM

New Mexico, like many other states, operates under a no-fault insurance system for auto accidents. This means that regardless of who is at fault in an accident, each driver's insurance company is responsible for covering their policyholder's damages and injuries up to the policy limits. Understanding the claims process is crucial for New Mexico drivers to ensure they receive the compensation they are entitled to after an accident. Here's a step-by-step guide on how to file a claim under no-fault insurance in New Mexico:

- Report the Accident: After an accident, it is essential to report it to your insurance company promptly. New Mexico law requires drivers to report accidents to their insurance carrier within a specific timeframe, usually within 10 days. Contact your insurance provider and provide them with details about the accident, including the date, time, location, and a description of the events. They will guide you through the next steps and may ask for additional information.

- Document and Gather Evidence: Proper documentation is critical in no-fault insurance claims. Take photos of the accident scene, including vehicle damage, road conditions, and any relevant signs or markers. Obtain contact information from other drivers involved, witnesses, and law enforcement officers who responded to the scene. Gather medical records and bills related to any injuries sustained. Keep all receipts and documentation organized to support your claim.

- Notify the Insurance Company: Your insurance company will assign a claims adjuster to handle your case. Provide the adjuster with all the necessary documentation and evidence. They will investigate the accident, assess the damages, and determine the coverage available under your policy. Be transparent and cooperative during the process, as this will help expedite the claims settlement.

- File a Claim: Once the investigation is complete, your insurance company will provide you with a claim form or guide you through the online process. Fill out the claim form accurately, providing all the requested information. Include details about the accident, damages, and any losses incurred. Submit the claim along with all supporting documents. Your insurance provider will review the claim and, if approved, initiate the payment process.

- Receive Compensation: Under no-fault insurance, you are typically entitled to compensation for medical expenses, lost wages, and property damage. The insurance company will process your claim and disburse the payments according to the terms of your policy. This may include direct payments to medical providers, wage replacement, and repairs or replacements for damaged property. Keep track of all payments received and ensure they align with your policy coverage.

- Appeal if Necessary: If you disagree with the insurance company's decision or feel that your claim was unfairly denied, you have the right to appeal. New Mexico's insurance regulations provide a process for appealing denied claims. Gather additional evidence or documentation to support your case and submit an appeal within the specified timeframe. An appeals process may involve a review by an independent arbitrator or a hearing before an insurance regulatory body.

Remember, each insurance company may have slightly different procedures, so it's essential to follow their specific instructions. No-fault insurance claims can be complex, and seeking guidance from your insurance provider or a legal professional can ensure that your rights are protected throughout the process.

The High Cost of Driving: Cannabis Legalization and Auto Insurance Rates

You may want to see also

Coverage Limits: New Mexico's limits on no-fault insurance coverage

New Mexico, like many other states, offers no-fault insurance coverage, which is designed to simplify the claims process after an accident. This type of insurance covers medical expenses and lost wages for the policyholder and their passengers, regardless of who was at fault in the accident. However, it's important to understand the coverage limits set by the state to ensure you have adequate protection.

In New Mexico, the no-fault insurance coverage limits are set by the state's financial responsibility laws. The state requires all drivers to carry a minimum level of coverage, which includes personal injury protection (PIP) and medical payments coverage. The PIP coverage typically covers medical expenses, lost wages, and other related expenses for the policyholder and their family members. The medical payments coverage, on the other hand, covers the medical expenses of anyone involved in the accident, including the at-fault driver, up to a certain limit.

The minimum coverage limits in New Mexico are as follows:

- Personal Injury Protection (PIP): $10,000 per person and $20,000 per accident.

- Medical Payments Coverage: $10,000 per accident.

It's worth noting that these limits are relatively low compared to other states. Many insurance experts recommend carrying higher coverage limits to ensure adequate protection. For instance, you might consider increasing the PIP and medical payments coverage to at least $50,000 per person and $100,000 per accident. This higher coverage can provide more financial security in case of a serious accident, especially if multiple people are injured.

Additionally, New Mexico allows for the stacking of coverage limits. This means that if you have multiple policies or vehicles, you can combine the coverage limits to provide a higher overall protection. For example, if you have two policies with $50,000 PIP limits each, you can stack them to have a total of $100,000 in PIP coverage.

Understanding the coverage limits is crucial when choosing a no-fault insurance policy in New Mexico. It ensures that you have the necessary financial protection in case of an accident. Always review your policy and consider consulting with an insurance agent to determine the best coverage options for your specific needs.

Auto Insurance: Your Driving Data and Privacy

You may want to see also

Cost Factors: Factors affecting the cost of no-fault insurance in New Mexico

New Mexico, like many other states, operates under a no-fault insurance system, which means that regardless of who is at fault in an accident, each driver's insurance policy will cover their own medical expenses and vehicle repairs. This system is designed to streamline the claims process and reduce the financial burden on individuals involved in accidents. However, the cost of no-fault insurance can vary significantly, and understanding the factors that influence these costs is essential for drivers in New Mexico.

Several key elements contribute to the overall cost of no-fault insurance in the state. Firstly, the driver's age and driving record play a crucial role. Insurance companies often consider the statistical likelihood of accidents based on age and driving history. Younger drivers, especially those in their teens and early twenties, typically face higher premiums due to their lack of experience and higher risk profiles. Conversely, drivers with a clean record and a history of safe driving may enjoy lower insurance rates.

The type of vehicle insured is another significant factor. Insurance providers assess the risk associated with different car models and their safety features. Vehicles with advanced safety systems, such as collision avoidance technologies, lane-keeping assist, and adaptive cruise control, may result in lower insurance costs. Additionally, the vehicle's value and usage also matter. Sports cars or luxury vehicles might be more expensive to insure due to their higher replacement costs and potential for increased theft.

The amount of coverage chosen by the driver directly impacts the premium. No-fault insurance policies offer various coverage options, including personal injury protection (PIP) and property damage liability (PDL). PIP covers medical expenses and lost wages for the policyholder and their passengers, while PDL covers damage to other people's property. Opting for higher coverage limits or adding additional coverage options will generally increase the insurance cost.

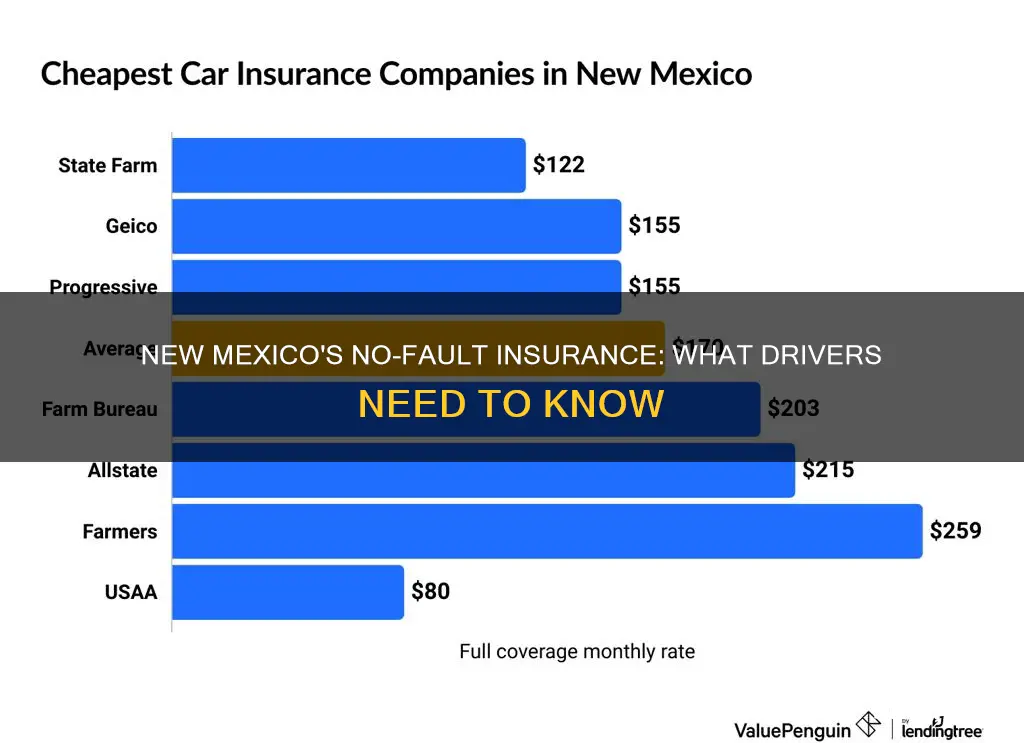

Lastly, the insurance company's pricing strategies and market competition in New Mexico also influence the cost of no-fault insurance. Different insurance providers may use varying risk assessment methods and set their rates accordingly. It is advisable for drivers to shop around and compare quotes from multiple insurers to find the best rates that suit their needs and budget. Understanding these cost factors can help New Mexico drivers make informed decisions when selecting and managing their no-fault insurance coverage.

Auto Insurance Appraisers: Their Role and Responsibilities Explained

You may want to see also

Frequently asked questions

No-fault insurance is a type of coverage that pays for medical expenses and lost wages regardless of who is at fault in an accident. It ensures that policyholders can receive compensation for their injuries and financial losses without the need to prove fault.

Yes, New Mexico has a no-fault insurance system, which means that all drivers are required to carry personal injury protection (PIP) coverage. This coverage provides medical benefits and wage loss compensation to the policyholder and their family members, regardless of who is at fault in an accident.

In a no-fault state like New Mexico, if you are involved in an accident, your insurance company will typically cover your medical expenses and lost wages up to the policy limits. You don't need to file a claim against the at-fault driver's insurance, although you can choose to do so for additional compensation.

While New Mexico mandates no-fault insurance, you have the option to choose a standard auto insurance policy that includes liability coverage. This allows you to file a claim against the at-fault driver's insurance, which can provide more comprehensive coverage for property damage and bodily injury. However, you must also carry the required no-fault PIP coverage as a minimum.