Private mortgage insurance (PMI) is a type of insurance that you may be required to purchase if you take out a conventional loan with a down payment of less than 20% of the purchase price. It is designed to protect the lender, not the borrower, in the event that the borrower stops making loan payments. PMI does not protect against foreclosure; if the borrower falls behind on mortgage payments, they can still lose their home. However, PMI companies may offer additional services such as partial claim advances and job loss insurance coverage, which can help prevent foreclosure under certain circumstances.

| Characteristics | Values |

|---|---|

| Who does it protect? | The lender, not the borrower |

| What does it protect against? | Loss caused by borrowers failing to make loan payments |

| Who arranges it? | The lender |

| Who provides it? | Private insurance companies |

| When is it required? | When a borrower's down payment is less than 20% |

| Can it be avoided? | Yes, by putting 20% or more down on a mortgage loan |

| Can it be cancelled? | Yes, once the borrower's equity reaches 20% |

| How is it paid? | Monthly premium, upfront premium paid at closing, or a combination of both |

| How much does it cost? | Between 0.22% and 2.25% of the total amount of the mortgage, depending on credit score |

What You'll Learn

Private mortgage insurance (PMI) does not protect against foreclosure

Private mortgage insurance (PMI) is a type of insurance that you may be required to purchase if you take out a conventional loan with a down payment of less than 20% of the purchase price. PMI is arranged by the lender and provided by private insurance companies. It is important to note that PMI protects the lender, not the borrower, in the event that the borrower stops making loan payments.

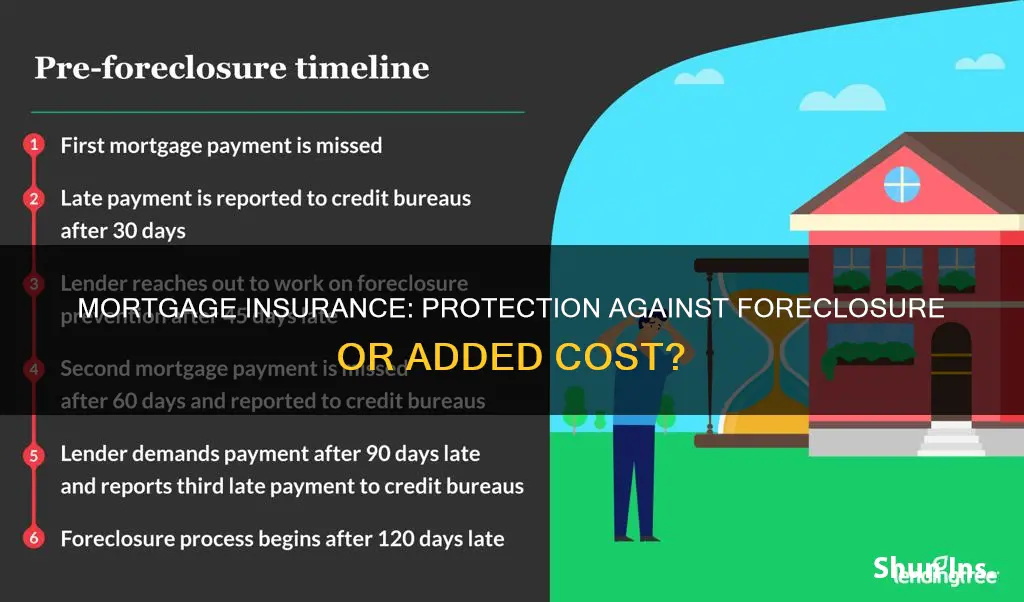

While PMI can help borrowers qualify for a loan they may not otherwise be eligible for, it does not protect them against foreclosure. If a borrower with PMI falls behind on their mortgage payments, they can still lose their home through foreclosure. In this case, PMI will reimburse the lender for any losses incurred during the foreclosure sale if the sale does not cover the full amount owed on the mortgage.

It is worth noting that PMI companies may offer additional benefits, such as partial claim advances and job loss insurance coverage. A partial claim advance allows the PMI company to cover missed payments and stop foreclosure, thereby minimizing its losses. Some PMI providers also offer job loss protection, covering mortgage payments for a limited time if the borrower loses their job.

In summary, while PMI provides valuable protection for lenders, it does not shield borrowers from foreclosure. Borrowers who find themselves unable to make mortgage payments may want to explore other options, such as mortgage protection insurance (MPI), which offers coverage in the event of job loss, disability, or death.

How Pharmacy Gag Clauses Profit Private Insurers

You may want to see also

PMI is designed to protect the lender, not the borrower

Private mortgage insurance (PMI) is a type of insurance that you may be required to purchase if you take out a conventional loan with a down payment of less than 20% of the purchase price. It is designed to protect the lender, not the borrower. PMI reimburses the lender if the borrower defaults on their loan and the house isn't worth enough to repay the debt in full through a foreclosure sale.

PMI does not protect the borrower from foreclosure or a decrease in their credit score if they fall behind on mortgage payments. It also has nothing to do with job loss, disability, or death, and it won't pay the mortgage if one of these things happens to the borrower. The borrower must continue to pay for PMI until they have accumulated enough equity in the home, which is usually 20%.

PMI can help borrowers qualify for a loan that they might not otherwise be able to get, but it increases the cost of the loan. The cost of PMI typically ranges from 0.5% to 2% of the loan balance per year but can be as high as 6%. The cost depends on several factors, including the borrower's credit score, the size of the down payment, the loan type, and the loan term.

There are a few types of PMI, so it is essential to understand your options before purchasing this type of insurance. The four main types of PMI include borrower-paid mortgage insurance, single-premium mortgage insurance, lender-paid mortgage insurance, and split-premium mortgage insurance.

United Healthcare: Private Insurance or Public Option?

You may want to see also

PMI is required for down payments of less than 20%

Private mortgage insurance (PMI) is a type of insurance that you will likely be required to purchase if you take out a conventional loan with a down payment of less than 20% of the purchase price. PMI is arranged by the lender and provided by private insurance companies, and it insures the lender against losses caused by borrowers failing to make loan payments. It's important to note that PMI protects the lender, not the borrower, and if you fall behind on your mortgage payments, you can still lose your home through foreclosure.

PMI is typically required when the down payment on a home is less than 20% because it lowers the risk to the lender of making a loan to the borrower. With a smaller down payment, the lender may be taking on more risk, and PMI helps mitigate that risk by providing protection against losses if the borrower defaults on the loan.

The cost of PMI can vary but usually ranges from 0.22% to 2.25% of the total mortgage amount, depending on the borrower's credit score. A higher credit score can result in a lower PMI payment, while a lower credit score can lead to a higher PMI cost.

While PMI can increase the cost of your loan, it also has some benefits. For example, it can help you qualify for a loan that you might not otherwise be able to obtain. Additionally, some PMI companies offer additional services such as partial claim advances and job loss insurance coverage, which can provide financial assistance if you experience job loss or other temporary difficulties in making your mortgage payments.

It's worth noting that PMI is different from mortgage protection insurance (MPI), which covers your mortgage payments if you lose your job, become disabled, or pass away. MPI is not required but can be purchased voluntarily to provide additional financial protection for homeowners.

Universal Healthcare and Private Insurance: A Global Perspective

You may want to see also

PMI can be paid monthly or as a lump sum

Private mortgage insurance (PMI) is a type of insurance that is required for borrowers who take out a conventional loan with a down payment of less than 20% of the purchase price. It protects the lender in the event that the borrower stops making payments and the proceeds from the foreclosure and sale of the property are insufficient to cover the outstanding loan.

PMI can be paid in a few different ways, including monthly or as a lump sum. Here are the details of each:

Monthly PMI

The most common type of PMI is borrower-paid monthly PMI (BPMI), often referred to simply as "PMI". The premium is added to the borrower's monthly mortgage payment and can be cancelled once the loan principal drops to 78% of the home's value, or when the borrower reaches 22% equity in their home. This type of PMI might be suitable for those who are unsure about how long they plan to stay in the home or keep the mortgage.

Lender-Paid PMI (LPMI)

With LPMI, the lender covers the cost of the borrower's mortgage insurance by raising their mortgage rate. As a result, the borrower ends up with a higher interest rate on their loan. LPMI might be a good option for those planning to stay in the home or keep the mortgage for at least five to ten years, as it typically takes 11 years to build enough equity to cancel a borrower-paid PMI policy. It's important to note that LPMI cannot be cancelled.

Single Premium PMI

Single premium PMI allows the homeowner to pay the entire mortgage insurance premium upfront in a lump sum, eliminating the need for monthly PMI payments. This option results in a lower monthly payment compared to paying PMI monthly, which can help the buyer qualify for a higher loan amount. However, the risk is that if the homeowner decides to refinance or sell the home within a few years, they may lose the upfront payment or end up with a higher loan amount because of it.

Split Premium PMI

Split premium PMI is the least common type, where the homeowner pays a portion of the insurance in a lump sum at closing and the remaining amount in monthly installments. This option can be useful for those who have extra cash but are above the typical 43% debt-to-income ratio maximum. By making a partial upfront payment, they can bring down their monthly payment enough to qualify for the loan.

Humana: Understanding Private Insurance and Its Benefits

You may want to see also

PMI can be avoided through lender-paid PMI or a piggyback mortgage

Private mortgage insurance (PMI) is a type of insurance that protects the lender in the event of a foreclosure. It is required when the down payment on a home is less than 20% of the purchase price. While PMI can increase the cost of your loan, it also makes it easier to qualify for a loan.

PMI can be avoided through lender-paid PMI (LPMI) or a piggyback mortgage. LPMI involves including the cost of PMI in the mortgage interest rate, resulting in a higher interest rate for the life of the loan. Although this technically avoids PMI, it has the same effect of increasing monthly payments. With a piggyback mortgage, a second mortgage or home equity loan is taken out simultaneously with the first mortgage, allowing the borrower to make a lower down payment without triggering the PMI requirement. However, interest charges will apply to the secondary loan, and both loans use the house as collateral.

It is important to carefully consider the benefits and drawbacks of different loan options before making a decision. While PMI can increase costs, it may be necessary to qualify for a loan. LPMI avoids PMI but increases interest rates, while a piggyback mortgage may result in higher overall costs if the secondary loan cannot be paid off quickly.

Understanding Primary Insurance: Medi-Cal vs Private Insurance

You may want to see also

Frequently asked questions

No, private mortgage insurance (PMI) does not protect against foreclosure. It protects the lender, not the borrower, in the event that the borrower stops making payments.

Private mortgage insurance is a type of insurance that you may be required to buy if you take out a conventional loan with a down payment of less than 20% of the purchase price. It insures the lender against loss caused by borrowers failing to make loan payments.

The annual cost of PMI usually ranges from 0.22% to 2.25% of the total amount of your mortgage, depending on your credit score. For example, if your FICO score is higher than 740, your PMI payment on a $300,000 mortgage will likely be about $660 a year, or $55 a month.

The most common way to pay for PMI is through a monthly premium which is added to your mortgage payment. Sometimes, you can also pay with a one-time upfront premium paid at closing, or through a combination of upfront and monthly payments.

You can avoid paying for PMI by making a down payment of 20% or more when taking out a mortgage loan. Alternatively, you can seek out a government home loan that doesn't charge PMI, such as a loan from the Federal Housing Administration (FHA), U.S. Department of Agriculture (USDA), or Department of Veterans Affairs (VA).