Progressive car insurance rates can change monthly, but this is not always the case. Progressive gives customers the option of paying monthly or in full, with a discount offered for paying the six-month policy upfront. Progressive rates can change due to various factors, including age, location, driving record, vehicle type, and usage. The company also takes into account acquisition and operation costs when determining rates.

Progressive is the second-largest auto insurer in the United States, with a market share of over 14%. While it may not be the cheapest option for most drivers, Progressive offers a range of discounts and the Snapshot® program, which personalizes rates based on driving habits.

| Characteristics | Values |

|---|---|

| Average monthly cost | $79.83 to $157.27 for a liability-only policy |

| Factors affecting cost | Age, location, driving record, vehicle usage, accidents, vehicle type, etc. |

| Discounts | Multi-policy, multi-car, teen driver, good student, sign online, paperless, pay-in-full, automatic payments |

| Payment options | Credit card, PayPal, online check, personal check, money order, electronic funds transfer (EFT) |

| Payment frequency | Monthly or in full |

What You'll Learn

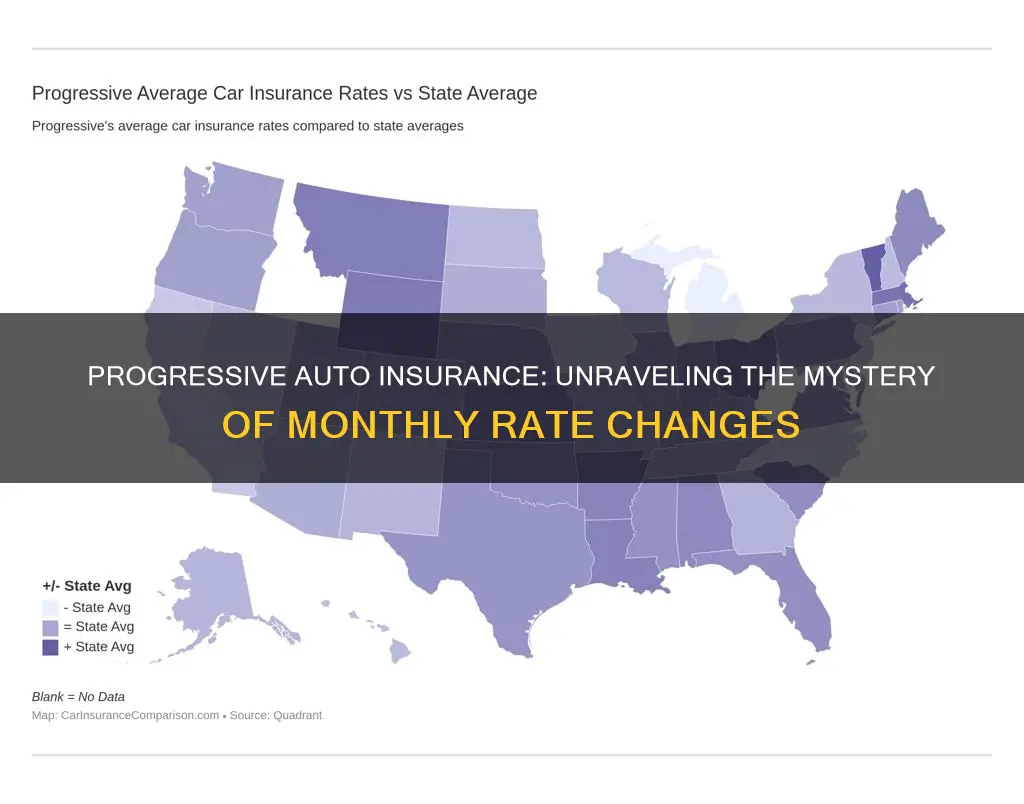

Progressive's rates for auto insurance vary by state

Progressive's auto insurance rates vary by state, and the company offers a range of discounts to help lower car insurance rates. The average cost of car insurance with Progressive ranges from $79.83 to $157.27 per month for a liability-only policy. The cost depends on several factors, including age, location, driving record, vehicle usage, and accidents.

Progressive has different rates for different states, which can be categorized into low-cost, medium-cost, and high-cost states. Low-cost states have an average cost of $79.83 per month, while medium-cost states have an average cost of $105.36 per month. High-cost states have an average cost of $157.27 per month.

Progressive also offers various discounts that can help lower car insurance rates. These include:

- Multi-policy discount: Customers can save an average of 5% by bundling auto insurance with homeowners, renters, or other types of insurance.

- Multi-car discount: This discount of 12% on average is for customers with more than one car listed on their policy.

- Teen driver discount: Progressive offers a discount for drivers under 18 who have been consistently covered for 12 months or more.

- Good student discount: Students with a B average or above can get an average discount of up to 10%.

- Sign online discount: Signing documents online can save customers an average of 9%.

- Paperless discount: Customers can save more by going paperless in addition to signing online.

- Pay-in-full discount: Progressive offers a discount for those who pay their full premium upfront.

- Automatic payments discount: Setting up automatic payments can lead to a discount.

Progressive's Snapshot® program also personalizes car insurance rates based on driving habits. Safe drivers can save an average of $156 by completing the program.

Overall, Progressive's auto insurance rates vary by state, and the company offers a range of discounts to help customers save on their car insurance.

Your Roommate's Auto Insurance: Can You Borrow It?

You may want to see also

Progressive's rates are influenced by age

Progressive's rates are influenced by several factors, and age is one of the most significant determinants of auto insurance premiums. The company's data shows that younger drivers tend to have higher insurance rates, which decrease as the driver ages. This is because younger and less experienced drivers are statistically more likely to be involved in accidents or engage in risky driving behaviours. Progressive's average premium per driver decreases significantly from ages 19 to 34 and then stabilises or slightly decreases from ages 34 to 75.

The impact of age on insurance rates is not limited to younger drivers. Progressive's data also indicates that insurance rates may increase for older drivers, even those with excellent driving records. This is due to physical, cognitive, or visual impairments that can affect driving ability and increase the risk of accidents among seniors. However, seniors often spend less time on the road, and safe driving habits can lead to savings through Progressive's Snapshot program, which personalises rates based on driving habits.

In addition to age, other factors that influence Progressive's insurance rates include location, driving record, vehicle type, and usage. Location plays a crucial role, as drivers in highly populated areas with higher risks of car theft, vandalism, and accidents tend to pay more for comprehensive coverage. Driving records are also important, as accidents, traffic violations, and claims can lead to higher rates. The type and usage of the vehicle are considered, with more expensive and newer vehicles typically costing more to insure due to higher repair and replacement costs.

Progressive offers various discounts to help offset insurance costs, including multi-policy, multi-car, teen driver, and good student discounts. Additionally, the company's Snapshot program rewards safe driving habits with discounted premiums. While Progressive's rates are influenced by age, the company strives to provide affordable coverage by taking into account multiple factors and offering a range of discounts.

Understanding Vehicle Insurance Surcharges

You may want to see also

Progressive's rates are influenced by gender

Progressive's rates are influenced by a variety of factors, including age, location, driving record, vehicle type, and more. One factor that also influences Progressive's rates is gender. While Progressive does not disclose the specific impact of gender on their rates, industry data and studies provide insight into how gender affects car insurance premiums.

In most states, gender plays a significant role in determining auto insurance rates, with males paying significantly more during their teenage and young adult years. The difference in rates between genders is particularly pronounced among young and inexperienced drivers. This gender disparity tends to decrease as drivers get older, and by the age of 30, rates for males and females become more aligned.

Statistically, male drivers are considered higher-risk than female drivers, which is reflected in their insurance rates. Male drivers are generally more likely to be involved in accidents, receive tickets, be arrested for DUI, and drive more expensive vehicles. As a result, insurance companies, including Progressive, may charge higher rates for male drivers, especially those who are younger.

It is worth noting that not all states allow gender to be considered when setting insurance rates. California, Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania prohibit insurers from using gender as a factor in calculating premiums. In these states, gender-based pricing is not a consideration for Progressive or any other insurance provider.

While gender is one factor that influences Progressive's rates, it is important to remember that it is just one of many factors that contribute to the overall rate determination. Driving history, age, location, vehicle type, and other factors also play a significant role in determining insurance rates.

Age: A Factor in Auto Insurance Premiums

You may want to see also

Progressive's rates are influenced by marital status

Progressive's rates are influenced by several factors, one of which is marital status. In general, married drivers tend to receive lower insurance rates than single drivers. This is because statistical analysis shows that married people have a lower risk of getting into accidents or filing insurance claims. Historical data also indicates that married couples tend to file fewer claims than single people.

Married couples are also more likely to be homeowners, which is another factor insurance providers use to calculate car insurance rates. Additionally, married couples tend to have better credit scores and multiple insurance policies, which can lead to savings through bundling.

It's important to note that Progressive's rates are also influenced by other factors such as age, location, driving record, vehicle type, and usage. These factors, along with marital status, are considered by Progressive to determine an individual's car insurance rate.

Vehicle Insurance: A Necessary Evil?

You may want to see also

Progressive's rates are influenced by vehicle type

Progressive's insurance rates are influenced by several factors, one of which is the vehicle type. The make and model of your car can affect your insurance rate based on how often that make is involved in insurance claims, how much it costs to repair or replace, and the safety features it has. For example, an expensive car model with lower safety ratings and higher repair costs will generally have a higher insurance rate, especially for comprehensive and collision coverage.

Cars with higher trim levels can also lead to higher rates as they tend to be more expensive to repair than cars with lower trim levels. Additionally, certain makes and models are known to cause more damage than other vehicles, resulting in higher insurance rates.

On the other hand, vehicles with great safety ratings, lower repair costs, and fewer insurance claims may have lower insurance rates. For instance, the Subaru Ascent, Subaru Forester, and Honda Passport are among the car models that may be less expensive to insure compared to the average.

It's important to note that Progressive considers various factors when determining insurance rates, and the vehicle type is just one aspect. Other factors include age, location, driving record, vehicle usage, and more.

LLC Auto Insurance: Owner Reimbursement?

You may want to see also

Frequently asked questions

Yes, Progressive auto insurance offers customers the option to pay monthly or in full, depending on what best fits their budget. Progressive also offers a discount for customers who pay their six-month policy upfront.

Progressive auto insurance costs vary depending on the person, vehicle, and coverage level. The average cost of car insurance ranges from $79.83 to $157.27 per month for a liability-only policy. Progressive is rarely the cheapest option for most drivers.

Progressive determines auto insurance rates based on several factors, including age, location, driving record, vehicle type, and usage. They also consider acquisition and operation costs.