When it comes to determining auto insurance rates, South Carolina considers a variety of factors, including age, gender, driving record, vehicle type, and credit score. The state also requires drivers to carry uninsured motorist coverage, which can increase insurance costs.

South Carolina's car insurance laws mandate that drivers carry a minimum amount of car insurance, including specific limits for bodily liability and property damage coverage. The average cost of car insurance in South Carolina is $1,812 per year for full coverage and $590 per year for minimum coverage. These rates are lower than the national average.

Various factors can impact car insurance rates in South Carolina. For example, younger and teen drivers tend to pay higher premiums than older, more experienced drivers. Additionally, drivers with a clean driving record may qualify for lower rates, while those with speeding tickets, accidents, or DUIs on their record may see their insurance rates increase.

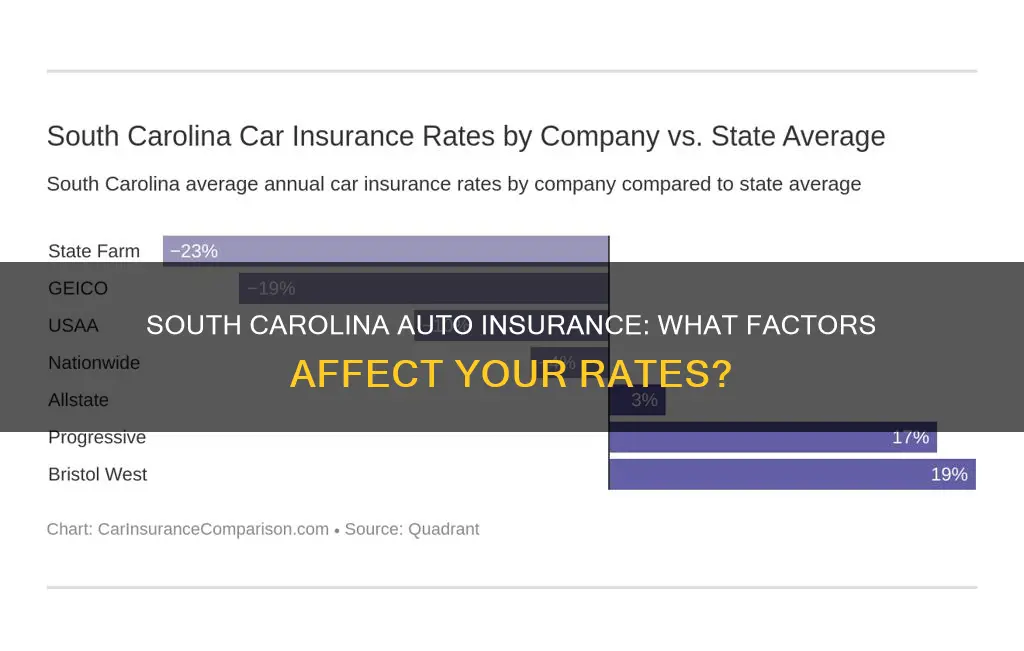

When shopping for car insurance in South Carolina, it is recommended to compare quotes from multiple providers, as rates can vary significantly between companies. Some of the cheapest car insurance companies in the state include USAA, Auto-Owners Insurance, and Geico.

What You'll Learn

Minimum coverage

In South Carolina, drivers are legally required to have minimum coverage auto insurance. The state-mandated minimum coverages are:

- $25,000 for bodily injury liability per person

- $50,000 for bodily injury liability per accident

- $25,000 for property damage liability per accident

- $25,000 uninsured motorist bodily injury per person

- $50,000 uninsured motorist bodily injury per accident

The average cost of minimum coverage car insurance in South Carolina is $590 per year, or about $55 per month. The cheapest minimum coverage option is offered by American National P&C at $25 per month.

While South Carolina does not require drivers to carry collision or comprehensive insurance, lenders often require both if you are financing or leasing a vehicle. Collision or comprehensive insurance ensures that the vehicle will be repaired or replaced in the event of an accident, theft, or other damages not covered by liability insurance.

Does AARP Offer Home and Auto Insurance Bundling?

You may want to see also

Full coverage

In South Carolina, full coverage car insurance costs an average of $1,812 per year, or $151 per month. This is notably lower than the national average, which stands at $2,278 per year, or $190 per month.

The cost of full coverage car insurance in South Carolina will depend on several factors, including your age, driving record, credit score, and the make and model of your vehicle. For example, younger drivers tend to pay higher rates than older drivers, with 18-year-old males having the highest average premium at $5,827 per year for full coverage. Additionally, a DUI conviction in South Carolina can nearly double full-coverage premiums.

When shopping for full coverage car insurance in South Carolina, it is important to compare quotes from multiple insurance providers, as rates can vary significantly. Maintaining a clean driving record and a good credit score can also help lower your premiums.

Insured Vehicles in South Africa: How Many?

You may want to see also

Discounts

There are several discounts available for car insurance in South Carolina. Here are some of the most common ones:

Multi-Policy Discount

Bundling two or more insurance policies with the same company can often lead to a discount.

Multi-Vehicle Discount

Combining auto insurance policies or insuring multiple cars under the same policy can also result in savings.

Military Discount

This discount is applicable for active military members, veterans, and their families.

Senior Discount

Senior citizens over the age of 55 often qualify for discounts on their car insurance.

Homeowner Discount

If you own a home, you may be eligible for a discount on your car insurance.

Good Student Discount

Students in high school or college who maintain good grades (usually a B average or a GPA of 3.0 or higher) can often receive a discount.

Good Driver Discount

Drivers with a clean driving record, free of accidents, DUIs, or speeding tickets, are often rewarded with lower rates.

Defensive Driving Course Discount

Completing a defensive driving course can lead to a discount on your car insurance.

Driver Training Discount

Taking a driver education course can result in a discount, especially for younger drivers.

Accident-Free Discount

If you have been accident-free for a certain period (usually three years), you may be eligible for a discount.

Low Mileage Discount

Some insurance companies offer discounts for drivers who don't drive many miles annually.

Paperless Discount

Opting for paperless billing and digital documents can sometimes lead to a small discount.

Pay-in-Full Discount

Paying your insurance premium in full upfront rather than in instalments may result in a discount.

New Car Discount

Insuring a new car, typically three model years or newer, can often lead to a discount.

Safe Car Discount

Cars with advanced safety features and anti-theft technology may qualify for a discount.

Usage-Based Insurance Discount

Programs like Snapshot® and SmartRide® monitor your driving habits and can offer discounts for safe driving behaviour and low mileage.

Auto Insurance and Hurricanes: What You Need to Know

You may want to see also

High-risk drivers

In South Carolina, high-risk drivers are those with a history of traffic violations or at-fault accidents, DUI convictions, or those caught driving with a suspended or revoked license. Young or inexperienced drivers are also considered high-risk.

State Farm offers the best balance of price and customer service for high-risk drivers in South Carolina, with an average policy cost of $1,210 per year. This is only about 10% more than what drivers with clean records pay. GEICO is another good option, with an average annual cost of $1,453 for high-risk drivers.

For drivers with a DUI conviction, State Farm again offers the cheapest rates, with an average annual cost of $1,210. USAA is another good option for those with a DUI, but their policies are only available to military members and their families.

For teenage drivers, GEICO offers the cheapest rates, with an average annual cost of $2,830.

Nationwide is the cheapest option for drivers with bad credit, with an average annual cost of $1,645.

If you are unable to obtain insurance through the traditional market, you can apply for the South Carolina Commercial Automobile Insurance Plan (SCCAIP) through the Automobile Insurance Plan Service Office (AIPSO).

MetLife Auto Insurance: Understanding Their Roadside Assistance Offerings

You may want to see also

Average cost

The average cost of car insurance in South Carolina varies depending on the level of coverage, age, gender, driving record, and credit score. Here is an overview of the average costs:

Average Annual Cost of Car Insurance in South Carolina:

On average, car insurance in South Carolina costs $1,812 per year for full coverage and $590 per year for minimum coverage. These rates are lower than the national average, which is $2,278 for full coverage and $621 for minimum coverage.

The cost of car insurance in South Carolina also depends on the level of coverage. Here are the average annual and monthly costs for different coverage levels:

- Full coverage with a $1,000 deductible: $1,720 annually or $143 monthly

- Minimum coverage: $871 annually or $73 monthly

- Full coverage with a $500 deductible: $1,450 annually or $121 monthly

- Liability-only coverage: $1,248 annually or $104 monthly

Age is a significant factor in determining car insurance rates, with younger drivers often paying higher premiums. Here are the average annual costs for different age groups:

- Teens: $3,899 to add a 16-year-old male to a family policy, $6,524 for an individual policy

- 22-year-old: $1,070 for state minimum coverage, $2,078 for full coverage with a $1,000 deductible

- 25-year-old: $1,453 for females, $1,433 for males

- 35-year-old: $1,093

- 60-year-old: $1,003

Gender also plays a role in car insurance rates, with males typically paying higher premiums. Here are the average annual costs for male and female drivers:

- 17-year-old male: $6,126

- 17-year-old female: $5,535

- 25-year-old male: $2,262

- 25-year-old female: $2,179

Your driving record can significantly impact your car insurance rates. Here are the average annual costs for drivers with different records:

- Clean driving record: $1,720 for full coverage

- Speeding ticket: $2,202 for full coverage

- At-fault accident: $2,491 for full coverage

- DUI: $2,381 for full coverage

Your credit score can also affect your car insurance rates. Here are the average annual costs for drivers with different credit scores:

- Excellent credit: $1,034

- Poor credit: $2,174

Auto Insurance Payouts: To Accept or Not to Accept?

You may want to see also

Frequently asked questions

The average cost of car insurance in South Carolina is $1,812 per year for full coverage and $590 per year for minimum coverage.

Factors such as age, gender, driving record, credit score, vehicle type, and location can all impact car insurance rates in South Carolina.

According to various sources, Auto-Owners Insurance offers the cheapest car insurance rates in South Carolina, with an average annual premium of around $1,180.

Yes, it is illegal to drive without insurance in South Carolina. The state requires drivers to carry liability insurance and uninsured motorist coverage.

The average cost of car insurance in South Carolina is lower than the national average. South Carolina's rates are also slightly lower than its neighboring state, North Carolina, and significantly lower than Georgia.