Whether or not you have to accept an auto insurance payout depends on several factors, including the type of insurance claim you file, whether you own the car outright or are still paying for it, and the extent of the damage. If you caused the accident and file a liability claim, the insurance check will go to the other driver. However, if you file a collision claim, the insurance check will be made out to you and can be used for repairs. If your car is financed or leased, the insurance company will likely issue the check to both you and the lienholder, and you will be required to use the money for repairs. If you own your car outright and the repairs are purely cosmetic, you may have more flexibility in how you use the insurance payout.

| Characteristics | Values |

|---|---|

| Whether you have to accept an auto insurance payout | You don't have to accept an auto insurance payout, but you can contest the amount if you think it is too low |

| How to contest the amount | Research and prepare evidence, make a counteroffer, file a complaint if your counteroffer gets rejected, and file a lawsuit as a last resort |

| What to research | Maintenance and inspection records, vehicle costs or repair costs, your use of the vehicle |

| How to make a counteroffer | Prepare two numbers: the highest amount you want and the lowest you'll accept; always start with the highest amount |

| Who gets the claim check | Depends on the type of insurance claim filed and who caused the accident |

| What if the car is leased or financed by a lender | The insurance company will likely issue a check addressed to both you and the lienholder for car repairs |

| What if the car is fully paid for and in your name | You may be able to use the payout for other purposes |

What You'll Learn

If you own your car, you can accept the payout without repairing it

If you own your car outright, you can choose to accept the insurance payout without committing to repairing your vehicle. However, there are some important considerations to take into account before cashing the check.

Firstly, read the fine print in your insurance contract. Some insurance companies have partnerships with auto body repair shops and will pay them directly, bypassing you, the car owner. Secondly, if your car is leased or financed by a lender, the bank, financing company, or car dealership still owns part of your car. They will likely mandate that you list them on your auto insurance policy as a 'loss payee'. The insurance company will then issue the check to the loss payee alone or make it payable to both you and the lender. Lenders will usually require that the insurance claim check is used to fix your vehicle. If you cash the check without the leasing agency or lienholder's endorsement, this could be considered insurance fraud.

Even if your car is fully paid for and in your name, and your auto insurance policy contains no stipulations about how to use your claims check, it is still important to consider the impact of any unrepaired damage on the mechanical performance or safety of your car. For example, a fender bender could compromise your wheel assembly and ultimately undermine your front-end chassis. In these situations, your auto insurance company may question the legitimacy of a secondary claim if you have another accident. Additionally, any unrepaired damage will likely reduce the value of your car in future losses.

Fault and Insurance: Who's Liable?

You may want to see also

If you don't own your car, the payout will likely go to the lienholder

If you don't own your car outright, the insurance payout will likely go to the lienholder. This is because, in the case of a leased or financed vehicle, the bank, financing company or car dealership still technically owns part of your car. For this reason, they will probably mandate that you list them on your auto insurance policy as a 'loss payee'.

If your car is leased or financed by a lender, the insurance company will probably issue a check to the loss payee alone, or make the check payable to both you and the lender. The vast majority of lenders will require that the insurance claim check is used to fix your vehicle. If you cash the check without the endorsement of the leasing agency or lienholder, this could land you in legal trouble under theories of insurance fraud.

Even if the insurance claim check is made payable only to you, your car loan agreement would still mandate that you alert the lienholder about the accident and insurance payout.

If you bought a car from a private seller and are making payments, it's best to transfer the title to you and list the seller as a lienholder on the title. You can then buy your own auto insurance policy.

Florida: Selling Auto Insurance with a 440 License

You may want to see also

You can contest a low payout with evidence

If you believe that your insurance company has offered a low payout, you can contest it with solid evidence to support your claim. The first step is to check your insurance policy and research your car's value. You can obtain a free estimate of your car's value on websites such as Kelley Blue Book and the National Automobile Dealers Association.

Next, contact your insurance company to find out how they calculated the payout. There could be calculation errors that undervalue your car or repair costs. Ask them about any inaccuracies they may have about your vehicle and be prepared to provide supporting documentation. For example, maintenance and inspection records can show that your car has lower mileage or is in better condition than estimated.

Once you've gathered evidence, make a counteroffer to the insurance company. Clearly state why you believe the initial payout is too low, the amount you think is fair, and provide your reasoning. You can also hire an independent appraiser to estimate your car's value and help with your counteroffer.

If your counteroffer is rejected, you can file a complaint with your state's insurance commissioner. Provide as much evidence as possible to support your complaint. If you're still unsatisfied, you can consider mediation or filing a lawsuit as a last resort. However, keep in mind that filing a lawsuit can be costly and time-consuming, so it's recommended only if the payout covers your legal fees.

Truckless? Get Auto Insurance Anyway

You may want to see also

If your car is undrivable, you'll probably need to repair it

If your car is undrivable, you have a few options for what to do with it. You could have it towed to a repair shop, a tow yard, or your home. If you choose to have it towed to a repair shop, you will likely incur storage fees, which can add up quickly, especially if your car is totaled. In this case, you should contact your insurance company and let them know where the vehicle is so they can decide what to do. They may be able to move the vehicle to a yard where storage fees are less or even to their own yard.

If you choose to have your vehicle towed to your home, be aware that you may end up getting parking tickets if you don't have room to leave it parked off the street. If you live in an area with strict HOA rules on vehicles in the street or inoperable vehicles in your driveway, towing your vehicle to your home may not be feasible.

Another option is to call a junk car pickup service and let them buy the car from you. This can help cover any fees you may owe for towing or storage.

It's important to consider the financial implications of repairing or replacing your vehicle. If your car has suffered major damage, you will likely need to fix it sooner rather than later. Even if you use your insurance payout for something else, you will eventually have to make the repairs, so it might not make sense to delay. If your vehicle is unsafe to drive, it is wise to use your payout to fix the problem.

Additionally, consider that if you do not make repairs immediately, your vehicle may incur additional damage, which will likely not be covered by your insurance. If your vehicle is deemed a total loss, you will probably need to surrender it to your insurance company as a condition of your payout.

Paid-Off Cars: Cheaper Insurance?

You may want to see also

You can use the payout for non-car-related expenses

If you own your car outright, you can choose to not repair your vehicle and use the auto insurance payout for non-car-related expenses. However, there are some considerations to take into account before doing so. Firstly, read the fine print in your insurance contract, as some companies have partnerships with auto body repair shops and will pay them directly. Secondly, consider the extent of the damage to your car. If it is significant, you will likely need to fix it eventually, and driving with an unsafe vehicle can compromise your safety and that of others. In addition, if you do not make repairs immediately, your vehicle may incur additional damage that will not be covered by your insurance. Lastly, if your vehicle is deemed a total loss, you will probably have to give up your car to receive the payout.

If you are currently leasing your vehicle or still making payments on it, you will not be able to spend the insurance payout on non-car-related expenses as the lender will require that the money is used for repairs. Cashing the check without the endorsement of the leasing agency or lienholder could result in legal trouble under theories of insurance fraud. Even if the check is made out only to you, your car loan agreement will likely mandate that you inform the lien holder about the accident and insurance payout.

Protection Gaps: Understanding Insurance Blind Spots

You may want to see also

Frequently asked questions

No, you can contest the amount of your auto insurance payout if you believe the insurance company's offer is too low and you have solid evidence to support your claim. You can make a counteroffer to the insurance company, providing evidence such as maintenance and inspection records, comparable vehicle costs, and the impact on your daily life.

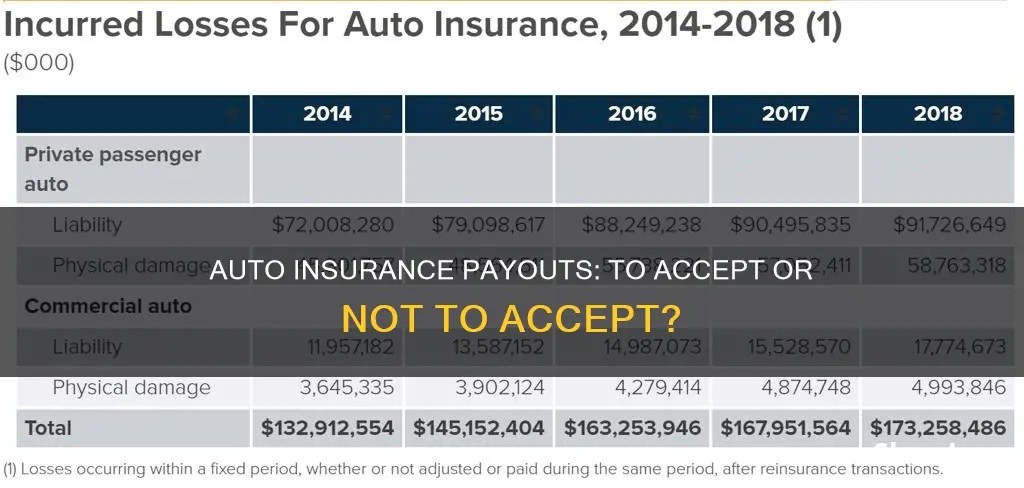

The amount of an auto insurance payout is based on the cost of repairs, the value of your vehicle, your coverage level, and your deductible. Insurance companies may send an appraiser to assess the damage or request repair quotes from pre-approved shops.

First, your payout claim must be approved by the insurance company, which can take around 30 days. Then, the insurance company will mail a check or set up a direct transfer to your bank account. Finally, if you disagree with the payment amount, you can negotiate with your insurer.

It depends on whether you own the car outright or have a loan or lease. If you own the car, you may be able to keep the payout and choose not to repair the vehicle, especially if the damage is purely cosmetic. However, if you have a loan or lease, the insurance company will likely issue a check addressed to both you and the lienholder, and the lienholder will require you to use the payout for repairs.