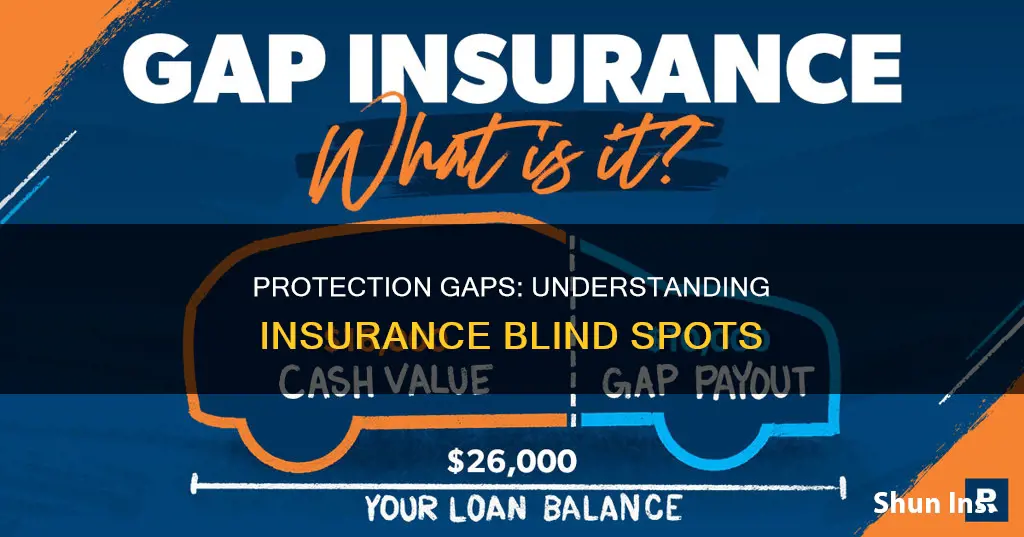

The insurance protection gap (IPG) is the difference between the resources you need and the resources you have available in the event of an unforeseen circumstance. In other words, it is the gap between the resources needed for your family to carry on without you and the resources they will have available if, for example, you pass away. This could refer to expenses, loans, and those of dependents, with available resources including savings and any existing coverage from insurance plans. Having a large protection gap indicates that you are seriously underinsured, which leaves you and your family vulnerable to the financial impact of unfortunate events such as death, disability, or critical illness. The protection gap can also refer to the difference between insured and uninsured losses in any given country, which shows how resilient societies and economies are to disasters.

| Characteristics | Values |

|---|---|

| Definition | The insurance protection gap is the difference between the resources you’ll need and the resources you have available in the event of an unfortunate event occurring. |

| Synonyms | Underinsured, uninsured losses |

| Calculation | Protection or resources needed – resources available = protection gap |

| Impact | A large protection gap leaves individuals and families vulnerable to the financial impact of unfortunate events such as death, disability or critical illness. |

| Example | If an individual has a $100,000 gap in the event they pass away, they can use this to guide them on how much life insurance to purchase – to close the gap, their sum assured should be at least $100,000. |

| Factors | Economic strength, changes in GDP and population, as well as risks such as climate change, cyber, pandemics or technological and behavioural developments. |

What You'll Learn

The protection gap is the difference between insured and uninsured losses

Determining the protection gap is essential for individuals and businesses to assess their financial preparedness for unforeseen events. It is calculated by subtracting the available resources, such as savings and existing insurance coverage, from the needed resources in the event of a loss. A large protection gap indicates underinsurance, leaving individuals and businesses vulnerable to financial strain in the face of disasters or personal tragedies like death, disability, or critical illness.

In the context of natural catastrophes, the protection gap affects the resilience of societies and economies. For example, in 2023, only 38% of global economic losses due to natural disasters were insured, leaving a significant gap that hindered financial recovery.

To address the protection gap, individuals can calculate their insurance needs and purchase additional coverage accordingly. Governments and insurance companies also play a crucial role in bridging the protection gap by developing affordable and accessible insurance solutions, especially for underserved populations and in the face of emerging risks like climate change and cyber threats.

The protection gap in insurance, therefore, highlights the disparity between optimal insurance coverage and actual coverage, with potential repercussions for financial stability, growth, and the quality of life of individuals, businesses, and entire countries.

Allstate Vehicle Service: Insurance or Contract?

You may want to see also

It describes a country's uninsured losses

The Insurance Protection Gap (IPG) is a term used to describe the difference between optimal insurance coverage and actual coverage in a given country. In other words, it represents the uninsured losses in a country. This gap is dynamic and influenced by various factors, including economic strength, changes in GDP and population, as well as risks such as climate change, cyber-attacks, pandemics, and technological and behavioural developments.

The IPG has significant implications for a country's financial stability, growth, and quality of life for its citizens. A large protection gap can hinder a country's ability to recover financially from disasters, as the lack of insurance coverage makes it more challenging for individuals and businesses to bounce back. This is particularly evident in the case of natural catastrophes, such as hurricanes, earthquakes, floods, and winter storms, which have become more frequent and intense due to climate change. These events can result in substantial economic losses, and a significant portion of them may be uninsured, leaving people and businesses vulnerable.

The protection gap is not limited to natural disasters but also extends to other risks. For example, in the context of climate change, the accumulation of assets, and the increasing population in high-risk areas, the impact of natural catastrophes is likely to continue growing. Additionally, the protection gap can be applied to the reinsurance arena, where there is a disparity between the demand for reinsurance capital and the actual supply. This is partly due to the concentration of a few large companies in the reinsurance industry, which lack the capacity to meet the extensive market demands, resulting in unfunded liabilities.

Closing the protection gap is crucial for enhancing societal and economic resilience in the face of disasters. This can be achieved by increasing the flow of capacity from the reinsurance arena to the consumer arena, introducing innovative solutions, and improving understanding and awareness of the risks associated with natural disasters. By addressing the protection gap, countries can improve their ability to recover from disasters and promote long-term financial stability and growth.

BECU: Gap Insurance Options

You may want to see also

It shows how resilient societies and economies are to disasters

The protection gap in insurance refers to the disparity between insured and uninsured losses. It is a dynamic metric that is influenced by various factors, including economic strength, GDP fluctuations, population changes, and risks such as climate change, cyber-attacks, pandemics, and technological advancements. This gap is significant because it reflects the resilience of societies and economies in the face of disasters.

A large protection gap can hinder a country's financial ability to recover from calamities. Insufficient insurance coverage makes it more challenging for individuals and businesses to get back on their feet after a disaster. For example, in 2023, only 38% of global economic losses amounting to USD 280 billion were insured. This indicates a significant protection gap that left many vulnerable in the face of disasters.

However, it is important to note that the world has made significant progress in reducing its vulnerability to disasters. Deaths from disasters have decreased, even with a fourfold increase in the global population. This improvement is attributed to advancements in various sectors, such as agriculture, politics, and technology. For instance, massive productivity gains have made agricultural systems more resilient to shocks, and improved weather forecasts have enabled better preparation for natural calamities.

To further enhance resilience, it is crucial to address the factors that determine the risk of damage when a hazard occurs. These include the characteristics of the hazard, the number of people and infrastructure exposed, and the vulnerability of those affected. By understanding and mitigating these factors, societies can reduce the impact of disasters and protect their citizens and economies.

Additionally, early warning systems play a crucial role in reducing exposure to hazards. By evacuating before a hazard strikes, people can temporarily reduce their exposure and potential harm. However, it is important to note that early warning systems are still lacking in many parts of the world, particularly in poorer countries.

In conclusion, while the protection gap in insurance can hinder a country's financial ability to recover from disasters, societies and economies have become more resilient over time. By addressing the factors that contribute to risk and damage, as well as investing in early warning systems and other protective measures, we can further enhance our resilience and minimize the impact of disasters.

Canceling Gap Insurance: Remove from Loan

You may want to see also

It can be applied to the reinsurance arena

The Insurance Protection Gap (IPG) can be applied to the reinsurance arena, which is global and provides a partial or full transfer of insurance risks. The IPG describes the difference between the demand for reinsurance capital and the actual supply of it.

The reinsurance arena is very centralised, with a handful of very large companies taking on insurance risks. These companies lack the capacity to meet immense market needs, which leads to a reinsurance protection gap. This gap has severe repercussions, as it affects a country's ability to achieve financial stability and growth, as well as improve the quality of life of its citizens.

The more innovative products that are introduced in the consumer arena, the larger the reinsurance protection gap becomes. This is due to the increased activity and demand for reinsurance capital. To address this issue, it is necessary to increase the flow of capacity from the reinsurance arena to the consumer arena. This can be achieved by implementing innovative and creative solutions, similar to those seen in the consumer arena, thereby opening up new opportunities in the reinsurance market.

One such solution is the Insurance-Linked Securities (ILS) market, which translates actuarial risk to financial risk through capital markets. ILS solutions are flexible, have high capacity, and can cover multiple years. By utilising ILS, cedents benefit from immediate capital, regulatory relief, and lower transaction costs. The growth of the ILS market will not only benefit cedents but also help decrease the Insurance Protection Gap, leading to economic growth and financial well-being on both local and global levels.

Vehicle Insurance Binder: What's the Deal?

You may want to see also

It can be calculated using a simple formula

The protection gap in insurance refers to the difference between the resources you need and the resources you have available in the event of an unforeseen circumstance, such as death, disability, or a critical illness. This gap can leave individuals and families vulnerable to financial difficulties in the face of unfortunate events.

Determining your protection gap can be done through a simple calculation:

Protection or resources needed - resources available = protection gap

Step 1: Determine the Resources Needed

The first step is to estimate the resources that would be required in the event of an unexpected situation, such as death or a critical illness. A general guideline provided by the Life Insurance Association suggests having resources equivalent to at least 9 times your annual income in the event of death, and at least 3.9 times your annual income in the case of a critical illness. This buffer ensures that your family has sufficient financial support to adapt to these life-changing events.

Step 2: Assess Your Current Available Resources

The next step is to take an inventory of your current financial resources. This includes tallying up your cash savings, easily liquidated assets, and any protection coverage from existing insurance policies. This step helps you understand the total funds that would be available to your family in the event of an unforeseen circumstance.

Step 3: Calculate Your Protection Gap

Once you have determined the resources needed and your current available resources, you can calculate your protection gap using the formula mentioned earlier. Simply subtract your available resources from the resources needed. If the result is a positive number, it indicates that you have a protection gap. This calculation provides valuable insight into the additional protection you should consider to ensure adequate coverage.

For example, if you estimate that your family would require $500,000 in resources to maintain their standard of living in the event of your unexpected death, and you currently have $300,000 in savings and insurance coverage, your protection gap would be $200,000. This indicates that you may want to consider purchasing additional insurance to bridge this gap and provide your family with sufficient financial support.

By calculating your protection gap, you can make informed decisions about your insurance needs and take the necessary steps to ensure that you and your loved ones are adequately protected in the face of unforeseen circumstances.

Criminal Enterprise Vehicles: Insured?

You may want to see also

Frequently asked questions

The protection gap in insurance refers to the difference between the resources you'll need and the resources you have available in the event of an unfortunate event occurring.

Knowing your protection gap will help you identify areas where you are not adequately insured so that you are fully prepared for the unforeseen.

You can determine your protection gap by using the following formula: Protection or resources needed - resources available = protection gap.

Having a large protection gap indicates that you are seriously underinsured, which leaves you and your family vulnerable to the financial impact of unfortunate events such as death, disability or critical illness.

You can fill the protection gap by purchasing additional insurance coverage or products to meet your specific needs.