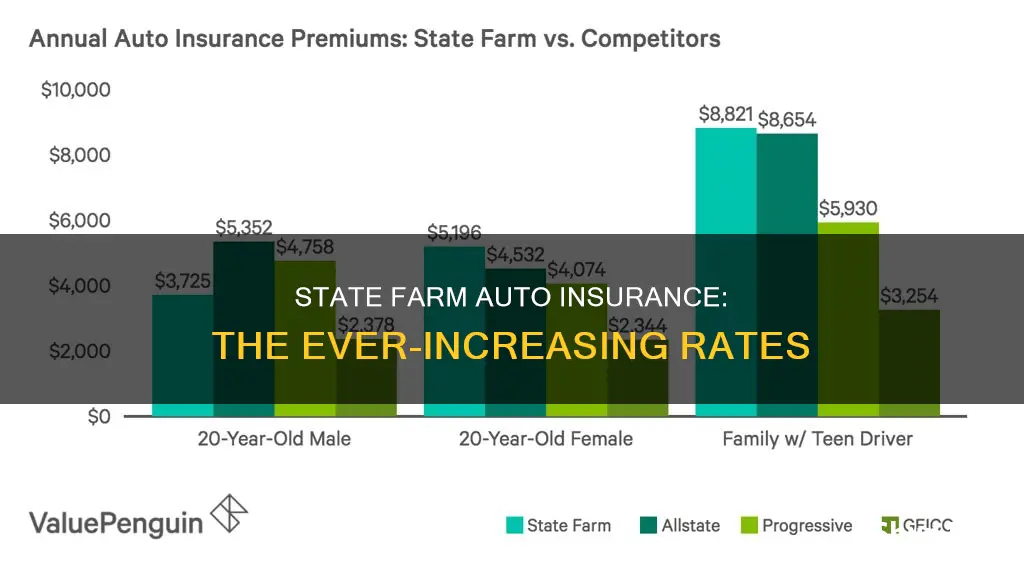

State Farm auto insurance rates have been increasing, with an average increase of 13.9% in 2024, following a 9.2% increase in 2023. This is largely due to inflation, increased claims payouts, rising repair and healthcare costs, and an increase in the number of auto insurance claims as more people are driving. State Farm's auto insurance rates are higher than the national average, and while they are not the most expensive, they are also not the cheapest option.

| Characteristics | Values |

|---|---|

| Reason for increase | Inflation, increased claims payouts, higher repair and healthcare costs, more accidents |

| Average increase in auto insurance premiums | 9.2% last year, 13.9% this year |

| Inflation rate in 2023 | 3.4% |

| Inflation impact on insurance rates | Historically high inflation has made cars, repairs, and replacements more expensive |

| Impact of inflation on repair costs | Supply chain disruption, labor issues, and new technology have increased repair costs |

| Impact of inflation on healthcare costs | Higher payouts for personal injury protection, bodily injury liability, and general liability claims |

| Impact of driving behavior on insurance rates | Driving history, age, sex, marital status, and credit score affect insurance rates |

| State Farm's performance | Ranked #4 in Best Car Insurance Companies and #7 in Cheapest Car Insurance Companies |

| State Farm's customer service | Received strong survey responses and high marks for customer loyalty |

| State Farm's claims handling | Ranked #4 alongside Nationwide with a score of 4.2 |

What You'll Learn

Inflation and rising costs

The increase in car values and repair costs has prompted insurers to raise premiums. Auto insurance rates rose by 2.6% in March and 22% from the previous year. This is despite a cooling of consumer-level inflation, which fell from a peak of 9.1% in 2022. The rise in insurance costs is also due to more people driving and an increase in claims.

The coronavirus pandemic also played a role in the rise of auto insurance rates. During the pandemic, there was a worldwide shortage of computer chips, production cuts, and supply chain issues, which led to higher vehicle prices. Additionally, there were fewer cars on the road, resulting in fewer accidents and less expensive losses. Now, with more people returning to offices and schools, there has been an increase in accidents, causing insurance rates to climb.

The combination of these factors has resulted in auto insurance becoming a significant expense for car owners, contributing to overall inflationary pressures and affecting the Federal Reserve's ability to control inflation.

To manage the impact of rising insurance costs, consumers can shop around for the best rates, consider higher deductibles, review their policies to eliminate unnecessary coverage, and take advantage of discounts offered by insurance companies.

Insurance Without Car Registration?

You may want to see also

More accidents and claims

There are several factors that can contribute to an increase in auto insurance rates, and one of the primary reasons is the rise in the number of accidents and claims. This trend has been observed across the insurance industry, and State Farm is no exception.

During the pandemic, there was a decrease in accidents due to fewer cars on the road, with many people working from home and schools conducting virtual classes. However, now that life is returning to pre-pandemic norms, roads are busier, and there has been a significant increase in car accidents and injuries. This rise in accidents has contributed to an increase in insurance rates.

In addition to the sheer number of accidents, the severity of these accidents has also worsened. According to Christopher Graham, a senior industry analyst, "driver inattentiveness and riskier driving habits have become more problematic in the last few years, and as a result, auto severity has worsened." This increase in accident severity has led to higher claim costs for insurers, who are struggling to keep up with the rising expenses.

The impact of accidents on insurance rates is influenced by factors such as fault determination, the type of claim, and the number of claims within a specific time frame. Being found at-fault in an accident will typically result in a higher chance of your insurance premium increasing. Additionally, both at-fault and not-at-fault insurance claims can lead to higher premiums. It's important to note that insurance companies consider the frequency of claims over their severity in most cases.

The type of claim also plays a role, with collision claims generally resulting in higher costs for insurers than other types of claims. This is due to the higher likelihood of categorizing the driver as high-risk, which can lead to increased premiums. Comprehensive claims, on the other hand, may result in a smaller rate increase, as they often involve instances when the driver is not in the vehicle.

In conclusion, the rise in accidents and claims is a significant factor contributing to the increase in State Farm auto insurance rates. The frequency and severity of accidents, along with the associated claim costs, have put pressure on insurers to adjust their rates. It's important for drivers to maintain safe driving habits and be mindful of the potential impact of accidents on their insurance premiums.

Erie Auto Insurance: Exploring the App Option

You may want to see also

Higher repair costs

Inflation, supply chain disruption, and labour issues have all contributed to rising car repair costs, which in turn have impacted insurance rates. Repairing a car involved in an accident takes longer, and policyholders may need to use a rental car for an extended period.

New technology, such as parking sensors, lane-departure warnings, and improved battery technology, has also increased repair costs. These devices and sensors improve safety, but they are more expensive to fix. Similarly, safety features like autonomous braking and lane departure warnings in newer cars can reduce the severity of injuries, but they also make vehicles more costly to repair after accidents. External mirrors, fenders, and bumpers that house these sensors may carry higher repair costs than conventional alternatives.

The growing popularity of hybrid and electric vehicles has also influenced insurance rates. These vehicles are more environmentally friendly, but they are pricier to acquire, repair, and replace.

In addition, certain vehicles are more expensive to repair than others, and insurance companies use data about each make and model to set insurance rates. Larger vehicles, for instance, tend to be safer and less costly to repair than smaller ones.

Allstate Auto Insurance: Understanding Towing Services and Benefits

You may want to see also

Distracted driving

Texting while driving is the most alarming and dangerous distraction, as it combines visual, manual and cognitive distraction. Sending or reading a text takes a driver's eyes off the road for 5 seconds. At a speed of 55 mph, that's the equivalent of driving the length of a football field with your eyes closed.

The National Highway Traffic Safety Administration (NHTSA) is leading the national effort to prevent distracted driving through education and law enforcement partnerships. Their "Put the Phone Away or Pay" campaign reminds drivers of the deadly dangers and legal consequences of texting and messaging behind the wheel.

To avoid distracted driving, drivers are encouraged to pull over and park in a safe location before reading or sending a text message. Drivers can also appoint a passenger as the "designated texter" to respond to calls or messages, or they can activate their phone's "Do Not Disturb" feature or put their phone away in the trunk.

Auto Insurance in the Modern Age: Does 21st Century Provide Coverage?

You may want to see also

Weather catastrophes

Weather-related catastrophes can have a significant impact on insurance rates. In 2023, the United States experienced several weather disasters, including wildfires in Maui, Hawaii, historical floods in California, and tropical cyclones. These events caused billions of dollars in losses, with State Farm alone paying $12 billion in catastrophic claims in 2023, a significant increase from the $7 billion paid in 2022.

State Farm has a dedicated catastrophe team that is the largest in the insurance industry. This team is specially trained to assess damage and provide assistance to policyholders affected by natural disasters. They work quickly to get to the scene and provide policyholders with the help they need, often covering immediate needs such as housing, transportation, and food.

The team has a variety of vehicles and equipment at their disposal, including the Mobile Catastrophe Facility (MCF), Catastrophe Response Trailers (CRT), Mobile Catastrophe Command Centers (M3Cs), and Mobile Catastrophe Trailers (MCTs). These vehicles serve as mobile offices, equipped with workstations, computers, power generators, satellite access, and other resources needed to handle claims and provide support to those affected by the disasters.

The deployment of these resources is organized from Bloomington, Illinois, and they can be delivered anywhere in the continental United States within 48 hours. The MCF, in particular, can be deployed within four hours of notification and has the capacity to handle up to 300 damaged cars per day.

State Farm also provides helpful information on ways to stay safe during severe weather events and how to prepare emergency kits in advance to ensure that individuals and families have the resources they need to weather the storm.

Dual Auto Insurance: Double the Coverage?

You may want to see also

Frequently asked questions

State Farm's insurance rates are increasing due to multiple factors, including inflation, increased claims payouts, higher labour and repair costs, and an increase in the number of auto insurance claims.

You can lower your State Farm insurance premium by choosing a higher deductible, dropping unnecessary coverage, and taking advantage of applicable discounts such as the Multiple Line Discount and the Good Student Discount.

Drive Safe & Save® is a usage-based insurance program that offers personalized discounts based on driving behaviour and miles driven. Steer Clear® is a driver safety course that can help younger drivers lower their premiums.

Yes, State Farm offers free car insurance quotes online. You can also contact a State Farm agent to discuss your specific needs and coverage options.

In addition to your driving history, your State Farm car insurance premium may be influenced by your credit score, age, sex, marital status, and the number of miles you drive per year.