Life insurance policies typically include a suicide clause that prevents the insurer from paying out the claim if the insured's death was due to suicide within a certain period, usually two years, from the start of the policy. This clause is intended to prevent individuals from purchasing a policy with the intention of taking their own lives so that their loved ones can receive financial benefits. After this exclusion period, most life insurance policies do cover suicide, and beneficiaries are entitled to receive the full death benefit. However, there are variations in the coverage based on the type of life insurance policy, such as group life insurance, traditional life insurance, and whole life insurance.

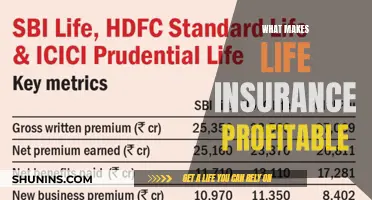

| Characteristics | Values |

|---|---|

| Does life insurance cover suicide? | Yes, but only after the suicide exclusion period has ended. |

| What is the suicide exclusion period? | Typically, the first two years of a life insurance policy. |

| What happens if a suicide occurs during the exclusion period? | The insurer may deny the death benefit or return the premiums paid. |

| What happens if a suicide occurs after the exclusion period? | The insurer will pay out the death benefit to the policy's beneficiaries. |

| What is a suicide clause? | A clause in a life insurance policy that states the insurer won't pay out if the insured's death was due to suicide within the exclusion period. |

| What is the purpose of a suicide clause? | To prevent someone from purchasing a policy immediately before taking their life so their loved ones can receive financial benefits. |

| Do all life insurance policies have a suicide clause? | No, group life insurance policies through an employer or military life insurance generally do not include a suicide clause. |

| What happens if a life insurance policy is changed? | Changing a policy, such as adding coverage or converting a term policy, can restart the suicide exclusion period. |

| What if there are discrepancies in the policy application? | A contestability period, typically two years, allows the insurer to deny a claim if undisclosed health conditions or discrepancies are found. |

What You'll Learn

Suicide clauses

The length of the exclusion period can vary depending on the state and the specific insurance company. In most states, the exclusion period is two years, but in some states, such as Colorado, Missouri, and North Dakota, it is only one year. The suicide clause applies to individual life insurance policies, which are purchased by individuals.

Group life insurance, which is often obtained through an employer or organization, typically does not contain a suicide clause. This means that if someone dies by suicide while covered by group life insurance, the policy will usually pay out a death benefit to the beneficiaries. However, supplemental life insurance purchased through an employer usually includes a standard suicide clause.

It is important to note that if a claim is denied due to the suicide clause, the beneficiary may still be entitled to a refund of the premiums paid into the policy. This means they would receive a sum of money equal to the amount the policyholder paid in premiums.

While suicide is not generally covered during the exclusion period, there may be exceptions depending on the specific policy and the circumstances of the case. It is always important to carefully review the terms and conditions of any life insurance policy to understand the specific coverage and exclusions.

Life Insurance: Managing Risk, Securing Future

You may want to see also

Suicide exclusion period

The length of the suicide exclusion period can vary by state and insurer, with some policies having a one-year clause. It is important to review your specific policy details, as different insurers and state laws may have unique stipulations. If the policyholder commits suicide after the exclusion period has ended, the life insurance policy will pay out the death benefit to the beneficiaries.

Supplemental life insurance purchased through an employer usually has a standard suicide clause, while group life insurance through an employer or organization typically does not include a suicide clause and will pay out for suicidal death. Switching life insurance policies restarts the suicide exclusion period, even if the new policy is from the same company.

Mental health considerations are also important when it comes to life insurance policies. Some policies may have exclusions or clauses related to mental health conditions, which can affect coverage. It is crucial to disclose any mental health history during the application process to avoid complications later.

Life Insurance: 15-Year Guarantee Explained

You may want to see also

Contestability period

The contestability period is a clause included in all life insurance policies that allows the insurer to review the policyholder's application for incorrect information, usually within the first two years of the policy. This period can vary from one to three years depending on the insurer, but it is typically two years.

During the contestability period, the life insurance company can deny a death claim if they find evidence of fraud or misrepresentation. For example, if the policyholder had concealed a mental health diagnosis, the company could deny or reduce the amount the beneficiary receives. The misrepresentations do not have to be related to the cause of death. For instance, if the policyholder dies in a car accident but had failed to disclose a history of alcohol abuse, the insurer can deny the claim.

The purpose of the contestability period is to deter fraud and allow insurers to thoroughly vet applications. It also helps to control the cost of insurance due to misrepresented claims. The period exists to penalize people who hide or lie about critical information that would otherwise place them in a higher premium bracket.

The contestability period is separate from the suicide clause, although there is some overlap. The suicide clause states that the insurer will not pay out to beneficiaries if the insured's death was due to self-harm within the contestability period (usually two years). If the insured dies by suicide after the suicide clause has expired, the insurer will pay the death benefit.

If a policy lapses and is then reinstated, the contestability period restarts.

Ohio National: Life Insurance Options in New York

You may want to see also

Suicide and insurance fraud

The presence of a suicide clause means that insurance companies will not pay a death benefit if the policyholder commits suicide within the specified time frame. This exclusion period can vary, with some policies covering suicide after one or two years, while others may have longer durations. It is important to carefully review the terms and conditions of a life insurance policy to understand the specific provisions related to suicide.

In the context of insurance fraud, individuals may attempt to deceive insurance companies by misrepresenting their mental health status or concealing relevant information during the application process. For example, failing to disclose a history of depression or anxiety could be considered insurance fraud. It is crucial to be transparent and provide accurate information when applying for life insurance, as nondisclosure or misrepresentation may result in the cancellation of the policy or denial of benefits.

While suicide clauses are common in individual life insurance policies, group life insurance policies obtained through employers often do not include such provisions. In these cases, beneficiaries may still receive the death benefit if the insured individual dies by suicide. Additionally, whole life insurance policies may provide beneficiaries with the plan's cash value, even if the insured person dies during the exclusion period.

It is important to note that insurance companies have the right to investigate suspected cases of suicide by requesting additional documentation, such as autopsy reports or medical records. This process may cause a delay in the payment of benefits to beneficiaries. If a claim is denied due to suicide, beneficiaries have the right to question and appeal the insurer's decision by providing relevant information and supporting documents.

GAAP, Life Insurance, and DAC: What's Allowed?

You may want to see also

Suicide and group life insurance

Group life insurance policies are often provided as part of an employee benefits package. They are different from individual life insurance policies in that they typically do not include a suicide clause. This means that, in the event of a covered person's death by suicide, their beneficiaries will usually receive the death benefit.

Suicide Clauses

Life insurance companies want to prevent people from taking out policies with the intention of ending their lives shortly afterward so their loved ones can receive financial benefits. That's why many life insurance policies include a "suicide clause" or "suicide provision".

Exclusion Periods

Suicide clauses typically last for a certain period after the policy goes into effect, usually between one and three years, but most commonly two years. This is known as the "exclusion period". If the insured person dies by suicide within the exclusion period, the insurer will not pay out the death benefit to the beneficiaries.

Switching Policies

Switching life insurance policies restarts the suicide clause and exclusion period, even if you purchase the new policy from the same company.

Contestability Period

There is also a "contestability period", usually lasting two years after the policy activates, which is separate from the suicide clause. During this period, the insurer can deny a claim if they find undisclosed health conditions or other discrepancies in the policy application.

Group Life Insurance and Suicide

Group life insurance policies, such as those offered by employers, generally do not include a suicide clause. This means that, if a covered person dies by suicide, their beneficiaries will usually receive the death benefit. However, each plan can differ, so it's important to carefully review the specific terms of your group life insurance policy.

Getting Help

If you or someone you know is struggling with mental health issues or having suicidal thoughts, there are resources available to help. You can message, text, or call the Suicide & Crisis Lifeline at 988. This service is free, confidential, and available 24 hours a day, seven days a week.

Life Insurance: Multiple Beneficiaries, Single Payout

You may want to see also

Frequently asked questions

Many life insurance policies include a "suicide clause" that prevents the insurer from paying out the claim if the insured's death was due to self-inflicted injury within a certain period, typically two years, from the start of the policy. After this exclusion period, most life insurance policies do cover suicide.

A suicide clause is a provision in a life insurance policy that states the insurer won't pay out to beneficiaries for a suicidal death within a certain period, usually the first two years. This clause is meant to prevent someone from purchasing a policy with the intention of committing suicide soon after.

After the exclusionary period, life insurance typically pays for suicidal death as it would for death from any other insurable cause. If suicide occurs during the exclusionary period, there may be no payout of the death benefit, but insurers often refund the premiums paid on the policy.

If your life insurance claim is denied, you can understand the insurer's reasoning and take steps to challenge the decision. Denials may occur if the death falls within the policy's suicide exclusion period. You can review the denial letter, gather relevant documentation, and consult an attorney or insurance professional to help you secure the benefits.

Yes, it is possible to obtain life insurance after a history of attempted suicide, but it may be more challenging and involve additional costs or specific conditions. Insurers evaluate the risk based on medical and personal history, and stability in mental health over several years can positively influence their decision.