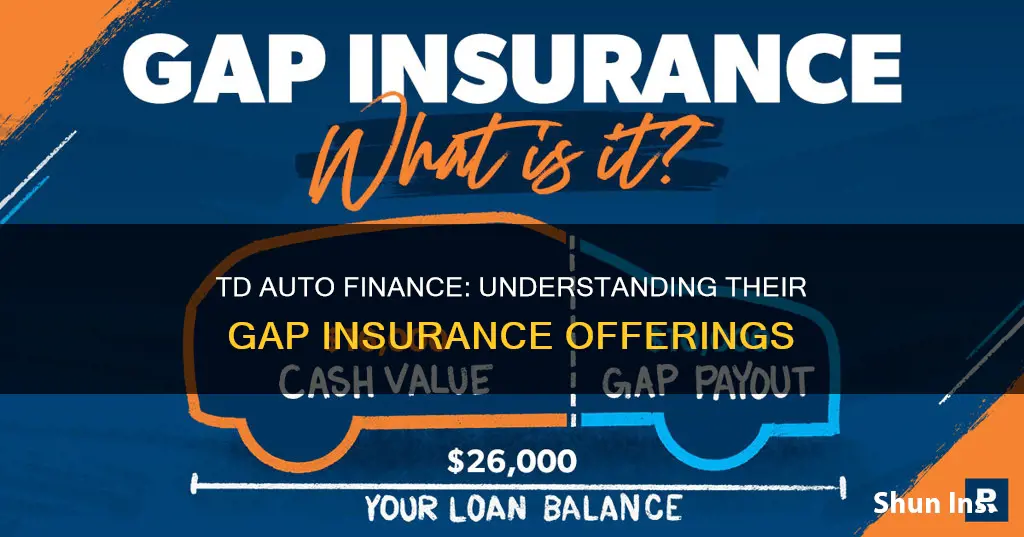

TD Auto Finance, a division of TD Bank, N.A., offers a range of services, including retail and floor-plan financing, to franchised dealerships. They also provide customers with the option of purchasing gap insurance. However, there have been several complaints from customers regarding issues with their online portal, billing, and customer service.

| Characteristics | Values |

|---|---|

| Does TD Auto Finance offer GAP insurance? | Yes |

| Is GAP insurance mandatory? | No |

| Can GAP insurance be cancelled? | Yes |

| How to cancel GAP insurance? | Send a cancellation form to TD Bank |

What You'll Learn

TD Auto Finance's customer service

TD Auto Finance is a division of TD Bank, N.A. The company offers a range of financial services, including retail and floor-plan financing, working capital loans, and revolving lines of credit. They also provide commercial real estate and construction loans, as well as enhanced reporting services.

The company's website also offers a range of resources, including an FAQ section, online account access, and a dealer portal called TDAF Connect.

Reviews of TD Auto Finance's customer service are mixed. While some customers praise the company's service, others have complained about issues with their online portal, rude staff, and a lack of professionalism. There have also been reports of billing errors and difficulties in resolving issues.

It is important to note that individual experiences with customer service may vary, and issues can often be resolved by contacting the company directly and expressing your concerns.

Quicksilver Credit Card Auto Rental Insurance: What's Covered?

You may want to see also

TD Auto Finance's online portal

TD Auto Finance offers an online portal called TDAF Connect, which is a dealer portal that provides access to tools and customer information to support sales and financing efforts. The portal offers seamless integration with RouteOne and DealerTrack, allowing dealers to collect prospecting and payoff information. TDAF Connect also provides access to portfolio data, funding issues, and contract status updates.

To sign up for TDAF Connect, a TDAF Connect System Authorization Form needs to be completed and processed. The System Administrator will then receive a temporary user ID and password via email and must log in to TDAF Connect to set up their profile. The TDAF Connect Guide provides detailed instructions on how to use the portal and perform key tasks.

The TD Auto Finance website also offers an online portal for customers to access their accounts, make payments, and request titles or lien releases. Customers can log in to their accounts on the TD Auto Finance website or through the TD Wheels app.

In addition, TD Auto Finance provides online banking services through EasyWeb Online Banking, where customers can manage their accounts, view transactions, and make payments.

Pre-Insurance Vehicle Inspection: What's the Deal?

You may want to see also

TD Auto Finance's billing statements

TD Auto Finance offers online bill payment services. The company provides a detailed privacy policy on its website, outlining the types of personal information it collects and how that information is used, shared, and protected.

Billing Statements

TD Auto Finance defines a "Billing Statement" as the statement typically sent by the Biller to the customer, indicating the amount owed for the provision of goods and/or services and the Due Date. The "Due Date" is the date reflected on the Billing Statement when the payment is due, excluding any late payment date or grace period.

The company's online bill payment system allows customers to schedule and manage payments. The system also provides a "Payment Wallet" feature, where customers can save their funding account information for future payments. This includes checking, savings, or debit card accounts.

Customers can choose to enrol in Auto Pay Payments or Recurring Payments. For Auto Pay Payments, the amount due on the Due Date is automatically deducted from the customer's account. For Recurring Payments, the customer selects a designated amount to be paid on a chosen date each calendar month.

TD Auto Finance also offers the option of Scheduled Payments, which are Payments that have been scheduled for a future date but have not yet begun processing. Customers can cancel or edit a Payment until the processing of the Payment Instruction has begun, with no associated charge.

The company's privacy policy outlines the various types of personal information collected, including name, postal address, email address, telephone number, bank account information, billing account information, and payment history. This information is used for everyday business purposes, such as processing transactions, maintaining accounts, and reporting to credit bureaus.

The privacy policy also details how personal information is protected, with physical, electronic, and procedural safeguards in place to prevent unauthorized access and use.

Switching Auto Insurance: Exploring the Potential Pitfalls and Pain Points

You may want to see also

TD Auto Finance's credit application process

TD Auto Finance is a division of TD Bank, N.A., and offers a variety of financing solutions for customers looking to purchase a vehicle. The company provides retail and floor-plan financing, along with services tailored to meet the needs of dealerships and their customers.

The credit application process for TD Auto Finance involves several steps and requirements. Here is an overview of the process:

Dealership Application:

TD Auto Finance offers loans through authorised automotive or recreational vehicle dealers. Customers cannot obtain auto financing directly from TD Auto Finance and must go through a dealer. The dealership's Finance and Insurance (F&I) manager typically handles the loan application process.

Credit Approval:

TD Auto Finance provides credit approvals valid for 30 days from the date of application. The company partners with RouteOne and DealerTrack for application submission, and dealers can access these platforms through TDAF Connect.

Documentation:

The dealership or applicant must provide various documents to support the credit application. These typically include proof of income (e.g., pay stubs), government-issued photo ID, void cheque or Pre-Authorised Payment form, address information (including previous addresses if residing at the current residence for less than two years), employment information, driver's license, and the amount they wish to borrow.

Co-applicants and Co-signers:

TD Auto Finance does not require co-applicants. However, if an individual applicant does not qualify for credit on their own, the dealer may submit a new application with a joint applicant. A Notice to Co-signer form is required if all parties listed on the contract are not listed on the title work.

Credit Decision:

After submitting the application and required documentation, the dealer will receive an automated decision or notification that the application is pending manual review. The credit team at TD Auto Finance aims to provide fast credit decisions.

Flexible Payment Options:

TD Auto Finance offers flexible payment options for customers, including online payments, payments by mail, phone, in person, or through autopay.

It is important to note that TD Auto Finance does not offer irregular payment plans. Additionally, applicants with a bankruptcy within the previous 36 months or prior repossessions are ineligible for financing.

Overall, the credit application process at TD Auto Finance involves working closely with authorised dealers who facilitate the loan application and provide necessary documentation. The company offers a convenient platform, TDAF Connect, to access and manage applications, and customers can benefit from flexible payment options once their loan is approved.

Insured: Personal Auto Policy Add-On

You may want to see also

TD Auto Finance's flat fee program

The Flat Fee Program also offers an Enhanced Flat Fee option, the details of which can be found on the Program Highlights Sheet.

The Flat Fee is subject to a chargeback or offset policy. All finance reserves and flat fees paid to the dealer are subject to chargeback or offset in certain circumstances, such as prepayment of contracts, default under contracts, or repossession of vehicles. The chargeback or offset policy applies up to the full amount of the finance charges or flat fees advanced to the dealer.

Dealers can view the status of their contracts, including any chargebacks or offsets, through TDAF Connect, which is TD Auto Finance's proprietary dealer portal. Through TDAF Connect, dealers can access information on their contracts, such as advances, retail reserves, payments, and adjustments.

Fleet Insurance: Vehicles Count

You may want to see also

Frequently asked questions

Yes, TD Auto Finance offers GAP insurance.

You can cancel your GAP insurance by sending a cancellation form to TD Bank.

The contact number for TD Auto Finance is 1-800-556-8172.