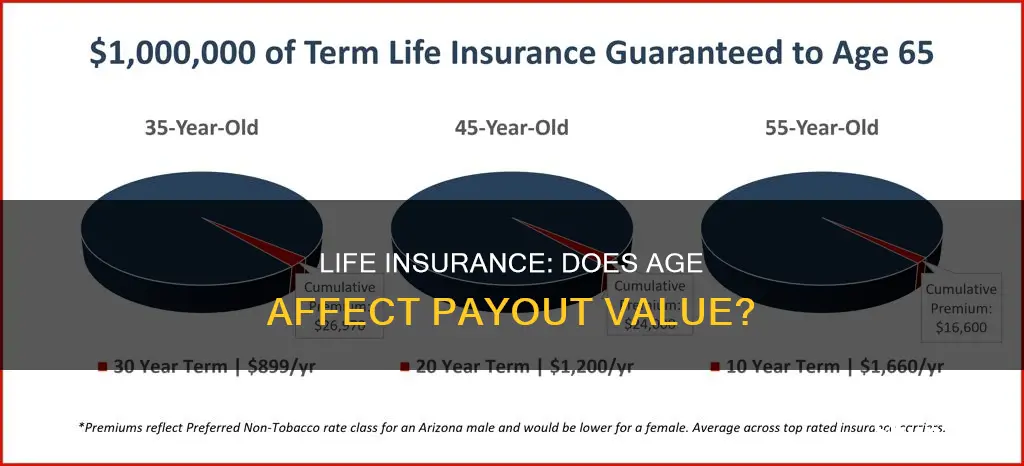

Life insurance is designed to pay out a death benefit to your beneficiaries when you pass away. The older you are, the more likely you are to become ill or die while under coverage, so age is one of the primary factors influencing your life insurance premium rate. The likelihood of a payout increases as you age, which elevates the risk to insurers. This means that as applicants get older, policy costs increase due to the heightened chance of a death benefit claim. The annual premium, or 'rate', for a term life insurance policy is determined when you buy the policy and remains the same every year. With some permanent life insurance policies, the premium rises annually.

| Characteristics | Values |

|---|---|

| How is the value of life insurance determined? | Life insurance rates are determined by a person's age, health, gender, lifestyle factors, type of policy, and amount of coverage. |

| How does age affect the value of life insurance? | The older a person is, the more expensive life insurance premiums will be as the cost is based on actuarial life tables that assign a likelihood of dying while the policy is in force. |

| How does age impact the rate of increase in value of life insurance? | The premium amount increases on average by about 8% to 10% for every year of age. |

| Are there different types of life insurance policies? | Term life insurance and permanent life insurance are two types of policies. Term life insurance is less expensive and provides coverage for a limited number of years. Permanent life insurance is more expensive and provides coverage for the entire lifetime of the insured. |

| Does the value of life insurance decrease after a certain age? | Life insurance coverage may decrease after the age of 70 while premium rates continue to increase. |

What You'll Learn

Life insurance rates increase with age

Life insurance rates typically increase with age, with age being one of the primary factors influencing your premium rate. This is because the older you are, the more likely you are to become ill or die while under coverage. The cost of life insurance is based on actuarial life tables that assign a likelihood of dying while the policy is in force. The closer you are to reaching your life expectancy, the higher the risk to the insurance company of having to pay out a death benefit.

The premium amount increases, on average, about 8% to 10% for every year of age. This can be as low as 5% annually if you're in your 40s, and as high as 12% annually if you're over 50. For example, a 45-year-old male will pay on average $1,125 for a new, 20-year term policy with $1,000,000 of coverage. The same policy purchased at age 46 will cost $1,225, and $1,345 a year if purchased at age 47.

Term life insurance policies typically offer lower premium rates compared to whole life insurance policies. With term life insurance, your premium is established when you buy a policy and remains the same every year. With some permanent life insurance policies, the premium rises annually.

In addition to age, life insurance companies consider various other factors when determining rates, including health, gender, lifestyle, and the amount of coverage. It's important to be transparent when applying for life insurance, as lying on an application can result in insurance fraud.

Key Man Insurance: Tax Benefits and Financial Security

You may want to see also

Advanced age corresponds to health complications

Actuarial tables are used by insurance companies to estimate life expectancy and mortality rates, which are then used to determine how much a person will pay for life insurance coverage. These tables show that the older a person is, the more likely they are to become ill or die. As a result, the cost of life insurance is based on these actuarial life tables, which assign a likelihood of dying while the policy is in force. The older someone is, the more likely they are to die while insured, which leads to higher premiums.

The impact of age on life insurance rates is significant. The average monthly rate for life insurance is $22 for a 30-year-old, $32 for a 40-year-old, and $80 for a 50-year-old. The premium amount increases by about 8% to 10% for every year of age, and it can be as high as 12% annually for those over 50. This means that a 45-year-old might pay around $1,125 for a new 20-year term policy with $1,000,000 in coverage, while a 46-year-old would pay approximately $1,225 for the same policy.

In addition to age, health is another major factor contributing to the cost of life insurance. People with pre-existing medical conditions may not live as long as healthy people, so insurance companies charge higher rates for those with health issues. The presence of pre-existing conditions, such as critical illnesses, is assessed during the life insurance application process, and applicants are placed into health classes that determine their monthly premium.

Older adults might also have a harder time purchasing life insurance, as many insurers stop issuing new life insurance policies to seniors over a certain age, usually around 80. Life insurance for seniors can be cost-prohibitive, depending on their health and the type of coverage they qualify for. Guaranteed life insurance policies, which do not require a medical exam, may be one of the only options available to seniors, but these policies can be expensive and have low policy limits.

Overall, advanced age is associated with health complications, and this correlation significantly impacts the cost of life insurance. As people get older, the likelihood of developing health issues increases, and insurance companies reflect this risk in their pricing. The result is that older individuals pay higher premiums for life insurance coverage.

Life Insurance: Understanding Payout Drops and Changes

You may want to see also

Life insurance for seniors

Types of Senior Life Insurance Plans

Term Life Insurance

Term life insurance is a good option for seniors who want to choose the length of their plan. Typically, term life insurance plans can be 10, 20, or 30 years long, but the older you are, the less variety there may be in term lengths. It is also possible that the fees will rise as you age. However, term life insurance is still a popular choice for those looking for a policy that can provide benefits for their loved ones.

Whole Life Insurance

Whole life insurance is another great option for seniors and will provide coverage for the entire life cycle of the policyholder. Unlike term life insurance, the benefits of whole life insurance will typically be payable to your beneficiary, no matter the timing of your passing. Whole life insurance can be a good option if you want to be certain that your family will receive benefits upon your death.

Final Expense Insurance

Final expense insurance is a permanent life insurance policy that offers a small death benefit when you pass away. Your beneficiaries can use the payout to cover your funeral, burial costs, and other end-of-life expenses. Since final expense insurance is a smaller type of plan, it typically comes with lower premiums than other permanent life insurance policies.

Benefits of Senior Life Insurance

Affordable Premiums

While the rates you’ll pay depend on the type of plan you get and other factors, many policies offer reasonable premiums that can fit your budget.

Tailored Coverage

From term life insurance to permanent policies, there are plenty of life insurance options at your disposal. Based on your needs and budget, you can find a policy that is right for you.

Peace of Mind

Having a senior life insurance policy can give you peace of mind knowing your loved ones will have financial support in your absence. They can use the death benefit payout to cover any expenses after your passing.

How to Get the Best Senior Life Insurance Policy

Figure Out Your Coverage Needs

Think about why you’d like senior life insurance. Maybe your goal is to cover your burial and funeral costs, or perhaps you’d like to continue income for a partner when your pension no longer applies.

Compare Policy Types

Once you understand your coverage needs, shop around and compare policy types. The two most common life insurance policy types are term and whole life insurance. Term life insurance is temporary and will cover you for a set period, while whole life insurance typically lasts a lifetime.

Work with a Life Insurance Advisor

A life insurance advisor can educate you on your options and help you find the ideal policy for your unique circumstances. While you can navigate senior life insurance on your own, an advisor can simplify the process at no additional cost.

PERS and Life Insurance: What's the Deal?

You may want to see also

Life insurance rates are determined by age and health

Life insurance rates are determined by a number of factors, with age and health being two of the most significant.

Age

Age is a pivotal factor in determining life insurance premiums. As individuals get older, the likelihood of passing away increases, thus elevating the risk to insurers. This results in higher policy costs due to the increased chance of a death benefit claim being made. Age can also impact the type of coverage one might need. For example, a young person may only require a minimum amount of coverage, whereas an older person supporting a family or running a business will likely need a larger, more expensive policy.

Health

Health is another major contributor to the cost of life insurance. Individuals with pre-existing medical conditions or a family history of certain diseases may not live as long as healthy individuals with no medical issues. As a result, insurance companies often charge higher rates for those with health issues. During the application process, insurers will ask about the applicant's health history, including any pre-existing conditions, and may require a short medical exam to help place the applicant into a specific health class. This, in turn, helps determine the monthly premium.

Other Factors

While age and health are the most influential factors, other aspects can also impact life insurance rates. These include gender, lifestyle choices, occupation, the type of policy chosen, and the amount of coverage required.

Life Insurance: Regions Bank's Offerings and Your Options

You may want to see also

Life insurance coverage decreases at 70

Life insurance coverage and premiums are determined by a number of factors, with age being a primary consideration. As age is one of the most influential factors in determining life insurance premiums, it is important to understand how coverage may change over time.

How Age Impacts Life Insurance Coverage

Age is a critical factor in life insurance rates because it is closely linked to life expectancy and the likelihood of a payout. As individuals get older, their life expectancy generally decreases, and the risk of passing away increases. This elevated risk is reflected in higher premiums for older individuals.

Life Insurance Coverage at Age 70

While life insurance coverage and rates vary depending on the specific policy and provider, a notable change in coverage occurs at age 70 for some policies. If an individual has continued their Optional Term Life Insurance benefit into retirement, their coverage begins to decrease at age 70 while their premium rates continue to increase every five years.

Specifically, at age 70, the coverage amount is reduced to a percentage of the pre-70 amount, starting at 65%. This means that an individual will only receive 65% of the coverage amount they had before turning 70. The coverage amount continues to decrease every five years, while the premium rates increase.

Factors Affecting Life Insurance Coverage

In addition to age, several other factors influence life insurance coverage and rates. These include:

- Health status and medical history: Pre-existing medical conditions, overall health, and family medical history can impact coverage and rates.

- Gender: Women generally have lower rates than men due to their longer average life expectancy.

- Lifestyle choices: High-risk activities, hobbies, and occupations can affect coverage and rates.

- Type of policy: Term life insurance typically has lower rates than whole life insurance, which includes an investment component.

- Coverage amount: Higher coverage amounts generally lead to higher premiums.

Planning for Life Insurance

When planning for life insurance, it is essential to consider your age, health, financial obligations, and long-term goals. While age is a significant factor, other considerations, such as health status and lifestyle choices, also play a role in determining coverage and rates. It is beneficial to regularly review and assess your life insurance coverage to ensure it aligns with your changing needs and circumstances.

Life Insurance: Understanding Conversion Clause Benefits

You may want to see also

Frequently asked questions

The value of life insurance does not decrease as you age, but the cost of premiums typically increases. This is because the older you are, the more likely you are to become ill or pass away, so insurance companies view older people as a higher risk and charge more for coverage.

Life insurance for seniors can often be cost-prohibitive, depending on health and the type of coverage. Guaranteed life insurance policies, which do not require a medical exam, are usually the only option for seniors over a certain age (often around 80) but come with high premiums and low death benefit caps.

Term life insurance rates increase with age, but the premium is locked in for the duration of the term. Whole life insurance rates also increase with age, and the premium rises every year.