USAA provides insurance and financial services to U.S. military members, veterans, and their families. Its life insurance products are available to the general public, and it offers term, whole, and universal policies. USAA has a strong financial stability rating and provides valuable military-specific benefits at no added cost for members. However, it has limited policy options, and some policies are not available in certain states.

What You'll Learn

USAA's life insurance policy options

USAA offers a range of life insurance options, including term life, whole life, and universal life policies. While the company primarily serves U.S. military members, veterans, and their families, its life insurance products are available to the general public. Here is an overview of USAA's life insurance policy options:

Term Life Insurance

USAA offers two types of term life insurance policies: Level Term V and Essential Term. The Level Term V policy is available for individuals between the ages of 18 and 70, with coverage ranging from $100,000 to $10 million. It can be converted to permanent coverage after one year without a medical exam. Active-duty and reserve duty service members are provided additional benefits, such as coverage during wartime and severe injury benefits. The Essential Term policy, on the other hand, is a simplified issue policy that does not require a medical exam. It is designed for young adults aged 21 to 35 and offers $100,000 in coverage until the age of 39.

Whole Life Insurance

USAA offers two types of whole life insurance policies: Simplified Whole Life and Guaranteed Whole Life. The Simplified Whole Life policy is available for individuals between the ages of 15 days and 85 years, with coverage ranging from $25,000 to $10 million. Policyholders have flexible payment options and can choose to pay level premiums for life, until they turn 65, or pay off the policy in 20 years. The Guaranteed Whole Life policy, underwritten by Mutual of Omaha, is available for individuals between the ages of 45 and 85 (50 to 75 in New York) and provides coverage from $2,000 to $25,000. This policy does not require a medical exam or health questionnaire.

Universal Life Insurance

USAA's Universal Life Insurance policy, underwritten by John Hancock, offers flexible payment options and a guaranteed interest rate of 1%. It is available for applicants aged 20 to 90, with coverage starting at $50,000. This policy is not available in New York.

USAA also offers guaranteed issue life insurance policies for individuals who are unable to qualify for traditional life insurance due to age or health conditions. These policies are available for applicants aged 45 to 85 (50 to 75 in New York) in all states except Montana. The face amounts range from $2,000 to $25,000 and are designed to cover burial or funeral costs.

Group Life Insurance: Contestability and You

You may want to see also

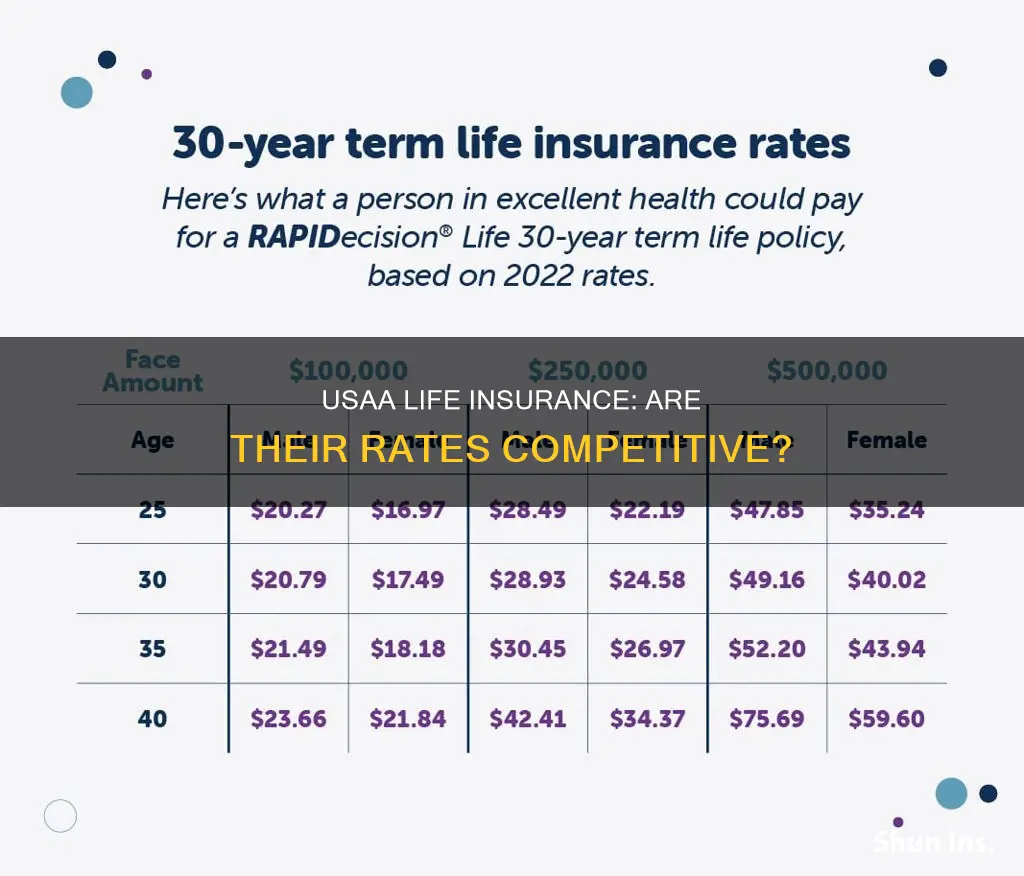

USAA's life insurance rates

USAA offers a range of life insurance policies, including term life, whole life, and universal life insurance. The rates for these policies vary depending on factors such as age, gender, health, and lifestyle choices. Here is an overview of the rates for some of USAA's life insurance policies:

Term Life Insurance:

USAA offers two types of term life insurance policies: Level Term and Essential Term. The Level Term policy is available for individuals between the ages of 18 and 70, with coverage ranging from $100,000 to $10 million. The monthly rate for a 20-year, $500,000 term life insurance policy from USAA is around $15 for a female in good health. For a male in the same age range and health status, the monthly rate would be higher, at $17.50.

The Essential Term policy is a simplified issue policy that does not require a medical exam. It is available for individuals between the ages of 21 and 35, with a coverage amount of $100,000. The monthly rate for this policy starts at $5 and increases upon each annual renewal.

Whole Life Insurance:

USAA offers Simplified Whole Life and Guaranteed Whole Life insurance policies. The Simplified Whole Life policy is available for individuals between the ages of 15 days and 85 years, with coverage ranging from $25,000 to $10 million. The Guaranteed Whole Life policy is available for individuals between the ages of 45 and 85 (50 to 75 in New York) and provides coverage from $2,000 to $25,000. This policy does not require a medical exam and is underwritten by Mutual of Omaha.

Universal Life Insurance:

USAA's Universal Life insurance policy is available for individuals between the ages of 20 and 90, with coverage starting at $50,000. This policy is underwritten by John Hancock and is not available in New York. The monthly rate for a 20-year, $500,000 universal life insurance policy from USAA is $24 for a female in good health. For a male in the same age range and health status, the monthly rate would be $33.32.

It is important to note that the rates mentioned above are just estimates, and the final quote may vary based on individual factors. Additionally, USAA offers various riders and add-ons to their life insurance policies, which can provide additional coverage and benefits.

Life Insurance: What Happens When You Die?

You may want to see also

USAA's life insurance riders

USAA offers several life insurance riders, which are optional endorsements that allow you to customise your life insurance policy to your specific needs. Riders can fill gaps in your coverage if there are exclusions and provide coverage for specific circumstances you might face. It is important to note that not all of USAA's riders are available on every policy and some riders are not sold in every state.

- Accidental Death Benefit Rider: If you pass away and your death is caused by a qualifying accident, this rider will provide a second death benefit on top of your base policy's death benefit.

- Child Rider: The child rider provides a limited amount of term life insurance coverage for your young children. The policy expires when the child reaches adulthood.

- Military Severe Injury Benefit Rider: This rider provides a payout of $25,000 for medical expenses if you are injured during military duties. Qualifying injuries include loss of limb function, paralysis, severe burns, and others.

- Military Future Insurability Rider: With this rider, you have the option to increase your life insurance coverage when you separate from the military without taking another medical exam.

- Term Life Event Option Rider: This rider allows you to purchase additional life insurance coverage in the future after a major life event, such as getting married, starting a family, or buying a home.

- Terminal Illness Rider: With this rider, you are allowed to withdraw money from your death benefit while you are still alive if you are diagnosed with a terminal illness. You can collect up to 50% of your policy's death benefit or up to $250,000, whichever is less.

- Waiver of Premium Rider: The waiver of premium rider will temporarily waive your life insurance premiums if you become totally disabled and unable to work. Your coverage will remain in force while using this rider.

Life Insurance and Skydiving: What's Covered in Accidents?

You may want to see also

USAA's life insurance customer satisfaction

USAA's customer satisfaction ratings are generally positive. The company's J.D. Power scores are high, and it has a good NAIC complaint index number, indicating fewer complaints than expected for a company of its size. Its AM Best rating, which assesses financial stability, is also the highest possible rating.

On Trustpilot, USAA has mixed reviews. Some customers praise the company's low premiums and positive experiences with its insurance agents, while others criticise its customer service and increasing premiums. Similarly, on Reddit, some users appreciate USAA's competitive rates and efficient claim handling, while others express frustration with long hold times and inefficient service.

Overall, USAA's customer satisfaction appears to be above average, especially for active-duty military members who can take advantage of the company's military-specific benefits.

Income Fluctuations: Life Insurance Impact and Adjustments

You may want to see also

USAA's life insurance pros and cons

USAA offers a range of life insurance products, including term life, simplified whole life, and universal life insurance. While the company primarily serves U.S. military service members, veterans, and their families, its life insurance policies are available to anyone. Here are some pros and cons of USAA's life insurance:

Pros:

- Financial Stability: USAA has the highest possible financial strength rating from AM Best, indicating its ability to pay future claims.

- Military-Specific Benefits: USAA offers various benefits tailored to military personnel, such as coverage during wartime, severe injury benefits, and guaranteed coverage after leaving the military.

- Flexible Payment Options: USAA provides flexible payment options for whole life insurance policies, allowing payments until a certain age or full payment of the policy over 20 years.

- High Coverage Limits: USAA offers coverage limits up to $10 million for term and whole life insurance policies, providing a wide range of options for customers.

- Survivor Relations Team: USAA has a dedicated team to assist families of deceased members, helping them navigate their accounts and benefits.

- Online Accessibility: USAA allows customers to get quotes, apply for policies, and manage their accounts online through its website and mobile apps.

- Low Complaint Volume: USAA has received fewer complaints than expected for a company of its size, according to the National Association of Insurance Commissioners (NAIC).

Cons:

- Limited Policy Options: USAA offers a limited number of life insurance policies, and some policies are not available in certain states, including New York and Montana.

- Medical Exam Requirements: Most of USAA's life insurance policies require a medical exam, and the process may be lengthy for some applicants.

- Higher Rates: USAA's term life insurance rates are higher than those of many competitors, which may be a factor for cost-conscious consumers.

- No Dividends: Unlike some other companies, USAA does not pay dividends on its whole life insurance policies.

- Limited No-Medical-Exam Policies: USAA offers limited options for policies that do not require a medical exam, which may be a disadvantage for those seeking quick coverage.

Social Security and Life Insurance: What's the Connection?

You may want to see also

Frequently asked questions

USAA offers term, whole, and universal life insurance policies.

USAA life insurance is available to everyone, regardless of whether they formally served in the armed forces.

USAA offers several benefits for military personnel, including coverage during wartime, severe injury benefits, and expedited coverage approval during deployment.

The cost of USAA life insurance depends on various factors such as age, health, and lifestyle. You can get a quote online or by contacting USAA directly.

USAA's life insurance rates are generally higher than those of its competitors. However, USAA offers unique benefits for military members and has a low volume of customer complaints.