Voya Financial, Inc. offers a range of life insurance products, including term, whole, and universal life insurance. In 2015, the company launched a new indexed universal life insurance solution, Voya IUL-Accumulator, which combines death benefit protection with the ability to build cash value. This product is designed to provide consumers with financial protection and flexibility in retirement planning. It is tied to the performance of the S&P 500® index, allowing for potential growth in the cash value of the policy. While the specific features of Voya's indexed universal life insurance may evolve over time, the fundamental characteristics of this product category remain consistent. Indexed universal life insurance policies are designed to offer permanent coverage, death benefits, and the potential for cash value growth based on the performance of an equity market investment index.

| Characteristics | Values |

|---|---|

| Type of Insurance | Indexed Universal Life Insurance |

| Provider | Voya Financial, Inc. |

| Features | Death benefit protection, flexibility, cash value growth |

| Cash Value | Tied to the performance of the S&P 500® index |

| Qualifications | Qualifying clients can utilize Voya's Orange Pass capability |

| Policy Issuance | In as little as five business days without bloodwork or a medical exam |

| Growth Potential | Tied to the S&P 500® |

| Floor | Consumers will not lose cash value if the index goes down or has a negative performance |

| Other Products | Voya IUL-Global Choice, Voya IUL-Protector |

| Cash Value Usage | Borrow against the policy through a loan or withdrawal |

| Borrowing Rates | Relatively low |

| Loan Requirements | No credit checks or other lending restrictions |

| Business Offerings | Customizable life insurance products, ongoing value to select distribution partners |

| Tools | Voya Life Journey, Concierge Service for Voya IUL-Global Choice and Voya IUL-Accumulator |

What You'll Learn

Voya's IUL Accumulator

Voya's Indexed Universal Life Insurance Solution, the Voya IUL-Accumulator, is a cash value life insurance product that offers protection and flexibility for retirement planning. It is designed to help consumers protect the financial future of their loved ones while building cash value that can supplement retirement income.

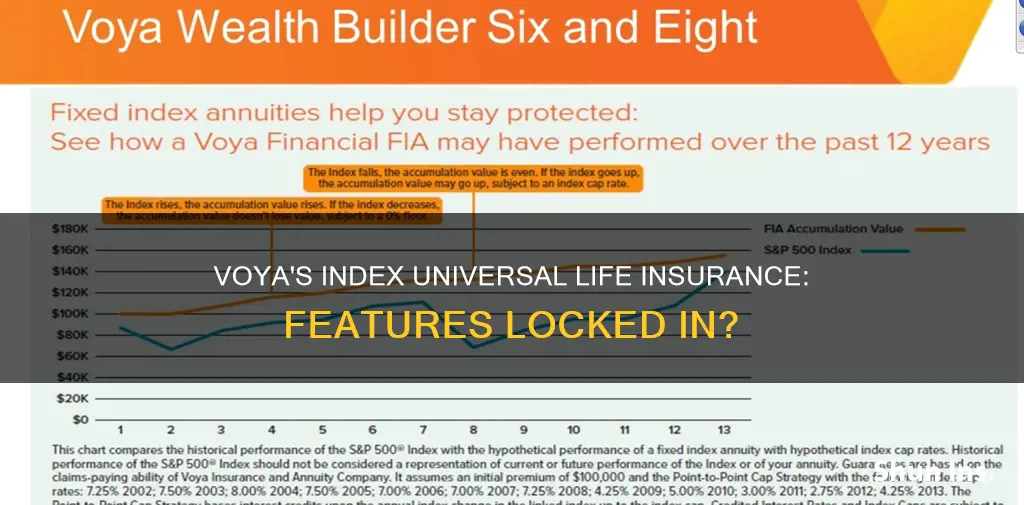

The Voya IUL-Accumulator is tied to the performance of the S&P 500® index, allowing for growth potential. The cash value in the customer's account grows at a rate based on the performance of the stock market index, with a floor that ensures consumers do not lose cash value if the index declines or has negative returns. This product provides long-term death benefit protection and is well-suited for younger consumers who want to build cash value for future use, as well as those nearing retirement who may need access to funds for unexpected expenses.

The Voya IUL-Accumulator is part of Voya Financial's Individual Life business, which offers customizable life insurance products to help consumers grow cash value, protect their loved ones through a policy's death benefit, and enjoy their financial future. The business provides tools and services such as Voya Life Journey, an online tablet-based selling system, and interactive long-term Concierge Service for Voya IUL-Global Choice and Voya IUL-Accumulator policies, to help manage customer expectations and results.

Voya's IUL-Accumulator is a valuable tool for retirement planning, offering protection and flexibility to consumers at various life stages. It is a welcome addition to Voya's portfolio of indexed universal life products, including the Voya IUL-Global Choice and Voya IUL-Protector, each with its own index options and policy objectives.

Health Insurance: A Key to Longevity?

You may want to see also

Permanent coverage

Universal life insurance is a type of permanent life insurance that offers lifelong coverage and flexibility in paying premiums. It is designed to last your entire life, not just a specific period of time, and it provides potential cash values that grow tax-deferred.

Universal life insurance has a cash value component that is separate from the death benefit. Each premium payment is split between the cost of insurance (such as administrative fees and the death benefit) and the cash value. The cash value can be used in several ways:

- Surrender value: If you decide you no longer want the policy, you can surrender it to the company and receive the cash value.

- Loan collateral: You can borrow money from the company and use the cash value as collateral.

- Premium payments: You can use the cash value to pay some or all of a premium.

It's important to monitor the cash value of your universal life insurance policy. If the cash value drops to zero, the policy will lapse and you will lose your coverage. Additionally, if your cash value runs out, you may get stuck paying the full cost of insurance.

Universal life insurance offers flexibility in how premiums are paid, how death benefits are paid, and how cash values may accumulate. There are several types of universal life insurance policies, including fixed, indexed, variable, and survivorship.

Fixed universal life policies offer flexibility in the amount and frequency of premium payments, and the death benefit can be adjusted up or down. The policy cash values are credited with interest at a rate declared by the insurance company, which can change from year to year.

Indexed universal life policies, such as Voya's IUL-Accumulator, combine the flexibility of universal life with cash value crediting based on the performance of an equity market investment index, such as the S&P 500. The cash value in the customer's account grows at a rate based on the performance of the stock market index, with a guaranteed minimum rate to protect against losses.

Variable universal life policies provide flexibility and allow the policy owner to choose from various variable investment options, offering more customizable investment potential. However, these policies are subject to market and investment risk, and there is a possible loss of the principal amount invested.

Survivorship universal life policies are designed to insure two people simultaneously, usually a husband and wife. They offer flexible premium payments and death benefits and provide coverage until the second insured person dies, resulting in lower premiums.

Usaa Life Insurance: Annual Fee or Free?

You may want to see also

Cash value growth

Voya's Indexed Universal Life Insurance offers a cash value life insurance product that is tied to the performance of the S&P 500® index. This means that the cash value in the customer's account grows at a rate based on the performance of the stock market index. The cash value has the potential to grow over time, and consumers can borrow from their policy through a loan or withdrawal. This is different from a traditional universal life policy, where part of a customer's premium grows at a fixed interest rate.

The Voya IUL–Accumulator is a product that allows consumers to protect the financial future of their loved ones while building cash value that can be used to supplement retirement income. It provides long-term death benefit protection while building cash value that can be used later in life. For those nearing retirement, the product offers the flexibility to access money for any purpose, including college tuition or unexpected medical expenses.

The Voya IUL–Accumulator features growth potential tied to the S&P 500®. Because the policy has a floor, consumers will not lose cash value if the index goes down or has a negative performance. This product is part of Voya's portfolio of indexed universal life products, which also includes the Voya IUL–Global Choice and Voya IUL–Protector, each with its own index options and policy objectives.

Indexed Universal Life Insurance policies provide death benefit protection and combine the flexibility of universal life with cash value crediting based on the performance of an equity market investment index. This results in a flexible policy with enhanced potential for cash value growth. The cash value in a policy like Voya IUL–Accumulator has the potential to grow over time, and consumers can borrow from their policy through a loan or withdrawal for any purpose.

Life Insurance for Veterans: Who Qualifies and What's Covered?

You may want to see also

Death benefits

Voya's Indexed Universal Life Insurance offers death benefit protection. This means that, in the event of the policyholder's death, their beneficiaries will receive a payout. This is a standard feature of life insurance policies.

The death benefit protection offered by Voya's Indexed Universal Life Insurance is designed to be long-term. This means that, unlike term life insurance, it is not limited to a specific number of years. Instead, it is designed to last the policyholder's entire lifetime.

The policy's death benefit can be adjusted up or down, but this requires evidence of insurability. This is another way in which Voya's Indexed Universal Life Insurance is flexible. The policy is designed to meet the needs of consumers at every age and life stage.

The death benefit payout can be used for a variety of financial needs, including paying off a mortgage, funding college educations, paying estate taxes, and providing money for the policyholder's spouse to pay off remaining debts and retire.

In addition to death benefit protection, Voya's Indexed Universal Life Insurance also offers the potential for cash value growth. This cash value can be borrowed against by the policyholder during their lifetime, or it can be left to grow and be paid out to beneficiaries upon the policyholder's death.

Life Insurance Benefits: Interest Accrual After Death?

You may want to see also

Borrowing against the policy

Borrowing against your Voya Index Universal Life Insurance policy is a feature that allows you to access the cash value of your policy before your death. This is a flexible feature that can be used to pay for unexpected expenses or supplement your retirement income.

The cash value of your Voya Index Universal Life Insurance policy is tied to the performance of the S&P 500® index. This means that the cash value in your account grows at a variable rate, depending on the performance of the stock market index. Because of this, the cash value of your account may increase over time, and you can borrow from your policy through a loan or withdrawal.

There are several benefits to borrowing against your Voya Index Universal Life Insurance policy. Firstly, the borrowing rates tend to be relatively low because the cash value of your account serves as collateral. Secondly, loans are not subject to credit checks or other lending restrictions. Thirdly, you can use the money borrowed for any purpose, including college tuition or unexpected medical expenses.

However, it is important to note that policy loans and withdrawals may have negative consequences. They can reduce or eliminate index credits, generate an income tax liability, reduce the available surrender value and death benefit, or even cause the policy to lapse. Therefore, while borrowing against your Voya Index Universal Life Insurance policy can be a useful feature, it is important to carefully consider the potential risks and consequences before doing so.

Life Insurance Proceeds: Tax Implications and Reporting Requirements

You may want to see also

Frequently asked questions

Voya's Indexed Universal Life Insurance is a permanent coverage option that offers death benefit protection and combines the flexibility of universal life with cash value crediting based on the performance of an equity market investment index.

The cash value portion of the policy earns interest based on the performance of an underlying stock market index. For example, returns may be linked to the Standard & Poor's (S&P) 500 composite price index. As the index moves up or down, so does the rate of return on the cash value component of the policy.

Voya Indexed Universal Life Insurance offers higher return potential, greater flexibility, tax-free capital gains, and no impact on Social Security benefits.

Some drawbacks include possible limits on annual returns, unpredictable returns, higher fees, and the risk of high premium payments if the policy is established during a time of poor market performance.