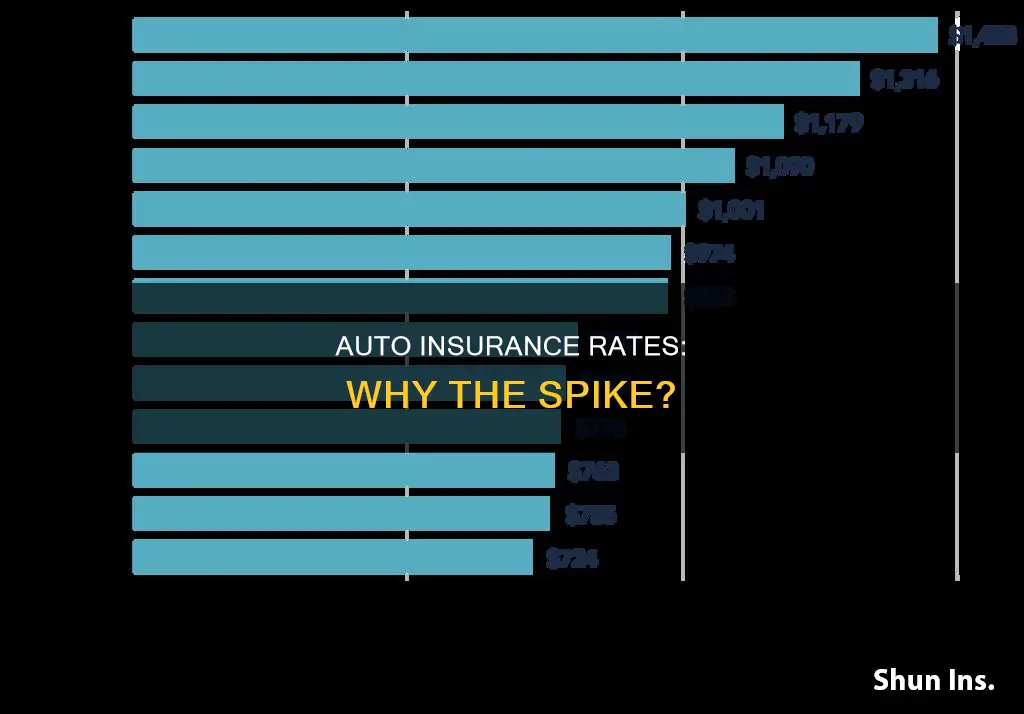

Auto insurance rates have been increasing in recent years, with a report from February 2023 showing that premiums rose by more than $240 on average, surpassing $2,000 a year. This surge in insurance costs is driven by several factors, including inflation, rising repair costs, labour and medical care expenses, and an increase in the frequency and severity of car accidents. Additionally, social inflation, or the public's negative attitude towards insurance companies, has led to higher litigation costs.

| Characteristics | Values |

|---|---|

| Average increase in insurance rates | $240 |

| Percentage increase in insurance rates | 15% |

| Average annual premium | $2,014 |

| Average annual income | $68,852 |

| Average annual premium in New York | $3,139 |

| Average annual premium in Florida | $3,183 |

| Average annual premium in Maine | $941 |

| Average annual premium in Vermont | $1,061 |

| Average cost of full coverage car insurance | $1,780 |

What You'll Learn

Inflation and rising costs of parts, labour, and medical care

The TechForce Foundation's 2022 Technician Supply & Demand Report highlighted the growing gap between the demand for transportation technicians and the limited supply, contributing to higher labour costs. Additionally, supply chain issues have caused prices for auto parts and vehicles to surge. From July 2022 to July 2023, the cost of vehicle repairs and maintenance increased by 12.7%, building on the increases of 4.1% and 8.1% in 2021 and 2022, respectively.

The increasing complexity of vehicle technology, such as microprocessors, cameras, and sensors, has also driven up repair costs. A simple fender bender can now result in costly repairs or replacements of these advanced features. As a result, insurers are paying more to fix or replace damaged vehicles, which is reflected in higher insurance rates.

Furthermore, the rising cost of medical care has also contributed to higher insurance costs. Medical expenses, including hospital stays and prescription drugs, continue to increase, impacting health insurance premiums. This, coupled with the rising costs of vehicle repairs and replacements, has led to a surge in insurance rates.

The impact of these factors is evident in the data. According to the U.S. Bureau of Labor Statistics, auto insurance costs in Louisiana increased by approximately 46% from December 2021 to 2024. Similarly, the average full-coverage auto insurance premium in the United States in 2023 was $1,601, representing a 17% increase since 2020. These rising costs have had a significant financial impact on consumers, with some drivers facing steep increases in their insurance premiums.

Parked Cars Need Insurance Too

You may want to see also

More accidents and violations

There are a number of factors that can cause car insurance rates to increase. One of the most significant reasons is the rise in the number of car accidents and traffic violations. The frequency and severity of car accidents have increased in recent years, leading to a higher number of insurance claims. This has resulted in increased costs for insurance companies, who then pass on these costs to their customers in the form of higher insurance rates.

Traffic violations, such as speeding tickets, DUI charges, and multiple moving violations, are a major contributing factor to rising insurance rates. These violations indicate to insurance companies that a driver is more likely to be involved in an accident, and as a result, the insurance company may increase their rates to account for the higher risk. Even a single speeding ticket or minor moving violation can lead to a rate increase.

Speeding, in particular, is a significant factor in traffic fatalities and injuries. It reduces the driver's reaction time in dangerous situations, increases the vehicle's stopping distance, and compromises the effectiveness of road safety structures. In 2022, speeding was a factor in 29% of all traffic fatalities in the United States, resulting in over 12,000 deaths. Young male drivers between the ages of 15 and 24 are the most likely to be speeding at the time of fatal crashes.

In addition to speeding, other human factors play a significant role in causing accidents. According to research, about 90% of traffic crashes are caused by human error, with traffic violations being one of the most common causes. Driving under the influence of alcohol or drugs, distracted driving (especially due to mobile phone use), and inadequate post-crash care are all factors that increase the risk of accidents and contribute to rising insurance rates.

Furthermore, the design of roads and unsafe road infrastructure can also impact safety. Roads that lack adequate safety features for all road users, such as pedestrians, cyclists, and motorcyclists, can lead to an increased number of accidents. This includes the absence of footpaths, cycling lanes, safe crossing points, and traffic calming measures.

To address the issue of rising insurance rates due to accidents and violations, it is essential to improve road safety. This can be achieved through stricter enforcement of traffic laws, improving road infrastructure, promoting safe driving practices, and enhancing post-crash care to reduce the severity of injuries. By addressing these issues, we can work towards reducing the number of accidents and violations, ultimately helping to stabilize or even decrease insurance rates.

Gap Insurance Tax in New York

You may want to see also

Location and population density

Population density is a significant factor in determining auto insurance rates. The more people in an area, the higher the likelihood of accidents, which results in increased insurance rates. This is especially true for urban centres, where the number of drivers on the road contributes to crowded roadways, heavy traffic, and a higher rate of collisions. As a result, insurance companies charge more for coverage in these areas to offset the cost of potential claims.

The impact of population density on insurance rates can be seen in the difference in insurance costs between states. For example, the average annual cost of car insurance in Idaho is $1,021, while in New York, it is $4,769. This is due in part to the higher population density in New York, which increases the risk of accidents and claims.

In addition to population density, other factors such as traffic, crime, and weather can also affect insurance rates. Moving from a rural to an urban area can cause premiums to increase by up to 40%. For example, Missouri saw a 40% increase in insurance premium prices this year, with drivers spending an average of $2,801 per year on auto insurance in 2024.

Furthermore, the cost of vehicle repair and labour in a particular state can also impact insurance rates. States that have experienced severe weather events, such as hurricanes or tornadoes, tend to have higher insurance rates as these events increase the number of claims made. For example, Louisiana and Florida, which have been impacted by severe weather in recent years, have some of the highest insurance rates in the country.

Overall, population density is a key factor in determining auto insurance rates, and it is important to consider how the location and population of an area can impact the cost of insurance.

Vehicle Insurance: Am I Covered?

You may want to see also

Credit score

In most states, auto insurance companies are allowed to consider an individual's credit score when determining their insurance rates. However, there are exceptions, such as California, Hawaii, Massachusetts, and Michigan, which prohibit or limit the use of credit scores in setting auto insurance rates.

The impact of a low credit score on insurance rates can be significant. On average, individuals with poor credit pay substantially more for full coverage car insurance than those with excellent credit. This difference in rates can amount to hundreds or even thousands of dollars annually.

To improve their credit score, individuals can take several steps, including paying their bills on time, minimizing hard credit inquiries, regularly monitoring their score, maintaining old lines of credit, and keeping their credit card balances low relative to their credit limits. By improving their credit score, individuals may be able to secure more favorable insurance rates.

It is worth noting that insurance companies use a credit-based insurance score, which is different from the traditional credit score used by lenders. This score is specifically designed to predict the likelihood of filing an insurance claim and weighs factors such as payment history, outstanding debt, credit history length, and pursuit of new credit differently.

Insuring Elderly Collector Vehicles

You may want to see also

Teen drivers

Auto insurance rates have been increasing across the board, with a report from February 2023 showing that prices were up nearly 15% from 2022. There are a number of factors contributing to this increase, including inflation, rising repair and replacement costs, and an increase in the number and severity of car accidents.

There are two main paths to insure a teen driver: adding them to an existing policy or having them purchase their own standalone policy. Typically, parents choose to add their teens to their own policies, as standalone policies for teens are often very costly. By adding a teen driver to an existing auto policy, parents can get them the same coverage for a lot less money.

However, adding a teen driver to a policy will still result in a bump in the insurance premium. There are ways to reduce these costs, such as taking advantage of discounts offered by insurance companies. Many companies offer "good student" discounts for students who maintain a certain GPA, as well as discounts for teens who complete an approved driving course. Another way to save is by choosing a higher deductible, which will lower the premium.

It's important for parents to involve their teens in the car insurance discussion and reinforce driving safety tips and the consequences of driving infractions or accidents, including increasing insurance costs. Additionally, assigning a teen driver to the least valuable car in the household can help reduce costs, as some insurers will assign the most expensive driver to the most expensive car to insure.

While insuring a teen driver can be costly, there are ways to mitigate these costs by taking advantage of discounts, choosing a higher deductible, and shopping around for the best policy.

Auto Insurance: Am I Covered in Canada?

You may want to see also

Frequently asked questions

There are several reasons auto insurance has increased. Firstly, inflation has had a significant impact on insurance rates, with the cost of goods and services rising, so too has the cost of protecting customers. Secondly, there has been a rise in the cost of repairing and replacing vehicles due to labour shortages, supply chain disruptions, and an increase in car accidents. Thirdly, the frequency and severity of costly weather events have increased, leading to more expensive storm-related insurance claims. Lastly, social inflation, or negative attitudes towards insurance companies, have led to more claims, higher litigation costs, and larger settlement payouts.

Auto insurance rates have increased by nearly 15% from 2022 to 2023, with some states like California receiving a rate increase of 19%. On average, drivers are now paying more than $240 extra per year for their auto insurance.

Several factors influence your auto insurance rate, including your location, driving record, credit score, type of vehicle, and whether you have added a new vehicle or driver to your policy.

To lower your auto insurance rate, you can maximize your discounts, personalize your rate based on your driving habits, explore payment options, and compare quotes from different insurance companies.