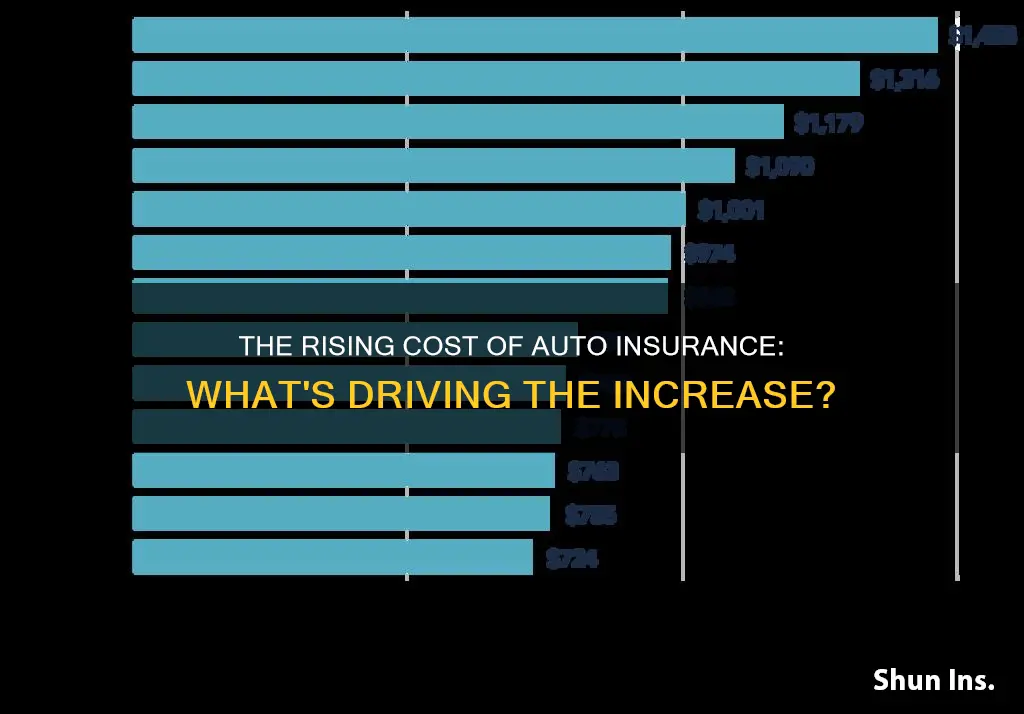

Car insurance rates have been on an upward trajectory, with a historic leap of more than 22% in the last year. This surge is attributed to a multitude of factors, including inflation, supply chain disruptions, rising repair costs, and climate change. Inflation, a significant contributor, has led to higher prices for auto parts and vehicles, with repair costs spiking by 12.7% from July 2022 to July 2023. Climate change has also played a role, with an increase in severe weather events causing extensive vehicle damage and subsequent insurance claims. Repair costs have risen due to advanced vehicle technology, and labour costs have increased by 5% from September 2021 to September 2022.

The convergence of these factors has resulted in steep losses for insurance companies, prompting them to raise rates. The impact of these rate hikes is felt by drivers, with some experiencing increases of 5%, 10%, or even 20% in 2023. While the cost of car insurance continues to climb, there are strategies individuals can employ to mitigate the financial burden, such as assessing coverage needs, maintaining a clean driving record, and taking advantage of various discounts offered by insurance companies.

| Characteristics | Values |

|---|---|

| Average increase in car insurance rates | 17% in the past year |

| Factors causing the increase | Inflation, supply shortages, climate change, reinsurance rates, increase in accidents, increase in repair costs, increase in health care costs, environmental events, increase in insurance claims |

| Average cost of car insurance | $81-$146 a month for a liability-only policy |

Inflation

Impact of Inflation on the Automotive Industry

- Vehicle values: The average cost of a new car has increased, with the average price reaching almost $49,000, an 18% increase over the past three years, according to Kelley Blue Book. This is partly due to the semiconductor chip shortage, which has resulted in higher-priced cars.

- Labor costs: The automotive industry is facing a shortage of qualified mechanics, leading to increased labor costs. The demand for transportation technicians outpaced supply by an estimated 5 to 1, resulting in higher labor costs for insurance companies.

- Replacement parts: The cost of replacement parts has gone up due to supply chain disruptions and increased demand as more people are keeping their old cars on the road.

- Repair costs: Car repair costs have increased significantly, with a 10% rise from December 2022 to December 2023, according to the December 2023 consumer price index. This is due to factors such as the chip shortage, intricate parts, and advanced technology in newer cars.

Impact of Inflation on Insurance Companies

- Claims costs: The increase in vehicle values, repair costs, and replacement parts has resulted in higher claim costs for insurance companies. This has been further exacerbated by the increase in accidents and severe weather events, leading to more expensive insurance claims.

- Company losses: The combination of higher claim costs and increased frequency of claims has resulted in significant losses for insurance companies. This has prompted them to raise premiums to cover these losses.

Other Factors Influencing Auto Insurance Rates

While inflation has played a significant role, there are also other factors that have contributed to the rise in auto insurance rates:

- Healthcare costs: Rising healthcare costs have impacted insurance premiums as insurance providers also cover injuries sustained by drivers and passengers in crashes.

- Severe weather events: An increase in severe weather incidents has resulted in more vehicles being damaged or totaled, leading to higher payouts for insurance companies.

- Supply chain issues: The semiconductor chip shortage and other supply chain disruptions have affected the availability of new vehicles and replacement parts, driving up costs.

- Increased driving and accidents: As people have returned to pre-COVID levels of driving, there has been an increase in accidents, leading to more claims for insurance companies.

Switching Auto Insurance: Mid-Year Changes

You may want to see also

Supply chain issues

The auto industry has also faced labour shortages, with the demand for transportation technicians outpacing supply. This has led to higher labour costs, which have also contributed to the increase in insurance rates.

The supply chain issues have particularly impacted the cost of repairing and replacing vehicles. As the cost of vehicle repairs and maintenance has increased, so has the amount that insurers pay to fix vehicles. Additionally, as vehicle values have risen, insurers have had to pay more to replace their customers' totaled cars and trucks. These factors have ultimately contributed to the rise in auto insurance rates.

The supply chain issues have also affected repair shops, as they may have to wait weeks or even months for parts that were previously readily available. This means that customers may need to keep a rental car for longer, which increases the cost for insurance companies.

The pandemic has also contributed to the rise in auto insurance rates by changing driving habits. During the pandemic, many people drove less due to lockdowns and fears of the virus. In response, auto insurers lowered premiums. However, as the pandemic has eased, people have returned to the roads, leading to an increase in accidents and insurance claims. This has resulted in higher costs for insurance companies, which have been passed on to customers in the form of higher insurance rates.

Auto Insurance Cards: Do Children Need Listing?

You may want to see also

Repair costs

Labour Shortages

The auto industry has faced labour shortages, with the demand for transportation technicians outpacing the supply. This has resulted in higher labour costs, which contribute to the overall increase in repair costs. The TechForce Foundation's 2022 Technician Supply & Demand Report showed a widening gap between the demand for and supply of automotive technicians, with an 11.8% drop in graduating technicians compared to the previous year.

Supply Chain Disruptions

Strained supply chains have caused prices for auto parts and vehicles to surge. This has been exacerbated by the COVID-19 pandemic, which shut down factories and disrupted trade routes globally. As a result, repair shops have faced challenges in sourcing parts, leading to longer repair times and higher costs. The microchip shortage, for example, led to a significant reduction in vehicle production in 2022.

Advanced Vehicle Technology

The increasing sophistication of vehicle technology has also contributed to higher repair costs. Newer cars often feature advanced safety systems, such as exterior cameras and sensors, which can be costly to repair or replace. A minor crash or damage to these components can result in substantial repair bills.

Frequency of Repairs

In addition to the cost of individual repairs, the frequency of repairs has also increased. This is partly due to the rise in accidents, with the National Highway Traffic Safety Administration reporting a significant increase in fatal accidents from 2020 to 2021. The combination of more frequent accidents and higher repair costs has resulted in more expensive insurance claims, leading to higher insurance rates.

Environmental Factors

Environmental factors, such as severe weather events and natural disasters, have also played a role in increasing repair costs. Floods, hail, hurricanes, and tornadoes can cause extensive vehicle damage, leading to more insurance claims and higher repair bills. States prone to climate disasters, such as Colorado and Florida, have experienced some of the steepest auto insurance rate hikes.

UK Vehicle Insurance: Am I Covered?

You may want to see also

Climate change

In 2023, the United States experienced several weather disasters, including wildfires in Maui, Hawaii, historic floods in California, and tropical cyclones. These events caused significant damage and led to an increase in insurance claims. For example, State Farm paid $12 billion in catastrophic claims in 2023, a significant increase from the $7 billion paid in 2022.

The impact of climate change on auto insurance rates is expected to continue, as extreme weather events become more frequent and intense. This, coupled with other factors such as rising repair costs and an increase in accidents, is likely to result in higher insurance premiums for drivers across the country.

Florida: Mandatory Auto Insurance Coverage

You may want to see also

Insurance fraud

Auto insurance rates have gone up due to a variety of factors, including inflation, supply chain issues, increased repair and medical costs, and severe weather events. These factors have contributed to higher insurance claims and ultimately driven up insurance rates for consumers.

Now, onto the topic of insurance fraud.

Soft Fraud

Soft fraud typically refers to exaggerating a claim or an event. For example, claiming that a dent in your car happened during a hit-and-run accident when it actually occurred from backing into your mailbox. It can also involve leaving out critical details on your insurance application, such as previous driving offenses. While soft fraud may seem minor, it is still considered insurance fraud and can result in legal penalties.

Hard Fraud

Hard fraud is a more serious offense that usually involves larger payout amounts. This could include faking an accident, abandoning a vehicle and claiming it was stolen, or providing a false address to obtain a lower insurance rate. Hard fraud tends to result in more severe punishments, including jail time.

- Counterfeit airbags: Deployed airbags are sometimes replaced with counterfeits during the repair process, which can put people's lives at risk.

- Staged accidents: These are strategically planned collisions intended to defraud insurance companies. Common types include the "swoop and squat," "drive down," and "wave down."

- Windshield replacement rip-offs: Unscrupulous vendors may approach drivers and offer gift cards to sign a false agreement for windshield replacement, resulting in inflated costs for insurers.

- Towing scams: Fraudulent tow truck services appear at accident scenes and insist on towing your vehicle to their shop, where they charge excessive fees for repairs.

- Car insurance premium evasion: Policyholders may deliberately provide false information, such as a lower-premium address, to obtain cheaper insurance rates.

To avoid becoming a victim of auto insurance fraud, it is important to be vigilant and follow these tips:

- Opt for original manufacturing parts when repairing your vehicle.

- Document all incidents, including accident damage, police reports, and invoices.

- Be cautious of individuals or services that seem suspicious, and consider calling the police if necessary.

- Keep your vehicle insurance information private and only share it with your insurer or when handling official claims or reports.

- Verify the legitimacy of your insurance agent and company before providing personal and payment information.

- Practice defensive driving to reduce the risk of accidents and potential fraud.

- Be suspicious of insurance prices that seem too good to be true, as they may be scams or policies with hidden exclusions.

Unlicensed Vehicles: Need Insurance?

You may want to see also

Frequently asked questions

Auto insurance rates have gone up due to inflation, supply chain issues, increased repair costs, climate change, and reinsurance rates.

Reinsurance is an industry that helps insurers pay claims. Insurers pay reinsurance rates to these companies, and when the cost of reinsurance goes up, the cost of insurance for consumers also goes up.

Inflation has caused the cost of goods and services to increase, which has led to higher insurance rates. Additionally, inflation has increased labour costs for insurance companies, as they may be spending more on their staff.

Yes, supply chain issues have contributed to higher auto insurance rates by causing a spike in auto parts and vehicle prices, leading to more expensive repairs and replacements.

Repair costs have increased due to more advanced car features and higher labour costs. As a result, insurance companies pay more to fix vehicles, which is reflected in higher insurance rates for consumers.