When an accident occurs, it's important to know when and how to contact your insurance company, especially if you believe the other driver is at fault. This guide will provide essential information on the steps to take, including gathering evidence, reporting the incident, and understanding your insurance coverage to ensure you're adequately protected during the claims process.

| Characteristics | Values |

|---|---|

| When to Contact the At-Fault Driver's Insurance | - Immediately after the accident to report the incident and file a claim. - Within a specified timeframe (often 24-48 hours) to provide details of the accident. - When you have a copy of the police report or any other relevant documentation. - If the at-fault driver's insurance company is unresponsive or refuses to cooperate. |

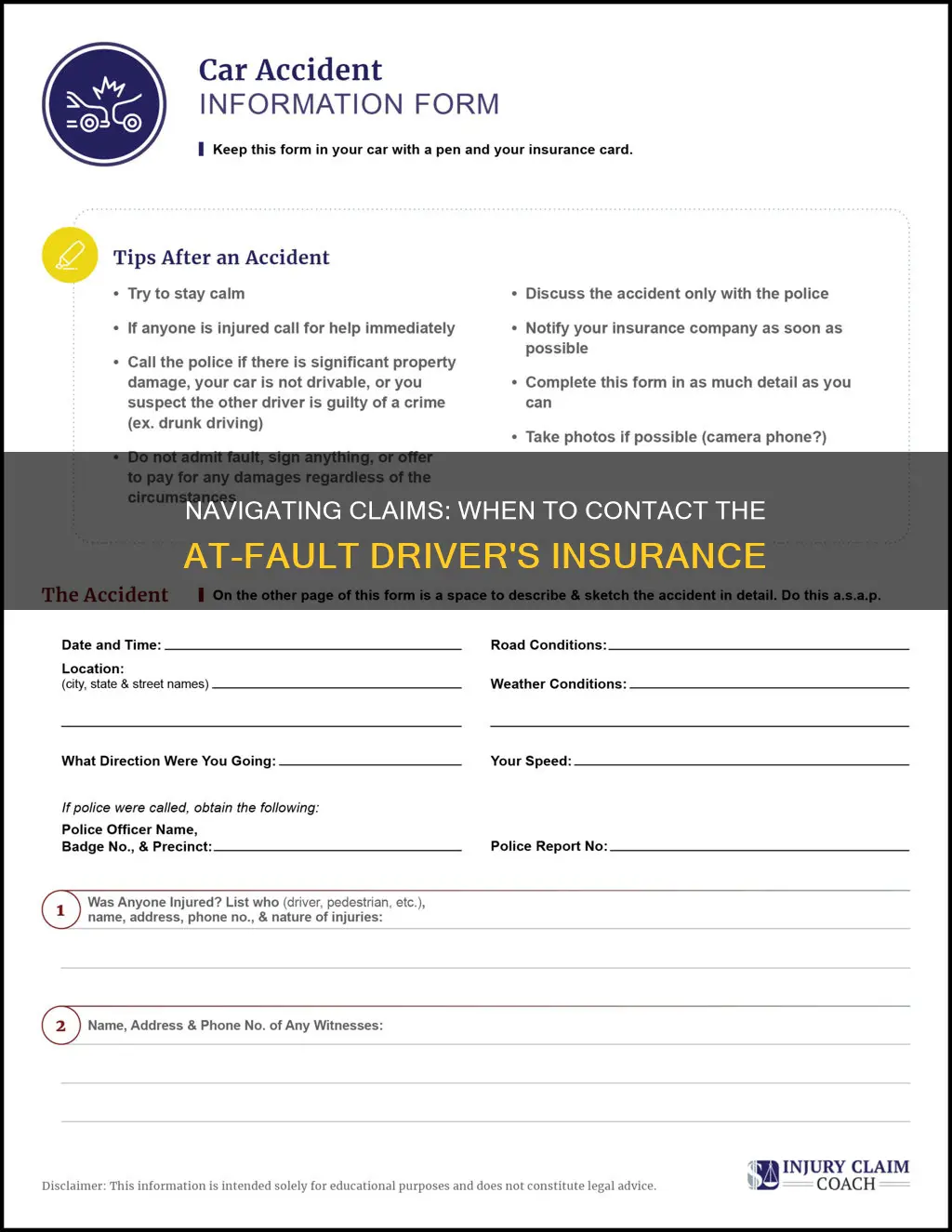

| Reporting the Accident | - Provide a detailed account of the accident, including the date, time, location, and a description of the events. - Share contact information and insurance details with the at-fault driver and any witnesses. - Take photos of the accident scene, vehicle damage, and any relevant evidence. |

| Dealing with Insurance Adjusters | - Be cooperative and provide all requested information truthfully. - Ask for clarification if you don't understand a question. - Keep records of all communication with the insurance company, including dates, names, and a summary of the conversation. - Don't accept the first settlement offer without understanding the full extent of your damages. |

| Legal Considerations | - Contact your insurance company as soon as possible to understand your coverage and rights. - If the at-fault driver's insurance is insufficient or denies coverage, you may need to pursue legal action. - Consult with an attorney specializing in personal injury or car accident cases for guidance. |

| Timeframe for Contact | - Most insurance companies have a specific timeframe for reporting accidents, typically within 7-10 days. - It's essential to act promptly to ensure your claim is processed efficiently. |

What You'll Learn

- Legal Requirements: Understand local laws and insurance regulations regarding fault and claims

- Policy Coverage: Review your insurance policy to know what is covered and when to file a claim

- Damage Assessment: Document and assess vehicle damage promptly to determine if a claim is necessary

- Witness Information: Collect witness details and evidence to support your claim and establish fault

- Insurance Company Protocols: Follow the insurance company's procedures for filing a claim and providing necessary documentation

Legal Requirements: Understand local laws and insurance regulations regarding fault and claims

When it comes to dealing with insurance claims, especially those involving a fault determination, understanding the legal requirements and regulations specific to your location is crucial. These laws can vary significantly from one jurisdiction to another, and they play a pivotal role in how insurance companies handle claims and how policyholders can protect their rights. Here's a breakdown of what you need to know:

Local Laws and Insurance Regulations: Each region has its own set of rules and regulations governing insurance practices. These laws are designed to protect both insurance companies and policyholders. For instance, in some areas, insurance companies might have strict guidelines on how quickly they must respond to claims, the information they need to process a claim, and the procedures for dispute resolution. Familiarize yourself with these local regulations to ensure you are aware of your rights and the expectations of the insurance provider.

Fault and Liability: The concept of fault is central to insurance claims, especially in cases of auto accidents. Local laws often dictate how fault is determined, whether it is based on a police report, witness statements, or a thorough investigation by the insurance company. Understanding these processes can help you navigate the system more effectively. For example, in some places, the at-fault driver's insurance company might have a specific process for handling claims, including the timeline for providing compensation and the documentation required.

Claims Process and Deadlines: Insurance regulations often outline the steps and timelines for filing a claim. This includes the time frame within which you must notify your insurance company about an incident and the subsequent steps for making a claim. Missing these deadlines can potentially result in denied claims, so it's essential to be aware of and adhere to these requirements. Additionally, local laws may specify the information you need to provide during the claims process, such as police reports, medical records, and witness statements.

Dispute Resolution: In the event of a dispute over fault or the amount of compensation, local laws will dictate the available avenues for resolution. This could include mediation, arbitration, or even legal proceedings. Understanding these processes can help you make informed decisions and potentially save time and money. For instance, some regions might encourage alternative dispute resolution methods, which can be less costly and time-consuming compared to a lawsuit.

Policy Review and Insurance Terms: Regularly reviewing your insurance policy is essential. This ensures you are aware of the coverage you have and the specific terms related to fault and claims. Insurance policies can be complex, and understanding the language used is critical. For example, some policies might have clauses that limit coverage for certain types of incidents or require specific actions to be taken after an accident. Being well-versed in your policy can help you make the right decisions when dealing with a claim.

Combining Renters and Auto Insurance

You may want to see also

Policy Coverage: Review your insurance policy to know what is covered and when to file a claim

When it comes to insurance, understanding your policy coverage is crucial, especially in the context of determining when to contact the at-fault driver's insurance. This knowledge can significantly impact the claims process and your overall experience. Here's a comprehensive guide to help you navigate this aspect:

Understanding Your Policy: Begin by thoroughly reviewing your insurance policy documents. These documents outline the specific coverage provided by your insurance company. Look for sections that detail liability coverage, which typically covers damages and injuries caused to others in an accident. Pay close attention to the policy's definition of 'fault' and any exclusions or limitations. For instance, some policies may have a 'fault threshold' that determines when you can file a claim, often based on the severity of the accident.

Identifying Coverage Limits: Your policy should also specify the coverage limits for bodily injury and property damage. These limits represent the maximum amount the insurance company will pay for each category. If the at-fault driver's coverage limits are lower than your policy's limits, you might still be able to file a claim, but you should be aware of potential financial implications. Understanding these limits is essential to know when to seek the at-fault driver's insurance involvement.

When to File a Claim: Filing a claim with the at-fault driver's insurance is generally appropriate when the other party's negligence is evident and they are legally responsible for the accident. Here are some key scenarios:

- Severe Injuries: If you or anyone involved in the accident has sustained significant injuries, it is advisable to contact the at-fault driver's insurance promptly. This ensures that medical expenses and related costs are covered.

- Property Damage: When your vehicle or other property is damaged, and the at-fault driver's insurance is likely to cover the repairs, it is beneficial to file a claim.

- Legal Obligation: In most jurisdictions, drivers are legally required to provide insurance information after an accident. Failing to do so can result in penalties, so it is essential to contact the at-fault driver's insurance to fulfill this obligation.

Documenting the Incident: Before contacting the insurance company, gather and document all relevant information related to the accident. This includes details of the at-fault driver, their insurance provider, witness statements, and any available evidence. Proper documentation will streamline the claims process and strengthen your case.

Communicating with the At-Fault Driver's Insurance: When you file a claim, the insurance company will investigate the incident. Be prepared to provide them with the necessary documentation and answer their inquiries. It is essential to cooperate fully to ensure a smooth claims process. Remember, the goal is to resolve the claim fairly and efficiently, so clear and honest communication is vital.

Michigan Auto Insurance: Understanding Trailer Coverage

You may want to see also

Damage Assessment: Document and assess vehicle damage promptly to determine if a claim is necessary

When it comes to assessing vehicle damage and deciding whether to file an insurance claim, prompt and thorough documentation is crucial. Here's a step-by-step guide to help you navigate this process efficiently:

- Immediate Documentation: As soon as you've assessed the scene of the accident and ensured everyone's safety, start documenting the damage. Take detailed photographs or videos of the vehicles involved, capturing all angles and any visible damage. Include close-ups of specific areas, such as dents, scratches, or any broken parts. This visual evidence will be invaluable for the insurance process.

- Create a Damage Report: Prepare a comprehensive report detailing the observed damage. Note the location and extent of each issue, describing any structural, cosmetic, or mechanical problems. Include the make, model, and year of your vehicle, as well as the estimated value of the damage. Be as specific as possible to ensure an accurate assessment.

- Compare with Insurance Coverage: Review your insurance policy to understand the coverage options available. Different policies may have varying requirements for damage assessment and claim processes. Determine if the damage is covered by your insurance and if there are any specific procedures you need to follow. This step will help you decide whether to proceed with a claim.

- Contact the Insurance Company: If the damage is significant and you believe a claim is necessary, promptly inform your insurance provider. Provide them with the detailed damage report and supporting documentation. Be transparent about the incident and answer any questions they may have. The insurance company will guide you through the next steps, which may include an adjuster's visit to assess the damage further.

- Follow-up and Negotiate: Stay in communication with your insurance company throughout the process. If there are any disputes or disagreements regarding the damage assessment, be prepared to provide additional evidence or explanations. Negotiate and collaborate to reach a fair agreement. Remember, your cooperation and prompt action can expedite the claim resolution.

By following these steps, you can ensure that the damage assessment process is thorough and efficient, helping you make an informed decision about contacting the at-fault driver's insurance company. Prompt documentation and communication are key to a smooth insurance claim experience.

Obtaining Auto Insurance Repair Jobs: A Comprehensive Guide

You may want to see also

Witness Information: Collect witness details and evidence to support your claim and establish fault

When you're involved in an accident, gathering witness information is crucial for supporting your insurance claim and establishing fault. Here's a detailed guide on how to collect and utilize witness details effectively:

- Act Promptly: Time is of the essence. After the accident, while the scene is fresh in everyone's minds, approach any witnesses and politely request their contact information. The sooner you collect this data, the more reliable the information will be.

- Gather Full Names and Contact Details: Obtain complete contact information for each witness. This includes their full name, address, phone number(s), and email address (if available). Having multiple ways to reach them increases the chances of obtaining their statements later.

- Document Witness Statements: Encourage witnesses to provide a detailed account of what they saw. Ask them to describe the events leading up to the accident, the actions of the drivers involved, and any specific details they remember. The more information you have, the better you can reconstruct the sequence of events.

- Take Notes and Record Statements: Take notes during witness interviews or have them provide written statements. Include the witness's name, the date and time of the interview, and a summary of what they observed. If possible, record their statements with their consent, ensuring you have their permission to use the recording.

- Capture Visual Evidence: If it's safe to do so, ask witnesses to take photos or videos of the accident scene, including vehicle positions, damage, and any relevant surroundings. This visual evidence can corroborate witness statements and provide valuable insights to insurance adjusters.

- Follow Up: Don't hesitate to contact witnesses again if you have any further questions or need additional information. They may remember details they initially overlooked or provide clarification on their statements.

- Share Witness Information with Your Insurer: Once you've collected all the witness information, provide it to your insurance company. They will use this data to investigate the claim, interview witnesses, and determine fault. Be transparent and cooperative during the claims process.

Remember, witness statements can significantly impact the outcome of your insurance claim. By gathering and documenting this information promptly and accurately, you're taking a crucial step towards establishing fault and receiving the compensation you deserve.

Rideshare Gap Auto Insurance: Which VA Companies Sell It?

You may want to see also

Insurance Company Protocols: Follow the insurance company's procedures for filing a claim and providing necessary documentation

When you've been involved in an accident and are considering contacting your insurance company, it's crucial to understand the specific protocols and procedures they follow. Insurance companies have established processes to ensure that claims are handled efficiently and fairly. Here's a guide on how to navigate this process:

Understand the Claim Process: Begin by familiarizing yourself with the insurance company's claim procedure. Most insurance providers have detailed guidelines on their websites or through customer service representatives. This process typically involves several steps, including reporting the accident, providing relevant information, and submitting necessary documentation. Knowing these steps beforehand will help you act promptly and efficiently.

Report the Accident Promptly: Time is of the essence when dealing with insurance claims. Contact your insurance company as soon as possible after the accident. Provide them with the details of the incident, including the date, time, location, and a description of what happened. Quick reporting ensures that the insurance company can initiate the claims process without unnecessary delays.

Gather and Provide Documentation: Insurance companies require specific documentation to process your claim. This may include police reports, medical records, repair estimates, and witness statements. Gather these documents and provide them to your insurance adjuster. Ensure that all information is accurate and up-to-date. The more comprehensive your documentation, the smoother the claims process will be.

Follow Up and Stay Informed: After submitting your claim, maintain regular contact with your insurance company. Inquire about the status of your claim and provide any additional information they may request. Insurance adjusters will guide you through the process and answer any questions you may have. Staying informed and proactive will help you understand the progress of your claim and ensure a more efficient resolution.

Adhere to Deadlines: Insurance companies often have strict deadlines for various claim-related tasks. These deadlines may include submitting initial reports, providing medical updates, or making repair decisions. Missing these deadlines could potentially delay the processing of your claim. Always be mindful of these timelines and work closely with your insurance provider to meet them.

By following the insurance company's protocols, you can ensure that your claim is handled according to their established procedures. This approach helps streamline the process, allowing you to receive the necessary support and compensation more efficiently. Remember, staying organized, providing accurate information, and maintaining open communication with your insurance provider are key to a successful claim experience.

Auto Insurance Liability: Who's Covered?

You may want to see also

Frequently asked questions

It is essential to contact the at-fault driver's insurance company as soon as possible after an accident. Prompt action ensures a smoother claims process and helps prevent any potential delays in compensation. Provide them with accurate details of the incident, including your contact information, policy number, and a description of the damages.

Gather all relevant details related to the accident, such as the date, time, and location. Have your policy number, contact information, and a clear record of the damages or injuries sustained. If possible, take photographs of the accident scene and any visible damage to your vehicle or property. This information will assist the insurance adjuster in assessing the claim efficiently.

While it is possible to file a claim through your own insurance company, contacting the at-fault driver's insurer is generally recommended. Their role is to facilitate communication and negotiate with the other party's insurance provider on your behalf. They can also guide you through the process, ensure all necessary paperwork is completed, and help expedite the settlement.