Haven Life Insurance, a subsidiary of Massachusetts Mutual Life Insurance Co., is no longer accepting new applications for its life insurance products. Existing policies, issued by MassMutual and its subsidiary C.M. Life, will continue to be administered and serviced by MassMutual. Haven Life was founded in 2014 as a digital insurance agency, offering two types of term life insurance: Haven Simple and Haven Term. The company's term life insurance rates were highly competitive, especially for younger customers, but its policies could not be renewed or converted to permanent life insurance later. Haven Life's insurance products were available in all 50 states and the District of Columbia, with the exception of certain riders in some states.

What You'll Learn

- Haven Life Insurance is no longer accepting new customers

- Existing policies will continue to be serviced by MassMutual

- Haven Life offered two types of term life insurance: Haven Simple and Haven Term

- Haven Life's term rates are highly competitive, especially for younger ages

- The cost of life insurance depends on several factors, including health and medical history

Haven Life Insurance is no longer accepting new customers

Haven Life offered two types of term life insurance: Haven Simple and Haven Term. Haven Simple was designed for individuals aged 20 to 55, with coverage ranging from $25,000 to $1 million for terms of 5, 10, 15, or 20 years. Haven Term was available to individuals up to the age of 64, with coverage of up to $3 million for terms of 10, 15, 20, 25, or 30 years. Haven Term typically required a medical exam, while Haven Simple did not. Both policies offered a guaranteed, tax-free death benefit, payable to beneficiaries in a lump sum.

Haven Life also offered several riders, including the Accelerated Death Benefit, which allows terminally ill patients to receive a portion of their death benefit, and the Waiver of Premium, which keeps the policy active if the policyholder becomes unable to make payments due to illness or injury. The Haven Life Plus rider gave policyholders access to free or discounted services, such as online wills, pharmacy discounts, and fitness apps.

While Haven Life is no longer accepting new customers, existing policies will continue to be administered and serviced by MassMutual, with no changes to the terms of the policies.

PNC Bank: Credit Life Insurance for Vehicles?

You may want to see also

Existing policies will continue to be serviced by MassMutual

Haven Life is no longer selling life insurance, but existing policies will continue to be serviced by MassMutual. This means that if you already have a Haven Life insurance policy, MassMutual will continue to administer and service your policy with no changes.

Haven Life was a digital insurance agency founded in 2014 that offered term life insurance policies issued by MassMutual and its subsidiary, C.M. Life. In late 2023, Haven Life announced it was ceasing new business. The company suffered from a "lack of consumer adoption" and "high costs associated with customer acquisition."

As a result, MassMutual will shift direct access to its life insurance products from Haven Life to its own website, MassMutual.com, over the coming months. Sales will continue through Haven Life for a limited time.

If you have a pending application with Haven Life, you don't need to reapply—the company will continue to issue policies through the end of March 2024.

If you are a current Haven Life customer, rest assured that your existing policy will continue to be serviced by MassMutual, and there will be no change to your policy. You can also still file a life insurance claim with Haven Life by contacting its policy service center.

While Haven Life is no longer accepting new applications, MassMutual, its parent company, is still offering its own life insurance products. MassMutual has superior financial strength, and you can apply for its life insurance policies directly through its website.

Retired Military: What Life Insurance Benefits Are Available?

You may want to see also

Haven Life offered two types of term life insurance: Haven Simple and Haven Term

Haven Simple is a simplified issue life insurance policy that does not require a medical exam. The application process is entirely digital and can be completed in just a few minutes. Coverage begins instantly upon approval, and the policy offers a guaranteed, tax-free death benefit for beneficiaries. Haven Simple is available to individuals aged 20 to 55 and offers coverage ranging from $25,000 to $1 million for terms of 5, 10, 15, or 20 years.

Haven Term is Haven Life's flagship product, offering coverage of up to $3 million for terms of 10, 15, 20, 25, or 30 years. Haven Term policies can be applied for online, but some applicants may be required to undergo a medical exam before approval. Haven Term also includes additional riders, such as an accelerated death benefit and the Haven Life Plus rider, which provides access to free or discounted resources for creating trusts and wills. Haven Term is available to individuals up to the age of 64.

Irrevocable Life Insurance Trusts: Estate Liquidity and Protection

You may want to see also

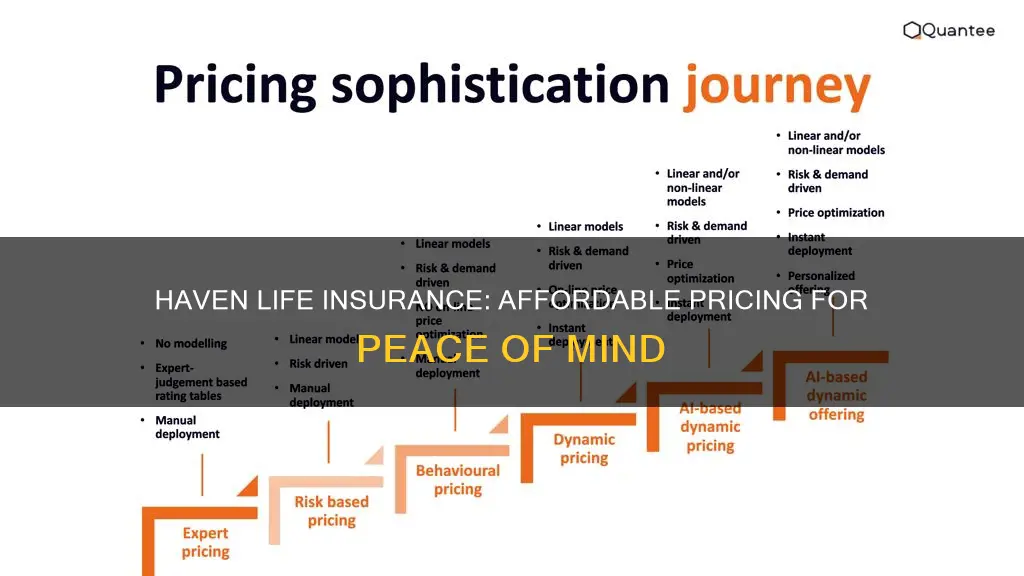

Haven Life's term rates are highly competitive, especially for younger ages

Haven Life is no longer selling life insurance, but its term rates were highly competitive, especially for younger ages. The company offered two types of term life insurance: Haven Simple and Haven Term. Haven Simple was available to individuals aged 20 to 55, while Haven Term was available to individuals up to age 64.

Haven Simple offered maximum coverage of $1 million with maximum term limits of 20 years. It was a simplified issue life insurance policy that did not require a medical exam. The application process was entirely digital and could be completed in just a few minutes. Coverage began instantly upon approval.

Haven Term offered maximum coverage of $3 million with maximum term limits of 30 years. It typically required a medical exam, although young and healthy individuals may have been exempt from this requirement. Haven Term also included an accelerated death benefit rider, which allowed policyholders to access a portion of their death benefit if they were diagnosed with a terminal illness.

Haven Life's term rates were very competitive, especially for younger buyers. However, the trade-off was that their policies could not be renewed or converted to permanent life insurance later on. For example, a 30-year-old female buyer could expect to pay around $250 per year for $250,000 of coverage over 10 years.

While Haven Life's term rates were attractive, it's important to consider other factors when choosing a life insurance provider. These include the company's financial strength, customer complaints, and the ability to buy online. Additionally, life insurance rates are based on several factors, such as health and medical history, engagement in risky activities, and the purchase of additional coverage or riders.

TD Bank's Life Insurance Offerings: What You Need to Know

You may want to see also

The cost of life insurance depends on several factors, including health and medical history

The cost of life insurance is influenced by a variety of factors, and understanding these factors can help you navigate the complexities of life insurance and possibly lower your costs. One of the most significant factors is health and medical history.

When you apply for life insurance, the insurance company typically reviews your health through a process called underwriting. This involves checking your medical records, collecting your blood and urine samples for lab testing, or arranging a medical exam. The insurance company will look for any current or past health problems, including treatments and prescription medications. They will also consider your height and weight, typically assessing your body mass index (BMI), which is a measure of body fat.

Certain health conditions are considered riskier to insure because they increase the likelihood of a life insurance payout. For example, high blood pressure, hypertension, anxiety, and depression can all affect life insurance rates. Serious, life-threatening conditions like cancer or a recent heart attack may even result in the insurance company denying your application.

In addition to your personal health, family medical history is also taken into account. A history of hereditary diseases, such as cancer, cardiovascular disease, or congenital heart disease, can affect your premium. Carriers are particularly interested in any conditions that have contributed to premature death among your parents or siblings.

Another factor that influences the cost of life insurance is tobacco use. Smoking puts you at a higher risk for various health problems, so life insurance companies charge more to insure smokers. In fact, smokers may pay more than twice as much as non-smokers for comparable coverage. This also extends to other forms of nicotine use, such as smokeless tobacco, pipes, vaping, and nicotine patches.

While health and medical history are significant factors, there are also other considerations that come into play when determining the cost of life insurance. These include age, gender, lifestyle, occupation, and the type of policy chosen.

PTSD and Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

The cost of life insurance depends on the type of policy and the amount of coverage. For example, a healthy 30-year-old woman can buy a 30-year, $250,000 Haven Term life insurance policy for about $16 per month. The same woman would pay closer to $200 per month for a whole life insurance policy.

Haven Life Insurance is more affordable than its competitors. A chart on the Haven Life website shows that their pricing is 42% lower than the industry average.

The cost of Haven Life Insurance depends on the type of coverage, the length of coverage, the coverage amount, and personal factors like age and health status.