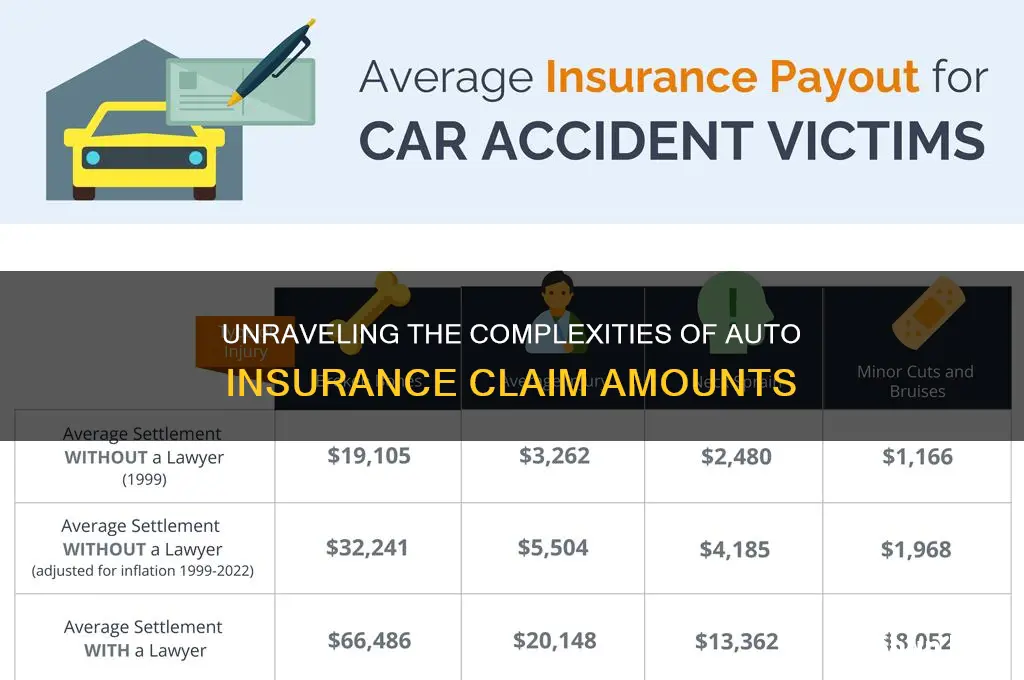

The amount of money you receive from a car insurance claim depends on several factors, including the type of insurance coverage you have, the extent of the damage, and who was at fault for the accident. The process for determining the payout amount typically involves an insurance adjuster, who inspects the damage to your vehicle and provides an estimate of the cost of repairs. This estimate, along with other factors, is used by the insurance company to determine the final payout amount.

| Characteristics | Values |

|---|---|

| Average time to receive a payout | 30 days |

| Factors determining the amount | Type of coverage, fault, location, age, gender, car type, credit score, driving record, driving frequency, etc. |

| Payout methods | Check, direct bank transfer, direct payment to mechanic |

| Insurance company options | Replace damaged/stolen property, repair damaged property, pay for the loss in cash |

What You'll Learn

Claim approval and payment

The first step in the claims process is to file a claim with your insurance company. This typically involves contacting your agent or insurer and providing them with information about the accident, such as the location and time of the accident, a basic description, the names and insurance information of the other driver(s) involved, and the names and contact information of any witnesses. You may also need to provide documentation related to the accident, such as photographs or a police report. It is important to report the accident as soon as possible and to follow any specific instructions provided by your insurance company.

Once you have filed a claim, the insurance company will typically assign an adjuster to assess the damage and determine the cost of repairs. The adjuster will inspect the vehicle or request that it be taken to a certified repair shop for inspection. They will also gather information about the accident, including witness statements and photographs. This process can take some time, and it is important to be patient and provide the adjuster with any requested information.

After the adjuster has completed their assessment, they will provide an initial estimate of the repair costs. The insurance company will then determine the final payment amount based on this estimate and the terms of your policy. It is important to carefully review the settlement offer and dispute it if you believe it is too low. You may need to provide additional evidence or documentation to support your claim.

Once the settlement has been agreed upon, the insurance company will make the payment. This can be done by sending a check or transferring the funds directly to your bank account. If you have a lease or loan on your vehicle, the payment may be made out to both you and the lender. In some cases, the insurance company may also pay the repair shop directly if you have already had the repairs done.

It is important to note that the time frame for receiving a payout can vary depending on the insurance company and the specific circumstances of the claim. In some cases, it may take 30 days or longer to receive the payment. Additionally, there may be instances where the insurance company denies the claim or offers a lower payout than expected. In such cases, it is important to carefully review your policy and understand your options for disputing the decision.

Auto Insurance Policies: North Carolina Specifics

You may want to see also

Total loss vs partial loss

When it comes to auto insurance claims, there are two types of losses: partial loss and total loss. A partial loss occurs when a car is damaged but not completely destroyed, meaning it can be repaired. In this case, the cost of repairing the damage is typically less than or equal to the vehicle's worth before the incident. On the other hand, a total loss occurs when the car is damaged beyond use or repair, or when the cost of repairing the damage exceeds the vehicle's pre-incident value.

In the event of a road collision, there are two types of insurance that can come into play: vehicle liability insurance ("OC insurance") and own-damage vehicle insurance ("AC insurance"). OC insurance protects the perpetrator of the damage, covering their obligation to pay compensation out of their own pocket, while also ensuring the repair of the loss for the injured party. AC insurance, on the other hand, protects the insured from losses resulting from damage to their vehicle, regardless of who is at fault. This includes damage caused by another person, natural events like hailstorms, or even unintentional accidents caused by the insured themselves.

When it comes to settling a loss, the type of insurance and the scope of the damage will determine whether it is classified as a partial or total loss. With OC insurance, a partial loss occurs when the repair cost is not higher than the vehicle's worth before the collision. A total loss, on the other hand, is when the repair cost exceeds the vehicle's pre-incident value. With AC insurance, the rules are usually slightly different. A partial loss occurs when the repair cost is no higher than 70% of the vehicle's pre-incident value, while a total loss occurs when the repair cost is higher than 70% of the vehicle's value before the damage.

It is important to note that the choice between seeking compensation through OC insurance or AC insurance can impact the qualification of the loss as partial or total, as well as the amount of compensation received. For example, in the case of a leasing agreement, a total loss under AC insurance might be beneficial as it could result in the termination of the leasing agreement and the acquisition of a new vehicle. On the other hand, opting for OC insurance in a situation where the repair cost is less than 100% of the vehicle's pre-incident value would allow for the car to be repaired and continue to be used.

Understanding the difference between partial and total loss is crucial when filing an insurance claim, as it will determine the compensation and settlement process. In the case of a partial loss, the insurance company will cover the cost of repairs, aiming to restore the vehicle to its pre-incident state. On the other hand, a total loss will result in the insurance company providing a settlement check that is equal to the car's pre-accident value, allowing the insured to purchase a new vehicle or spend the money as they see fit.

Careless Driving: Friend or Foe to Your Auto Insurance Rates?

You may want to see also

Actual cash value vs replacement value

When it comes to auto insurance claims, there are two main methods for determining the value of your car: actual cash value (ACV) and replacement value.

Actual Cash Value

The actual cash value of your car is how much it is worth in its current condition, including depreciation. In other words, it's the amount you could reasonably expect to get for it if you sold it today. As soon as you drive a new car off the lot, it begins to depreciate, so the ACV will be less than the original purchase price. When a car is declared a total loss, the insurance company will reimburse you for the car's ACV (minus your deductible).

If you disagree with the insurer's valuation, you may be able to negotiate a higher payout, but you will need evidence to support your claim. You can refer to sources like Kelley Blue Book to find depreciation estimates and double-check the insurer's valuation. It's important to provide as many details as possible about your specific car to get the most accurate estimate.

Actual cash value is the standard level of coverage that comes with comprehensive car insurance. It is considered a more economic choice, as it is almost universally favoured by insurance companies and results in a lower monthly premium.

Replacement Value

Replacement cost insurance, on the other hand, reimburses you for 100% of the value of a new car of the same or similar model. This type of insurance is not included in every policy and may not be available from all insurers. Opting for replacement cost insurance will result in a higher monthly premium.

The decision between actual cash value and replacement value depends on your risk tolerance and budget. If you want full compensation with zero risk, replacement cost insurance is the best option, even though it will cost more. Actual cash value coverage, on the other hand, will save you money on insurance, but you may not receive enough to buy new replacements for lost or stolen items.

For example, if your 2-year-old laptop is stolen and you have ACV coverage, the insurance company will take the original cost, calculate its depreciated value, and pay you that amount minus your deductible. With replacement cost coverage, you would receive enough money to buy a new laptop of similar quality, minus your deductible.

Other Considerations

It's important to note that collision insurance, which covers damages to your car in an accident, is not required by law in most states. Comprehensive car insurance, which covers theft, damage by weather, or natural disaster, is also typically optional. However, liability insurance, which covers damages or injuries to another party or vehicle in an accident, is required by law in most states.

Additionally, when choosing between actual cash value and replacement value, consider the deductible, which is the amount you pay out of pocket before insurance coverage begins. A higher deductible will result in a lower monthly premium for either type of insurance.

Eyecare Insurance: Filling the Gap

You may want to see also

Collision or comprehensive coverage

Collision and comprehensive coverage are two types of auto insurance that cover damage to your own vehicle. While collision coverage pays for damages caused by colliding with another vehicle or object, comprehensive coverage pays for damages from almost everything else. This includes theft, vandalism, hail, and animal collisions. For example, if you hit a deer while driving, comprehensive coverage would apply, but if you swerve to avoid the deer and hit a tree, collision coverage would be needed.

Both types of coverage pay for damages up to the actual cash value (ACV) of your vehicle, which is calculated by an insurance adjuster. This means that if your vehicle is totaled, the insurer will send you a settlement check equal to the car's pre-accident value. Additionally, both collision and comprehensive coverage typically include a deductible, which is the amount you must pay before the insurance company starts covering damages. Deductibles generally range from $500 to $1,500.

While collision and comprehensive coverage are not required by state law, they are often required by lenders if you lease or finance your vehicle. Even if you own your vehicle outright, it is generally recommended to purchase both types of coverage, along with liability insurance, to ensure you have full-coverage car insurance. However, if your vehicle is older and has a low ACV, it may be more cost-effective to save on premiums and repair minor damages yourself.

When deciding whether to purchase collision or comprehensive coverage, consider the age and value of your vehicle, as well as your budget. As your vehicle depreciates in value over time, you may eventually decide to switch to a liability-only policy. However, comprehensive and collision coverage can provide valuable protection for yourself and your vehicle, so it's important to weigh the costs and benefits before making a decision.

Rideshare Gap Insurance: Filling the Coverage Gap

You may want to see also

Liability claims

Liability car insurance covers the cost of other people's injuries and property damage if you are deemed responsible for an accident. It is mandated by law in nearly every state.

Liability insurance is divided into two categories: bodily injury liability coverage and property damage liability coverage.

Bodily injury liability coverage pays for the medical treatment of people injured in an accident for which you are found to be at fault. This includes medical bills, pain and suffering, lost wages, and funeral costs. It also covers legal costs if the injured party files a lawsuit against you.

Property damage liability coverage pays for the repair of property damaged in an accident for which you are found to be at fault. This includes damage to other cars, buildings, fences, mailboxes, street signs, and government infrastructure like guardrails. It may also cover legal costs if the owner of the damaged property files a lawsuit.

Liability insurance policies have different limits, which determine the maximum amount the insurance company will pay out per person and per accident. For example, a policy with limits of $25,000/$50,000/$20,000 will pay out a maximum of $25,000 for injuries per person, $50,000 for injuries per accident, and $20,000 for property damage per accident.

The cost of liability insurance varies depending on factors such as age, location, driving record, and vehicle type. The national average cost of minimum car insurance, which typically includes liability coverage, is $488 per year.

Insuring Your Girlfriend's Car: What You Need to Know

You may want to see also

Frequently asked questions

An auto insurance claim is a request for financial compensation filed by a driver with an insurance company after their vehicle is damaged or they are injured in a car accident.

The amount paid out by an insurance company depends on the type of claim that's been filed. If the claimant is at fault, the insurance company will pay out to the other driver in the accident. If the other driver was at fault, the insurance claim payout goes directly to the claimant or the body shop where repairs are being done, depending on the state.

The factors that determine whether a person gets a payout and how much are specific to their insurance policy. The type of coverage that pays for a total payout depends on the cause of the accident or damage. For instance, if the cause is a collision, the claimant would need to have collision coverage. If the cause is something other than a collision, such as fire or vandalism, the claimant would need to have comprehensive coverage.