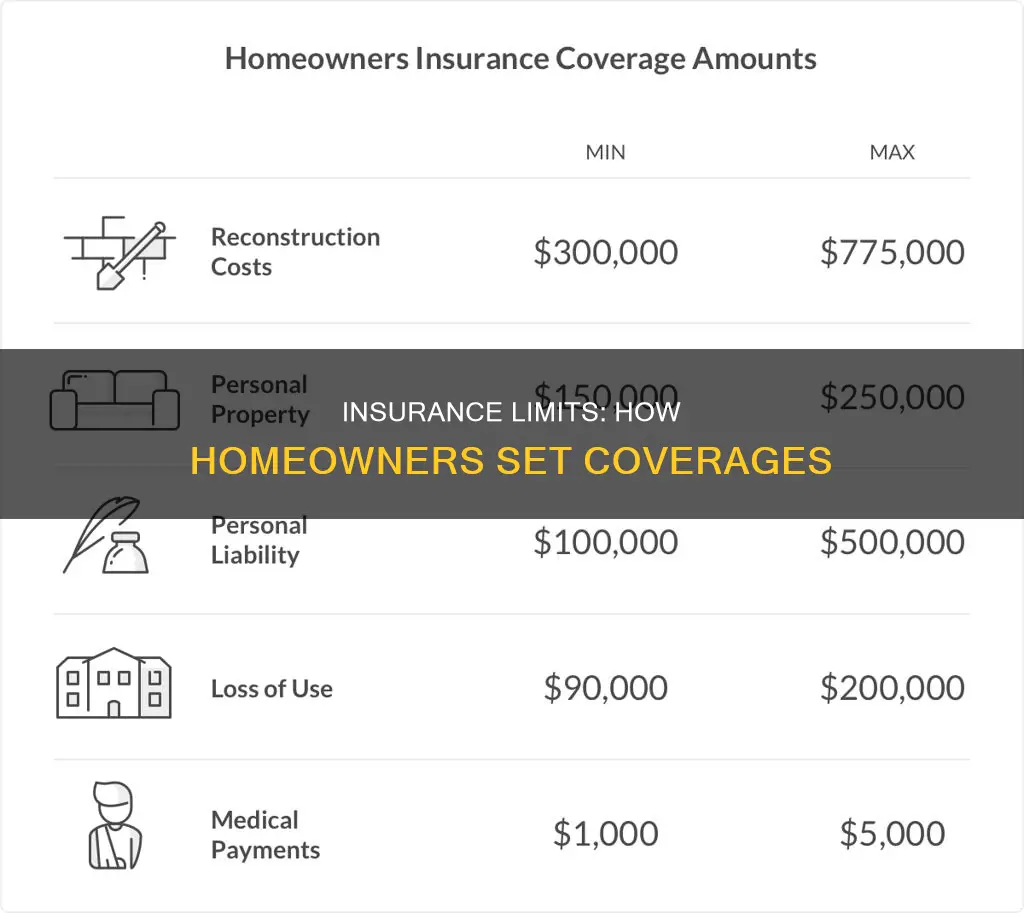

Home insurance is essential to protect your finances in the event of a disaster or accident. When establishing insurance limits on a house, it is crucial to consider various factors to ensure adequate coverage. The key components of homeowners insurance include dwelling coverage, personal property coverage, liability coverage, and additional living expenses.

Dwelling coverage focuses on the cost to rebuild the physical structure of the house, including walls, roof, built-in appliances, and attached structures. This amount, known as the replacement cost, is determined by factors such as square footage, construction style, local building costs, and special features. It is important to regularly review and update dwelling coverage limits to account for inflation and renovations.

Personal property coverage pertains to the value of belongings within the home, such as furniture, electronics, and clothing. This coverage is typically set as a percentage of the dwelling coverage but can be adjusted based on the value of possessions. Creating a home inventory can help in calculating the necessary coverage.

Liability coverage provides protection against accidental injuries to others or damage to their property. It covers legal and medical expenses arising from such incidents. The coverage limit should be based on the financial value of the homeowner's assets.

Additional living expenses coverage assists with temporary living costs if the insured cannot reside in their home due to repairs or rebuilding. This coverage is often set as a percentage of the dwelling coverage but can be increased if needed.

When setting insurance limits, it is important to consider current market costs, the location of the home, and any minimum requirements stipulated by lenders or Home Owners Associations. Regularly reviewing and adjusting coverage limits ensures that the insurance adequately protects the home and the policyholder's finances.

| Characteristics | Values |

|---|---|

| Purpose | To protect your home and your assets with adequate insurance coverage |

| Coverage | Damage to the structure of your home, your possessions, additional living expenses, liability |

| Determining factors | Current market costs of building materials and consumer goods, the risk of where your home is located, any minimum requirements in a contract or agreement |

| Policy limit | The most an insurance company will pay for a specific type of coverage |

| Deductible | An amount that you, as the policyholder, will pay if there is a covered claim before the insurance limit steps in to provide coverage |

| Premium | The recurring cost you pay to keep your insurance policy active |

| Inflation | Inflation guard automatically adjusts the dwelling limit to reflect current construction costs in your area |

| Loss of use | If your house is damaged by a covered peril and you need to temporarily relocate, this coverage provides help |

| Liability | Should someone get hurt on your property or you damage someone else’s property, the liability limit will step in if it is a covered claim |

What You'll Learn

Dwelling coverage

The limit of dwelling coverage is determined by a combination of factors, including lender requirements and facts about the home, such as square footage and building materials. It is important to ensure that your dwelling coverage limit is sufficient to cover the cost of rebuilding your home from scratch in the event of a total loss. This amount is known as the "replacement cost value" and may differ from the home's market value or purchase price.

To calculate how much dwelling coverage you need, consider factors such as the home's square footage, the price of construction and labour, interior features, and any home renovations or additions. You can use an online calculator or get an appraisal to estimate the replacement cost of your home.

Untangling the Web: Navigating the Termination of Sub-Producer Contracts with Farmers Insurance

You may want to see also

Personal property coverage

There are different types of personal property coverage. The actual cash value coverage takes depreciation into account and pays the value of the item at the time of the incident. On the other hand, the replacement cost coverage provides the exact amount required to replace the item at the current market price. The latter may cost more but ensures you receive the full amount needed for replacements.

Additionally, personal property coverage may have sub-limits or specific limits for certain valuable items, such as jewelry, silverware, art, or collectibles. To increase coverage for these items, you can purchase a special personal property floater or endorsement, providing higher coverage limits for individual items or collections.

Navigating the Path to Becoming a Farmers Insurance Vendor

You may want to see also

Liability coverage

Understanding Liability Coverage

Personal Liability Coverage

Personal liability coverage comes into effect when you are sued due to a covered incident, such as an injury or property damage for which you are deemed responsible. It provides funds to cover legal expenses and pays damages up to the limits of your policy. For example, if a visitor slips and falls on your property, your personal liability insurance can help cover their medical costs and other expenses.

Medical Expense Coverage

Medical expense coverage, on the other hand, helps pay for medical bills incurred by a visitor who is injured on your property, regardless of who is at fault. This no-fault coverage allows the injured party to submit their medical bills directly to your insurance provider without filing a claim against you.

Determining Liability Coverage Limits

When establishing insurance limits for your home, it's crucial to consider the liability coverage limit, which is the maximum amount your insurance company will pay for a liability claim. Most homeowners insurance policies start with a minimum of $100,000 in liability coverage, but higher amounts are often recommended.

To determine the appropriate liability coverage limit for your home, consider the following factors:

- Value of Your Assets: Evaluate the value of your assets, including your home, investments, and savings. In a lawsuit, all your assets could be at risk, so it's advisable to have liability coverage equivalent to or greater than your total net worth.

- Risk Factors: Consider any risk factors that may increase the likelihood of a liability claim. For instance, if you have a dog, a swimming pool, or frequently host gatherings, you may want to opt for a higher liability coverage limit.

- Cost of Umbrella Insurance: If you require additional coverage beyond your homeowners policy, you may need to purchase umbrella insurance. This provides extra liability protection above your policy limit, typically in increments of $1 million.

By carefully assessing your needs and potential risks, you can establish appropriate insurance limits for your home, ensuring that your liability coverage adequately protects your finances in the event of an accident or injury.

Trump's Gamble with Farmers: Crop Insurance at Risk?

You may want to see also

Loss of use coverage

The coverage limit for loss of use coverage is typically based on a percentage of the dwelling coverage limit, usually around 20%. For example, if a homeowner has a dwelling coverage limit of $300,000, their loss of use coverage would be $60,000. This coverage limit can vary by insurance provider and policy type. Condo insurance, for instance, may provide loss of use coverage that is a percentage of both dwelling and personal property coverage limits. Renters insurance may offer a set amount or a percentage of personal property coverage.

It is important to note that loss of use coverage only applies to additional living expenses above what the policyholder would normally spend. For example, if a policyholder typically spends $300 a week on groceries but spends $400 a week on groceries while temporarily displaced, their insurance would cover the additional $100 expense. Loss of use coverage does not apply to ongoing expenses such as mortgage payments, insurance, or child care costs.

To file a loss of use claim, policyholders should keep all receipts related to their additional living expenses and submit them to their insurance provider for reimbursement. Some insurance companies may offer a cash advance on these claims, while others will reimburse the policyholder after expenses have been incurred. It is also important to note that loss of use coverage claims typically do not require a deductible.

Farmers Insurance Coverage in the Pacific Northwest: Exploring Policies in Washington and Idaho

You may want to see also

Inflation guard

Without inflation guard coverage, if you need to file a claim, you may end up having to pay for some expenses out of pocket if the cost of construction materials has increased since you initially purchased your policy.

Typical inflation adjustments are usually 2% to 4% annually, but your home insurance premium will not go up by the same percentage. For example, if your coverage increases by 4%, 6% or 8%, your premium will only go up by 2%, 3% or 4% respectively.

The Mystery of Depreciation: Unraveling Roof Replacement Coverage with Farmers Insurance

You may want to see also

Frequently asked questions

The insurer will determine the replacement value through multiple factors, including the home's location, size, age, and condition.

Most insurance companies adhere to the 80% rule, which states that an insurer will only cover the cost of damage to a house or property if the homeowner has purchased insurance coverage equal to at least 80% of the house's total replacement value.

The replacement cost will reflect the size of the house, its features, and the cost of building in your area. You can calculate the replacement cost by multiplying the square footage of the home by the cost of building materials per square foot in your area.