Auto insurance rates are calculated based on a variety of factors, including personal information, driving history, and vehicle details. The cost of car insurance is influenced by age, gender, location, marital status, credit score, vehicle type, driving record, claims history, and insurance coverage.

Insurance companies assess these factors to determine the risk posed by each client, with the aim of assigning an appropriate insurance rate. For instance, younger and older drivers often face higher premiums due to increased accident risks, while women tend to pay lower premiums as they are statistically less likely to be involved in accidents.

Additionally, location plays a significant role, with urban drivers facing higher rates due to increased risks of accidents, theft, and vandalism. The type of vehicle also impacts rates, as luxury or expensive vehicles with advanced features tend to be more costly to insure and repair.

By considering these factors, insurance providers can set premiums that reflect the level of risk associated with each client.

| Characteristics | Values |

|---|---|

| Driving record | The more accidents and violations, the higher the premium |

| Location | Urban areas have higher rates of theft and vandalism, so insurance is more expensive |

| Age | Younger and older drivers tend to pay more |

| Gender | Women often pay less than men |

| Marital status | Married people pay less |

| Credit score | A higher score typically means lower premiums |

| Vehicle | The cost, safety, engine size, and likelihood of theft all affect the premium |

| Mileage | The more miles driven, the higher the premium |

| Claims history | A history of claims will increase the premium |

| Insurance history | A long history of insurance with high limits is seen as positive |

| Coverage level | The more coverage, the more expensive the premium |

| Deductible | A higher deductible means a lower premium |

What You'll Learn

Driving record

A driving record is a record kept by the Department of Motor Vehicles (DMV) that stores your personal identification, license information, and any tickets or other infractions. It follows you from the day you get your license until you stop driving. A good driving record should be free of tickets, traffic violations, convictions, and fines.

Your driving record is a major factor in determining your car insurance premiums. A history of accidents or serious traffic violations, such as speeding or reckless driving, will result in higher insurance rates as you are considered a high-risk driver. The more infractions or negative marks on your driving record, the worse it is, and the more you will have to pay for insurance. Minor moving violations will tend to increase your insurance premiums by 10 to 15%. Insurance companies look back at approximately three years of your driving record, so it will take a while for any violations to disappear. Major violations, on the other hand, may result in insurers refusing to offer you a policy or renew an existing one.

In most U.S. states, a points system is used to codify the severity of violations and keep track of how dangerous a driver is. You usually only get points for moving violations, such as speeding or running a stop sign, as they are seen as more severe and more likely to cause damage or harm. Each state has a different formula for the number of points assigned to each violation, but if you accumulate a certain number of points within a given period (usually 18 months), your license will be suspended. For example, in California, a driver's license will be suspended for four points in a year, six points in two years, or eight points within three years.

In addition to your driving record, insurance companies also consider other factors when determining your insurance premiums, such as your age, gender, location, credit score, and the type of car you drive.

Progressive Auto Insurance in Colorado: What You Need to Know

You may want to see also

Location

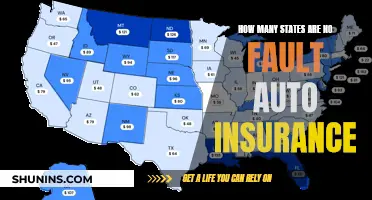

Auto insurance rates vary depending on where you live. In the US, auto insurance is regulated by each state, and priced based on the ZIP code in which a driver resides. If a state requires its drivers to have high basic minimum coverage, its residents may face higher insurance costs.

Insurance costs are higher in locales with more drivers. ZIP codes prone to floods, wildfires, crimes such as vandalism or theft, or other risks also face higher rates. In many cases, those in rural areas pay less in car insurance premiums than their urban counterparts.

Insurers calculate your likelihood of an auto accident based on the county or state in which you live, and calculate your risk of vehicle theft or vandalism based on the city or neighborhood in which you live. This is because you typically have an accident while your car is moving, and car theft and vandalism typically occur while a vehicle is parked.

Some states that are considered no-fault states require personal injury protection (PIP) coverage, which costs more. This is one reason car insurance in Michigan is so expensive. Because Michigan is a no-fault state with high PIP insurance requirements, residents pay more for auto insurance than drivers in other states.

At the ZIP code level, higher rates of claims could lead to pricier car insurance premiums, as an insurance company adjusts for the increased likelihood of accidents and the greater probability of claims payouts.

Golf Cart Conundrum: Navigating Insurance Coverage for Your Ride

You may want to see also

Age

Statistically, teenagers aged 16 to 19 have the highest crash risk, with male drivers in this age group being three times more likely to get into accidents than their female counterparts. As a result, insurance companies often charge more to insure teen drivers, and young male drivers may pay significantly more than young female drivers. However, the gender-based difference in premiums tends to narrow with age.

Driving Hospital Vehicles: Get Insured

You may want to see also

Gender

Women between the ages of 16 and 24 pay around $500 less per year for car insurance than men, according to Insure.com. However, this gender gap in rates narrows as drivers age and gain more driving experience. By the age of 30, rates for males and females even out, with males sometimes paying a few dollars less at age 40. After age 50, females may pay slightly less again, but the difference is usually less than $50 annually.

The impact of gender on insurance rates is most pronounced among young and inexperienced drivers. Studies have shown that the difference in rates between genders is minimal for older, more experienced drivers. Once a driver turns 25, their insurance rates usually decrease, and males and females with the same driving record can expect to pay almost the same amount.

It is important to note that some states have banned the use of gender in determining auto insurance rates. These states include California, Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. In these states, insurance companies are prohibited from using gender as a factor in calculating premiums.

While gender plays a role in auto insurance rates, it is not the only consideration. Insurance companies also take into account other factors such as age, driving history, credit score, marital status, vehicle type, and location when calculating policy rates.

Understanding Auto Insurance Deductibles: The Standard or the Exception?

You may want to see also

Credit score

Individuals with higher credit scores tend to receive lower insurance rates as they are perceived as less likely to file claims. Conversely, those with lower credit scores may face higher insurance rates as they are considered higher-risk. The impact of credit scores on insurance rates varies across states, with some states prohibiting or limiting the use of credit scores in determining insurance rates.

Improving one's credit score can be beneficial for obtaining lower insurance rates. This can be achieved by paying bills on time, maintaining old lines of credit, minimising hard credit inquiries, and keeping credit utilisation low.

It is worth noting that requesting car insurance quotes typically does not affect one's credit score, as insurance companies usually perform a soft credit check. Additionally, paying for car insurance does not directly build credit, as insurance companies do not report premium payments to credit bureaus.

Gap Insurance: UK Car Protection

You may want to see also

Frequently asked questions

Many factors are considered when calculating auto insurance, including your location, age, gender, credit score, driving record, type of car, and more.

Urban drivers tend to pay more for auto insurance than those in small towns or rural areas due to higher rates of vandalism, theft, and accidents.

Younger and older drivers tend to pay more for auto insurance as they are considered higher-risk. Drivers under 25 and over 75 often face higher premiums.