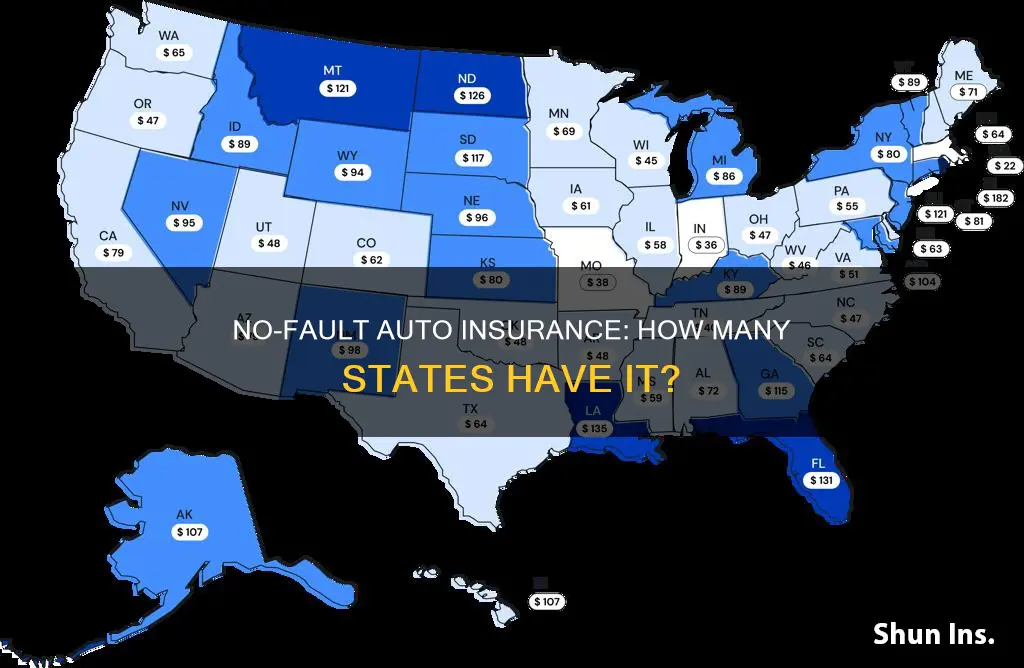

No-fault insurance, also known as personal injury protection insurance (PIP), is a type of car insurance that covers medical expenses and loss of income resulting from a car accident, regardless of who is at fault. As of November 2016, there were 18 no-fault insurance states in the US, although this number may have changed. Currently, there are 12 no-fault states, including Florida, Michigan, New Jersey, and New York, and three choice no-fault states where drivers can opt for traditional tort liability insurance. No-fault insurance is intended to reduce the cost of auto insurance by removing the ability to sue, with some exceptions for severe injuries.

| Characteristics | Values |

|---|---|

| Number of No-Fault States | 12 |

| No-Fault States | Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, Utah |

| Choice No-Fault States | Kentucky, New Jersey, Pennsylvania |

| Add-On No-Fault States | District of Columbia, Delaware, Washington D.C., Maryland, New Hampshire, Oregon, Arkansas |

| Tort States | 38 |

What You'll Learn

No-fault insurance states

No-fault insurance, also called personal injury protection insurance (PIP), is required in certain states. As of November 2016, there were 18 no-fault states, but laws are subject to change, so it's best to check with a local agent for the most up-to-date information.

In no-fault states, drivers must use their own car insurance to pay for their injuries after a crash, regardless of who is at fault. This means that each driver's car insurance provider pays their medical claims after an accident. No-fault insurance covers medical expenses and loss of income, up to coverage limits. It usually also includes funeral costs and other out-of-pocket expenses.

There are 12 states that have no-fault insurance laws: Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah. Drivers in Kentucky, New Jersey, and Pennsylvania can opt out of a no-fault policy, making these "choice no-fault" or "optional no-fault" states.

In addition to these 12 states, 10 states allow drivers to add personal injury protection to their policies, but do not require it. These states are known as "add-on" states.

No-fault insurance differs from at-fault insurance, also known as tort insurance, where the driver who caused the accident is responsible for paying for injuries and property damage. At-fault insurance is used in tort liability states, where there are no restrictions on lawsuits.

No-fault states limit lawsuits from car accidents, and drivers can only sue for injuries if they are considered severe, with the definition of "severe" varying by state.

Progressive Auto Insurance: Does Canada Get Covered?

You may want to see also

Tort states

In the United States, auto insurance laws are decided at the state level, resulting in a varied regulatory landscape. States can choose to be a no-fault state, a tort liability state, or a combination of the two.

In a tort state, if you are found to be at fault for a car crash, you are responsible for paying the other driver's medical bills and any other damages. Tort states do not require drivers to carry additional coverages, like personal injury protection and medical payments coverage. However, drivers can choose to purchase this extra coverage if they wish.

There are two types of tort insurance: limited tort and full tort. With limited tort, you cannot sue for pain and suffering unless you sustain a serious or permanent injury. Full tort allows you to sue the at-fault driver with no restrictions if you are injured in a car accident that is not your fault. You can file charges for damages like lost wages, suffering, and pain.

In the US, 38 states are tort liability states.

The Surprising Benefits of GEICO Auto Insurance

You may want to see also

Choice no-fault states

In the United States, auto insurance laws are decided at the state level. There are 12 no-fault states, including Florida, Michigan, New Jersey, New York, Pennsylvania, Hawaii, Kentucky, Massachusetts, Minnesota, North Dakota, and Utah. In these states, drivers are required to have personal injury protection (PIP) coverage as part of their auto insurance policy. PIP covers things like health insurance deductibles, lost wages, funeral expenses, and medical expenses exceeding coverage limits.

Three of these 12 no-fault states are also "choice no-fault" states, also known as "optional no-fault" states. In these states, drivers can choose between a no-fault policy or a traditional tort (or at-fault) policy. In other words, they can opt out of the no-fault system. The three choice no-fault states are Kentucky, New Jersey, and Pennsylvania.

In choice no-fault states, drivers can select one of two options: a no-fault auto insurance policy or a traditional tort liability policy. If a driver chooses a no-fault policy, they are opting into the no-fault system, where they must file a claim with their own insurance company after an accident, regardless of who was at fault. This is different from a traditional tort liability policy, where the driver who caused the accident is responsible for damages.

In New Jersey and Pennsylvania, the no-fault option has a verbal threshold, meaning that drivers can only sue for severe injuries or pain and suffering if the case meets certain conditions. In Kentucky, there is a monetary threshold, meaning that drivers can only sue if their medical expenses reach a certain stipulated amount.

Choosing a no-fault policy has implications for a driver's right to sue. In New Jersey, for example, applicants for insurance are presumed to have opted for the verbal threshold on lawsuits unless they specifically reject it. This means that more than 85% of policyholders in New Jersey have policies restricting lawsuits. On the other hand, in Pennsylvania, policyholders are assumed to want unrestricted access to the courts unless they specifically request the verbal threshold. As a result, less than 50% of policyholders in Pennsylvania have policies restricting lawsuits.

Limited tort insurance policies are less expensive than full tort insurance policies. Therefore, many drivers may choose no-fault insurance coverage to save money. However, their ability to recover compensation for all damages after a car crash is restricted.

Maximizing Auto Insurance Savings: Navigating the Road to the Best Rates

You may want to see also

Add-on no-fault states

Add-on no-fault insurance states are a hybrid of traditional auto insurance policies and no-fault insurance. In these states, drivers are free to sue, but they can also add first-party coverage to their policy, meaning their insurance company will pay for their medical and other expenses. This is also known as personal injury protection (PIP) and can be added to a policy in these states without limiting the injured party's right to sue in tort.

While add-on no-fault states allow drivers to add PIP to their policies, they are not required to do so. This means that drivers can add the benefits of personal injury protection to their policy if they wish, but it is not mandatory. This type of policy can be useful if you want extra protection, as health insurance doesn't usually cover lost income or funeral expenses after a crash.

In total, there are 10 add-on no-fault states, plus the District of Columbia. These are:

- District of Columbia

- Colorado

- Connecticut

- Pennsylvania

- And 6 others

It's important to note that these laws are subject to change, so it's always a good idea to check with local laws or an insurance agent to confirm the type of coverage required in your state.

Buy Auto Insurance Without Talking to Anyone

You may want to see also

At-fault insurance states

In the United States, auto insurance laws are decided at the state level. There are 38 at-fault, or tort liability states, where the insurance company of the driver at fault is responsible for paying for all damage costs in the event of an accident.

In at-fault states, the driver who caused the accident is responsible for compensating the other party or parties for their losses. The property damage liability portion of the at-fault driver's insurance pays for the other driver's vehicle repairs, and their bodily injury liability insurance pays for the other driver's and passengers' medical expenses. The at-fault driver's insurance company indemnifies them by paying up to the policy limits. If the insured individual does not agree with the payout, they can file a lawsuit and seek uncompensated economic damages, such as medical expenses and lost wages, as well as non-economic damages, such as pain, suffering, and anxiety.

In at-fault states, you likely won't have to file a claim with your insurance company if the accident was caused by someone else, saving you from paying a deductible or higher premiums. Additionally, at-fault states don't limit lawsuits.

While the laws differ between states, at-fault states generally allow injured parties to sue for economic damages, such as medical payments and vehicle repairs, as well as non-economic damages, like pain and suffering.

Determining fault after an accident usually involves the police analyzing the scene, making diagrams, and noting the extent and location of vehicle damage. The drivers involved may also discuss fault at the scene, and in some cases, a driver may admit guilt.

Red Cars: Insurance Premiums Higher?

You may want to see also

Frequently asked questions

There are 12 no-fault states: Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah.

In a no-fault state, drivers must use their own car insurance to pay for their injuries after a crash, regardless of who caused the incident.

In a tort state, the insurance company of the driver at fault pays for all damage costs in the event of an accident.