Michigan is a No-Fault state, meaning that a person's auto insurance company will pay for their medical expenses and lost wages after a car accident, regardless of who caused the crash. No-fault auto insurance will pay for all of a car crash victim's necessary medical bills for as long as their injury or disability persists, and can even cover in-home nursing care, lost wages, and funeral expenses. Michigan drivers have all-new choices and lower-cost insurance options, with Governor Whitmer signing historic bipartisan auto no-fault legislation to lower costs, maintain the highest coverage options, and strengthen consumer protections.

| Characteristics | Values |

|---|---|

| Type of insurance system | No-fault |

| Who pays for medical bills and lost wages | The driver's own insurance company |

| Who pays for car damage | Collision insurance or the at-fault driver's PPI insurance |

| Can you sue the at-fault driver | Yes, for pain and suffering compensation |

| Can you sue your insurer | Yes, if they refuse to pay or delay payment |

| Time limit to file a claim | 1 year from the date of the accident |

| Is no-fault insurance mandatory | Yes |

| Penalty for not having a valid auto insurance policy | Fine of $200-$500 and disqualification from suing for pain and suffering compensation and no-fault benefits |

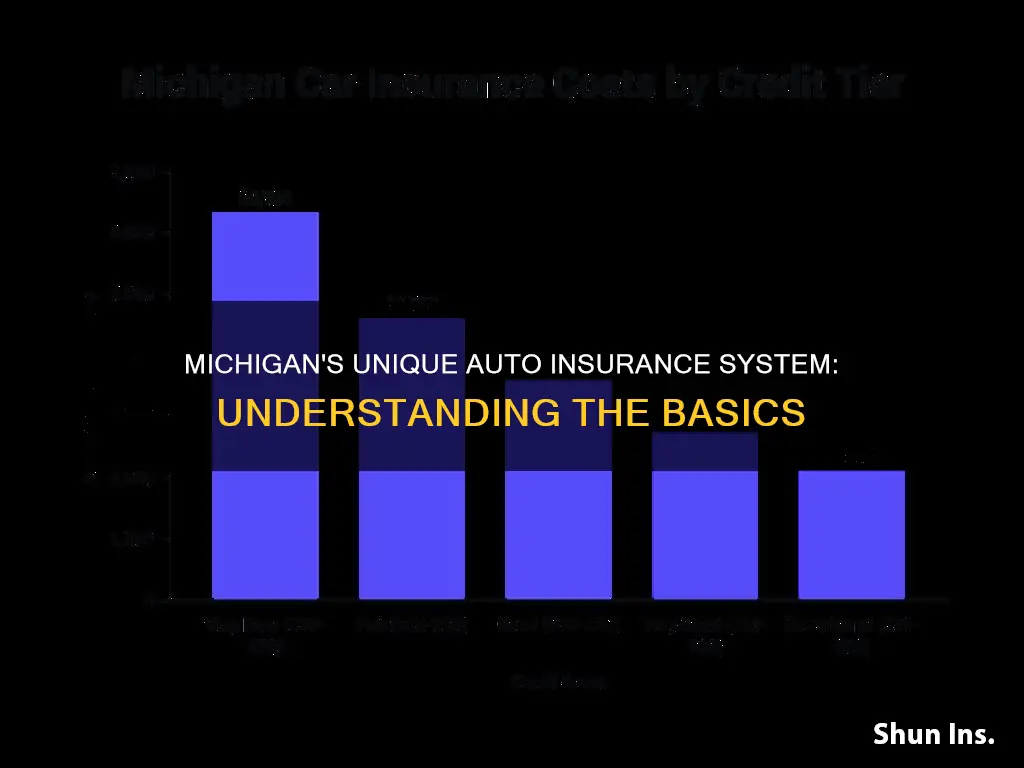

| Average insurance rates in Detroit | Over $3,000 a year |

What You'll Learn

- No-fault insurance pays for medical coverage, lost wages, and property damage

- No-fault insurance is mandatory in Michigan

- No-fault insurance pays for long-term care, including in-home nursing

- No-fault insurance covers medical expenses for passengers

- No-fault insurance can be claimed up to a year after an accident

No-fault insurance pays for medical coverage, lost wages, and property damage

No-fault insurance in Michigan is designed to help those who have been injured in a car accident. It ensures that car accident victims get the help they need without regard to fault. This means that if you are injured in a car accident, your auto insurance company will pay for your medical bills and lost wages, regardless of who was at fault for the accident. This is different from other states, where you would need to prove that another driver was at fault before claiming compensation.

No-fault insurance will pay for all necessary medical bills for as long as the injury or disability persists, which could be for life. This includes long-term physical therapy and in-home nursing care, known as "attendant care", which can be provided by a relative, friend, or agency. It also covers lost wages for up to three years and $20 a day for someone to do the injured person's household chores. There is also money available to pay for funeral expenses and the cost of modifying a vehicle or home to be accessible for people with disabilities.

The amount of coverage provided by no-fault insurance depends on the level of PIP coverage selected in the policy. The No-Fault PIP medical benefits coverage level in Michigan can be unlimited with no cap on medical coverage, or it can be $500,000, $250,000, or $50,000 if the named insured on the policy receives Medicaid.

It is important to note that Michigan was previously a pure no-fault state, but after an amendment to the No-Fault Law in May 2019, it is no longer considered as such. Under the new law, the other driver may be responsible for up to $3,000 of collision damages, and if you elected to waive medical coverage, the other driver may be responsible for these damages as well.

Progressive Auto Insurance: Understanding Rental Truck Coverage

You may want to see also

No-fault insurance is mandatory in Michigan

Michigan's no-fault insurance system is unique to the state. It was introduced in 1973 to address the issues with the previous tort liability system, which often left car accident victims under-compensated or not compensated at all. The new system ensures that victims receive prompt assistance without having to sue the driver who caused the accident.

Under the no-fault insurance system, auto insurance companies cover the medical bills of car crash victims for as long as the injury or disability persists, which could be for life. This includes long-term physical therapy and in-home nursing care, known as "attendant care". No-fault insurance also covers lost wages for up to three years, and $20 a day for someone to do the injured person's household chores. It also provides money for funeral expenses and the cost to modify a vehicle or home to be accessible to people with disabilities.

Drivers in Michigan are required to have auto liability coverage, personal injury protection (PIP), and property protection insurance (PPI). The minimum amount for personal injury protection is $250,000 per accident, although other PIP options are available for those who can prove they have certain qualified health coverage.

State Farm Auto Insurance: Moving Truck Coverage Explained

You may want to see also

No-fault insurance pays for long-term care, including in-home nursing

No-fault insurance in Michigan is unique to the state and covers a wide range of expenses for car crash victims, including long-term care and in-home nursing services. This type of insurance ensures that a person's medical bills and lost wages will be paid, regardless of who caused the accident. This means that even if the insured person is at fault for the crash, their insurance company will still cover their medical expenses and lost wages.

No-fault auto insurance in Michigan will cover all necessary medical bills for as long as the person's injury or disability persists, which could be for life. This includes long-term care, such as in-home nursing services, also known as "attendant care". This type of care can assist with basic tasks such as dressing, showering, and meal preparation, and can be provided by a relative, friend, or professional agency. No-fault insurance also covers lost wages for up to three years and provides money for household chores and funeral expenses.

The amount of coverage provided by no-fault insurance in Michigan depends on the level of Personal Injury Protection (PIP) coverage selected in the policy. The PIP medical benefits coverage level can be unlimited, $500,000, $250,000, or $50,000 if the insured person receives Medicaid. It's important to note that no-fault insurance rates are likely to increase if the insured is found to be at fault in an accident.

In addition to no-fault insurance, Michigan's Medicaid program can also provide funding for long-term nursing home care for individuals with few assets and low incomes. To be eligible for Medicaid-covered long-term care, individuals must meet certain income and asset limits, and demonstrate that they require a "nursing home level of care".

Lower Auto Insurance Premiums: What Works?

You may want to see also

No-fault insurance covers medical expenses for passengers

No-fault insurance in Michigan covers medical expenses for passengers, including family members living with the policyholder, even if they are riding in someone else's car or are injured as a pedestrian. Passengers or pedestrians without their own no-fault insurance are also covered if they are hurt in an accident involving the policyholder's car. Motorcyclists injured in an accident with the policyholder's car are also covered.

No-fault insurance covers all costs of medical care deemed necessary after a car accident, including hospital visits, doctor appointments, physical therapy, prescriptions, and ambulance trips. It also covers medical appliances, such as wheelchairs and crutches. Additionally, no-fault insurance may cover transportation expenses for medical appointments, including mileage and the cost of hiring a transportation company if the injured person has no access to their own transportation.

No-fault insurance also covers lost wages due to injury, up to 85% of the income that would have been earned, for up to three years. It also provides a daily allowance of up to $20 for replacement services, such as hiring someone to perform household chores that the injured person cannot do.

Auto Insurance Deductibles: Per Incident?

You may want to see also

No-fault insurance can be claimed up to a year after an accident

No-fault insurance in Michigan is unique. It is a system that ensures car accident victims get the help they need promptly and without regard to fault. If you are injured in a car accident, your auto insurance company will pay for your medical bills and lost wages, regardless of who caused the crash. This is mandatory for all vehicle owners in Michigan.

No-fault auto insurance will pay for all of a car crash victim's necessary medical bills for as long as the injury or disability persists, potentially for life. It also pays for in-home nursing care, known as "attendant care", and lost wages for up to three years. There is also money to pay for funeral expenses and the cost to modify a home or vehicle to be accessible for people with disabilities.

If you have been in a car accident in Michigan, you must file an application for No-Fault benefits with the responsible auto insurance company within one year of the crash. If you do not file the application on time, you will be barred from claiming or suing for No-Fault benefits. You can sue the at-fault driver for pain and suffering compensation, but you will need to prove that their negligence caused the crash and that your injuries have affected your ability to lead a normal life.

Instant Auto Insurance: Fact or Fiction?

You may want to see also

Frequently asked questions

No-fault car insurance in Michigan will pay for all of a car crash victim's necessary medical bills, lost wages, and other expenses for as long as the injury or disability persists, potentially for life. It doesn't matter who caused the crash.

No-fault insurance in Michigan covers medical bills, lost wages, medical transportation expenses, household replacement services, and attendant care services.

Yes, no-fault insurance is mandatory in Michigan. Drivers who fail to maintain a valid auto insurance policy are guilty of a misdemeanour and could be fined $200-$500.