Life insurance is a contract between an insurance company and a policy owner, where the insurer guarantees to pay a sum of money to the policy's beneficiaries when the insured person dies. In exchange, the policyholder pays premiums to the insurer during their lifetime. The death benefit can be used to cover funeral costs, pay off debts, fund children's education, and supplement the lost income of the insured person, helping to pay for day-to-day expenses. Life insurance can also be used to leave an inheritance or contribute to a charity.

| Characteristics | Values |

|---|---|

| Financial security | Protects your spouse and children from financial losses |

| Peace of mind | Provides assurance that your loved ones will be financially secure |

| Income replacement | Helps your family manage expenses and maintain their standard of living |

| Tax-free benefit | Death benefit is generally not subject to federal income taxes |

| Cash value growth | Whole life policies build cash value over time, offering investment opportunities |

| Dividend potential | Some policies offer dividends that can be used to reduce premiums or increase coverage |

| Optional riders | Additional protection can be purchased to meet specific needs, such as disability or chronic illness |

| Living benefits | Access a portion of the death benefit while still alive in case of terminal or chronic illness |

| Debt repayment | Helps pay off mortgages, credit card bills, and other debts |

| Final expenses | Covers funeral and burial costs |

| Education funding | Assists with children's college tuition and expenses |

What You'll Learn

- Life insurance can help pay off debts and mortgages, cover funeral costs, and supplement lost income

- It can also help with college tuition fees and living expenses

- Life insurance can provide a financial safety net for loved ones

- It can be used to leave an inheritance or donate to charity

- Life insurance can help protect your business

Life insurance can help pay off debts and mortgages, cover funeral costs, and supplement lost income

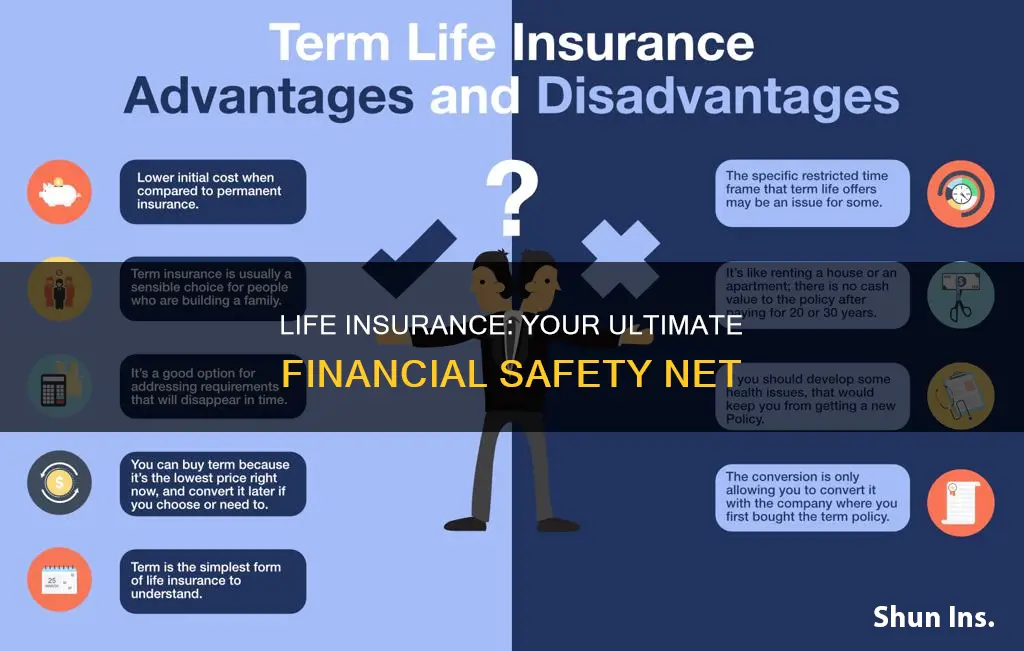

Life insurance is a contract between an insurance company and a policy owner, where the insurer agrees to pay a sum of money to one or more beneficiaries when the insured person dies. There are two main types: term life insurance and permanent life insurance. Term life insurance is designed to last a certain number of years, whereas permanent life insurance is more expensive but stays in force throughout the insured's entire life unless they stop paying the premiums or surrender the policy.

Paying Off Debts and Mortgages

Life insurance can be used to pay off significant debts and mortgages. While debts are rarely inherited, there are instances when an outstanding balance can become the responsibility of others, such as co-signers or joint owners. Life insurance can cover these amounts, preventing financial strain on loved ones. Additionally, a life insurance payout can help beneficiaries pay off debts so that the money in the estate can be preserved for heirs.

Covering Funeral Costs

Burial or final expense insurance is a type of permanent life insurance with a small death benefit that can be used to cover funeral and burial expenses. The average cost of a funeral and burial in the United States is $7,848, and adding a vault, as required by many cemeteries, increases this cost to $9,420. Life insurance can help ease the financial burden on families during an already difficult time.

Supplementing Lost Income

Life insurance can also supplement lost income, helping to maintain the standard of living for surviving dependents. It can be used to cover daily expenses, mortgage payments, and school tuition, ensuring financial security for loved ones. This is especially important for parents with minor children, adults who depend on the income of their spouse, or those with special-needs adult children who require lifelong care.

Life Term Insurance: Gaining Cash Value?

You may want to see also

It can also help with college tuition fees and living expenses

Life insurance can be used to help pay for college tuition fees and living expenses. This is especially useful if you have whole life insurance, universal life insurance, or another type of permanent life insurance policy. Permanent life insurance policies accrue a cash value that you can borrow against to pay for college. This is not an option for term life insurance policyholders, as term life insurance does not accrue cash value.

When you take out a loan against your permanent life insurance policy, it is usually income tax-free. It also does not count against a student's eligibility for financial aid or other assistance. This means that permanent life insurance can help to supplement other financial aid funds a student has or help pay the bulk costs of college.

However, if you pass away before the loan is repaid, the death benefits paid to your beneficiaries will be decreased. This is something to keep in mind when considering using your life insurance policy to pay for college.

Another option for saving for college is a 529 plan. This is a tax-advantaged account that can be used to pay for qualified education costs. Withdrawals from a 529 plan for qualified education-related expenses are tax-free. However, the savings in a 529 plan are considered a parental asset and may reduce your eligibility for certain kinds of student aid.

Life Insurance: Epidemic Coverage and Your Policy

You may want to see also

Life insurance can provide a financial safety net for loved ones

Life insurance can provide a financial safety net for your loved ones in several ways. Firstly, it ensures that your beneficiaries will receive a lump-sum payment upon your death, which can help cover living expenses, pay off debts, and fund children's education. This death benefit is generally not subject to federal income taxes, so your beneficiaries will receive the full amount.

Additionally, life insurance can provide income replacement for your loved ones, helping them to afford childcare, healthcare, and other essential services. It can also assist in eliminating household debt and preserving a family business.

Life insurance can also offer peace of mind, knowing that your loved ones will be financially secure if something happens to you. This protection is especially important if you have a family or others who depend on your income.

Furthermore, life insurance can help supplement retirement income, fund education for children or grandchildren, protect existing assets, and establish an emergency fund. The cash value of a life insurance policy can be accessed during the insured's lifetime, providing flexibility and financial support when needed.

Overall, life insurance provides a financial safety net for loved ones by offering financial protection, income replacement, and peace of mind, ensuring that your beneficiaries will be taken care of even after your death.

Life Insurance and VA Benefits: What's the Connection?

You may want to see also

It can be used to leave an inheritance or donate to charity

Life insurance can be used to leave an inheritance or donate to charity. This is because the death benefit from a life insurance policy is typically tax-free and can be paid directly to a beneficiary, bypassing probate and any outstanding debts. This means that the beneficiary can use the payout for any purpose, including donating to charity.

Leaving an Inheritance

Life insurance can be an effective way to pass money to your heirs. The death benefit from a life insurance policy is typically tax-free and can be paid directly to a beneficiary, bypassing probate and any outstanding debts. This means that your beneficiaries will receive the payout regardless of how your estate is handled. However, if no beneficiaries are named on the policy, or if they are deceased when you die, the payout will become part of your estate. Therefore, it is important to ensure that the beneficiaries listed on the policy are accurate and current and to name a contingent beneficiary. While the death benefit is tax-free, it is still considered part of your estate for tax purposes if you own the policy.

Donating to Charity

You can also use life insurance to donate to charity by naming a charity as the beneficiary of your policy. This is a simple way to boost your charitable giving, as the charity will receive a much larger donation than they would otherwise. For example, a $500,000 policy would provide $500,000 in death benefit proceeds directly to the charity. This method does not offer income tax advantages, but it does reduce the donor's estate by the amount of the death benefit. Alternatively, you can transfer ownership of the policy to the charity, allowing them to receive the tax-free payout when you die or surrender the policy for the cash value if it is a permanent life insurance policy. This option allows you to take an immediate charitable contribution tax deduction, but the decision is irrevocable. Another option is to donate the dividends from your life insurance policy to charity. This strategy does not require any additional cash outlay from the donor, and the dividends donated are tax-deductible.

Geico: Life Insurance Options and Benefits Explored

You may want to see also

Life insurance can help protect your business

Key Person Insurance:

Key person life insurance, also known as key man or business life insurance, is designed to protect your business in the event of the death of a critical employee or a person vital to the company's success. This type of insurance provides the business with a financial safety net, helping to make up for lost revenue and covering expenses related to finding and training a replacement. It ensures that the business has enough readily available cash to continue operating smoothly during a challenging time.

Funding Buy-Sell Agreements:

Life insurance can be used to fund buy-sell agreements, also known as buyout agreements. These agreements are common among co-owners of a business and allow the surviving co-owner(s) to buy out the deceased owner's share of the business from their heirs or estate at a predetermined price. Life insurance policies help ensure that the necessary funds are available to facilitate this transaction and maintain business continuity.

Protecting Your Family and Business Legacy:

Life insurance can provide financial protection for your family, especially if they are involved in the business. It can replace lost income, pay off personal debts, and ensure that your family can maintain their standard of living. Additionally, it can help equalize an estate, especially if one child works in the family business while the other does not. Life insurance allows you to leave an inheritance for your children, ensuring that both receive a fair share.

Personal Life Insurance for Business Owners:

As a business owner, personal life insurance is crucial for protecting your family and personal finances. It can help replace your income, pay off debts, and provide an inheritance for your loved ones. This type of insurance is separate from key person insurance and focuses on safeguarding your family's financial well-being.

Business Debt Coverage and Cash Flow:

Life insurance for business owners can be used to pay off business debts and supplement cash flow. It ensures that your business has the financial resources to continue operating, even in your absence. Additionally, if the policy has a cash value component, you may be able to access those funds to fuel tax-free business growth while you are still alive.

OPM Life Insurance: War Death Coverage?

You may want to see also

Frequently asked questions

Life insurance is a contract between a policyholder and an insurance company that pays out a death benefit when the insured person passes away.

Life insurance works by providing your beneficiaries with a death benefit payout if you die, but only if your policy is in force when you pass away, meaning you've paid the required premiums. The death benefit can be used for any purpose your beneficiaries choose.

Financial protection and peace of mind are at the forefront of life insurance. It ensures your loved ones will be financially taken care of if you die.

You need life insurance if you need to provide security for a spouse, children, other family members, or business partners in the event of your death. Life insurance can also help beneficiaries pay off debts and meet future financial needs.