Dreaming of becoming an insurance adjuster in Colorado? Here's what you need to know to get started on this exciting career path.

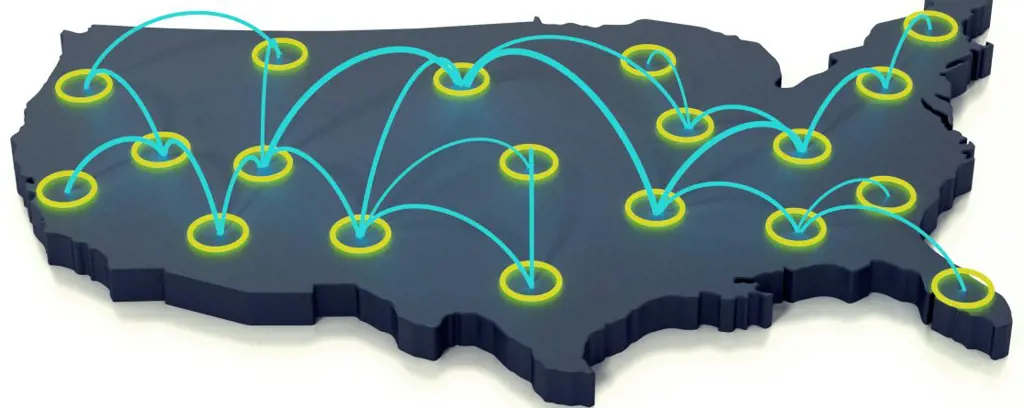

First, it's important to understand that Colorado is one of 16 states that do not license insurance adjusters. This means that while you can legally adjust claims in Colorado without a license, your ability to work in other states may be limited. This presents a challenge if you're aiming for a career as a claims adjuster, as many employers prefer licensed adjusters who can work across different states.

So, what's the solution? Enter the Designated Home State (DHS) license. By obtaining a DHS license, you can declare a licensing state, such as Florida or Texas, as your home state. This will allow you to go through that state's licensing process, testing, and compliance regulations, giving you the flexibility to work in other states as well.

To obtain a DHS license, you'll typically need to complete a pre-licensing course and pass an exam. For example, Florida's DHS license requires a 40-hour pre-licensing course, after which you can apply for the Florida 70-20 DHS License, which is highly regarded in the industry and offers great reciprocity. Alternatively, Texas also offers a popular DHS license, and obtaining a Texas All-Lines Adjuster License will enable you to enjoy the full benefits of reciprocity when trying to obtain a license in other states.

Remember, while you may not legally need a license to work as an insurance adjuster in Colorado, obtaining a DHS license can significantly enhance your career prospects and employability in the long run. So, if you're serious about becoming an insurance adjuster, investing in a DHS license is a smart move.

| Characteristics | Values |

|---|---|

| Licensing | Colorado does not license insurance adjusters. |

| Recommended License | A Designated Home State (DHS) license from another state, such as Florida or Texas. |

| Benefits of DHS License | Increased employability, ability to work in other states, and higher income potential. |

| Requirements for DHS License | Declare a licensing state as your home state, complete that state's licensing process, testing, and compliance regulations. |

| Recommended Courses | AdjusterPro, The Adjuster School, Kaplan Financial Education, and 2021 Training. |

What You'll Learn

- Colorado doesn't require a license to work as an insurance adjuster

- However, a license is recommended to increase your employability

- You can obtain a Designated Home State (DHS) license from another state

- A popular choice is the Texas All Lines Adjuster's License

- Alternatively, the Florida 70-20 DHS license is also highly regarded

Colorado doesn't require a license to work as an insurance adjuster

Colorado is one of 16 states that do not require insurance adjusters to be licensed. This means that, as a Colorado resident, you can legally adjust insurance claims in your state without a license. However, working without a license has some major drawbacks. Many employers prefer or even require adjusters to be licensed, as they work with insurance carriers from across the country. Additionally, most adjusters want out-of-state licenses so they can work across the entire country and increase their income potential.

Since Colorado doesn't issue adjuster licenses, you can obtain what's called a Designated Home State (DHS) license from another state. A DHS license allows you to choose a licensing state as your home state and go through their licensing process, testing, and compliance regulations. This will enable you to work as an adjuster in your home state and other states with reciprocal licensing agreements.

While there are several states that offer DHS licenses, the two most recommended options are Florida and Texas. Obtaining a Florida 70-20 Nonresident DHS license is the top recommendation for Colorado residents. This is because Florida has the quickest application turnaround time, a relatively short exam, and high reciprocity with other states. Additionally, Florida requires fingerprinting, which some other states require for reciprocity, so you won't have to worry about that later.

Alternatively, you can obtain a Texas All Lines Adjuster License and designate Texas as your home state. Texas is a large state with heavy storm activity, so it's a common place for adjusters to work. It's also easy to get Continuing Education (CE) credits for Texas to renew your license, as many conferences for adjusters offer CE credits approved by Texas.

Understanding AHCCCS Income Adjustments for Private Insurance Holders

You may want to see also

However, a license is recommended to increase your employability

Colorado is one of 16 states that do not require insurance adjusters to be licensed. This means that you can work as an insurance adjuster in Colorado without a license, but only in Colorado. If you want to work in multiple states, you will need a license.

Many employers will only deploy licensed adjusters, as they have clients all over the country. Most adjusters want out-of-state licenses that will enable them to work across the entire country, increasing their income potential.

To get a license in a state that doesn't require licensing, you can apply for a Designated Home State (DHS) license. This allows you to declare a licensing state as your home state. You will need to go through that state's licensing process, testing, and compliance regulations. Once you have a DHS license, you can apply for reciprocal license privileges, allowing you to work in other states.

The two most popular DHS licenses are from Florida and Texas. A Florida DHS license has great reciprocity, the quickest application process, and a relatively short insurance adjuster exam. The Texas DHS license is also highly respected in the industry and can significantly enhance your marketability.

The Secrets Behind Insurance Adjusters: Unveiling the Unspoken

You may want to see also

You can obtain a Designated Home State (DHS) license from another state

Obtaining a Designated Home State (DHS) License from Another State

A Designated Home State (DHS) license is a type of license that allows people who live in a non-licensing state to "designate" a different state as their "home state". This enables them to apply for and obtain an insurance adjuster license in the designated state as if they were a resident. This is particularly beneficial for those seeking to become insurance adjusters in states that do not require or offer adjuster licenses, such as Colorado.

- Identify a state that offers DHS licenses: Several states offer DHS licenses, including Florida, Texas, and Indiana. Among these, Florida and Texas are the most popular choices due to their comprehensive licensing systems, online pre-licensing courses, and reciprocity agreements with many other states.

- Meet the licensing requirements of the chosen state: To obtain a DHS license, you will need to fulfill the licensing requirements of the state you have selected. This typically includes completing pre-licensing education courses, passing a licensing examination, and fulfilling any other state-specific requirements, such as fingerprinting.

- Submit the DHS license application: The application process usually involves submitting an application to the licensing state, paying the required fees, and providing proof of completed education and exam scores.

- Adhere to ethical and professional standards: Even as a non-resident licensee, it is essential to abide by the professional and ethical standards set by the licensing state. Ensure that you understand and comply with the regulations of the state from which you are obtaining the DHS license.

- Maintain your DHS license: Keeping your DHS license valid typically involves completing a certain number of continuing education (CE) hours within specified periods. This ensures that you stay up-to-date with industry practices and regulatory changes.

By obtaining a DHS license from another state, you can enhance your marketability as an insurance adjuster and increase your employment opportunities, especially if you intend to work across different states.

How to Become an Insurance Adjuster in Colorado

Colorado is one of the states that do not license insurance adjusters. While you can legally work as an adjuster in Colorado without a license, obtaining a license from another state (DHS license) is highly recommended to improve your career prospects. Here's a summary of the process:

- Obtain a DHS license from a state like Florida or Texas: These states offer convenient online pre-licensing courses and have reciprocity agreements with many other states.

- Apply for reciprocal licenses: Once you have your DHS license, you can apply for reciprocal licenses in other states, allowing you to work across a wider area and making you more attractive to potential employers.

- Consider becoming a public adjuster: If you want to become a public adjuster in Colorado, you will need to obtain a license. This involves completing a pre-licensing education course, passing the Colorado Public Adjuster Examination, and filing for your license online via Sircon.

By following these steps, you can become a licensed insurance adjuster in Colorado and maximize your career potential in the insurance claims industry.

Navigating Insurance Claims: The Benefits of Hiring a Public Adjuster

You may want to see also

A popular choice is the Texas All Lines Adjuster's License

A popular choice is the Texas All Lines Adjusters License

The Texas All-Lines Adjuster License is a popular choice for those seeking to become insurance adjusters. This license allows you to handle a wide range of insurance claims, including property, casualty, residential, commercial, automobile, farm and ranch, inland and ocean marine, as well as workers' compensation insurance. Obtaining this license will enable you to work in various states and maximise your income potential.

How to Obtain the Texas All-Lines Adjuster License

To obtain the Texas All-Lines Adjuster License, you can choose between online courses and in-person classroom training. The Adjuster School, AdjusterPro, and Kaplan Financial Education are popular providers of the 40-hour pre-licensing course. These courses are designed to prepare you for the Texas Adjuster State License exam, which is typically a 150-question multiple-choice exam. Prices for these courses range from $169 to $649. Upon successful completion of the course and exam, you will only need to submit your application and fingerprints to the Texas Department of Insurance.

Benefits of the Texas All-Lines Adjuster License

The Texas All-Lines Adjuster License is highly regarded in the industry and provides a path to becoming a licensed insurance adjuster. It offers a comprehensive license that covers multiple lines of insurance. Additionally, it serves as a great starting point for obtaining reciprocal licenses from other states, allowing you to work across the country and cater to a broader client base. The license is also convenient to obtain and renew, with many conferences and courses offering Continuing Education (CE) credits approved by Texas.

Other Options

While the Texas All-Lines Adjuster License is a popular choice, it's important to note that there are other options available as well. Some sources recommend obtaining a Designated Home State (DHS) license from Florida, as it offers quicker processing times and a shorter exam. However, the Texas license is still a highly respected and recognised qualification that can enhance your marketability as an adjuster.

Unraveling the Path to Becoming an Insurance Adjuster in North Carolina

You may want to see also

Alternatively, the Florida 70-20 DHS license is also highly regarded

The Florida 70-20 DHS license is a highly regarded license for insurance adjusters. This is because Florida has great reciprocity (30 states + Puerto Rico), online pre-licensing education and exams, the quickest application process, and relatively short exams in comparison to other states.

The Florida 70-20 DHS license is a nonresident designated home state (DHS) license. This license is for nonresidents of Florida who live in states that do not license insurance adjusters. If your home state does not require an adjuster license, you will need to obtain another state's license and then designate it as your home state.

- Complete Pre-Exam Education: It is recommended that you complete some form of pre-exam education such as a study guide or a state-approved designation course. AdjusterPro offers online courses that come with a 98% satisfaction rate.

- Florida DHS Adjuster License Exam: After completing your coursework, you will need to take and pass the Florida insurance adjuster license exam. This is a proctored test, meaning that you will be in a controlled environment with a person watching over you. The exam consists of 100 questions and includes a time limit of two hours.

- Florida DHS Insurance Adjuster License Application: Once you have passed your examination, you will need to apply for your license. The fee for an application is $55, and you can apply online via the Florida MyProfile page.

- Fingerprinting and Background Check: The State of Florida requires that all insurance license applications provide fingerprints prior to licensing. You will process your fingerprints through IdentoGO. The fee for fingerprinting services is $50.75.

- Application Review: After submitting your application and completing all other requirements, your license application will be reviewed by the state. This process generally takes a few days.

It is important to note that the Florida 70-20 DHS license is not the only option for those seeking a designated home state license. Other popular options include Texas and Indiana. However, Florida stands out for its quick turnaround time, license duration, and comprehensive reciprocity.

Navigating the Aftermath: Effective Communication Strategies with Insurance Adjusters Post-Accident

You may want to see also

Frequently asked questions

No, Colorado does not require insurance adjusters to have a license. However, it is recommended that you obtain a license from another state to increase your employability and allow you to work in other states.

A DHS license allows you to choose a licensing state as your home state and go through their licensing process. This enables you to obtain a license to work in your home state and apply for reciprocal licensing privileges to work in other states.

Florida and Texas are the most recommended DHS licenses. They are highly respected in the industry and offer good reciprocity. Florida also has the quickest application turnaround time and a relatively short exam.

To obtain a Texas DHS license, you need to complete the Texas All-Lines Pre-Licensing Class, get fingerprints to submit with your application, and designate Texas as your home state on the application.