Are you interested in becoming an insurance adjuster in Missouri? If so, there are a few things you should know.

First and foremost, it's important to understand that Missouri does not offer a state license for insurance adjusters. This means that you will need to obtain a license from another state, known as a Designated Home State (DHS) license, to work as an adjuster. This is because most employers will require you to have a license, and a DHS license will allow you to work in other states as well.

The good news is that obtaining a DHS license is a relatively simple process. You can choose to obtain your license from a state like Florida or Texas, which offer quick application processes, short exams, and high reciprocity with other states. Once you've completed an online adjuster licensing course, passed the state exam, and submitted your application, you'll be well on your way to becoming a licensed insurance adjuster in Missouri.

So, if you're interested in a career as an insurance adjuster in Missouri, don't let the lack of a state license hold you back. With a little bit of effort and the right guidance, you'll be on your way to a successful and rewarding career.

What You'll Learn

Missouri doesn't offer a license for insurance adjusters

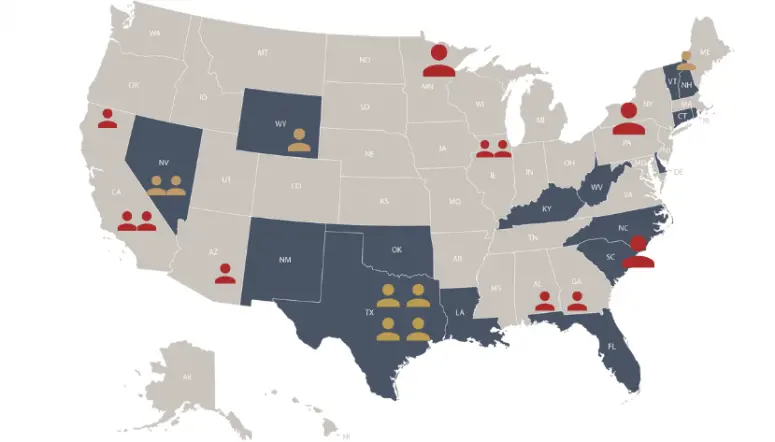

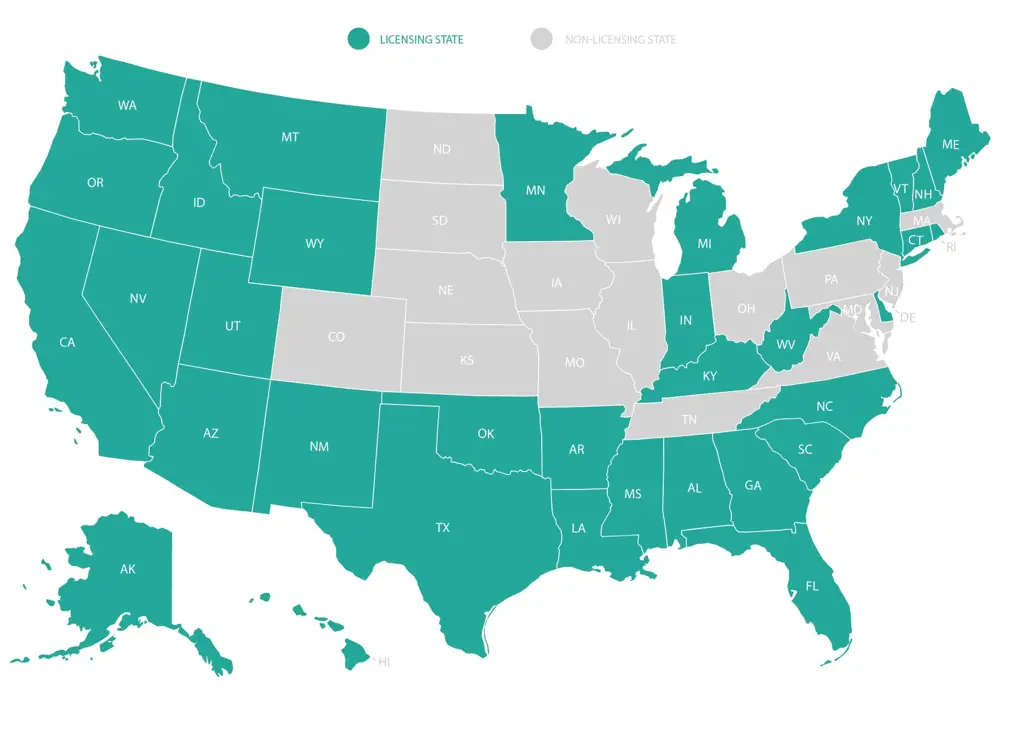

If you're a resident of Missouri and want to become a licensed insurance adjuster, you should know that Missouri is one of 16 states that do not license insurance adjusters. This means that you can work as an adjuster in Missouri without a license, but only in Missouri.

Being unlicensed can present challenges if you want to pursue a career as an insurance adjuster. Many employers prefer or require their adjusters to be licensed, as they have clients all over the country and need adjusters who can work across different states.

If you want to work outside of Missouri, you will need to obtain a license from another state, known as a Designated Home State (DHS) license. This allows you to choose a licensing state as your home state and go through their licensing process, testing, and compliance regulations.

There are several states that offer DHS licenses, including Florida, Texas, and Indiana. Obtaining a DHS license is beneficial as it increases your employment opportunities and enables you to work across the country, maximizing your income potential.

- Choose a state that offers adjuster licensing, such as Florida, Texas, or Indiana.

- Enroll in a pre-licensing course to cover topics like insurance policies, ethics, and state-specific laws.

- Pass the state-administered licensing exam to ensure you have the necessary knowledge to perform as an adjuster.

- Complete a fingerprinting and background check process to verify your identity and ensure you meet the standards of the insurance adjusting profession.

- Submit your DHS license application along with any required documents and fees, including proof of education, exam scores, and background check results.

By obtaining a DHS license, you'll be able to pursue a career as an insurance adjuster both within and outside of Missouri, providing you with more flexibility and opportunities in the field.

The Role of Insurance Adjusters in Post-Repair Inspections

You may want to see also

You need a Designated Home State (DHS) license from another state

If you live in a state that does not require adjusters to be licensed, such as Missouri, you will need to obtain a Designated Home State (DHS) license from another state. This is because a DHS license allows you to declare a licensing state as your home state, and their license will act as your resident or home state license.

There are several states that offer DHS licenses, including Florida, Texas, and Indiana. However, Florida is recommended due to its great reciprocity, quick application process, and relatively short insurance adjuster exam. Texas is also a good option due to its comprehensive licensing program and wide acceptance under reciprocity agreements.

To obtain a DHS license, you will need to:

- Enroll in a pre-licensing course. These courses cover a broad range of topics, including insurance policies, adjuster ethics, and state-specific laws and regulations.

- Pass the state-administered exam. This ensures you have the necessary knowledge to perform as an adjuster.

- Complete fingerprinting and a background check. This step is critical for verifying your identity and ensuring you meet the requirements to work in the insurance adjusting profession.

- Submit your application for licensure in the DHS, along with any required documents and fees. This application will include proof of your education, exam scores, and background check.

The Eagle-Eyed Approach: Insurance Adjusters' Roof Inspection Secrets

You may want to see also

Florida and Texas are the most popular DHS options

Florida and Texas are the two most popular states to obtain a Designated Home State (DHS) license. This is because they offer high reciprocity, a quick application process, and a relatively short insurance adjuster exam. Obtaining a DHS license is necessary for residents of non-licensing states like Missouri who want to work as insurance adjusters. Here are some reasons why Florida and Texas are the most popular choices for a DHS license:

Florida:

- Reciprocity with most states except New York, California, and Hawaii.

- Simple exam process with fewer questions and no requirement for a monitor.

- Streamlined and automated licensing process with a quick application turnaround time.

- Includes fingerprinting, which is required by many other states for reciprocal licenses.

- Offers an All-Lines license with great reciprocity and a shorter exam.

Texas:

- Comprehensive licensing program with wide acceptance under reciprocity agreements.

- Online pre-licensing courses and exams available.

- Includes fingerprinting, which is required by many other states for reciprocal licenses.

While Florida is often recommended as the top choice due to its faster application process and shorter exam, Texas is still a popular option and has made recent improvements in processing time.

Becoming an Insurance Adjuster in Connecticut: A Comprehensive Guide

You may want to see also

A DHS license allows you to work in other states

If you're a resident of a U.S. state that doesn't require insurance adjusters to be licensed, such as Missouri, you can still work as an adjuster in your state. However, you won't be able to work in other states without a license. This is where a Designated Home State (DHS) license comes in.

A DHS license allows you to declare a licensing state as your home state. You'll need to go through that state's licensing process, which may include testing and compliance regulations. By doing so, you'll obtain a resident or home state license, which you can then use to gain reciprocal license privileges. This will enable you to work in other states and increase your employability.

When choosing a state for your DHS license, consider Florida and Texas, which are the most popular options. These states offer online pre-licensing courses and exams, making it convenient for you to complete the process from your home state. Florida also stands out for its quick application processing time and high reciprocity with other states.

To obtain your DHS license, follow these steps:

- Enroll in a pre-licensing course offered by the state of your choice. These courses cover a range of topics, including insurance policies, adjuster ethics, and state-specific laws and regulations.

- Pass the state-administered exam to demonstrate your understanding of the course material and your competency as an adjuster.

- Undergo fingerprinting and a background check to verify your identity and ensure you meet the necessary standards for the insurance adjusting profession.

- Submit your application for licensure in the chosen state, along with any required documents and fees. This may include proof of education, exam scores, and background check results.

The Essential Question: Unraveling the Role of Insurance Adjusters in Times of Crisis

You may want to see also

You can then apply for a reciprocal license to work in more states

The State of Missouri does not offer a Missouri adjuster license for its residents. This means that you will need to obtain a designated home state license (DHS license) from a different state in order to become licensed and work outside of Missouri.

There are several states that offer DHS licenses, including Florida, Texas, and Indiana. This type of license allows people who live in a non-licensing state, such as Missouri, to "designate" a different state as their "home state". This enables them to apply for and obtain a license from that state as if they were a resident.

A DHS license is beneficial for several reasons:

- Employment: Many employers of insurance claims adjusters specifically look for applicants who are already licensed. Even if they don't require a license, they often prefer licensed individuals due to their geographical flexibility.

- Catastrophe (CAT) or Traveling Adjusters: If a non-licensed adjuster wants to work on CAT claims, they will likely need to travel across state lines. To operate in a state other than your home state, you will need a reciprocal license in that state. Therefore, applying for a reciprocity license requires holding an equivalent license in your own state (such as a DHS license).

Once you have obtained your DHS license, you can apply for a reciprocal license to work in more states.

When Insurance Adjusters and Police Cross Paths: A Collaborative Investigation

You may want to see also

Frequently asked questions

No, Missouri does not require a license to practice as an insurance adjuster in the state. However, it is recommended that you obtain a license from another state, known as a Designated Home State (DHS) license, to improve your employment opportunities.

You can obtain a DHS license by declaring a licensing state, such as Florida or Texas, as your home state. You will then need to complete that state's licensing process, which may include testing and compliance regulations.

Obtaining a DHS license will allow you to apply for reciprocal license privileges, making you more employable and able to adjust claims in other states. This is particularly important if you want to work on catastrophe (CAT) claims, as you may need to travel across state lines.

There are four main types of insurance adjusters:

Independent adjuster: Works for a third-party company contracted by insurance carriers to help settle their claims.

Public adjuster: An independent insurance adjuster hired by customers to settle insurance claims.

Please note that while Missouri does not require a license for staff, independent, and catastrophe adjusters, a license is necessary for public adjusters.