Dreaming of becoming an insurance adjuster in Illinois? Here's what you need to know to get started on this exciting career path.

First, let's address the elephant in the room: Illinois is one of a handful of states that do not require licensing for insurance adjusters. This means you can legally work as an adjuster in Illinois without any license. However, this is where it gets interesting. While you can work in your state without a license, it limits your ability to work across state lines. This is where the concept of a Designated Home State (DHS) license comes into play.

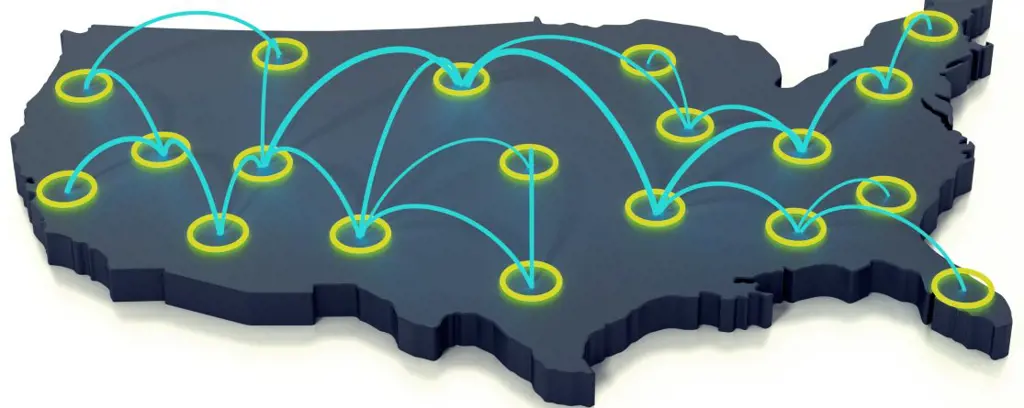

A DHS license is a creative solution for residents of non-licensing states like Illinois. By obtaining a DHS license, you can designate a licensing state (such as Florida or Texas) as your home state. This opens up a world of opportunities. With a DHS license, you can:

1. Increase your marketability: Many employers prefer licensed adjusters who can work across different states. Having a DHS license demonstrates your flexibility and commitment to the profession.

2. Enjoy reciprocity: A DHS license allows you to apply for reciprocal licensing privileges in other states. This means you can work on claims in those states, maximizing your income potential and career opportunities.

3. Enhance your credibility: A DHS license from a respected state like Florida or Texas can enhance your credibility with clients and employers alike.

So, what's the next step? If you're an Illinois resident, consider obtaining a DHS license from a state like Florida or Texas. These states offer efficient application processes, shorter exams, and high reciprocity. You can complete a pre-licensing course, pass the state exam, and apply for your DHS license.

Remember, while Illinois doesn't require licensing, obtaining a DHS license can significantly boost your career prospects and earning potential in the insurance adjusting field.

| Characteristics | Values |

|---|---|

| License Requirement | Illinois does not require a license to become an insurance adjuster. |

| Recommended License | A Designated Home State (DHS) license is recommended to increase employability and allow adjusting claims in other states. |

| DHS License States | Florida, Texas, and Indiana are the most popular choices for a DHS license. |

| Benefits of DHS License | Employment opportunities, ability to work on CAT claims across states, and increased income potential. |

| Public Adjuster License | Required in Illinois for public adjusters; must pass the Illinois Public Adjusters Examination and submit Form PA-1: Public Adjuster License Application with a fee. |

What You'll Learn

- Illinois doesn't require a license for insurance adjusters

- You can operate without a pre-exam course, state exam, or license application

- To increase earnings, get a Designated Home State (DHS) license

- A DHS license allows you to declare a licensing state as your home state

- Florida and Texas are the most popular choices for a DHS license

Illinois doesn't require a license for insurance adjusters

Illinois is one of 16 states that do not require insurance adjusters to have a license. This means you can work as an insurance adjuster in Illinois without a license, but only in Illinois.

However, being unlicensed can limit your career options. Many employers will only deploy licensed adjusters, as they have clients all over the country. Most adjusters want out-of-state licenses that will enable them to work across the entire country, which is how to truly maximize your income potential.

A DHS license allows you to declare a licensing state as your home state. You will go through that state's licensing process, testing, and compliance regulations, and their license will act as your resident or home state license.

Although Illinois doesn't require a license, many Illinois residents choose to obtain a DHS license from another state to increase their potential long-term earnings.

There are several states that offer DHS licenses, including Florida, Texas, and Indiana. Florida and Texas are the most popular options.

- Employment opportunities: Many potential employers of claims adjusters will specifically look for applicants who are already licensed. Even if they don't specifically require a license, they will likely prefer a licensed adjuster over a non-licensed one due to the geographical flexibility advantage.

- Catastrophe (CAT) or Traveling Adjusters: If a non-licensed adjuster wishes to work on CAT claims, they will likely need to travel across state lines. To operate in a state other than your home state, you will need to have a reciprocal license in that state. Applying for a reciprocity license can only be done if you hold an equivalent license in your own state (such as a DHS license).

Navigating the Path to Becoming an Insurance Adjuster in Oklahoma

You may want to see also

You can operate without a pre-exam course, state exam, or license application

Illinois is one of 16 states that do not require insurance adjusters to be licensed. This means you can operate without purchasing a pre-exam course, sitting a state licensing exam, or applying for a license. However, being unlicensed can limit your career options. Many employers will only hire licensed adjusters, and you will need a license to work in other states.

If you want to become a public adjuster in Illinois, you will need to apply for a public adjuster license. This requires passing the Illinois Public Adjusters Examination, administered by Pearson VUE, and submitting Form PA-1: Public Adjuster License Application to the Illinois Department of Insurance.

If you want to be able to work in other states, you will need to obtain a Designated Home State (DHS) license. This allows you to declare a licensing state as your home state and go through that state's licensing process. A DHS license is required by most employers and enables you to apply for reciprocal licensing privileges.

The most popular states to obtain a DHS license from are Florida and Texas, as they offer online pre-licensing courses and exams, and have good reciprocity with other states.

The Road to Becoming an Automotive Insurance Adjuster: A Comprehensive Guide

You may want to see also

To increase earnings, get a Designated Home State (DHS) license

If you're looking to become an insurance adjuster in Illinois, it's important to know that the state does not require adjusters to be licensed. However, obtaining a Designated Home State (DHS) license can significantly boost your earnings and open up more employment opportunities. Here's why and how you can get one:

- Enhanced Employability: Many employers prefer licensed adjusters as they can handle claims across different states. A DHS license demonstrates your qualifications and willingness to take on a wider range of assignments.

- Increased Earnings: With a DHS license, you can work on catastrophe (CAT) claims that often arise due to severe weather events. These assignments are typically associated with higher earnings.

- Geographical Flexibility: A DHS license allows you to work across state lines. This flexibility not only benefits your employer but also increases your income potential by enabling you to work in more locations.

- Career Longevity: By obtaining a DHS license, you're taking a crucial step toward establishing a long-lasting career in the insurance claims industry. This license is highly valued by employers and can lead to more opportunities over time.

How to Get a DHS License:

- Choose a Licensing State: Select a state that offers a DHS license, such as Florida or Texas. These states are popular choices due to their online processes and favourable reciprocity agreements with other states.

- Meet Basic Requirements: Ensure you meet the basic eligibility criteria, such as being a US citizen or legal alien with work authorization, being at least 18 years old, and not holding a resident adjuster license in another state.

- Complete Pre-Licensing Education: Enrol in a pre-licensing course specific to the state you've chosen. These courses will prepare you for the licensing exam and ensure you meet the educational requirements.

- Pass the Licensing Exam: After completing your pre-licensing education, you'll need to pass the state's licensing exam. This is usually a proctored test, so be prepared for a controlled testing environment.

- Fulfil Additional Requirements: Some states, like Texas, require fingerprinting and a background check as part of the licensing process. Ensure you provide all necessary documentation and fulfil any state-specific requirements.

- Submit Your Application: Once you've passed the exam and met all requirements, submit your application for the DHS license to the relevant state authority. There may be application fees and processing charges.

- Maintain Your License: Keep your DHS license active by completing any required continuing education credits and renewing your license periodically, as specified by the licensing state.

By obtaining a DHS license, you're taking a significant step toward maximising your earnings and establishing a successful career as an insurance adjuster. Remember, each state may have slightly different processes and requirements, so be sure to review the specific guidelines for your chosen licensing state.

The Art of Adjustment: Navigating the Fine Line of Insurance Claims

You may want to see also

A DHS license allows you to declare a licensing state as your home state

A Designated Home State (DHS) license is a solution for those who live in a state that does not license insurance adjusters, such as Illinois. A DHS license allows you to declare a licensing state as your home state, and go through that state's licensing process, testing, and compliance regulations. This means that you can obtain a license in a state that doesn't offer one to its non-residents.

The DHS license is a workaround for those who want to work as insurance adjusters in non-licensing states, and it is also beneficial for those who want to work across multiple states.

The DHS license is also useful for those who want to work on catastrophe (CAT) claims, which often require travel across state lines.

There are several states that offer DHS licenses, including Florida, Texas, and Indiana. Florida is recommended due to its quick application process, short exam, and high reciprocity.

The Economics of Insurance Adjusting: Navigating the Claims Landscape

You may want to see also

Florida and Texas are the most popular choices for a DHS license

If you live in a US state that does not require a license to be an insurance adjuster, you will need to obtain a Designated Home State (DHS) license from another state. This is because a DHS license allows you to act as a licensed adjuster in states that do require a license.

Florida and Texas are the two most popular and common choices for a DHS license. This is because they offer great reciprocity with other states, have a relatively simple exam process, and a quick application process.

Florida has the quickest application process in the country and the entire application is done online. The Florida exam is also shorter than other states, consisting of 100 questions, and has a simple attestation process. The Florida DHS license also has great reciprocity with all states except New York, California, and Hawaii.

Texas also offers online pre-licensing and exams, but the exam is longer and requires a proctor. Texas has made recent commitments to improving its processing time but Florida is still quicker. Texas offers a P&C Adjuster license, while Florida offers a General Lines or All Lines license.

Both Florida and Texas DHS licenses are available online through AdjusterPro, meaning no additional testing or coursework is required.

Understanding Your Rights: Communicating with Insurance Adjusters After Water Damage

You may want to see also

Frequently asked questions

No, Illinois does not require insurance adjusters to have a license. However, it is recommended that you obtain a Designated Home State (DHS) license from another state to improve your employment opportunities.

You can obtain a DHS license by declaring a licensing state as your home state and going through their licensing process, testing, and compliance regulations. This will allow you to adjust claims in your home state and other states with reciprocal licensing agreements.

Florida and Texas are two of the most popular options for DHS licenses due to their online pre-licensing courses and exams, as well as their reciprocity with other states. Florida also has the quickest application turnaround time and a relatively short insurance adjuster exam.

Having a DHS license can increase your employment opportunities as many employers prefer licensed adjusters. It also allows you to work across state lines and maximize your income potential by working on claims in different states, such as hurricanes in the Gulf or hail in the Midwest.