A Career in Automotive Insurance Adjusting: How to Get Started

Automotive insurance adjusters play a crucial role in the aftermath of vehicle accidents, working to assess damage, estimate repair costs, and negotiate settlements. It's a challenging but rewarding career path that offers good salaries, benefits, and opportunities for advancement. So, how can you become an automotive insurance adjuster?

First, it's important to meet the minimum education requirements, which typically include a high school diploma or GED. While a bachelor's degree is not always necessary, it can set you apart from other candidates. Relevant areas of study include business, criminal justice, and communication.

Next, you'll need to decide what type of automotive insurance adjuster you want to be. The two main paths are staff adjuster and independent adjuster. Staff adjusters work full-time for an insurance company, while independent adjusters are contractors who work for one or several insurance companies.

To enhance your employability, consider gaining relevant work experience, such as in an auto repair shop or as an automotive technician. This will not only make your application stand out but also provide valuable insights into the automotive industry.

Once you've gained some experience, find a mentor who can guide you through the intricacies of the job. Working under an experienced adjuster will allow you to start with smaller claims and gradually progress to more complex cases.

Before long, you'll be ready to take on your first insurance adjusting job, negotiating settlements and helping clients navigate the challenging aftermath of accidents.

| Characteristics | Values |

|---|---|

| Education Requirements | Minimum of a high school diploma or GED equivalent. A bachelor's degree or higher may set candidates apart. |

| Skills | Strong communication, customer service, analytical, math, and interpersonal skills. Patience, empathy, and the ability to drive a vehicle are also important. |

| Experience | Previous experience in claims processing, familiarity with insurance policies, and knowledge of legal regulations are advantageous. |

| Licensing | Many states require insurance adjusters to obtain a license by completing pre-licensing classes and passing an exam. Licensing requirements vary by state. |

| Career Paths | Staff adjusters work full-time for insurance companies, while independent adjusters are contractors working for one or multiple companies. |

| Specialization | Auto insurance adjusters may specialize in vehicle theft, vandalism, or other areas. |

What You'll Learn

Get a high school diploma or GED

To become an automotive insurance adjuster, you'll need to get a high school diploma or GED. This is the minimum requirement for most entry-level adjuster positions. If you don't plan to continue your education, you can take classes at a vocational school or community college to learn more about auto body repair. This additional training can make you a more competitive candidate for entry-level positions.

- Enroll in a high school diploma program: If you haven't already completed your high school education, you can enroll in a program at a local school or online. This will allow you to take the necessary courses and earn your diploma.

- Study hard and attend classes regularly: Getting your high school diploma requires dedication and commitment. Make sure to attend classes regularly and study hard to understand the material.

- Seek help if needed: If you struggle with any subjects, don't hesitate to seek help from teachers, tutors, or peers. It's important to build a strong foundation of knowledge.

- Complete any required assessments or exams: High school programs usually have specific graduation requirements, which may include passing standardized tests or completing a capstone project. Make sure you're aware of these requirements and work towards meeting them.

- Consider taking relevant courses: To make your resume more appealing to future employers, consider taking courses in subjects like mathematics, communication, and business. These skills will be valuable in your future career as an insurance adjuster.

- Stay motivated: Earning your high school diploma may take a few years, so it's important to stay motivated throughout the process. Set short-term goals, find a study group, and remind yourself of the benefits of completing your education.

- Obtain your GED: If you've already left high school without a diploma, consider enrolling in GED courses and preparing for the GED exam. Passing this exam will show that you have the academic skills equivalent to a high school graduate.

Providing a Recorded Statement to the Insurance Adjuster: What You Need to Know

You may want to see also

Decide on staff or independent adjuster role

When considering a career as an automotive insurance adjuster, it is important to decide whether you want to work as a staff adjuster or an independent adjuster. Both paths have their own unique advantages and challenges, and understanding the differences between the two will help you make an informed decision about which route is best for you.

Staff Adjuster

A staff adjuster, also known as a company adjuster, is an employee of a single insurance company and typically works full-time, receiving a salary and benefits from their employer. They represent the insurance company and only handle claims for that company. Staff adjusters usually work standard business hours and have a set coverage area, providing more routine and stability in their work. They may work either inside or outside the office. Outside staff adjusters focus on gathering evidence and inspecting damages, while inside staff adjusters handle policy decisions, paperwork, and settling claims. Staff adjusters often have their expenses covered by the company and receive benefits such as health insurance and retirement plans. However, their salaries are capped, and they may face constraints in their decision-making due to the corporate environment.

Independent Adjuster

Independent adjusters, on the other hand, are business owners who contract with multiple insurance companies or independent adjusting firms. They have more flexibility in their work and can set their own schedules. Independents typically have a higher earning potential than staff adjusters, but they also have more responsibilities as they need to manage their own business, including covering expenses and finding work. Work for independent adjusters can vary, with busy periods followed by lulls in claims. They have the freedom to work for different companies and decide how many claims they want to handle. However, they may face inconsistent work and need to obtain their own accounts and contracts. Independent adjusters usually work as 1099 contractors, and their pay can be per claim, hourly, or on a daily or fee schedule basis.

In summary, the decision between becoming a staff or independent automotive insurance adjuster depends on your personal preferences and work style. If you value stability, a consistent income, and the support of a corporate structure, a staff adjuster role may be more suitable. On the other hand, if you prefer flexibility, higher earning potential, and the freedom to work with multiple companies, the independent adjuster path could be a better fit. Ultimately, both options offer rewarding careers in the insurance industry, and understanding the differences will help you make an informed choice.

Navigating the Path to Becoming an Insurance Adjuster in Oklahoma

You may want to see also

Check state requirements for licensing

The requirements for becoming a licensed insurance adjuster vary from state to state. While some states require insurance adjusters to obtain a license, others do not. It is important to check the specific requirements for the state in which you plan to work.

Education Requirements

In most states, a high school diploma or GED is the minimum educational requirement for becoming an insurance adjuster. Some states may also require additional education, such as a post-secondary degree or insurance-related coursework. It is important to check the specific education requirements for your state.

Licensing Exam

Many states require insurance adjusters to pass a licensing exam. This typically involves completing a pre-licensing course and passing a state-specific exam. The content of these exams can vary, but they generally cover insurance regulations, types of insurance, and state laws relevant to insurance adjusters. Some states may also require additional steps, such as fingerprinting and background checks.

Reciprocity

If you plan to work in multiple states, it is important to consider reciprocity agreements. Some states recognize the licensing requirements of other states, allowing you to work without completing additional exams. However, other states may require you to obtain a separate license to work within their borders.

License Maintenance

Once you have obtained your license, it is important to maintain it through continuing education credits and regular license renewal. The requirements for maintaining your license may vary depending on your state.

Pursuing a Career in Insurance Adjusting: A Guide to Licensing and Opportunities in Pennsylvania

You may want to see also

Complete pre-licensing classes and exam

To become an automotive insurance adjuster, you will need to complete pre-licensing classes and an exam. Here is a step-by-step guide to help you through the process:

Step 1: Check State Requirements

First, check the requirements for the state where you want to practice. Each state has its own requirements for licensing, which you can usually find on the state's Department of Insurance website. This information will include details such as residency requirements, states with reciprocal licensing agreements, experience requirements, and education prerequisites.

Step 2: Complete Pre-Licensing Classes

Once you understand your state's requirements, it's time to enrol in pre-licensing classes. These classes will cover topics such as insurance regulation and automobile insurance. Pre-licensing classes may be offered online or in a traditional classroom setting, and there may be a fee associated with them.

Step 3: Prepare for the Licensing Exam

The pre-licensing classes will help you prepare for the licensing exam, which is typically a requirement for becoming a licensed insurance adjuster. The exam will cover various topics, including personal automobile insurance coverage, state laws relevant to adjusters, and fair claims settlement practices. You may also have access to study materials and practice questions provided by your state's Department of Insurance.

Step 4: Take the Licensing Exam

After completing your pre-licensing classes and preparation, you will be ready to take the licensing exam. There may be a fee associated with the exam, and you will need to achieve a passing score on both the national and state-specific sections. Passing the exam is a crucial step towards obtaining your insurance adjuster license.

Step 5: Complete the License Application

Even after passing the exam, there may be additional steps to obtain your license. This could include submitting your pre-licensing class certificate, completing fingerprinting and background checks, and paying any necessary license application fees. Make sure to carefully follow the instructions provided by your state's Department of Insurance to ensure a smooth application process.

By following these steps and completing the necessary pre-licensing classes and exam, you will be well on your way to becoming a licensed automotive insurance adjuster in your desired state.

Navigating the Path to Becoming an Insurance Adjuster in Florida: A Comprehensive Guide

You may want to see also

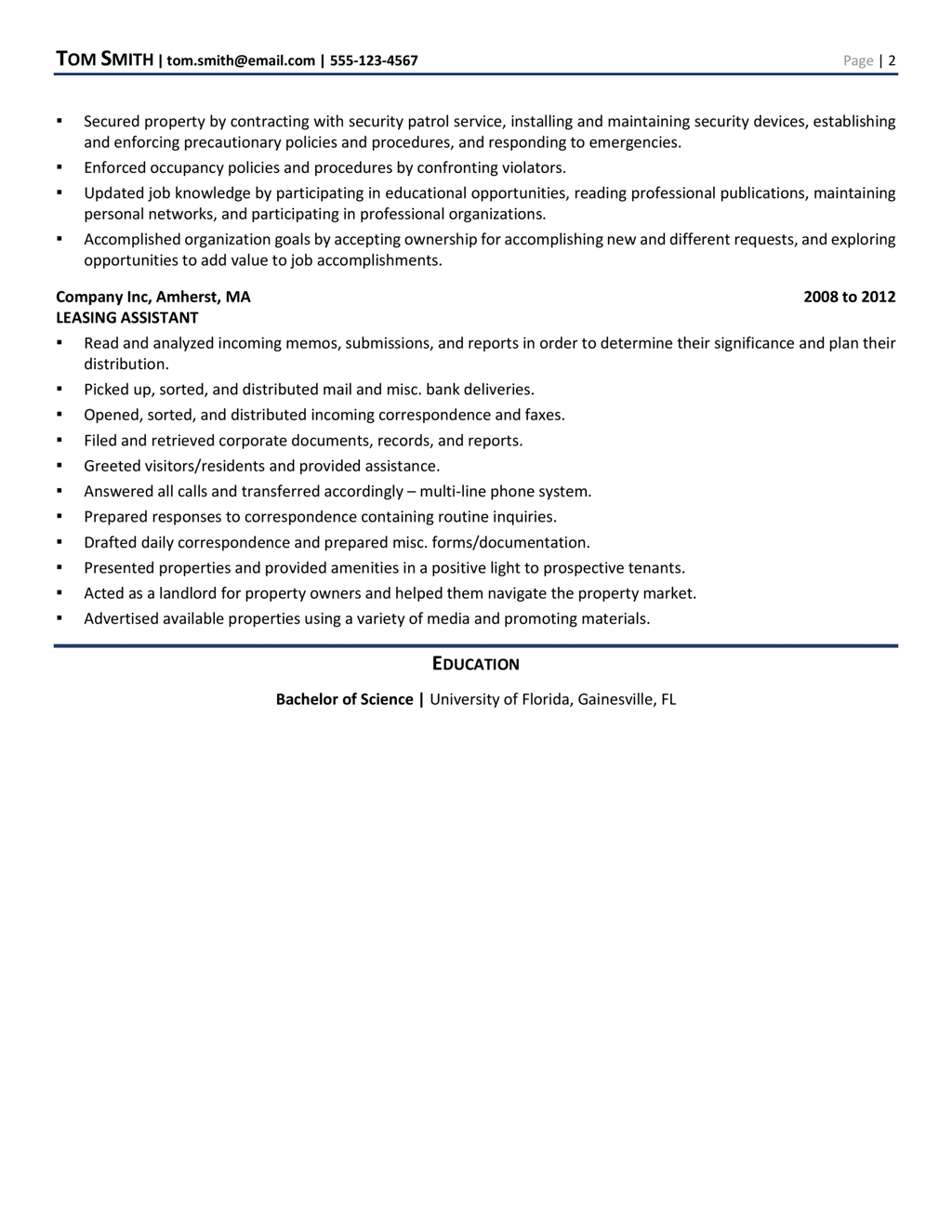

Gain experience and build a resume

Gaining experience and building a resume are crucial steps in becoming an automotive insurance adjuster. Here are some tips to help you in this process:

- Education: While a high school diploma is the minimum requirement, consider pursuing a bachelor's degree in a relevant field such as business, criminal justice, or communication. This will set you apart from other candidates and provide valuable knowledge.

- Vocational Training: Enrol in vocational schools or community colleges to learn about auto body repair. This advanced training will enhance your understanding of automotive mechanics and make your resume more competitive.

- Insurance Industry Experience: Aim for positions that provide insurance industry work experience, especially those that involve estimating the cost of repairing different types of damage. This experience will be highly valued by employers.

- Auto Repair Shop Employment: Working in an auto repair shop can provide valuable insights into automotive mechanics and repair processes. This experience will be beneficial when assessing vehicle damage as an insurance adjuster.

- Mentorship: Find a mentor who is an experienced automotive insurance adjuster. Working under their guidance will allow you to learn the trade firsthand and gain practical experience. Start with small claims and gradually take on more complex ones as your knowledge grows.

- Licenses: Research the licensing requirements for the state where you plan to practice. Obtain the necessary licenses, such as the adjuster's license, by completing pre-licensing classes and passing the licensing exam. This is a crucial step, as most companies prefer licensed candidates.

- Tailor Your Resume: Ensure your resume highlights your relevant education, experience, training, and licensing. Emphasize your analytical, communication, math, and interpersonal skills, which are highly valued in this profession.

- Network: Join industry associations, insurance job boards, and networking events to connect with potential employers and peers. Building a strong network can increase your chances of learning about job openings and gaining referrals.

Unraveling the Path to Becoming an Insurance Adjuster in Georgia

You may want to see also

Frequently asked questions

A high school diploma or GED is the minimum requirement for most entry-level adjuster positions. However, a bachelor's degree or advanced vocational training in a relevant field, such as automotive repair or business, can make your application more competitive.

Analytical, communication, math, and interpersonal skills are essential for automotive insurance adjusters. You should also have strong customer service skills, including patience, empathy, and the ability to resolve conflicts.

Yes, most states require insurance adjusters to be licensed. You will need to complete pre-licensing classes and pass the licensing exam. Some states may also require continuing education credits for license renewal.

The salary for automotive insurance adjusters can vary depending on experience and location. On average, automotive insurance adjusters earn between $38,000 and $71,000 per year in the United States, with a median salary of around $52,621.