Are you interested in becoming an insurance adjuster in Pennsylvania? If so, there are a few things you should know about getting started in this dynamic field.

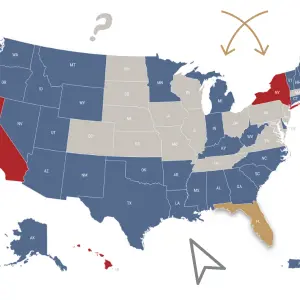

First, it's important to note that Pennsylvania is one of 16 states that do not require licensing for insurance adjusters. This means you can legally work as an adjuster in Pennsylvania without obtaining a license. However, being unlicensed may limit your career opportunities as many employers prefer to hire licensed adjusters who can work across different states.

To enhance your employability and income potential, it is recommended to pursue a Designated Home State (DHS) license. A DHS license allows you to choose a licensing state as your home state and go through their licensing process, enabling you to work in other states with reciprocal licensing privileges. Florida and Texas are popular choices for DHS licenses due to their quick turnaround times, relatively short exams, and high reciprocity.

To obtain a Florida DHS license, you can complete a 40-hour pre-licensing course and pass the included exam. This license is valid for four years and requires fingerprinting, which is beneficial when applying for reciprocal licenses in other states.

Alternatively, you can pursue a Texas All-Lines Pre-Licensing Course, which will equip you with the knowledge and credentials to work in Texas and other reciprocal states. This course covers various aspects such as ethics, caseload management, and practical skills like using Xactimate software.

Remember, while obtaining a license is not mandatory in Pennsylvania, it can significantly boost your career prospects and earning potential in the insurance adjusting field.

| Characteristics | Values |

|---|---|

| Licensing requirements | Pennsylvania does not license insurance adjusters. |

| Licensing recommendations | It is recommended to obtain a Designated Home State (DHS) license from another state, such as Florida or Texas. |

| Licensing benefits | A DHS license increases employment opportunities and earning potential. |

| Licensing process | Complete a pre-licensing course and pass the included exam. |

| Licensing fees | N/A |

| Other requirements | N/A |

What You'll Learn

- You don't need a license to be an insurance adjuster in Pennsylvania

- However, a license from another state will increase your employment opportunities

- This is called a Designated Home State (DHS) license

- A popular choice is Florida, due to its quick application process and high reciprocity

- Texas is another good option, as it's highly respected in the industry

You don't need a license to be an insurance adjuster in Pennsylvania

Pennsylvania is one of 16 states that do not require insurance adjusters to be licensed. This means that you can legally adjust claims in Pennsylvania without a license. However, being unlicensed can limit your career options as an insurance adjuster.

Many employers prefer to deploy licensed adjusters, as they have clients all over the country and need adjusters who can work wherever there is a need. Most adjusters also want out-of-state licenses that will enable them to work throughout the entire country, increasing their income potential.

How to get a license

If you live in a state that doesn't require licensing, such as Pennsylvania, you can obtain what is called a Designated Home State (DHS) license. This type of license allows you to declare a licensing state as your home state and go through that state's licensing process, testing, and compliance regulations. A DHS license is required by most employers and enables you to apply for reciprocal licensing privileges.

Where to get a DHS license

Several states offer DHS licenses, including Florida, Texas, and Indiana. Florida is a popular choice for a DHS license because it has great reciprocity, a quick licensing process, and a relatively short insurance adjuster exam. The Texas DHS license is also a good option, as it is highly respected in the industry and can significantly enhance your marketability as an adjuster.

How to get started as an insurance adjuster in Pennsylvania

If you're looking to become an insurance adjuster in Pennsylvania, you can take a "Designated Home State" course to get started. It is also recommended to learn Xactimate, the number one claims adjustment software program used by adjusters.

Providing a Recorded Statement to the Insurance Adjuster: What You Need to Know

You may want to see also

However, a license from another state will increase your employment opportunities

Although Pennsylvania does not require insurance adjusters to be licensed, it is highly recommended that you obtain a license from another state, known as a Designated Home State (DHS) license. This is because insurance adjusters with a license have increased employment opportunities and earning potential.

A DHS license allows you to declare a licensing state as your home state. You will need to go through that state's licensing process, testing, and compliance regulations, and their license will act as your resident or home state license. Once you have a DHS license, you can use it to obtain reciprocal licensing privileges, making you more employable and allowing you to adjust claims in other states.

The two most popular states to obtain a DHS license from are Florida and Texas. This is because they offer high reciprocity, a quick application process, and a relatively short licensing exam. Obtaining a DHS license from Florida or Texas will also exempt you from needing to complete additional coursework or exams.

The Secrets Behind Insurance Adjusters: Unveiling the Unspoken

You may want to see also

This is called a Designated Home State (DHS) license

Pennsylvania is one of 16 states that do not license insurance adjusters. This means you can work as an insurance adjuster in Pennsylvania without a license, but only in Pennsylvania. Not having a license can limit your career as an adjuster as you won't be able to work on out-of-state claims. Many employers will only deploy licensed adjusters, as they have clients all over the country and need adjusters who can help wherever there is a need.

This is where the Designated Home State (DHS) license comes in. A DHS license allows you to declare a licensing state as your home state. You will go through that state's licensing process, testing, and compliance regulations, and their license will act as your resident or home state license.

Once you hold a DHS license, you can use it to get reciprocal license privileges, making you more employable and allowing you to adjust claims in other states. Both are vital if you want to have a long and successful career as a claims adjuster.

There are several states that offer a DHS license, but the most popular are Florida and Texas. Florida is recommended because it has great reciprocity, the quickest licensing process, and a relatively short insurance adjuster exam. The Florida 70-20 DHS license is good for 4 years, which is twice as long as most other DHS options. Florida also requires fingerprinting, which some states do not, so you won't have to worry about doing it later when applying for reciprocal licenses in states that require it.

The process of obtaining a DHS license involves the following steps:

- Identify the state in which you hold a "designated home state" non-resident license.

- Enter basic identifying information about yourself, including your name, Social Security Number, and DHS License Number.

- Enter the state(s) to which you wish to submit a non-resident adjuster license application.

- Provide additional personal and professional information, such as gender, citizenship, email address, and employment history.

- Answer background questions pertaining to your personal and professional background and ethical conduct.

- Attest to the application, confirming that the information submitted is complete, truthful, and accurate.

- Review the state license application fee.

- Submit the license application.

- Review the confirmation and receipt information for your license application transaction.

- Complete the process by submitting any required supporting documentation and following up with the state department of insurance.

By obtaining a DHS license, you can increase your employment opportunities and income potential as an insurance adjuster in Pennsylvania.

Unraveling the Path to Becoming an Insurance Adjuster in Tennessee

You may want to see also

A popular choice is Florida, due to its quick application process and high reciprocity

If you're a Pennsylvania resident looking to become a licensed insurance claims adjuster, you should know that Pennsylvania is one of 16 states that do not license insurance adjusters. This means you can work as an adjuster in Pennsylvania without a license, but you can't work in other states.

To work in other states, you'll need to obtain a license from a different state, known as a Designated Home State (DHS) license. This allows you to designate a different state as your "home state." A DHS license is required by most employers and enables you to apply for reciprocal licensing privileges.

A popular choice for a DHS license is Florida. Here are some reasons why:

- Quick Application Process: Florida has the quickest turnaround time for processing applications in the country.

- Reciprocity: The Florida DHS license is reciprocal with most licensing states and Puerto Rico. This means you can obtain licenses from these states without taking their exams.

- Duration: A Florida DHS license is valid for four years, twice as long as most other DHS options.

- Fingerprinting: Florida requires fingerprinting, which some states that offer DHS licenses don't. Getting this done for your DHS license means you won't need to do it again when applying for reciprocal licenses in states that require it.

To obtain a Florida DHS license, you'll need to complete a 40-hour pre-licensing course and pass the included exam. This course is offered by various institutions, including AdjusterPro and Kaplan Financial Education.

Texas is another good option, as it's highly respected in the industry

Texas is another great option for obtaining a Designated Home State (DHS) license. A DHS license is often recommended for those living in a non-licensing state like Pennsylvania. This is because operating without a license can significantly limit your employment opportunities.

The Texas DHS Adjuster License is highly respected in the industry and can significantly enhance your marketability as an adjuster. The Texas All-Lines Adjuster's License is the most versatile and sought-after adjuster's license in the insurance industry. It is also reciprocal in 30 states.

To obtain a Texas Adjuster License, you must:

- Be at least 18 years old

- Be a United States citizen or legal alien with work authorization

- Complete a pre-licensing course and pass the state exam

- Process and submit fingerprints

- Submit the application through Sircon

The application fee is $50, the fingerprinting fee is $70, and the license renewal fee is $50.

Frequently asked questions

No, you don't need a license to be an insurance adjuster in Pennsylvania. However, most employers prefer licensed adjusters, and a license will increase your employment opportunities and earning potential.

You can obtain a Designated Home State (DHS) license from another state that does license adjusters. This will allow you to apply for reciprocal licensing privileges and work in other states.

Florida and Texas are two popular choices due to their high reciprocity, fast application process, and online pre-licensing and exam options.