Becoming a part-time insurance adjuster is a great way to supplement your income or transition to a new career. However, it is important to note that part-time insurance adjuster jobs are relatively rare. A part-time insurance adjuster investigates insurance claims, evaluates evidence and coverage, and decides on payouts. They often work on specific types of insurance, such as auto, life, casualty, or property insurance. To become a part-time insurance adjuster, you will need an adjuster's license, training, and/or experience. While a college degree is not always required, it is often preferred by employers. Additionally, some states have specific licensing requirements, so it is important to check the regulations in your state.

What You'll Learn

Check compatibility with existing work

Part-time insurance adjuster jobs are relatively rare, and they are usually not compatible with a full-time job. This is because insurance claims volumes are unpredictable, and employers need adjusters who are available when needed.

However, since the pandemic, there have been more opportunities to work part-time as an inside or desk adjuster. These roles can range from entry-level positions supporting field staff to experienced file reviewers who handle large-scale, complicated claims.

If you are looking to supplement your income with a part-time insurance adjuster role, you will likely need to be available on short notice and work irregular hours. This may be compatible with a full-time job that allows for flexible scheduling, such as shift work or freelance work. However, it is important to note that even part-time insurance adjuster roles typically require a significant time commitment, and you may need to be available outside of traditional business hours to meet with policyholders.

Additionally, some insurance companies offer remote work options for claims adjusters, which may provide more flexibility in terms of compatibility with an existing work schedule.

Ultimately, if you are interested in pursuing a career as an insurance adjuster, it is recommended to start with a full-time position to establish yourself and build a positive reputation with employers. Part-time positions, working from home, and other benefits typically become available once you have proven your reliability and earned the trust of your employers.

Bridging the Gap: Effective Strategies for Communicating Treatment Gaps to Insurance Adjusters

You may want to see also

Get licensed in your state

The requirements for becoming a licensed insurance adjuster vary from state to state. While most states (34 out of 50) issue their own licenses for claims adjusters, some states do not. The following 17 jurisdictions do not issue their own licenses:

- Colorado

- Kansas

- Nebraska

- South Dakota

- North Dakota

- Missouri

- Iowa

- Illinois

- Wisconsin

- Tennessee

- Ohio

- Virginia

- Maryland

- Pennsylvania

- New Jersey

- Massachusetts

- The District of Columbia

If your state does issue adjuster licenses, you must obtain your home state license first. You will need to pass your state's licensing exam, and in some cases, you may need to complete a pre-licensing course before you can take the exam. Application instructions and requirements vary by state, but generally, you will need to submit your application and pay the associated fees after passing the exam.

Even if your state does not issue adjuster licenses, it is still recommended that you obtain a license to increase your employability. You can obtain a Designated Home State (DHS) license from Florida, as many Independent Adjusting Firms require you to be licensed before applying, regardless of their location.

Once you have your home state license, you can apply for reciprocal licenses in the states you are most likely to work in. For most states, you only need to complete an application and pay the required fees to receive a reciprocal license without needing to take an additional exam. However, some states, such as New York, California, and Hawaii, do not offer reciprocity, so you will need to complete their specific requirements to process claims in those states. Additionally, New York, California, and New Mexico require adjusters to get bonded.

Flood of Opportunities: A Guide to Becoming a Flood Insurance Adjuster

You may want to see also

Gain experience

Gaining experience is a crucial step in becoming a part-time insurance adjuster. Here are some detailed instructions and guidelines to help you build the necessary experience:

Entry-level positions

Start by exploring entry-level roles within the insurance industry. Look for positions such as "claims specialist" or adjuster positions at insurance firms. These roles can provide valuable training and help you develop a solid understanding of the claims process.

Trainee programs and internships

Consider applying for trainee programs or internships specifically designed for aspiring insurance adjusters. These programs can offer structured training and provide you with the necessary skills and knowledge to handle claims. It is a great way to gain hands-on experience and build expertise in the field.

Network and establish connections

Networking is an essential aspect of gaining experience. Attend industry events, join local and national insurance associations, and actively participate in insurance job boards. Building connections with peers and professionals in the industry can open doors to future opportunities and help you stay informed about the latest developments in the field.

Develop relationships with IA firms

Independent Adjusting (IA) firms are always on the lookout for talented individuals. Reach out to their HR departments, inquire about openings, and express your interest in gaining experience. Building a positive relationship with these firms can increase your chances of being considered for future roles or trainee programs.

Take on field adjuster roles

Field adjuster positions allow you to work externally and interact directly with clients. These roles can provide valuable experience in handling claims, performing inspections, and dealing with contractors. It will also help you develop strong communication and interpersonal skills, which are essential for effective claims adjustment.

Specialize in a specific type of claim

As you gain experience, consider specializing in a particular type of claim, such as auto, property, or catastrophe (CAT) claims. This specialization will make you more attractive to employers and demonstrate your expertise in a specific area of insurance adjustment.

Take advantage of certification opportunities

Pursue certifications such as the Certified Insurance Examiner (CIE) or State Farm Certification. These certifications can set you apart from other candidates and increase your earning potential. They demonstrate a strong understanding of the industry and a commitment to professional development.

Stay informed about licensing requirements

Ensure that you meet the licensing requirements for the state in which you plan to work. Obtain the necessary licenses, including reciprocal licenses if you intend to work in multiple states. Remember that some states, like California and New York, have additional requirements, such as bonding.

Be prepared for catastrophe (CAT) claims

CAT claims, which arise from natural disasters or widespread damage, offer unique opportunities for adjusters. Be prepared to handle these claims by staying informed about emerging situations and being ready to deploy quickly. CAT claims can provide intense but rewarding experiences and often offer higher earnings.

Consider working as a staff adjuster for an insurance company. This will provide you with the stability of full-time employment and the opportunity to gain valuable experience in claims management. Staff adjusters often work directly for insurance carriers, handling regular 'daily claims' and gaining a deep understanding of the insurance industry.

Remember that gaining experience is a gradual process, and it may take a few months to several years to establish yourself in the field. Stay patient, proactive, and committed to continuous learning, and you'll be well on your way to becoming a successful part-time insurance adjuster.

Navigating the Path to Becoming an Insurance Adjuster in Maryland

You may want to see also

Develop skills and knowledge

Developing the skills and knowledge to become an insurance adjuster is a crucial step in your career journey. Here are the key areas you should focus on:

Education and Licensing

While a high school diploma or GED is the minimum educational requirement, consider pursuing a bachelor's degree in a related field such as business, criminal justice, or insurance. A degree demonstrates commitment and provides valuable knowledge. Additionally, some states require insurance adjusters to obtain a license, so be sure to check your state's requirements and complete any necessary pre-licensing courses and exams.

Software Proficiency

Proficiency in industry-standard claims writing software, such as Xactimate, is critical for your success as an insurance adjuster. This software is widely used by adjusting firms, and you will need to be able to use it to close claims efficiently.

Communication Skills

As an insurance adjuster, you will regularly interact with policyholders, insurance companies, and other professionals. Strong communication skills, both oral and written, are essential to effectively convey complex insurance terms and ensure all parties are well-informed throughout the claims process.

Analytical and Detail-Oriented Skills

Insurance adjusters need to assess complex information and make sound decisions. Paying close attention to the specifics of each claim is vital. Analytical skills will help you evaluate evidence, investigate claims, and determine fair settlements.

Interpersonal Skills

When dealing with claimants, especially those who may be upset or stressed, empathy and understanding are crucial. Strong interpersonal skills will enable you to handle these interactions effectively and provide excellent customer service.

Time Management Skills

As an insurance adjuster, you will often juggle multiple claims simultaneously. Effective time management skills will help you stay organised, meet deadlines, and efficiently handle the demands of your job, especially when dealing with time-sensitive catastrophe claims.

Additional Training

Stay open to continuous learning and development. Consider pursuing specific adjuster accreditations or certifications, such as the Certified Insurance Examiner (CIE), to enhance your resume and demonstrate advanced proficiency in specialised areas of insurance adjusting.

Steep Rooftop Adventures: The Perils of an Insurance Adjuster's Job

You may want to see also

Apply for adjuster jobs

Now that you've completed your training and met the necessary requirements, it's time to start applying for insurance adjuster jobs. Here are some tips to help you with your job search:

- Browse job boards: Search for relevant job postings on job boards such as ZipRecruiter, Indeed, and Zippia. You can set up email alerts to receive the latest job postings that match your criteria.

- Network: Tap into your professional network to learn about any potential job opportunities. Reach out to your contacts in the insurance industry or claims adjustment field and let them know you're looking for adjuster roles.

- Direct outreach: Make a list of companies you're interested in working for and reach out to them directly. Visit their websites to look for job postings, and consider contacting their HR or recruitment departments to express your interest in working for them.

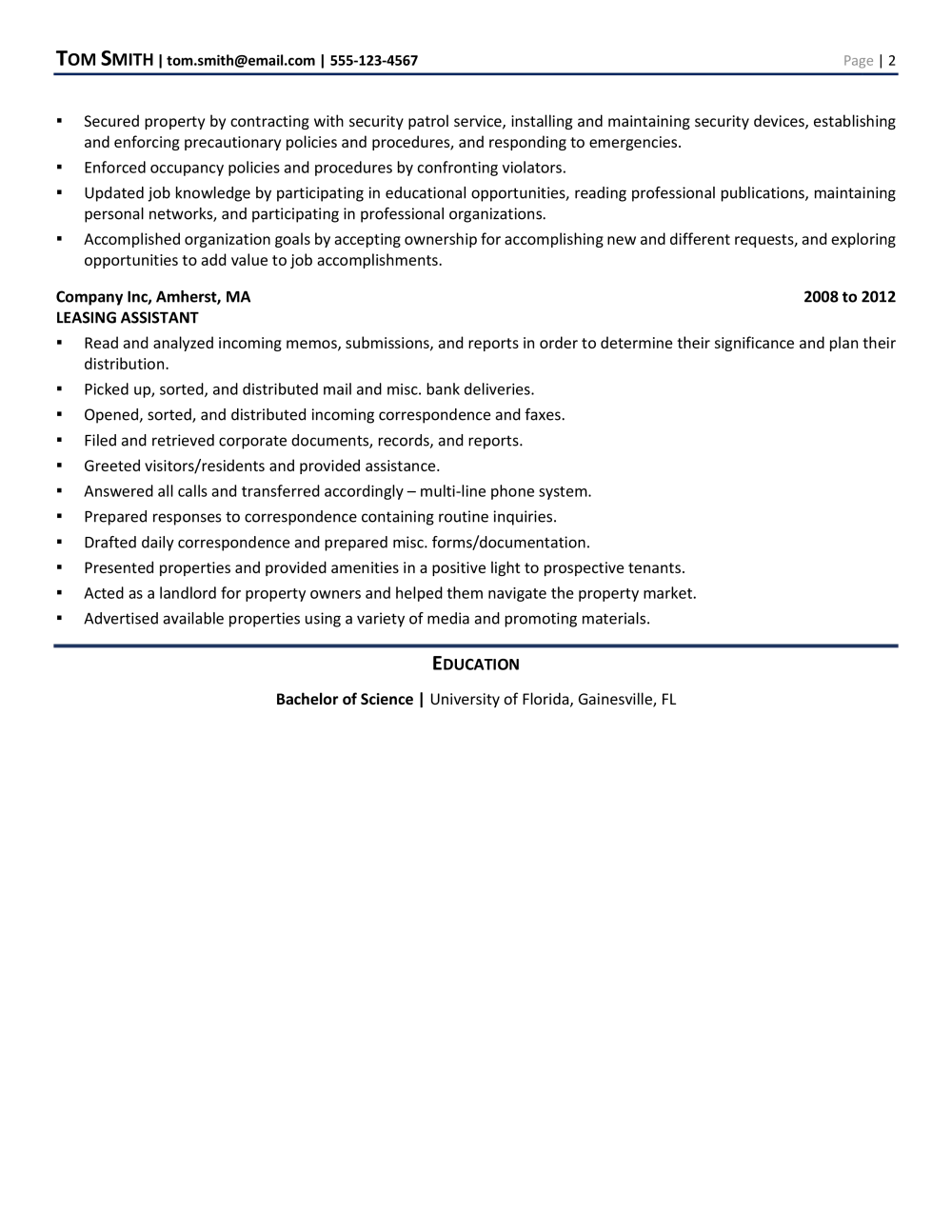

- Prepare your resume: Ensure your resume is tailored to the claims industry and highlights the skills and experiences that employers are looking for. Emphasize any relevant education, training, internships, or work experience you have. Include any certifications or licenses you've obtained.

- Watch out for scams: Be cautious when applying for jobs online and watch out for potential scams. Only apply for jobs with reputable companies and be wary of any opportunities that seem too good to be true.

- Consider entry-level roles: If you're new to the field, consider applying for entry-level roles such as "claims specialist" or adjuster roles at insurance firms. These roles can provide valuable on-the-job training and help you gain the experience needed for more senior positions.

- Stay compliant: Keep your licenses and certifications current and in good standing. This is important for both your job applications and your future career as an insurance adjuster.

- Be prepared to deploy: Particularly during catastrophe season, be ready to deploy quickly if you're offered a position. Firms often work with tight deadlines, so be prepared to move fast when an opportunity arises.

Understanding Escrow Adjustments: Navigating the Impact of New Insurance Policies

You may want to see also

Frequently asked questions

Qualifications to become a part-time insurance adjuster include an adjuster's license, as well as training or experience in the field. A bachelor's degree in criminal investigation or experience in law enforcement or another investigative career is often preferred by insurance companies. Auto claims adjusters require skills in auto repair.

A part-time insurance adjuster investigates insurance claims and evaluates evidence and coverage in the claimant's policy. They decide on coverage and payouts and may negotiate settlements. Part-time adjusters often work on specific types of insurance, such as auto, life, casualty, or property insurance.

Part-time insurance adjusters typically work less than 40 hours per week and their hours may vary depending on the company's needs and the volume of claims.

In addition to relevant qualifications and experience, insurance adjusters require strong communication skills, analytical skills, attention to detail, interpersonal skills, math skills, and time management skills.