Prepaid insurance is an insurance premium paid by a company during an accounting period that doesn't expire within that same period. It is considered an asset on a company's balance sheet, specifically a current asset, because it is not yet used. Once the insurance coverage begins, it becomes an expense instead of an asset.

Prepaid insurance is usually charged to expense on a straight-line basis over the term of the related insurance contract. When the asset is charged to expense, the journal entry is to debit the insurance expense account and credit the prepaid insurance account.

What You'll Learn

Prepaid insurance is a current asset

Prepaid insurance is considered an asset because it benefits future accounting periods. It relieves businesses of the monthly premium expense, reducing their costs while conferring the benefit of having coverage. It is also considered an asset because of its redeemable value. Any remaining prepaid portion of the premium could be refunded to the business if the policy is cancelled before the period covered by those premiums expires.

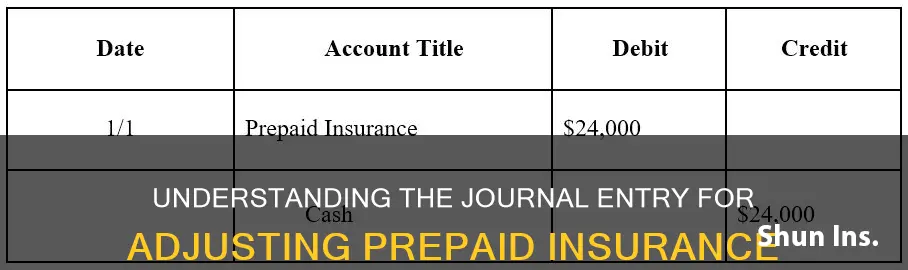

Prepaid insurance is initially recorded as an asset, but its value is expensed over time onto the income statement. It is recorded in the general ledger as a prepaid asset under current assets. The full value of the prepaid insurance is recorded as a debit to the asset account and as a credit to the cash account. Each month, as a portion of the prepaid premiums are applied, an adjusting journal entry is made as a credit to the asset account and as a debit to the insurance expense account.

As the amount of prepaid insurance expires, the expired portion is moved from the current asset account to the income statement account. This is usually done at the end of each accounting period through an adjusting entry. The asset is converted to an expense for the period in which the prepaid is used.

The Role of Insurance Adjusters in Payout Determinations: An Overview

You may want to see also

It is a part of the insurance premium paid in advance

Prepaid insurance is a part of the insurance premium paid by a company in advance of the coverage period. It is the amount expended for an insurance contract that has not been used through the passage of the time period stated in the contract. Prepaid insurance is treated as an asset in accounting records, which is gradually charged to expense over the period covered by the related insurance contract.

Insurance providers prefer to bill insurance in advance. If a business were to pay late, it would risk having its insurance coverage terminated. Therefore, the providers of medical insurance usually insist on being paid in advance. As a result, a company must record an insurance payment at the end of one month as prepaid insurance and then charge it to expense in the next month, to which the payment relates.

Prepaid insurance is commonly classified as a current asset on the balance sheet, as the term of the related insurance contract that has been prepaid is usually for a period of one year or less. If the prepayment covers a longer period, the portion of the prepaid insurance that will not be charged to expense within one year should be classified as a long-term asset.

Prepaid insurance is usually charged to expense on a straight-line basis over the term of the related insurance contract. When the asset is charged to expense, the journal entry is to debit the insurance expense account and credit the prepaid insurance account. Thus, the amount charged to expense in an accounting period is only the amount of the prepaid insurance asset ratably assigned to that period.

For example, a business buys one year of general liability insurance in advance for $12,000. The initial entry is a debit of $12,000 to the prepaid insurance (asset) account and a credit of $12,000 to the cash (asset) account. In each successive month for the next twelve months, there should be a journal entry that debits the insurance expense account and credits the prepaid expenses (asset) account.

Understanding the DHS License: A Necessary Credential for Insurance Adjusters

You may want to see also

It is adjusted at the end of each accounting period

Prepaid insurance is the insurance premium paid by a company in an accounting period that didn't expire in the same accounting period. It is considered an asset and is recorded as such on a company's balance sheet. As the insurance coverage period elapses, the expired portion is moved from the current asset account to the income statement account as an expense. This is typically done at the end of each accounting period through an adjusting entry.

For example, consider a company that pays an insurance premium of $2,400 for coverage from December 1 to May 31. On the payment date, the transaction is recorded with a debit of $2,400 to Prepaid Insurance and a credit of $2,400 to Cash. Initially, the entire $2,400 will be reported on the balance sheet as Prepaid Insurance or Prepaid Expenses. However, at the end of each month, an adjusting entry will be made to reflect the expired portion. On December 31, an adjusting entry will debit Insurance Expense for $400 (1/6 of the total cost) and credit Prepaid Insurance for $400. This process will continue each month until the entire prepaid insurance amount has been adjusted to expense.

The adjusting entry for prepaid insurance depends on the initial journal entry method used. Under the asset method, a prepaid expense account (an asset) is recorded when the amount is paid. In contrast, under the expense method, the entire payment is initially recorded as an expense. Regardless of the method chosen, the goal of the adjusting entries is to ensure that the incurred or expired portion is treated as an expense, while the unused part remains in assets.

By making these adjusting entries at the end of each accounting period, companies can accurately reflect the utilisation of their prepaid insurance and maintain proper financial reporting.

The Financial Nature of Insurance Adjusting: Unraveling the Monetary Side of Claims

You may want to see also

The expired portion is moved to the income statement account

Prepaid insurance is the insurance premium paid by a company in an accounting period that didn't expire in the same accounting period. In other words, it is an expense that has been paid for by the business in advance.

When a company prepays for an expense, it is initially recognised as a prepaid asset on the balance sheet. This is because the expense has been paid upfront, but it is not considered an expense yet in a business's financial records.

As the insurance expense accrues, and the prepaid insurance amount begins to expire, part of the prepaid insurance expense will be gradually moved from the current asset account under the balance to the income statement under the expenses as insurance expense. This is done through an adjusting entry, which is usually done at the end of each accounting period.

The process of moving the expired portion of prepaid insurance to the income statement account is known as amortization. This is done to balance the books of accounts and prevent the need for pointless new business transaction entries.

For example, a company pays $2400 on December 31, 2020, in advance to buy insurance cover for the next year. The journal entry for this will include:

Paid in advance for the insurance cover for next year.

Consequently, at the end of the month of January, when the company wants to record the insurance expense for the month, they will need to divide the amount paid, i.e. $2400, by 12 months, which will give the insurance expense for each month, $200.

Let's say the financial year of the company ends on April 30. To record insurance expenses for 4 months, the company will make the following journal entry:

To account for the insurance expense for the current financial year.

The debit entry to the insurance expense will result in adding the expenses, whereas the credit to the prepaid expense account will result in decreasing the current asset.

By making this journal entry, the company will be able to record the insurance expense that has been incurred already and the part of prepaid insurance that has now expired.

Regulatory Oversight: Georgia's Insurance Adjuster Licensing and Compliance

You may want to see also

Prepaid insurance is charged to expense on a straight-line basis

Prepaid insurance is a fee paid by individuals or businesses to their insurers in advance for insurance services or coverage. It is considered a prepaid expense, which is an expense paid for in advance but not yet incurred. In accounting, prepaid expenses are initially recorded as assets on the balance sheet, but their value is expensed over time onto the income statement.

Prepaid insurance is commonly recorded because insurance providers prefer to bill insurance in advance. If a business were to pay late, it would risk having its insurance coverage terminated. Prepaid insurance is usually charged to expense on a straight-line basis over the term of the related insurance contract. This means that the expense is recognised evenly over the period of coverage.

When a prepaid insurance contract is initially recorded, the journal entry is a debit to the prepaid insurance (asset) account and a credit to the cash (asset) account. As the coverage period progresses, the prepaid insurance is gradually charged to expense. This is done through a journal entry that debits the insurance expense account and credits the prepaid insurance account. The amount charged to expense in each accounting period is only the portion of the prepaid insurance asset assigned to that period.

For example, consider a business that buys one year of general liability insurance in advance for $12,000. The initial journal entry would be a debit of $12,000 to the prepaid insurance (asset) account and a credit of $12,000 to the cash (asset) account. In each of the next twelve months, a journal entry is made that debits the insurance expense account and credits the prepaid expenses (asset) account by $1,000. By the end of the twelve months, the prepaid insurance asset account will have a balance of $0, and the total amount of the insurance expense will be reflected in the income statement.

Adjustable-Term Insurance: Exploring the Renewable Angle

You may want to see also

Frequently asked questions

What is prepaid insurance?

FAQ 2

When a company pays for insurance in advance, the journal entry that must be made to account for the purchase of prepaid insurance is: debit the prepaid insurance account and credit the cash or bank account.

FAQ 3

When a journal entry has to be made for the prepaid insurance to be adjusted for insurance expense, the total amount of the insurance cover is divided equally over the number of months covered as a part of the insurance coverage period stated in the agreement. The journal entry will now affect the current asset section of the balance sheet, as well as the expense section of the income statement. The prepaid insurance account is credited, while the insurance expense account is debited by the same amount.