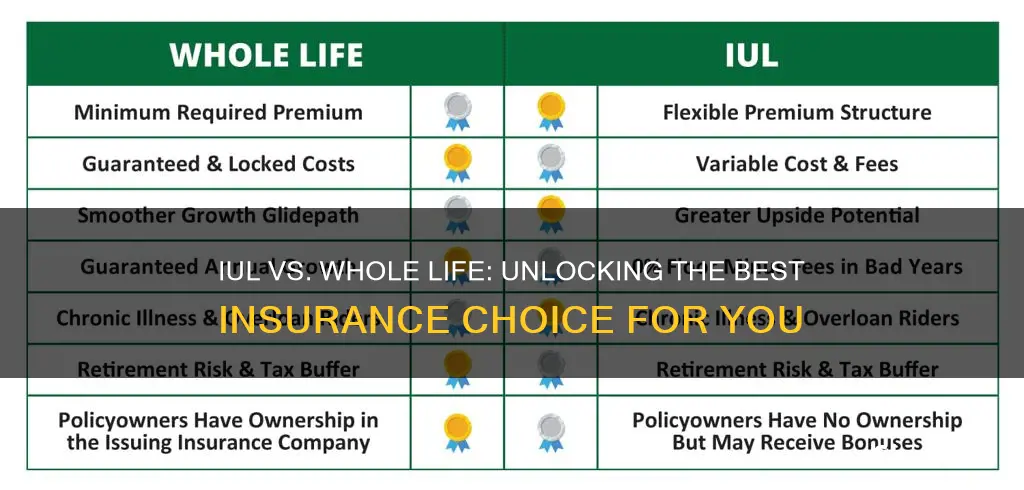

When considering insurance options, the choice between Immediate Annuity (IUL) and Whole Life Insurance can be a significant decision. Both types of policies offer long-term financial security, but they differ in structure, cost, and flexibility. IULs provide a flexible investment component with the potential for higher returns, while Whole Life Insurance offers a fixed death benefit and a guaranteed interest rate. Understanding these differences is crucial for individuals seeking to make an informed decision about their insurance needs and financial goals.

What You'll Learn

- Cost: Compare premiums and fees of IUL and whole life to determine which is more affordable

- Flexibility: IUL offers investment options, while whole life provides fixed premiums and death benefits

- Liquidity: IUL allows policyholders to access cash value, whereas whole life is more permanent

- Tax Advantages: Both offer tax benefits, but IUL's investment growth may be more tax-efficient

- Long-Term Value: Whole life provides guaranteed death benefits, while IUL's value depends on investment performance

Cost: Compare premiums and fees of IUL and whole life to determine which is more affordable

When considering the cost of insurance, it's important to understand the differences between Indexed Universal Life (IUL) and whole life insurance. Both types of policies offer long-term financial protection, but their structures and associated costs vary significantly. This analysis will focus on the cost comparison between IUL and whole life insurance to help you determine which option is more affordable for your needs.

Premiums and Fees:

IUL and whole life insurance policies typically have different premium structures. Whole life insurance offers a fixed premium that remains the same throughout the policy's duration, providing a consistent cost for the insured individual. In contrast, IUL policies often have variable premiums that can fluctuate based on market performance. These variable premiums are tied to an investment account, allowing for potential growth but also introducing more uncertainty. As a result, IUL premiums may vary over time, making it challenging to predict long-term costs accurately.

The fees associated with each policy also differ. Whole life insurance typically includes a fixed death benefit, and the policyholder pays a premium that covers this benefit and other administrative costs. IUL policies, on the other hand, may have additional fees for investment management, policy loans, and withdrawals. These fees can impact the overall cost, especially when considering the potential for market volatility in IUL policies.

Long-Term Cost Analysis:

To determine which policy is more affordable, it's essential to consider the long-term cost implications. Whole life insurance provides a guaranteed death benefit and a fixed premium, ensuring stability in costs over time. This predictability can be advantageous for budgeting and financial planning. In contrast, IUL policies may offer more flexibility in investment choices, but the variable nature of premiums and associated fees can make long-term cost estimation more complex.

Additionally, the investment performance of IUL policies can significantly impact the overall cost. While IUL policies allow for potential growth in the investment account, there is no guarantee of positive returns, and market fluctuations can affect the policy's value. Whole life insurance, with its fixed premiums and death benefit, provides a more stable and predictable cost structure, making it easier to plan for the future.

Comparing the cost of IUL and whole life insurance involves evaluating both the initial premiums and the long-term financial implications. Whole life insurance offers a consistent and predictable cost structure, making it an attractive option for those seeking stability. IUL policies, while providing investment opportunities, may introduce more variability in costs due to market fluctuations and associated fees. When making a decision, it is crucial to consider your financial goals, risk tolerance, and the level of predictability you require in your insurance policy.

ICICI Prudential Life Insurance: Is It Worth the Investment?

You may want to see also

Flexibility: IUL offers investment options, while whole life provides fixed premiums and death benefits

When it comes to choosing between Indexed Universal Life (IUL) and Whole Life Insurance, one of the key factors to consider is flexibility. IUL insurance offers a unique advantage in this regard, providing policyholders with investment options that can be tailored to their financial goals and risk tolerance. This flexibility allows individuals to potentially grow their money over time, as the performance of the underlying investments can directly impact the cash value of the policy. With IUL, you can choose from various investment strategies, such as stocks, bonds, or a combination of both, allowing you to participate in the market's growth while also benefiting from the safety of insurance.

In contrast, Whole Life Insurance provides a more traditional and predictable approach. Once you purchase a whole life policy, your premiums and death benefits are fixed for the entire term of the policy. This means that you can count on a consistent level of coverage without the need for adjustments or additional investments. The fixed nature of whole life insurance provides a sense of security and stability, especially for those who prefer a more straightforward and long-term financial commitment.

The investment aspect of IUL gives policyholders the opportunity to potentially increase their cash value over time. As the market performs well, the value of your policy can grow, providing a potential financial cushion or even allowing for policy loans or withdrawals. This flexibility is particularly appealing to those who want to maximize their money's potential and are willing to take on some market risk. On the other hand, whole life insurance's fixed premiums and benefits offer a guaranteed return, ensuring that your loved ones receive the promised death benefit when the time comes.

It's important to note that the flexibility of IUL comes with certain risks. The investment performance is not guaranteed, and there is a possibility of losing some or all of the invested amount if the market takes a downturn. Whole life insurance, with its fixed nature, provides a more secure and predictable outcome, but it may offer less potential for growth compared to IUL. Ultimately, the decision should be based on an individual's financial situation, risk tolerance, and long-term goals.

In summary, IUL insurance stands out for its flexibility, allowing policyholders to make investment choices that align with their financial strategies. Whole life insurance, on the other hand, provides a stable and predictable financial commitment with fixed premiums and death benefits. Understanding these differences can help individuals make an informed decision when choosing between the two, ensuring they select the option that best suits their unique needs and preferences.

Borrowing from Life Insurance: Genworth's Policy Loan Option

You may want to see also

Liquidity: IUL allows policyholders to access cash value, whereas whole life is more permanent

When considering the liquidity aspect of insurance policies, it's important to understand the differences between Indexed Universal Life (IUL) and Whole Life insurance. Liquidity refers to the ability to access the cash value of the policy, which can be a significant advantage for certain individuals.

Indexed Universal Life insurance offers policyholders a level of liquidity that is not typically found in traditional whole life policies. With IUL, the cash value of the policy can be borrowed against or withdrawn, providing policyholders with a source of funds that can be used for various purposes. This flexibility allows individuals to access their money when needed, whether for emergencies, investments, or other financial goals. For example, if a policyholder needs to cover unexpected medical expenses, they can borrow against the cash value of their IUL policy, ensuring they have the necessary funds without having to surrender the policy or take a loan with potentially higher interest rates.

On the other hand, whole life insurance is designed to provide permanent coverage and has a more structured approach to liquidity. While it does accumulate cash value over time, the policy is typically designed to be a long-term investment, and accessing the cash value may come with certain restrictions. Policyholders may need to pay back any loans or withdrawals with interest, and there might be surrender charges associated with early withdrawals. This means that while whole life insurance does offer some liquidity, it is generally more limited compared to IUL.

The key difference lies in the policy's design and the freedom it provides to the policyholder. IUL's focus on liquidity and accessibility makes it an attractive option for those who prioritize flexibility and the ability to access their funds when needed. In contrast, whole life insurance, with its permanent nature, may be more suitable for individuals who want a consistent and long-term financial commitment, even if it means slightly reduced liquidity.

In summary, when it comes to liquidity, IUL takes the lead by allowing policyholders to access and utilize their cash value more freely. This feature can be particularly beneficial for those who require financial flexibility and want to have control over their funds. Understanding these differences in liquidity can help individuals make informed decisions when choosing between IUL and whole life insurance, ensuring they select the policy that aligns best with their financial needs and goals.

Who Can Claim Life Insurance Check Benefits?

You may want to see also

Tax Advantages: Both offer tax benefits, but IUL's investment growth may be more tax-efficient

When it comes to tax advantages, both Indexed Universal Life (IUL) and Whole Life insurance policies offer certain benefits, but there are some key differences to consider. Firstly, both types of insurance can provide tax-deferred growth, meaning the money accumulated within the policy grows without being taxed until it is withdrawn. This is a significant advantage as it allows the policyholder to build a substantial cash value over time.

However, the tax efficiency of IULs can be more advantageous in certain scenarios. IULs are structured in a way that the policy's cash value is linked to an investment account, often an index-based account. This investment component allows for potential tax-free growth. As the policy's value increases, the growth is not taxed as income, which can be particularly beneficial for long-term wealth accumulation. This feature is especially attractive for those who want to maximize their after-tax returns and potentially minimize the impact of taxes on their investment growth.

In contrast, Whole Life insurance, while offering guaranteed death benefit and cash value accumulation, may be subject to certain tax implications. The cash value of a Whole Life policy grows tax-deferred, similar to IULs. However, when the policyholder takes withdrawals or surrenders the policy, the gains may be taxed as ordinary income. Additionally, if the policy's value exceeds the cost basis (the initial investment amount), any excess growth could be taxed as capital gains, which may be at a lower rate than ordinary income but still a consideration for tax planning.

For those seeking to optimize their tax strategy, IULs can provide a more tax-efficient approach. The investment component of IULs allows for the potential of tax-free growth, which can be a significant advantage over time. This is particularly relevant for individuals who want to maximize their investment returns while minimizing tax liabilities. It's important to note that tax laws can be complex, and consulting with a financial advisor or tax professional is essential to understanding how these policies fit into your overall financial plan.

In summary, while both IUL and Whole Life insurance offer tax advantages, IULs provide a more tax-efficient approach through their investment-linked structure, allowing for potential tax-free growth. This feature can be a compelling reason for individuals to consider IULs as part of their financial strategy, especially when aiming to optimize long-term wealth accumulation and tax planning.

Understanding Post-Purchase Life Insurance: Key Milestones and Timelines

You may want to see also

Long-Term Value: Whole life provides guaranteed death benefits, while IUL's value depends on investment performance

When considering long-term value, whole life insurance stands out as a reliable and consistent option. One of its key advantages is the guaranteed death benefit, which is a fixed amount paid out to the policyholder's beneficiaries upon their passing. This guarantee provides financial security and peace of mind, ensuring that your loved ones receive the intended financial support regardless of market fluctuations. In contrast, Indexed Universal Life (IUL) insurance offers a different approach. Its value is directly tied to the performance of the investments within the policy. While IULs can provide a competitive return on investment, the final payout is not guaranteed and can vary based on market conditions.

Over time, the guaranteed nature of whole life insurance becomes increasingly valuable. As the policyholder ages, the death benefit grows, often at a steady rate, ensuring that the coverage remains adequate for the long term. This is particularly important for those who want to provide financial security for their families or beneficiaries, as it offers a consistent and predictable level of protection. On the other hand, IULs may experience fluctuations in value, and the investment performance can vary, potentially impacting the overall return.

The investment aspect of IULs is a double-edged sword. It allows for potential growth, but it also carries the risk of underperformance. If the investment markets perform poorly, the IUL's value may not grow as expected, and the policyholder might not receive the full death benefit they anticipated. In contrast, whole life insurance offers a more stable and secure approach, making it an attractive choice for those seeking long-term financial planning and peace of mind.

In summary, when evaluating the long-term value of these insurance types, whole life insurance excels due to its guaranteed death benefit. This feature ensures that the policyholder's beneficiaries receive the intended financial support, providing stability and security. While IULs offer investment opportunities, the variability in performance means that the final payout is not assured, making whole life insurance a more reliable choice for long-term financial planning. Understanding these differences is crucial for individuals to make informed decisions about their insurance needs.

Understanding Jackson Life Insurance's Transaction Charges: A Comprehensive Guide

You may want to see also

Frequently asked questions

The primary distinction lies in their investment components. IUL, or Index Universal Life, is a type of permanent life insurance that offers a flexible investment option, typically tied to an index fund or a stock market index. It provides a way to grow your money while also ensuring lifelong coverage. On the other hand, Whole Life Insurance is a more traditional form of permanent life insurance with a fixed death benefit and a guaranteed interest rate on the cash value accumulation.

IUL policies often offer more flexibility in terms of investment choices and potential returns. They may provide a higher rate of return compared to Whole Life, especially during market upswings. However, IUL can be more expensive, with higher fees and commissions. Whole Life Insurance, while offering guaranteed returns, may have lower initial costs and is generally more affordable for long-term coverage.

Yes, Whole Life Insurance provides a guaranteed death benefit, meaning the insurance company will pay out a specified amount upon the insured's death, regardless of market performance. It also offers a fixed premium, which remains the same over the policy's lifetime. Additionally, the cash value in Whole Life builds up faster due to the guaranteed interest rate, providing more immediate financial benefits.