Jackson Life Insurance offers a range of insurance products, and understanding the various charges associated with these policies is essential for policyholders. One such charge is the transaction fee, which can be applied to various activities related to your insurance policy. These charges are typically associated with policy changes, withdrawals, or other transactions that require administrative processing. Knowing the specific details of these transaction fees is crucial for managing your insurance effectively and ensuring you are aware of any associated costs.

What You'll Learn

- Policy Details: Understand coverage, premium, and policy terms

- Charges Breakdown: Identify specific fees for administration, processing, and other services

- Transparency: Ensure clear communication of charges and their purposes

- Comparison: Analyze charges against industry standards and competitors

- Customer Impact: Assess how charges affect overall policy cost and value

Policy Details: Understand coverage, premium, and policy terms

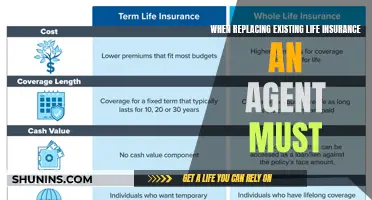

When considering a Jackson Life Insurance policy, it's crucial to delve into the specifics of what's covered and the associated costs. The coverage provided by Jackson Life can vary depending on the type of policy you choose, such as term life, whole life, or universal life. Understanding the coverage options is essential to ensure you select the right plan for your needs. For instance, term life insurance provides coverage for a specified period, while whole life offers lifelong coverage with an investment component. Universal life, on the other hand, provides flexible coverage with the potential for higher returns on your premiums.

The premium is a significant aspect of any insurance policy, and Jackson Life is no exception. Premiums are the regular payments made by the policyholder to maintain the insurance coverage. These payments can vary based on factors such as age, health, lifestyle, and the amount of coverage desired. It's important to carefully review the premium structure to ensure it aligns with your budget and financial goals. Jackson Life may offer different premium payment options, such as annual, semi-annual, or monthly payments, allowing you to choose a plan that suits your financial preferences.

Policy terms are the conditions and duration of your insurance contract. These terms outline the rights and obligations of both the insurance company and the policyholder. Understanding the policy terms is vital to ensure you are aware of any restrictions, exclusions, or conditions that may apply. For instance, some policies may have a waiting period before coverage begins, and others might have specific conditions related to health or lifestyle factors. It's essential to read and comprehend these terms to make an informed decision.

Jackson Life Insurance policies often include various fees and charges, which are important to consider. These charges can include transaction fees, which are typically associated with policy changes, withdrawals, or other administrative actions. Understanding these fees is crucial to managing your policy effectively and ensuring you are not incurring unexpected costs. Additionally, be aware of any surrender charges, which may apply if you decide to terminate the policy early. These charges are designed to compensate the insurance company for the potential loss of future premiums.

In summary, when reviewing Jackson Life Insurance policies, it is imperative to thoroughly examine the coverage options, premium structures, and policy terms. By doing so, you can make an informed decision that aligns with your specific needs and financial goals. Remember, a comprehensive understanding of these policy details will enable you to choose the most suitable insurance plan and ensure a positive long-term relationship with your chosen insurance provider.

Life Insurance for Students: Is Cash Value a Good Option?

You may want to see also

Charges Breakdown: Identify specific fees for administration, processing, and other services

When it comes to Jackson Life Insurance, understanding the various charges associated with their policies is crucial for policyholders. Transaction charges are an essential aspect of insurance, and they can significantly impact the overall cost of your policy. These charges are typically associated with the administration and processing of your insurance policy, ensuring smooth operations and efficient management.

Administration Fees:

Jackson Life Insurance Company incurs administrative costs to manage your policy effectively. These fees cover the expenses related to maintaining policy records, updating customer information, and ensuring compliance with regulatory requirements. The administration charge is often a fixed amount and may vary depending on the complexity of your policy. It is essential to review the policy documents to understand the specific administrative fees applicable to your plan.

Processing Fees:

Processing charges are incurred when there are changes or updates to your policy. This could include requests for policy loans, withdrawals, or any modifications to your coverage. When you initiate such transactions, Jackson Life Insurance may charge a processing fee to cover the administrative work involved. These fees are typically calculated as a percentage of the transaction amount and can vary based on the type of policy and the specific action taken. For instance, a policy loan might attract a processing fee based on the loan amount, while a policy change could have a flat processing fee.

Other Service Fees:

In addition to administration and processing, there may be other service charges associated with your Jackson Life Insurance policy. These fees could include charges for policyholder services, such as providing policy documents, issuing new policies, or handling policy-related inquiries. There might also be fees for additional services like premium financing, which allows you to borrow money to pay for your insurance premiums. It is important to carefully review the policy contract to identify all the potential service fees that may apply to your specific situation.

Understanding these charges is vital for managing your insurance expenses effectively. By knowing the specific fees for administration, processing, and other services, you can make informed decisions regarding your policy. It is recommended to regularly review your policy documents and communicate with Jackson Life Insurance representatives to ensure transparency and clarity regarding any charges you may incur. Being well-informed about these transaction charges will enable you to better manage your insurance policy and its associated costs.

How to Insure Your Girlfriend's Life: All You Need to Know

You may want to see also

Transparency: Ensure clear communication of charges and their purposes

Jackson Life Insurance Company, like many other insurance providers, charges various fees and expenses associated with their policies. These charges are essential to understand as they directly impact the overall cost of your insurance coverage. When considering a life insurance policy from Jackson, it is crucial to be transparent and provide clear communication regarding these charges to ensure a fair and informed decision-making process.

One of the primary transaction charges is the initial policy fee, which covers the administrative costs associated with setting up your insurance contract. This fee is typically a one-time payment and is an essential part of the underwriting process. It ensures that the insurance company can process your application, verify your information, and issue the policy. Understanding this charge is vital as it forms the foundation of your insurance coverage.

In addition to the initial fee, Jackson Life Insurance may charge ongoing policy maintenance fees. These charges are incurred periodically, such as annually or semi-annually, and are used to cover the costs of maintaining and managing your policy. This includes administrative tasks, policy updates, and ensuring that your coverage remains active and up-to-date. It is the insurance company's responsibility to provide clear communication about these recurring charges and their frequency to policyholders.

Another critical aspect of transparency is explaining the purpose of these charges. For instance, a portion of the policy fees might go towards the insurance company's operational expenses, including salaries, rent, and marketing. Some charges could also contribute to the reserves required to pay out future claims and ensure the financial stability of the company. By providing detailed explanations, Jackson Life Insurance demonstrates its commitment to transparency, allowing policyholders to understand how their premiums are utilized.

Furthermore, it is essential for Jackson to provide clear and accessible information about any additional charges or fees associated with specific policy features or add-ons. For example, if you opt for additional riders or benefits, there might be extra transaction charges. Transparency in this area ensures that policyholders are aware of all potential costs and can make informed choices based on their specific needs and financial situations.

Becoming a Life Insurance Agent in Alberta: A Guide

You may want to see also

Comparison: Analyze charges against industry standards and competitors

The term "transaction charges" in the context of Jackson Life Insurance likely refers to various fees and costs associated with purchasing, owning, or servicing an insurance policy. These charges are an essential aspect of understanding the overall cost structure of an insurance product. When comparing Jackson Life Insurance's transaction charges to industry standards and competitors, several key factors come into play.

Firstly, it's crucial to research and understand the typical fees associated with life insurance policies in the industry. These industry standards often include initial application fees, policy administration fees, and rider fees for additional coverage options. For instance, standard industry practice might involve a flat rate for an initial application, a percentage of the policy's value for administration, and a per-rider fee for each additional benefit. By comparing these standard charges to Jackson Life Insurance's offerings, you can identify any deviations or unique pricing structures.

Secondly, analyzing competitors' pricing is vital. Different insurance providers may have varying fee structures, and understanding these variations can provide context for Jackson Life Insurance's charges. For example, some competitors might offer lower initial application fees but higher policy administration costs, while others may have unique rider pricing models. By studying these competitor strategies, you can assess whether Jackson Life Insurance's transaction charges are competitive, higher, or lower than the market average.

A detailed comparison should also consider the frequency and timing of these charges. Are the transaction charges one-time fees incurred at the policy's inception, or are they recurring annual or periodic fees? Understanding the timing and nature of these charges is essential for policyholders to manage their finances effectively. For instance, a one-time application fee might be more appealing to customers who prefer a straightforward, upfront cost, while recurring fees could be more manageable if they are lower and predictable.

Additionally, transparency in communication is key. Insurance companies should provide clear and detailed breakdowns of transaction charges, ensuring that policyholders understand the costs associated with their policies. This transparency allows for informed decision-making and enables customers to compare charges across different providers. When analyzing Jackson Life Insurance's practices, it is beneficial to assess their level of transparency and whether they provide comprehensive fee disclosures.

In summary, comparing transaction charges on Jackson Life Insurance policies against industry standards and competitors involves a thorough examination of typical fees, competitor pricing strategies, timing of charges, and transparency in communication. By conducting this analysis, customers can make informed choices, ensuring they understand the costs associated with their insurance policies and how they compare to the market. This comparison is a critical step in evaluating the overall value and competitiveness of Jackson Life Insurance's offerings.

Maximizing Life Insurance: Finding the Perfect Coverage

You may want to see also

Customer Impact: Assess how charges affect overall policy cost and value

When considering Jackson Life Insurance policies, understanding the impact of transaction charges is crucial for customers to make informed decisions. These charges, often referred to as 'processing fees' or 'administration costs', are incurred by the insurance company for managing and processing policy-related transactions. Here's an assessment of how these charges can affect the overall policy cost and value for customers:

Policy Cost: Transaction charges can significantly contribute to the overall cost of a life insurance policy. These fees are typically added to the premium, which is the amount paid regularly to maintain the policy. Over time, the accumulation of transaction charges can result in a substantial increase in the total policy cost. For instance, if a policyholder pays a monthly premium, the transaction charges might be a percentage of that premium, and these charges can add up over the policy's duration. This means that customers might pay more than they initially expected, impacting their financial planning and budgeting.

Value for Money: The value of a life insurance policy is often determined by the coverage amount and the policy's ability to provide financial security to the beneficiary. However, transaction charges can indirectly affect the perceived value. Higher transaction costs might lead to lower overall policy benefits, as a larger portion of the premium goes towards these fees. Customers should consider whether the additional charges justify the increased cost, especially if they are already paying higher premiums for the same coverage. A thorough understanding of these charges can help customers make a more informed decision about the policy's overall value.

Long-Term Impact: Transaction charges can have a more pronounced effect over the long term. Life insurance policies are often taken for extended periods, sometimes lasting for decades. As these charges accumulate over time, they can significantly impact the policy's overall cost. For example, a customer purchasing a 30-year term life insurance policy might face higher transaction costs, which could result in a more expensive policy by the time it matures. This long-term impact should be carefully considered, especially for those planning for the future or seeking long-term financial security.

Transparency and Communication: It is essential for insurance companies to provide transparent information about transaction charges. Customers should be made aware of these fees and their potential impact on the policy. Clear communication regarding the breakdown of costs, including transaction charges, ensures that customers can make well-informed choices. By understanding these charges, customers can assess whether the additional costs align with their expectations and the value they receive from the policy.

In summary, transaction charges on Jackson Life Insurance policies can have a direct and significant impact on the overall cost and value for customers. These charges influence the premium, the policy's long-term cost, and the perceived value of the coverage. Customers should be well-informed about these fees to make decisions that align with their financial goals and expectations. Assessing the impact of transaction charges is a critical step in evaluating the overall policy and ensuring a positive customer experience.

Understanding International Life Insurance: A Comprehensive Guide

You may want to see also

Frequently asked questions

Transaction charges, also known as policy fees or administrative costs, are additional fees levied by insurance companies for various services and processes. In the context of Jackson Life Insurance, these charges can include policy issuance fees, surrender fees, and other administrative expenses. These fees are typically a percentage of the policy's value and are designed to cover the costs associated with processing and managing the policy.

The calculation of transaction charges varies depending on the specific policy and insurance company. Jackson Life Insurance may use a formula that considers factors such as the policyholder's age, the policy's term, and the amount of coverage. Generally, younger policyholders with longer policy terms might face lower charges, while older individuals or those with shorter terms may incur higher fees.

In some cases, transaction charges can be negotiated or waived, especially for high-value policies or long-term commitments. Jackson Life Insurance may offer discounts or waive certain fees for policyholders who meet specific criteria, such as maintaining a high level of coverage or being a long-term customer. It's best to review the policy documents or consult with a representative to understand the potential for negotiating these charges.

Yes, transaction charges can significantly impact the total cost of a Jackson Life Insurance policy. These fees are often deducted from the policy's death benefit or added to the premium payments. Over the policy's lifetime, these charges can accumulate and affect the overall value received by the policyholder or beneficiary. It's essential to carefully consider these costs when evaluating different insurance options.