Dealing with insurance companies can be a stressful experience. While insurance adjusters are meant to assess your claim in good faith, they are employed by the insurance company and are therefore incentivized to settle your claim as quickly and cheaply as possible. This means that it is not uncommon for insurance adjusters to undervalue or wrongfully deny claims.

If you receive an unsatisfactory settlement offer from an insurance adjuster, you do not have to accept their determination of liability. Instead, you can dispute the outcome of your claim. The first step is to contact an attorney, who will be able to advise you on whether you are entitled to additional compensation. If you are, your lawyer can communicate with your insurance adjuster directly and work to reverse or modify their determination before any formal steps are taken.

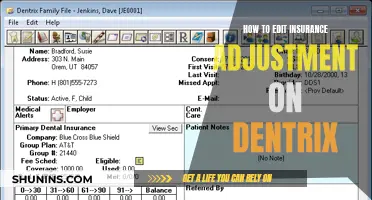

| Characteristics | Values |

|---|---|

| How long does it take for an insurance adjuster to respond? | Typically, an insurance adjuster must complete an initial review and send a response within 30 days. |

| How long does it take to receive a settlement? | It can take anywhere from 7-8 days to more than 30 days to reach a settlement. |

| What to do if you disagree with the insurance adjuster's decision? | You can dispute the outcome of your claim by contacting an attorney, reviewing your insurance policy, gathering relevant records and medical documents, and providing any necessary additional information. |

| How to prevent delays when filing an insurance claim | Provide as much information as possible, including photos, details of the accident, and relevant laws in your state. Be proactive and reach out to the insurance company for updates. |

What You'll Learn

Insurance adjusters work for insurance companies, not the claimant

When you file an insurance claim, you will most likely be dealing with an insurance adjuster, whose role is to review what happened and estimate the claims payment. However, it is important to remember that insurance adjusters work for the insurance company paying the claim, not the claimant. Their job is to settle claims on behalf of the insurance company, always serving the company's best interests and bottom line.

Insurance adjusters are employed and paid by insurance companies, and they may be kept on the payroll in-house or hired from an outside agency. They are tasked with evaluating insurance claims to determine the insurance company's liability under the terms of the owner's policy. They will assess the damages, look into the details of the incident, speak with the claimant and witnesses, and peruse accident records to determine how much the insurance company should pay.

While insurance adjusters may appear friendly and professional, they are not objective parties. They are biased towards the insurance company that employs them and will use various tactics to try to reduce the settlement amount. For example, they may try to get you to admit fault in the accident, delay the process to frustrate you, or avoid communication to cause frustration. They may also use your medical records against you or try to record your statements to use against your claim.

If you disagree with an insurance adjuster's decision or settlement offer, you can dispute the outcome of your claim. Contacting an attorney who can communicate with the insurance adjuster and work to reverse or modify their determination is often the best course of action.

The Intriguing World of Insurance Adjusters: Unraveling Their Earnings and More

You may want to see also

Adjusters are incentivised to delay and minimise payouts

Adjusters work for insurance companies, not for the people making claims. Their job is to save the insurance company money, and they are incentivised to reduce or minimise payouts. They do this by using tactics to trick claimants into taking lower settlement amounts than they deserve.

Adjusters are trained to sound friendly and approachable. They want claimants to open up to them and tell them more than they need to, so that they can use this information against the claimant. They will ask questions that seem innocent but are designed to get the claimant to admit partial fault for the incident, or to get them to say something that can be used to delegitimise their claim.

Adjusters will often delay the process, hoping that the claimant will get frustrated and accept a lowball offer. They may do this by failing to respond, or by requesting additional, unnecessary information. They may also delay payment, knowing that the claimant is in a precarious financial position and hoping that they will accept a meagre settlement.

Adjusters will also try to avoid communication altogether, hoping that the statute of limitations will run out and the claimant will be unable to recover through the claims process or a lawsuit.

In addition, adjusters will often undervalue repairs and wrongfully deny benefits. They may also ask the claimant to sign a blanket medical authorisation, giving the insurance company the right to collect the claimant's private medical information. The insurance company can then use this information against the claimant to reduce their overall settlement.

It is important to remember that adjusters are not your friend, and they are not there to help you. If you are making a claim, it is best to consult a lawyer who can help you navigate the process and ensure that you receive a fair settlement.

Marketing Strategies for Insurance Adjusters: Navigating the Self-Promotion Landscape

You may want to see also

Claimants can dispute an adjuster's decision

If you disagree with an insurance adjuster's decision, you do not have to accept their determination of liability. Instead, you can – and should – dispute the outcome of your claim. The adjuster's word is not final, and you have the legal right to dispute their opinion or evaluation of your claim.

- Understand your rights: It is important to know that insurance adjusters work for the insurance company, not for you. They will not have your best interests in mind, and their goal is to settle your claim as quickly and cheaply as possible.

- Review your policy and the adjuster's letter: Make sure you are filing a claim within your coverage limits. Double-check the letter from the insurance adjuster to fully understand the reason behind their decision and whether it aligns with your policy.

- Collect evidence and documentation: Keep all documentation related to your claim, including letters, emails, and other communications. Gather as much evidence as you can to support your case, such as photographs, medical records, and other relevant information.

- Ask the adjuster to reconsider: Speak to the claims adjuster directly and ask for their reasoning. It may be a simple misunderstanding that can be cleared up. Provide any additional information or supporting documents to strengthen your case.

- Request an internal review: If speaking with the adjuster does not resolve the issue, you can write a letter to the insurance company requesting an internal review of your claim. They are legally required to grant you this right, and they will assign someone to review the facts of your case and determine if the adjuster made a mistake.

- File a complaint: If the internal review does not reverse the adjuster's decision, you can file an official complaint against the insurance company. In the US, this complaint is typically filed with the state's department of insurance. An unbiased representative will review your case and help resolve the matter.

- Contact a lawyer: Consider seeking legal assistance, especially if you suspect insurance bad faith or if your dispute remains unresolved. A lawyer can help you understand your rights, navigate the appeals process, and determine if you have grounds for legal action.

While it is difficult to determine how often insurance adjusters reverse their decisions, disputing their determination is a valid option for claimants who believe they are not receiving fair compensation. It is important to act promptly and be persistent in pursuing your dispute.

The Art of Adjustment: Navigating the Fine Line of Insurance Claims

You may want to see also

Claimants should contact a lawyer to review their case

Secondly, insurance adjusters are trained to use various tactics to reduce the value of a claim or deny it altogether. For example, they may delay responding to a claim, fail to communicate, ask leading questions to shift the blame to the claimant, use the claimant's statements against them, or offer low settlement amounts. A lawyer can help claimants navigate these tricky situations and ensure their rights are protected.

Thirdly, a lawyer can provide objective legal advice and guidance to claimants. They can review the claimant's situation, evidence, and insurance policy to determine if they have a valid case and if the insurance company is acting in good faith. Lawyers can also communicate and negotiate with the insurance company on the claimant's behalf, helping to strengthen their claim and maximise their compensation.

Finally, claimants may need a lawyer to take legal action against the insurance company if they feel their claim has been unfairly denied or handled improperly. Lawyers can explain the legal options available, including bad faith tort lawsuits and unfair trade practices lawsuits. They can also represent claimants in court and help them navigate the complex legal process.

In conclusion, claimants should contact a lawyer to review their case to ensure they receive fair compensation, protect their legal rights, and navigate the complex insurance claims process.

Providing a Recorded Statement to the Insurance Adjuster: What You Need to Know

You may want to see also

Claimants can request an internal review and file a complaint if needed

If claimants disagree with an insurance adjuster's decision, they can dispute the outcome of their claim. The first step is to contact an attorney who will review the available evidence and insurance policy. The attorney will then advise on whether the claimant is entitled to additional compensation. If so, the attorney can communicate with the insurance adjuster directly and work to reverse or modify their decision before any formal steps are taken.

If some time has passed since the insurance adjuster's decision, claimants should still contact an attorney, who will assess what options are available. This could involve the attorney communicating directly with the adjuster, or taking other action based on the current status of the claim. Depending on the circumstances, this could involve hiring an independent appraiser to dispute the adjuster's determination or taking legal action against the insurance company.

There are deadlines for seeking insurance coverage after an incident, so it is important not to wait too long. To give themselves the best chance of recovering losses, claimants should contact a lawyer right away.

In addition to contacting a lawyer, claimants can take other steps such as reviewing their insurance policy, gathering all records pertaining to their claim, and collecting their medical records.

If claimants are unhappy with the outcome of their claim, they can request an internal review and file a complaint if needed. They should review the language and fine print of their insurance policy to ensure they are filing a claim within their coverage limits. They should also carefully read any letters from the insurance claims adjuster and understand the reasons for the decision. It is important to thoroughly document the claim and gather as much evidence and information as possible.

Claimants can then ask the adjuster to reconsider and provide their reasoning. If this does not resolve the issue, claimants can write to the insurance company requesting an internal review. If the internal review does not reverse the adjuster's decision, claimants can file an official complaint.

Strategies for Acing the Insurance Adjuster Exam: A Comprehensive Guide

You may want to see also

Frequently asked questions

If you disagree with your insurance adjuster's decision, you can dispute their outcome. Contact an attorney to review the available evidence and your insurance policy. They can advise you on whether you are entitled to additional compensation and communicate with your insurance adjuster directly to work on reversing or modifying their decision.

To speed up your insurance claim, provide as much information as possible, including photos of any damage, a description of what happened, and when and where the incident took place. Research the laws in your state and be proactive by reaching out to your insurance company for updates.

If your insurance company is taking a long time to process your claim, you can take matters into your own hands. Reach out to the adjuster overseeing your claim and ask for an update. Keep a log of every conversation you have with the insurer, including the date and next steps. Respond to requests and complete any necessary paperwork as soon as possible.