An insurance adjuster report is a crucial element of the insurance claim process. An insurance adjuster, also known as a claims adjuster, is a person professionally trained to assess the damage to your property. They are responsible for assessing the extent of a loss, conducting investigations, and making informed recommendations regarding claim settlements. The adjuster's report includes key components such as claimant information, claim details, witness statements, policy information, loss evaluation, cause of loss, documentation, interview summaries, coverage determination, liability assessment, estimates and valuations, recommendations, and legal opinions. This report aids in the claim settlement process and holds legal significance, playing a pivotal role in ensuring fair and just compensation for policyholders.

| Characteristics | Values |

|---|---|

| Purpose | To determine if the insurer should pay for damage or injuries, and if so, how much they should pay |

| Created by | An insurance adjuster |

| Created for | The policyholder or claimant |

| Includes | Claimant information, claim details, witness statements, policy information, loss evaluation, cause of loss, documentation, interview summaries, coverage determination, liability assessment, estimates and valuations, recommendations, legal opinions, witness affidavits |

| Legal significance | Can be used as evidence in court, in insurance-related legal proceedings, and in alternative dispute resolution processes |

| Objectivity | Insurance adjusters are expected to be independent and objective in their assessments |

What You'll Learn

The role of an insurance adjuster

An insurance adjuster, also known as a claims adjuster, is a person professionally trained to assess damage to property and determine whether the insurer should pay for the damage or injuries, and if so, how much. They are responsible for reviewing the insurance policy, assessing the damage, investigating the incident, and making informed recommendations regarding claim settlements. Here is a detailed overview of the role of an insurance adjuster:

Claim Assessment

Insurance adjusters review insurance claims to determine the nature and extent of the loss or damage. They assess whether the damage is covered under the policy and evaluate the applicable coverage limits and exclusions.

Investigation

Adjusters investigate the circumstances surrounding the loss. This may include examining the scene, interviewing witnesses, reviewing documents, and collecting evidence such as photographs or video footage. They may also review police reports or other relevant information related to the incident.

Loss Valuation

They estimate the value of the loss, including property damage, injuries, medical expenses, and other covered costs. This involves quantifying the financial impact of the incident and determining the appropriate compensation amount.

Negotiation

Insurance adjusters negotiate with claimants and their legal representatives to reach a settlement. They discuss the options available to the claimant, such as repairs or financial compensation, and work towards resolving the claim fairly for all parties involved.

Documentation

Adjusters document their findings in a comprehensive report known as the adjuster's report. This report serves as a detailed record of the claim evaluation process and plays a crucial role in claim settlement, evidence in court, insurance litigation, and dispute resolution processes.

Independence and Objectivity

Insurance adjusters are expected to maintain independence and objectivity in their assessments. Their primary duty is to evaluate claims impartially, ensuring that policyholders receive the benefits they are entitled to without any undue influence or bias towards the insurance company.

In summary, the role of an insurance adjuster is to thoroughly investigate and evaluate insurance claims, determine the extent of damage or loss, review policies and coverages, estimate repair or replacement costs, negotiate with claimants, and provide informed recommendations for claim settlements. Their work is essential in ensuring fair and just compensation for policyholders while maintaining the integrity of the insurance industry.

Unraveling the Complexities of Pain and Suffering Calculations in Insurance Adjustments

You may want to see also

Claim assessment

- Claim Details and Loss Evaluation: Adjusters carefully examine and document the specifics of the incident or loss that led to the insurance claim. This includes assessing the date, time, location, and cause of the loss, such as an accident or natural disaster. They also evaluate the extent of the loss, including property damage, injuries, or other covered losses.

- Policy Review: Insurance adjusters scrutinise the insurance policy in question to identify the relevant coverages, limitations, and exclusions that apply to the specific claim. This ensures that the claim falls within the scope of the policy's terms and conditions.

- Loss Valuation and Estimates: They estimate the monetary value of the loss, taking into account property damage, injuries, medical expenses, and other applicable costs. This involves obtaining repair estimates, assessing fair market pricing for materials and labour, and considering any depreciation in value.

- Negotiation and Settlement: Adjusters negotiate with claimants and their legal representatives to reach a fair settlement. They make informed recommendations regarding the settlement amount and may propose a specific payment figure.

- Documentation and Reporting: Throughout the claim assessment process, adjusters document their findings and conclusions comprehensively. This documentation serves as a detailed record of the claim evaluation process and is crucial for claim settlement, dispute resolution, and legal proceedings.

The claim assessment phase is pivotal in ensuring that policyholders receive appropriate and just compensation for their covered losses. Adjusters are expected to maintain independence and objectivity in their evaluations, prioritising the interests of the policyholders while upholding the integrity of the insurance industry.

Understanding Contractual Adjustments: Unraveling the Complexities of Insurance Reimbursements

You may want to see also

Investigation

An insurance adjuster, also known as a claims adjuster, is a person who investigates an insurance claim to determine if the insurer should pay for damage or injuries, and if so, how much they should pay. They are professionals employed by insurance companies or hired as independent experts.

The investigation is a crucial part of the insurance claim process and involves the following steps:

Incident Overview

The investigator will begin by compiling a short summary of the event, including the claimant data, type, date, time, location, and brief description of the claim.

Claimant Interview/Statement

The claimant will be given an opportunity to make a statement, either verbally or in writing. This statement might be recorded and entered into the investigation report. The investigator will ask a series of questions to understand the context of the incident, such as "who, what, where, why," and follow up with more probing questions to gather as much detail as possible.

Documentary Evidence

The investigator will request and scrutinize documentary evidence related to the claim. This may include police reports, receipts, invoices, shipping records, titles, bills of sale, deeds, appraisals, diagrams, proof of ownership, and photographs or video records.

Physical Evidence

Physical evidence such as fingerprints, damaged property, DNA, and computer hard drives will also be considered and inspected for any signs of fabrication or illicit substitution.

Witness Statements

Witness statements are considered critical to the investigation process. The investigator will interview people who may have witnessed the incident and compare their statements against the claimant's statement and other evidence collected. Any discrepancies may lead to further probing and the need for substantiating evidence.

Site Inspection

In some cases, the adjuster may visit the scene of the accident or incident to inspect and document the damage. They will take photographs or videos of the site, including any property damage, and may also interview people in the vicinity who may have witnessed the incident.

Review of Official Records

The adjuster will request and review official records related to the incident. This may include police reports, accident reports filed with relevant authorities, medical records, and repair or replacement estimates from construction contractors.

Policy Review

The adjuster will review the insurance policy to determine the coverage, limitations, and exclusions that apply to the claim. They will assess whether the loss is covered under the policy and any applicable coverage limits.

Loss Valuation

The adjuster will estimate the value of the loss, including property damage, injuries, medical expenses, and other covered costs. They will put a value on the claim and negotiate a settlement with the claimant.

Documentation

Throughout the investigation process, the adjuster will document their findings and conclusions. This documentation serves as a comprehensive record of the claim evaluation process and can be used as evidence in court or other legal proceedings if disputes arise.

It is important to note that insurance adjusters are expected to maintain independence and objectivity in their assessments. Their primary duty is to evaluate claims fairly and impartially, ensuring that policyholders receive the benefits they are entitled to without any undue influence or bias towards the insurance company.

Understanding the Intricacies of Prepaid Insurance and M-1 Adjustments

You may want to see also

Policy review

An insurance adjuster, also known as a claims adjuster, is a person professionally trained to assess and investigate insurance claims. They determine whether the insurer should pay for damage or injuries, and if so, how much they should pay.

The role of a policy review in an insurance adjuster's report is to assess the insurance policy and determine the coverage, limitations, and exclusions that may apply to the claim. This involves reviewing the policy details to identify the relevant coverages that may apply to the specific claim being made. For example, in the case of a car accident, the adjuster will verify if the claimant has the applicable coverages for vehicle damage.

The policy review process also helps identify any applicable coverage limits or exclusions that could impact the settlement. For instance, in the context of a homeowner's insurance policy, there may be specific exclusions or limitations on certain types of property damage, such as flood damage.

By conducting a thorough policy review, the insurance adjuster can make informed recommendations regarding claim settlements. They can determine whether the loss is covered under the policy and advise on any applicable coverage restrictions. This ensures that policyholders receive fair and just compensation for their covered losses while also upholding the principles of independence and objectivity in the assessment process.

Understanding the Role of Public Adjusters in Insurance Claims

You may want to see also

Loss valuation

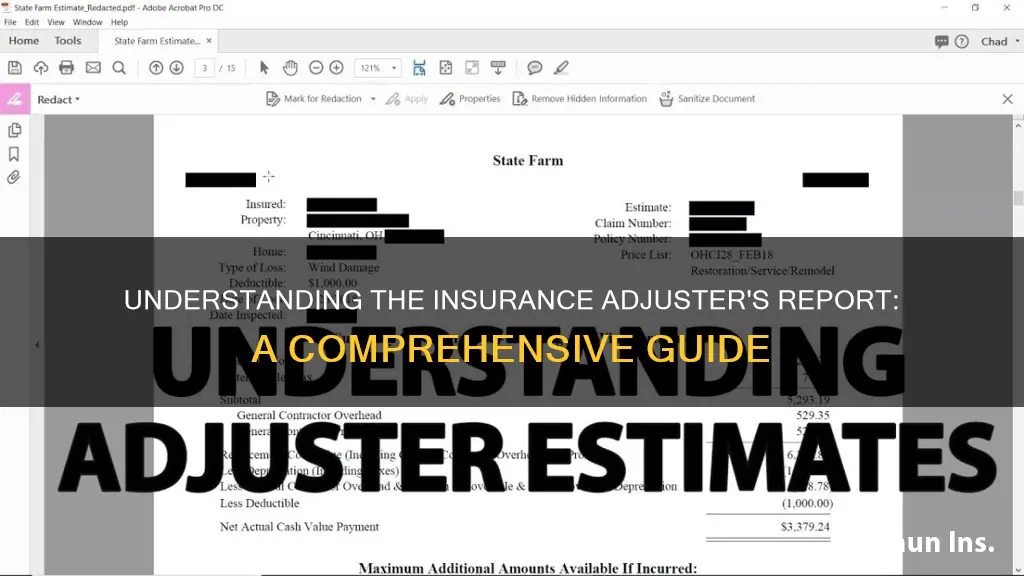

In the context of property insurance, the adjuster's report will include an assessment of the damage to the property and an estimation of the financial value of this damage. This valuation takes into account repair costs, depreciation, market values, and policy coverage. For instance, if your home has been damaged by a fire, the insurance adjuster will estimate the cost of rebuilding your house. This estimate will factor in the cost of materials and labour, with software like Xactware being used to determine fair market pricing.

When it comes to vehicle insurance, the adjuster determines the value of your car by considering factors such as the make, model, year, pre-loss condition, mileage, and the sales value of similar cars in your region. This valuation helps decide whether the insurer should opt to repair or replace your car. If the repairs are more than 70% of the actual cash value (ACV) of the car, it will likely be declared a total loss. The ACV is the fair market value of your car at the current rate, considering its pre-accident condition.

It's important to note that insurance adjusters are expected to be independent and objective in their assessments. They have a duty to evaluate claims fairly and impartially, ensuring policyholders receive their entitled benefits. However, as they are usually appointed by the insurance company, there may be a natural inclination to work in the company's best interests. If you believe the adjuster's valuation is inaccurate or unfair, you have the right to challenge their report and provide additional evidence or seek a second opinion.

Launching Your Insurance Adjusting Office: A Comprehensive Guide

You may want to see also

Frequently asked questions

An insurance adjuster report is a document created by an insurance adjuster, who is responsible for assessing the extent of a loss, conducting investigations, and making informed recommendations regarding claim settlements. It is a crucial element of the insurance claim process and plays a significant role in the resolution of claims, disputes, and the determination of compensation for policyholders.

An insurance adjuster, also known as a claims adjuster, is a person who investigates an insurance claim to determine if the insurer should pay for damage or injuries, and if so, how much they should pay. They assess many types of claims, including those resulting from car accidents.

An adjuster's report typically includes the following key components:

- Claimant Information: Details about the policyholder or claimant, including their contact information and policy number.

- Claim Details: A description of the loss or incident that led to the claim, including the date, time, and location.

- Witness Statements: If applicable, statements from witnesses to the incident.

- Policy Information: A summary of the relevant insurance policy's terms and conditions.

- Loss Evaluation: An assessment of the extent of the loss, including property damage, injuries, or other losses covered by the policy.