Are you interested in becoming an insurance adjuster in New Jersey? If so, you're in luck! New Jersey is one of the few states that don't require a license to work as an insurance adjuster. This means you can start working as an adjuster without any special licensing or certification.

However, there are some important things to consider if you're serious about a career as an insurance adjuster. First, most insurance companies prefer to hire individuals with training or experience. One way to gain the necessary training is to take a designated home state (DHS) license course in another state like Florida or Texas. This type of license allows residents of a non-licensing state like New Jersey to designate another state as their home state and obtain a license to work in that state.

Obtaining a DHS license can increase your employment opportunities and income potential as an adjuster. It also enables you to apply for reciprocal licensing privileges, allowing you to work in multiple states. Additionally, learning Xactimate, the top claims adjustment software, can give you a competitive edge when applying for jobs.

So, while you can technically start working as an insurance adjuster in New Jersey without a license, pursuing a DHS license and gaining relevant experience can significantly enhance your career prospects in this exciting field.

| Characteristics | Values |

|---|---|

| Licensing | New Jersey does not require insurance adjusters to be licensed. |

| Most insurance adjusters obtain a Designated Home State (DHS) license from another state, such as Florida or Texas. | |

| Public adjusters in New Jersey are required to obtain a license. | |

| Training | Training or experience is preferred by employers. |

| Training courses are available from various providers. | |

| Xactimate is the most commonly used claims adjustment software. |

What You'll Learn

- New Jersey doesn't require a license to work as an insurance adjuster

- However, most employers prefer licensed adjusters, so consider getting a Designated Home State (DHS) license

- A DHS license allows you to declare a licensing state as your home state

- The Florida DHS license is a popular choice due to its quick application process and reciprocity

- You can also consider the Texas DHS license, which is also well-regarded

New Jersey doesn't require a license to work as an insurance adjuster

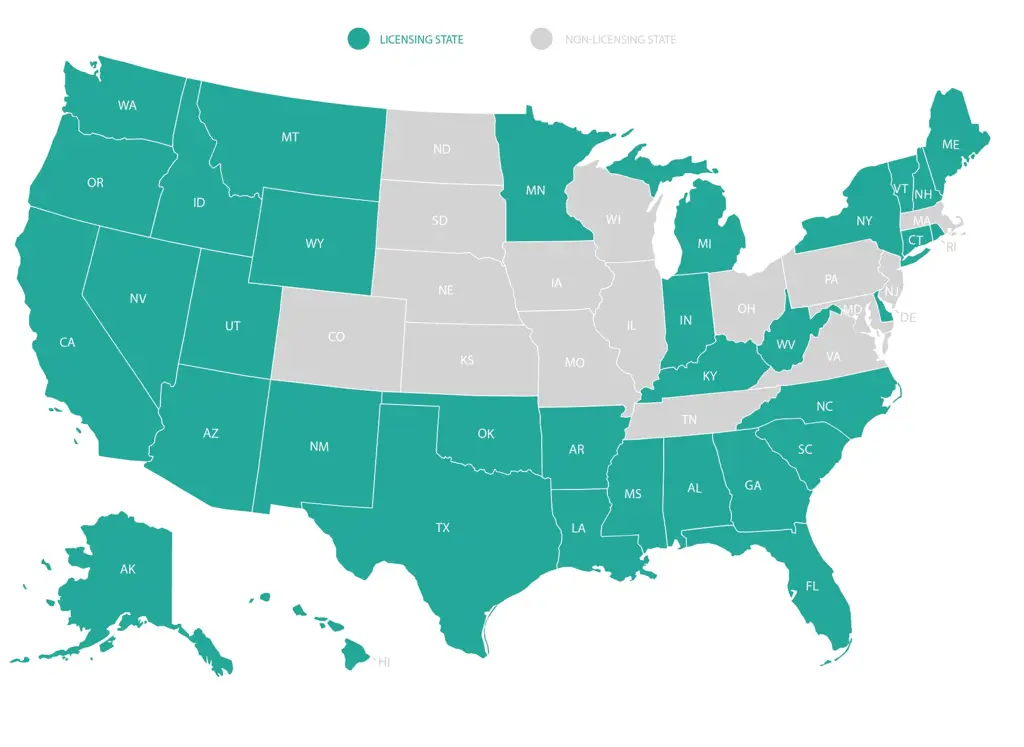

New Jersey is one of 16 states that do not require insurance adjusters to be licensed. This means you can legally adjust claims in your state without a license, but only in your state. However, being unlicensed presents some challenges if you're serious about a career as an adjuster. Many employers will only deploy licensed adjusters, as they have clients all over the country and need adjusters who can work wherever there is a need.

If you want to work as an insurance adjuster in New Jersey, you have two options:

- Obtain a Designated Home State (DHS) license from another state.

- Work without a license.

Option 1: Obtain a Designated Home State (DHS) license

A DHS license allows you to declare a licensing state as your home state. You will go through that state's licensing process, testing, and compliance regulations, and their license will act as your resident or home state license. Once you hold a DHS license, you can use it to get reciprocal license privileges, which will make you more employable and allow you to adjust claims in other states.

The most popular states to obtain a DHS license from are Florida, Texas, and Indiana. Florida is often recommended because it has great reciprocity, the quickest application process, and a relatively short insurance adjuster exam. The process involves completing a 40-hour pre-licensing course and passing the included exam.

Option 2: Work without a license

While it is possible to work as an insurance adjuster in New Jersey without a license, it is not recommended. Operating without a license can significantly limit your earnings and employment opportunities as an adjuster. Most employers prefer to hire licensed adjusters, and you will need a license to work outside of New Jersey.

Bottom Line

If you wish to work in insurance claims in New Jersey, it is best to obtain a designated home state license from another state, such as Florida or Texas. This will give you the flexibility to work in multiple states and increase your earnings potential.

Navigating the Path to Becoming an Insurance Adjuster in Texas

You may want to see also

However, most employers prefer licensed adjusters, so consider getting a Designated Home State (DHS) license

Although New Jersey does not require insurance adjusters to be licensed, most employers prefer licensed adjusters. This is because licensed adjusters can work across the country, wherever there is a need. Therefore, if you are an aspiring insurance adjuster in New Jersey, you should consider getting a Designated Home State (DHS) license.

A DHS license allows you to declare a licensing state as your home state. You will go through that state's licensing process, testing, and compliance regulations, and their license will act as your resident or home state license. This means that you can obtain a license in a state that doesn't require licensing, such as New Jersey.

There are several states that offer DHS licenses, including Florida, Texas, and Indiana. However, Florida and Texas are the most popular choices. This is because they offer the convenience of online pre-licensing courses and state exams, or exam exemptions. Additionally, a Florida DHS adjuster license has great reciprocity, a quick application process, and a relatively short insurance adjuster exam. Obtaining a Florida DHS license will also exempt you from having to do fingerprinting for other states that require it.

Once you have your DHS license, you can apply for reciprocal licenses, which will allow you to work in more states and make you more attractive to potential employers.

The Complex Role of Insurance Adjusters: Navigating Third-Party Claims

You may want to see also

A DHS license allows you to declare a licensing state as your home state

A Designated Home State (DHS) license is a type of license that allows people who live in a state that does not require licensing—such as New Jersey—to "designate" a different state as their "home state". This allows them to apply for and obtain a license in the designated state as if they were a resident of that state.

In the context of insurance adjusting, a DHS license is particularly relevant for residents of non-licensing states who want to work as insurance adjusters. Since most employers prefer licensed adjusters, obtaining a DHS license can enhance an individual's employability and career prospects in the insurance industry.

To obtain a DHS license, individuals typically need to complete a pre-licensing course and pass a state exam. The specific requirements may vary depending on the designated state. It is important to note that not all states offer DHS licenses, and individuals should check the licensing regulations in their desired designated state.

Once an individual obtains a DHS license, they can use it to seek reciprocal licensing privileges, which further expands their employment opportunities in the insurance industry.

Texas Twister: Insurance Adjusters and the Lone Star State's Unique Claims Landscape

You may want to see also

The Florida DHS license is a popular choice due to its quick application process and reciprocity

The Florida DHS license is a popular choice for insurance adjusters due to its quick application process and reciprocity. Here's a detailed overview:

A Designated Home State (DHS) license is designed for individuals who reside in states that do not license insurance adjusters. It allows them to designate a licensing state as their home state, complete that state's licensing process, and obtain a resident or home state license. This is particularly beneficial for those seeking to work in multiple states and maximize their income potential.

The Florida DHS license is a popular choice due to the following advantages:

- Quick Application Process: Florida has one of the quickest application processes for the DHS license. The state offers online pre-licensing education and exams, making it convenient for applicants to complete the requirements from their home state.

- Reciprocity: Florida has excellent reciprocity agreements with other states. Holding a Florida DHS license enables you to apply for reciprocal licensing privileges in many states without needing to retake exams. This expands your geographical reach and enhances your career opportunities.

- Short Exam: Compared to other states, Florida's insurance adjuster exam is relatively short, consisting of 100 questions with a 2-hour time limit.

- Fingerprinting Requirement: Florida's DHS license includes a fingerprinting requirement, which is beneficial for future reciprocal licensing as some states mandate fingerprinting.

- Simple Process: Florida's licensing process is straightforward, with clear instructions and online resources.

Obtaining the Florida DHS License:

To obtain the Florida DHS license, follow these steps:

- Complete Pre-Exam Education: Enroll in a state-approved designation course or purchase a study guide to prepare for the exam. AdjusterPro is a popular choice, offering online courses with a high satisfaction rate.

- Take the Florida Adjuster License Exam: The exam is proctored and consists of 100 questions with a 2-hour time limit. It can be taken through Pearson VUE, and the fee is $44 per attempt.

- Submit the Florida DHS Insurance Adjuster License Application: Apply online via the Florida MyProfile page. The application fee is $55.

- Fingerprinting and Background Check: Process your fingerprints through IdentoGO, and appointments can be made on their website or by phone. The fingerprinting fee is $50.75.

- Application Review: The state will review your application and background check, and you will receive an update on the status of your license via email or through your MyProfile account.

By obtaining the Florida DHS license, you can benefit from the quick application process and reciprocity agreements, enabling you to work as an insurance adjuster in multiple states.

The Confidential Conundrum: Navigating the Privilege of Insurance Adjuster Log Notes

You may want to see also

You can also consider the Texas DHS license, which is also well-regarded

If you live in a state that doesn't require a license to practice insurance adjusting, it may seem unnecessary to get an adjuster license. However, there will likely come a time when the benefits will outweigh the effort.

There are two main reasons why a person would need a designated home state license: non-resident licensing and career marketability.

Non-Resident Licensing

Insurance adjusting often involves travelling outside of your state to take advantage of opportunities in other areas of the country. In most cases, you will need to obtain a license in the state where the situation is occurring. As mentioned earlier, insurance licenses only work in one state.

To get a license in a state that is not your home state, you will apply for a non-resident license in that state. These states require that you have a license in your home state before attaining their license. Since some states don't offer an adjuster license, this is where designated home state licenses come in.

If you have a designated home state license, you will be able to apply for a non-resident license using Texas as your home state.

Career Marketability

While it is true that some states don't require that you have a license to practice insurance adjusting, there may come a time when a potential employer prefers a person to carry a license.

If you apply for a position at an adjusting firm with no real-world experience, and another person without any experience applies for the same position but has a license, the licensed applicant will likely be chosen.

There are also situations when a company will eventually want you to be able to travel to impacted areas outside of your home state. Having a license will enable you to do so.

How to Get a Texas DHS Adjuster License

Step 1: Meet the Basic Requirements

Before you start taking steps to get your Texas DHS license, make sure you meet Texas' basic requirements:

- Be a U.S. citizen or legal alien with work authorization from the Immigration and Naturalization Services

- Be at least 18 years of age

- Do not hold a resident adjuster license in another state

Step 2: Take a Pre-Licensing Course and Pass the Exam

While Texas residents have the option to choose between an All-Lines or P&C adjuster license, the DHS license is only offered for All-Lines.

Texas is one of a handful of states that allow a state-approved pre-licensing course with an exam to provide an exemption from the state exam. After completing the required 40-hour pre-licensing course, you will be given a 150-question, multiple-choice exam, which you will also take online. You must correctly answer at least 70% of the questions to pass. Once you pass the included exam, you are qualified to apply for your Texas adjuster license.

Step 3: Submit an Application

Once you've taken the required pre-licensing course and passed the included state exam, you're ready to apply for your Texas Designated Home State (All-Lines) adjuster license.

Texas requires applicants to submit a fingerprint background check with their license application. Visit the Texas Fingerprint Requirements page to see detailed instructions on submitting your fingerprints to the state.

After fingerprinting, submit your adjuster application through Sircon. Remember to choose the Texas Designated Home State All-Lines license on your application.

You can check to see if your Texas DHS Adjuster License has been issued on TDI's License Search page.

Step 4: Complete Texas Continuing Education and License Renewal Requirements

Once you have your DHS license, you'll need to complete some additional steps every few years to keep it active. Texas DHS adjusters are required to complete 24 hours of continuing education every two years to renew their license. Licenses must be renewed every two years, on the last day of the licensee's birthday month.

The 24 hours of continuing education must include 2 hours of Ethics.

Step 5: Reciprocity

With your Texas DHS License, you'll receive the same reciprocity privileges as resident adjusters. This is vital for both finding employment and maintaining a successful career.

Texas grants reciprocal licenses to adjusters who are licensed in their home state or who hold a Designated Home State (DHS) license, as long as that state grants reciprocal licenses to Texas adjusters. California, Hawaii and New York do not offer reciprocal licenses to Texas adjusters.

Providing a Recorded Statement to the Insurance Adjuster: What You Need to Know

You may want to see also

Frequently asked questions

No, New Jersey does not require insurance adjusters to have a license. However, most insurance adjusters choose to obtain a license to increase their earnings and employment opportunities.

A DHS license allows residents of a state that does not license adjusters, like New Jersey, to obtain a license from another state, such as Florida or Texas, and designate that state as their "home state." This enables them to work in multiple states and increase their earnings.

You can obtain a DHS license by completing a pre-licensing course and passing the included exam. For example, the Florida Certified Adjuster Designation course offered by AdjusterPro satisfies the requirements for a Florida DHS license.

Obtaining a DHS license increases your employability and allows you to work in multiple states. Most employers prefer licensed adjusters who can work across the country. A DHS license also enables you to apply for reciprocal licensing privileges, making you more attractive to potential employers.

While there is no licensing requirement, most insurance companies prefer candidates with training or experience. You can increase your chances of becoming an insurance adjuster in New Jersey by obtaining a DHS license, learning Xactimate (a claims adjustment software program), or enrolling in an adjuster licensing course.