Advanced driver training programs have gained popularity as a way to improve road safety and reduce the number of accidents. These programs often focus on teaching drivers advanced techniques, such as defensive driving, hazard perception, and vehicle control. The question of whether these training programs can lead to lower insurance premiums is an important one, as it can encourage more people to invest in their driving skills. This paragraph will explore the relationship between advanced driver training and insurance costs, examining the potential benefits and challenges for drivers and insurance companies alike.

What You'll Learn

- Cost-Effectiveness: Advanced training may lower insurance premiums for drivers

- Risk Mitigation: Improved skills can reduce accidents and claims, benefiting insurers

- Driver Behavior: Training influences safer driving habits, potentially lowering insurance costs

- Statistical Analysis: Research shows a correlation between training and reduced insurance expenses

- Long-Term Savings: Investing in training can lead to long-term savings for drivers and insurers

Cost-Effectiveness: Advanced training may lower insurance premiums for drivers

Advanced driver training can indeed have a significant impact on insurance costs, offering a cost-effective solution for both drivers and insurance companies. The idea behind this is that skilled and confident drivers are less likely to be involved in accidents, which directly translates to lower insurance premiums. This concept is supported by numerous studies and real-world data, indicating that advanced training programs can reduce the risk of accidents and, consequently, the financial burden on insurance providers.

The cost-effectiveness of advanced driver training is twofold. Firstly, it empowers individuals with the skills and knowledge to drive more safely, reducing the likelihood of accidents and, thus, the need for insurance claims. This proactive approach to road safety can lead to substantial savings for insurance companies, who can then pass on these benefits to policyholders in the form of lower premiums. Secondly, by investing in advanced training, individuals can improve their driving abilities, making them safer on the road and potentially avoiding costly repairs or medical expenses that might otherwise be incurred in accidents.

Insurance companies often offer discounts or incentives for drivers who have completed advanced training programs. These discounts can be substantial, sometimes reaching up to 10% or more on insurance premiums. The logic is straightforward: insurers are willing to reward drivers who have demonstrated a commitment to improving their skills and reducing the risk they pose to themselves and others. Over time, this can lead to significant savings for individuals, especially those who frequently drive or have a high-risk profile.

Moreover, advanced driver training can have a broader impact on road safety, contributing to a decrease in the overall accident rate. This has a positive effect on society as a whole, reducing the number of injuries, fatalities, and property damage caused by road accidents. By encouraging safer driving practices, these programs can help create a more secure and efficient transportation system, benefiting everyone, including insurance companies, who may see a reduction in the volume and severity of claims.

In summary, advanced driver training is a cost-effective strategy that can lead to lower insurance premiums for drivers. It empowers individuals with the skills to drive safely, reduces accident risks, and encourages insurers to offer discounts. This approach benefits both drivers, who can save on insurance costs, and insurance companies, who can operate more efficiently and sustainably in a safer driving environment.

The Art of Waiting: Navigating the Timeline of Auto Insurance Adjusters

You may want to see also

Risk Mitigation: Improved skills can reduce accidents and claims, benefiting insurers

Advanced driver training programs have been widely recognized as an effective method to enhance road safety and reduce insurance-related risks. The primary goal of these training initiatives is to improve driving skills, which, in turn, can significantly lower the likelihood of accidents and subsequent insurance claims. By focusing on risk mitigation, insurers can benefit from a more secure and responsible driving population.

The concept is straightforward: better-trained drivers are less likely to be involved in accidents, which directly translates to reduced insurance liabilities. This is especially relevant in the context of defensive driving techniques, where learners are taught to anticipate potential hazards and react appropriately. For instance, understanding how to manage vehicle speed, especially in adverse weather conditions, can prevent accidents and minimize damage.

Moreover, advanced training often covers topics such as hazard perception, vehicle control, and emergency response. These skills are crucial in avoiding accidents and minimizing their impact. For example, a driver trained to react swiftly and effectively during a sudden obstacle on the road is less likely to be involved in a collision, thus reducing insurance payouts.

Insurers can also benefit from the data-driven insights provided by advanced driver training programs. Post-training assessments and feedback mechanisms can identify areas where drivers excel and areas that need improvement. This information can be used to tailor insurance policies, offering incentives for drivers who have completed advanced training and demonstrating a reduced risk profile.

In summary, advanced driver training is a powerful tool for risk mitigation in the insurance industry. By improving driving skills and promoting a culture of safety, insurers can contribute to a significant reduction in accidents and claims, ultimately benefiting both the drivers and the insurance companies through lower premiums and improved customer satisfaction. This approach not only enhances road safety but also fosters a more responsible and secure driving environment.

Insurance Surveillance: What to Do

You may want to see also

Driver Behavior: Training influences safer driving habits, potentially lowering insurance costs

Advanced driver training programs have gained significant attention for their potential to improve road safety and reduce insurance premiums. These training initiatives aim to enhance drivers' skills and knowledge, ultimately leading to safer driving habits and a decrease in insurance costs. The concept is straightforward: by providing drivers with advanced techniques and a deeper understanding of road dynamics, insurance companies can offer more competitive rates, as the risk of accidents and claims is reduced.

The impact of driver training on behavior is a critical aspect of this discussion. Trained drivers often exhibit a heightened sense of awareness and responsibility on the road. They are more likely to adhere to traffic rules, maintain safer distances from other vehicles, and make well-informed decisions in various driving scenarios. For instance, a trained driver might be more cautious when approaching intersections, recognizing potential hazards and reacting accordingly, which could prevent accidents and subsequent insurance claims.

Training programs often cover a range of topics, including defensive driving techniques, hazard perception, and risk assessment. These skills enable drivers to handle unexpected situations, such as sudden stops, lane changes, or adverse weather conditions, with greater confidence and control. As a result, trained drivers are less likely to be involved in accidents, which directly translates to lower insurance premiums for both the individual and the insurance provider.

Moreover, advanced driver training can foster a culture of continuous improvement. Drivers who have undergone such training may become more proactive in their approach to driving, seeking further education and staying updated with the latest safety practices. This commitment to self-improvement can lead to a long-term reduction in insurance costs, as safer driving habits become a natural part of their routine.

In summary, advanced driver training has a profound impact on driver behavior, encouraging safer practices and potentially reducing insurance expenses. By investing in these training programs, individuals can improve their driving skills, contribute to road safety, and enjoy the financial benefits of lower insurance premiums. This approach not only benefits the drivers themselves but also has a positive ripple effect on the overall insurance industry.

Understanding Auto and Condo Insurance: Comprehensive Coverage

You may want to see also

Statistical Analysis: Research shows a correlation between training and reduced insurance expenses

Research has consistently demonstrated a positive correlation between advanced driver training and reduced insurance expenses, offering valuable insights for both drivers and insurance providers. Numerous studies have analyzed the impact of driver education programs on insurance costs, revealing a compelling trend. These studies often involve large-scale data analysis, comparing insurance records of trained and untrained drivers over extended periods. The findings consistently indicate that drivers who undergo advanced training programs tend to have lower insurance premiums and reduced claim frequencies.

One of the key statistical insights is the significant decrease in accident rates among trained drivers. Advanced training programs focus on enhancing driving skills, including hazard perception, defensive driving techniques, and improved vehicle control. As a result, trained drivers are more likely to avoid accidents, which directly translates to lower insurance claims. Insurance companies often use accident rates as a primary factor in determining premium prices, and the data consistently shows that trained drivers have a reduced risk profile.

The correlation between training and insurance expenses is further supported by the analysis of claim costs. Trained drivers, due to their improved skills, are less likely to be involved in costly accidents. This leads to lower claim payouts for insurance companies, which, in turn, can result in reduced premiums for policyholders. Studies have shown that the savings in insurance expenses can be substantial, especially for high-risk drivers or those in regions with high accident rates.

Moreover, the long-term benefits of advanced driver training are evident in the data. Research suggests that the positive impact on insurance expenses can persist over time. Trained drivers may retain their improved skills and safer driving habits for extended periods, leading to sustained lower insurance costs. This is particularly relevant for insurance providers, as it indicates a potential for long-term cost savings and more stable premium structures.

In summary, statistical analysis of various studies provides strong evidence that advanced driver training significantly contributes to reduced insurance expenses. The correlation is evident in lower accident rates, decreased claim costs, and the potential for long-term savings. This research highlights the importance of investing in driver education programs, not only for individual drivers but also for the overall insurance industry, leading to more sustainable and cost-effective insurance solutions.

Navy Federal Auto Insurance: What You Need to Know

You may want to see also

Long-Term Savings: Investing in training can lead to long-term savings for drivers and insurers

Advanced driver training programs have been shown to significantly reduce insurance costs for both drivers and insurance companies over the long term. While the initial investment in training might seem like an added expense, the benefits it brings to road safety and risk management can lead to substantial financial savings. Here's how:

Reduced Claims and Premiums: One of the most direct ways advanced driver training impacts long-term savings is by reducing the number of accidents and traffic violations. Trained drivers are more likely to make better decisions on the road, following traffic rules and maintaining safe distances. This results in fewer claims, which directly translates to lower insurance premiums for all policyholders. Insurance companies can offer more competitive rates when they know that a significant portion of their insured drivers has undergone advanced training, as the risk of accidents and subsequent claims decreases.

Lower Insurance Costs for Individuals: For individual drivers, investing in advanced training can lead to lower insurance premiums. Insurance providers often offer discounts to drivers who have completed such programs. These discounts can be substantial, especially for those who have accumulated multiple traffic violations or have a history of accidents. Over time, these savings can offset the cost of the training, making it a financially sound decision.

Improved Road Safety and Reduced Liability: Advanced driver training programs often focus on defensive driving techniques, hazard perception, and risk assessment. These skills enable drivers to anticipate and respond to potential dangers on the road. As a result, trained drivers are less likely to be involved in accidents, which can lead to reduced liability for insurance companies. Lower liability means fewer payouts for insurance providers, allowing them to maintain stable premiums and potentially offer more competitive rates to their customers.

Long-Term Risk Management: The benefits of advanced driver training extend beyond the immediate reduction in accidents. Trained drivers are more likely to develop a safer driving mindset, which can lead to better decision-making in various road conditions. This improved risk management can result in fewer claims over an extended period, benefiting both the driver and the insurance company. Additionally, insurers can use data from trained drivers to refine their risk assessment models, further optimizing their pricing and risk management strategies.

In summary, investing in advanced driver training has a positive impact on road safety and insurance costs. The long-term savings for drivers come in the form of reduced insurance premiums, while insurers benefit from lower claims and improved risk management. This symbiotic relationship between drivers and insurers highlights the importance of promoting and supporting advanced driver training programs as a means to enhance road safety and financial stability.

Auto Insurance Premiums: The Post-Accident Hike

You may want to see also

Frequently asked questions

Yes, advanced driver training can significantly influence insurance rates. Many insurance companies offer discounts to drivers who have completed specialized training programs. These courses often cover advanced techniques like defensive driving, hazard perception, and vehicle control, which can lead to safer driving habits and a reduced risk of accidents. As a result, insurers may view these trained drivers as less likely to file claims, potentially lowering their insurance premiums.

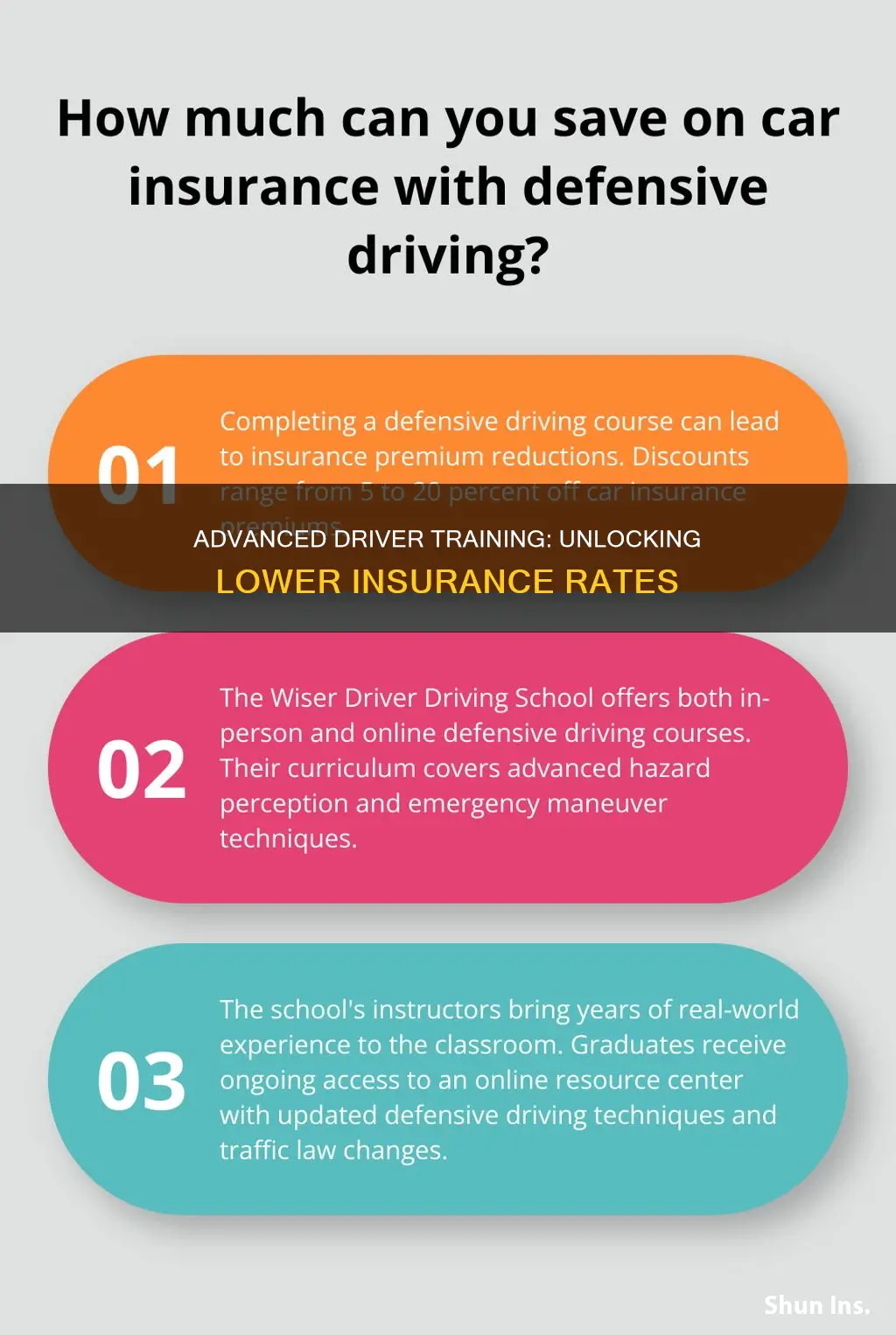

The savings on insurance premiums can vary depending on the insurance provider and the specific training program. On average, completing an advanced driver course can lead to a reduction of 10-20% in insurance costs. Some insurers even offer substantial discounts, sometimes up to 30%, for drivers who have completed recognized driver education programs. It's always a good idea to check with your insurance company to understand the potential savings based on their policies.

Absolutely! Advanced driver training provides numerous benefits beyond insurance savings. These courses enhance your driving skills, improve road awareness, and promote safer driving practices. You'll learn to handle various driving scenarios, from adverse weather conditions to emergency situations. The training can also boost your confidence behind the wheel, making you a more competent and responsible driver. Additionally, it may contribute to a better understanding of road rules and regulations, ensuring you stay within legal boundaries.