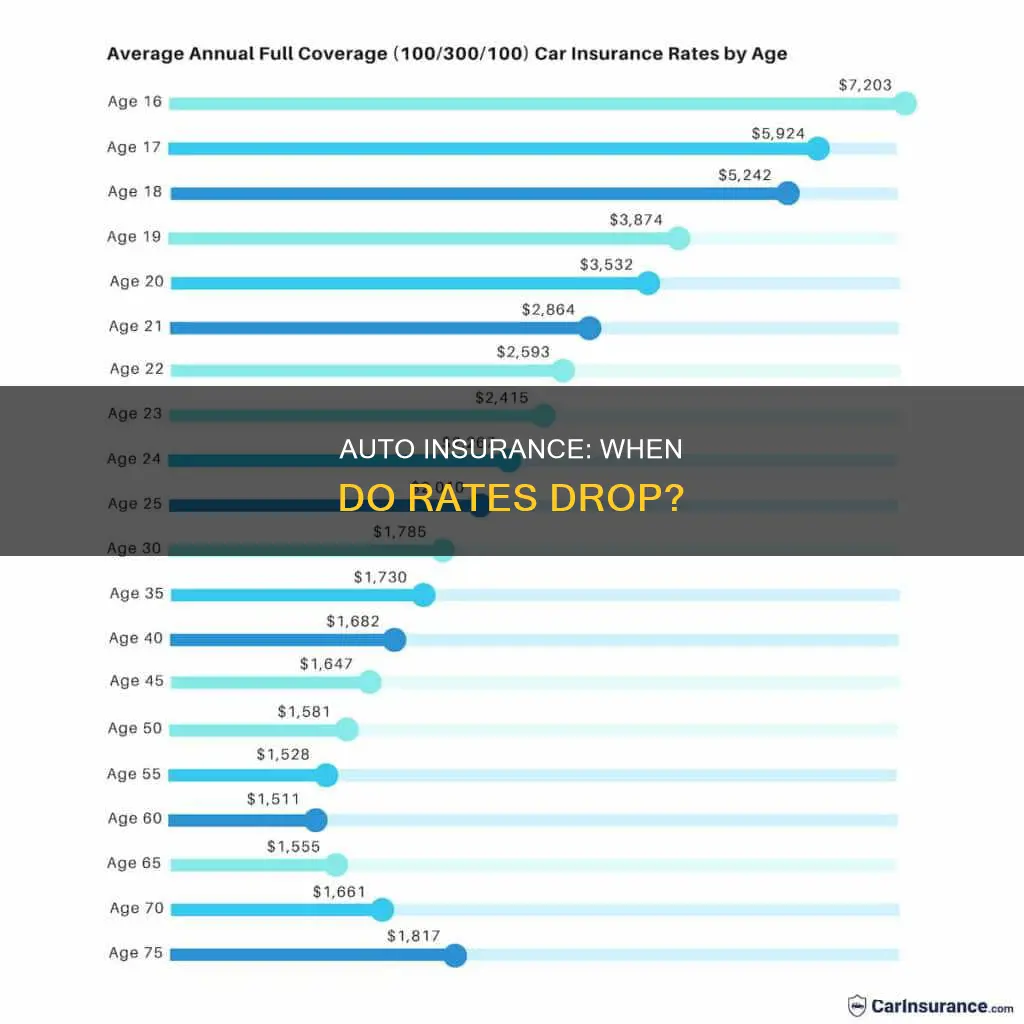

There are many factors that determine the cost of car insurance, and age is one of the most important ones. Generally, car insurance costs go down as you get older, with rates decreasing significantly from age 19 to 34, levelling off between 35 and 55, and then rising again after age 75. This is because younger drivers are more likely to have accidents or take risks on the road, while older drivers may be more prone to accidents due to physical, cognitive, or visual impairments. Additionally, insurance rates can be influenced by factors such as claims history, driving experience, gender, location, credit history, and marital status.

| Characteristics | Values |

|---|---|

| Age | Insurance rates tend to decrease significantly from 19-34, stabilize or decrease slightly from 34-75, and increase again at 75. |

| Gender | Male drivers pay more than female drivers, but the difference decreases after age 25. |

| Driving experience | Inexperienced drivers are more likely to have accidents and are therefore more expensive to insure. |

| Driving record | A history of accidents, traffic violations, or DUIs will increase insurance rates. Most driving infractions will fall off an insurance record after three years. |

| Credit score | A lower credit score may increase insurance rates. |

| Location | Living in an area with high crime rates or a large city will increase insurance rates. |

| Marital status | Married couples are considered lower risk and may be eligible for lower insurance rates. |

| Vehicle type | Driving a luxury or sports car will increase insurance rates, while driving a used, safe vehicle will decrease rates. |

| Insurance company | Rates vary between insurance companies. |

What You'll Learn

- Age: Premiums decrease as you get older and less risky to insure

- Clean record: Premiums decrease if you're a good driver with no accidents or violations

- Gender: Male drivers' premiums decrease by 12% at 25, while women's decrease by 9%

- Policy renewal: Premiums decrease every time you renew your policy without making a claim

- Discounts: Students with good grades, alumni, and those who complete safe driving courses can get discounts

Age: Premiums decrease as you get older and less risky to insure

Age is a significant factor in determining your car insurance rate. Insurance companies calculate insurance rates based on assessed risk, and younger drivers are generally more likely to have accidents or take risks on the road. As a result, they are considered high-risk and charged higher rates.

As you get older, your insurance premiums will typically decrease. This is because older drivers are more experienced and less likely to make accident claims, making them less risky to insure. At Progressive, for instance, the average premium per driver tends to decrease significantly from ages 19 to 34, stabilize or slightly decrease from 34 to 75, and then begin to trend upward again at age 75.

The decrease in insurance rates with age is most significant for young drivers. Between the ages of 16 and 21, average car insurance rates can decrease by as much as $814 per year. The biggest drop typically occurs at age 25, when drivers are no longer considered part of the riskiest age group. At this age, rates can decrease by about 11% on average, with men seeing a 12% reduction and women a 9% reduction.

However, it's important to note that age is not the only factor influencing insurance rates. Other factors, such as driving history, claims history, credit history, location, and marital status, can also impact your premium. Additionally, the specific insurance company and their policies can affect the rate, so it's always a good idea to shop around and compare rates.

Insuring Your Vehicle in BC

You may want to see also

Clean record: Premiums decrease if you're a good driver with no accidents or violations

Auto insurance premiums are largely determined by the risk profile of the insured. A driver's risk profile is influenced by factors such as age, gender, driving history, and location. While age is a significant factor, with younger and older drivers generally considered higher-risk, a clean driving record can also contribute to lower insurance rates.

Maintaining a clean driving record without accidents or violations is one of the most effective ways to reduce your auto insurance premiums. Insurance companies typically view drivers with no history of claims or traffic infractions as lower-risk, which leads to more favourable rates. This is because a driver's record is a key indicator of their likelihood to file a claim or be involved in an accident. By avoiding incidents and demonstrating safe driving habits, you can significantly impact your insurance costs.

Most driving infractions and at-fault accidents will be removed from your insurance record after three years, resulting in lower premiums. However, the timeline may vary depending on the type of violation and the laws of your state. More serious violations, such as driving under the influence (DUI), can remain on your record and affect your rates for longer.

It's important to note that simply reaching a certain age, such as 25, won't automatically reduce your insurance costs if you have accidents or violations on your record. Age is only one factor in determining insurance rates, and a clean driving record is a more influential factor in achieving lower premiums.

In addition to a clean record, there are other strategies to reduce auto insurance costs. These include taking a defensive driving course, bundling insurance policies, improving your credit score, and comparing rates from different insurance providers. By combining a clean driving record with these cost-saving strategies, you can maximise your chances of obtaining lower auto insurance premiums.

Vehicle De-Insure: What You Need to Know

You may want to see also

Gender: Male drivers' premiums decrease by 12% at 25, while women's decrease by 9%

Age is one of the most important factors in determining your car insurance rate. Generally, younger drivers are more likely to have accidents or take risks on the road, and so they pay higher rates. As a result, insurance rates tend to decrease as drivers age and gain more experience.

Male drivers, in particular, tend to pay more for car insurance than female drivers during their teenage years and early adulthood. This is because car insurance providers consider young men to be riskier drivers than their female counterparts. The gap in insurance rates between genders narrows around the age of 25, as both male and female drivers gain more maturity and experience behind the wheel.

At Progressive, for example, rates drop by 9% on average at age 25. Specifically for male drivers, premiums decrease by 12% at age 25, while women's premiums decrease by 9%. However, it's important to note that other factors, such as claims history, can also impact insurance rates. For instance, if a driver is in an accident right before turning 25, their rate may not drop as expected.

As drivers continue to age, the gender gap in insurance rates may fluctuate. In some states, women may pay slightly higher premiums than men around the age of 35, while in other states and age groups, the rates may be similar or even higher for men. The reasons for these differences are not entirely clear, but they may be related to factors such as driving history, mileage, and risky driving behaviors.

It's worth noting that some states have started taking steps to eliminate gender as a factor in determining insurance rates. Currently, six states prohibit the use of gender as a pricing factor in auto insurance.

Reassess Your Car Insurance, Save More

You may want to see also

Policy renewal: Premiums decrease every time you renew your policy without making a claim

Policy renewal is an important time for insurance policyholders. It marks the end of the effective period of an insurance policy, during which the insurance provider may choose to adjust the premiums and coverages offered. While premium rates can increase at renewal, they can also decrease, especially if you haven't made any claims.

Insurance policies typically have a policy period of one year, during which the insurance provider locks in the premium rate and does not make any changes to the policy's premiums or coverages. However, once the policy period ends and it's time for renewal, the insurer has the option to adjust the coverages and premiums before starting a new policy period. While premium increases are common, they can also decrease, especially if you haven't made any claims during the previous policy period.

Age is another critical factor in determining auto insurance rates. Younger drivers, particularly teenagers, often face higher insurance rates due to their higher risk of accidents and traffic violations. As you age, your insurance rates tend to decrease, reflecting your growing experience and lower accident risk. At Progressive, for instance, the average premium per driver tends to decrease significantly from ages 19 to 34 and then stabilizes or decreases slightly from 34 to 75.

In addition to age and claims history, other factors that can influence auto insurance rates include driving record, changes in your situation (such as a teen on your policy ageing into their 20s), credit score, and state insurance requirements. It's worth noting that not all states allow insurance companies to consider credit scores when setting premiums.

When it comes to policy renewal, it's essential to be proactive and review your policy details. Ensure that your address, insured names, coverage limits, and payment method are all up to date. If you've made any significant changes, such as renovations or big-ticket purchases, you may need to adjust your coverage limits accordingly. By being vigilant during policy renewal, you can ensure that you're getting the coverage you need at the best possible rate.

Auto Accident Medical Coverage in Michigan

You may want to see also

Discounts: Students with good grades, alumni, and those who complete safe driving courses can get discounts

Students with good grades can get a discount on their auto insurance. Most insurance companies require a minimum of a B average to qualify for a good student discount, which saves drivers an average of 14%. Some companies offer discounts of up to 25% for students with good grades. The good student discount usually lasts until the student reaches the age of 25.

Alumni can also get discounts on their auto insurance. For example, GEICO offers special savings to alumni association members, faculty, and staff of certain colleges and universities.

Finally, drivers who complete safe driving or defensive driving courses can also get discounts on their auto insurance. GEICO, for example, offers a discount to drivers who complete an approved defensive driving course. The eligibility criteria for this discount vary by state but generally include age requirements and that the course was completed voluntarily.

Rodent Damage: Is Your Car Insured?

You may want to see also

Frequently asked questions

Auto insurance rates tend to decrease as you get older, with rates dropping significantly at age 25. However, this is not a "magical" number, and rates can continue to decrease until age 30 or even 35.

Insurance companies consider younger drivers to be higher-risk due to their lack of driving experience and the statistical likelihood of being involved in accidents. As you get older and gain more driving experience, you are seen as less risky to insure, which results in lower rates.

Yes, insurance companies consider various factors when determining your rate, including your driving record, credit history, location, marital status, and the type of car you drive. Keeping a clean driving record and improving your credit score can help lower your insurance rate.

There are several strategies to reduce your auto insurance costs, such as taking a defensive driving course, bundling insurance policies, increasing your deductible, or shopping around for quotes from different insurance providers.

The decrease in auto insurance rates at age 25 varies by company and other factors. On average, rates drop by about 11% at age 25, but this can range from 9% to 16%. Male drivers typically see a larger decrease (12%) than female drivers (9%) at this age.