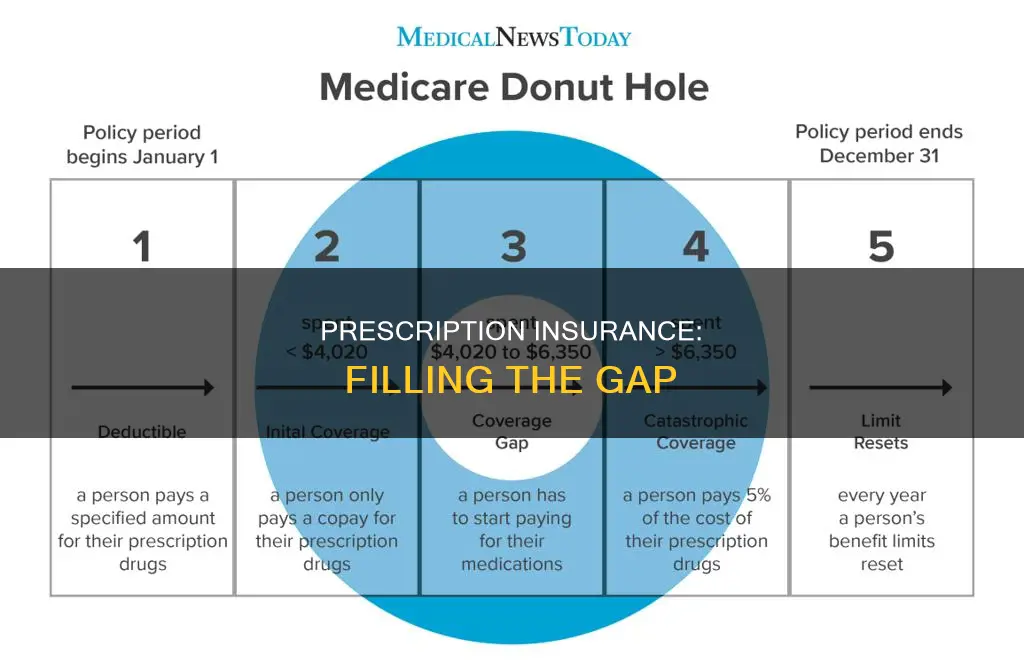

There are many reasons why there may be a gap in your prescription insurance. In the US, for example, most Medicare drug plans have a coverage gap, commonly referred to as the donut hole. This means there is a temporary limit on what the drug plan will cover for drugs. Once you and your plan have spent a certain amount on covered prescription drugs during a calendar year, you reach the coverage gap and are considered in the donut hole. In 2023, this limit was $4,660, and in 2024, it is $5,030. Not everyone will enter the donut hole, and people with Medicare who also have Extra Help will never enter it.

| Characteristics | Values |

|---|---|

| Name | Coverage gap, "donut hole" |

| Description | A phase of Medicare Part D prescription drug coverage where beneficiaries must bear a higher portion of their medication costs. |

| Who is affected | Not everyone will enter the coverage gap. Only those who have spent a certain amount on covered prescription drugs during a calendar year. In 2024, this limit is $5,030. |

| What happens when you're in the coverage gap | You are responsible for a percentage of the cost of your drugs. In 2024, you will pay no more than 25% of the cost of your plan's covered brand-name prescription drugs and 25% of the dispensing fee. |

| How to get out of the coverage gap | Your total out-of-pocket costs must reach $8,000. If you hit this number, then you enter the catastrophic payment stage, where your plan pays most of the cost for your drugs. |

| How to avoid the coverage gap | It is not possible to completely avoid the coverage gap. However, choosing generic medications whenever possible can help keep prescription drug costs lower and slow down the progression into the coverage gap. |

What You'll Learn

The donut hole

The "donut hole" is a colloquial term for the coverage gap in Medicare Part D, which is the portion of Medicare that helps a person pay for prescription drugs. This coverage gap means that there is a temporary limit to what the drug plan will cover for drugs. Not everyone will enter the coverage gap, and the amount that brings someone into the coverage gap may change each year. In 2024, the coverage gap begins once a person and their plan have spent $5,030 on covered drugs.

Once in the coverage gap, a person is responsible for a percentage of the cost of their drugs. In 2024, this is 25% of the cost of the drugs. This is a decrease from previous years, as lawmakers have passed legislation to help close the donut hole. In 2011, the Affordable Care Act required pharmaceutical manufacturers to introduce discounts of up to 50% for brand-name drugs and up to 14% for generic drugs. The Bipartisan Budget Act of 2018 also helped to speed up changes to prescription drug discounts when a person was in the donut hole.

While in the donut hole, a person will pay 25% of the cost of their drugs, and the manufacturer will pay 70% to discount the price. The person's plan will then pay the remaining 5% of the cost. The person will also pay a dispensing fee, of which their plan will cover 75% and they will cover the remaining 25%. While in the coverage gap, almost the full price of the drug will count as out-of-pocket costs to help the person get out of the coverage gap.

To get out of the donut hole, a person must reach the "catastrophic coverage" stage of their medication coverage. To reach this stage, a person must pay out-of-pocket costs for covered drugs until they reach a certain amount. In 2020, this amount was $6,350. Once a person has reached this amount, their insurance company will require them to pay either 5% of the drug's cost or a minimum copay, whichever is higher.

VW Leases: Gap Insurance Included?

You may want to see also

Entering the donut hole

The "donut hole" is a common nickname for the coverage gap in most Medicare drug plans. This means that there is a temporary limit to what your insurance will cover for drugs. Not everyone will enter the coverage gap.

You enter the donut hole when the total cost of your drugs—including what you and your plan have paid—reaches a certain limit. In 2024, that limit is $5,030. This amount may change each year.

Once you've entered the donut hole, you will be responsible for paying a percentage of the cost of your drugs. The donut hole closed for all drugs in 2020, meaning that when you enter the coverage gap, you will be responsible for 25% of the cost of your drugs. In the past, you would have been responsible for a higher percentage of the cost of your drugs.

For example, if a drug costs $100 and you pay your plan's $20 copay during the initial coverage period, you will be responsible for paying $25 (25% of $100) during the coverage gap.

You will enter catastrophic coverage after you reach $8,000 in out-of-pocket costs for covered drugs. This amount includes what you pay for covered drugs and some costs that others pay. During this period, you will owe no cost-sharing for the cost of your covered drugs for the remainder of the year.

Florida: Vehicle Insurance, Mandatory or Not?

You may want to see also

Brand-name prescription drugs

When it comes to prescription drug coverage, most Medicare drug plans have what is known as a "coverage gap" or "donut hole". This means that there is a temporary limit to what the drug plan will cover for drugs. Once you and your plan have spent a certain amount on covered drugs, you enter the coverage gap and will be responsible for a percentage of the cost of your drugs. In 2024, this limit is $5,030. While in the coverage gap, you will pay no more than 25% of the cost for your plan's covered brand-name prescription drugs. This is often still more affordable than generic drugs, as brand-name drugs come with a manufacturer's discount that counts towards out-of-pocket spending, whereas generics do not.

Generic drugs are medications with the same active ingredients as brand-name drugs, taken in the same way and offering the same effect. They are typically 80-85% cheaper than brand-name drugs. However, generic drugs do not always exist for brand-name medications, as new drugs are protected by patents for 17 years on average. After the patent expires, other companies can get a generic version of the drug approved and start selling it.

If you are looking to save money on prescription drugs, you can ask your pharmacist about generic alternatives. You can also try the following:

- Ask for a 90-day supply at your pharmacy, which may help lower your copay.

- Try mail-order prescriptions, which may have a lower copayment.

- Pick a pharmacy in your plan's preferred network.

- Sign up for a prescription discount program, which works with drug manufacturers to keep costs down for patients.

- Search for non-profit organisations that help lower prescription drug costs.

- Contact pharmaceutical companies directly, as some sponsor assistance programs to help cover prescription costs for low-income or disabled individuals.

Vehicle Insurance: Washington's Guide

You may want to see also

Generic prescription drugs

Many people wonder if generic prescription drugs are as good as their brand-name counterparts. Generic drugs are copies of brand-name drugs with the same dosage, use, effects, side effects, administration route, risks, safety, and strength as the original drug. In other words, their pharmacological effects are identical to those of the brand-name versions. For example, a generic drug for diabetes is metformin, while Glucophage is a brand name for the same drug.

The FDA (U.S. Food and Drug Administration) requires generic drugs to be as safe and effective as brand-name drugs. Generic drugs are only cheaper because their manufacturers have not incurred the expenses of developing and marketing a new drug. When a company launches a new drug, it has already spent a substantial amount on research, development, marketing, and promotion. A patent is granted that gives the company the exclusive right to sell the drug for a certain period. As the patent nears expiration, manufacturers can apply to the FDA for permission to make and sell generic versions, and without the startup costs for development, they can afford to sell the drug at a lower price. When multiple companies begin producing and selling a generic drug, the competition among them can further drive the price down.

According to the IMS Health Institute, generic drugs saved the U.S. healthcare system $2.2 trillion from 2009 to 2019. The FDA established the Drug Competition Action Plan in 2017 to encourage market competition for generic products so that consumers can access the medicines they need at more affordable prices.

Medicare drug plans have a coverage gap, often called a "donut hole," which means there's a temporary limit on what the plan will cover for drugs. In 2024, once you and your plan have spent $5,030 on covered drugs, you enter the coverage gap and are responsible for 25% of the cost of your drugs. Medicare will pay 75% of the price for generic drugs during the coverage gap.

Safeco's Insurance Policy for Rebuilt Cars

You may want to see also

Getting out of the donut hole

The "donut hole" is a colloquial term for the gap in prescription drug coverage in Medicare Part D. Once a person and their insurance company have jointly paid out a certain amount for covered drugs, the individual reaches the donut hole, and has to pay out-of-pocket for their medication until they reach another specified amount.

In 2024, the donut hole begins when an individual and their plan have spent $5,030 on covered drugs. While in the coverage gap, the individual is responsible for 25% of the cost of their drugs. The amount an individual has to spend to get out of the donut hole is $6,350.

- Extra Help: A Medicare program that helps people pay for medications and other aspects of medical care. A person can qualify for Extra Help if their income is $18,735 or less when single or $25,365 or less as a couple. They must also have less than $14,390 as a single person or $28,720 as a married couple in resources, including savings, stocks, or bonds.

- Medicaid: A federal program that helps low-income individuals pay for healthcare. People who qualify for Medicaid are automatically enrolled in the program.

- State Health Insurance Assistance Program (SHIP): State-specific programs that can provide additional assistance for people in funding healthcare costs, including medications.

- Prescription assistance programs: Many pharmaceutical manufacturers offer programs that can reduce prescription drug costs.

In addition, here are some ways to avoid the donut hole:

- Shop around for a better plan: Not all Medicare Part D plans are created equal. During the annual enrollment period, pay close attention to the drug formularies and compare your options to enroll in the best plan for your unique needs at the best price.

- Pharmaceutical Assistance Programs: Find out whether there’s a pharmaceutical assistance program available to you that can lower your prescription costs. These programs are usually offered by states, pharmaceutical companies, and non-profit organizations.

- Use your plan's preferred pharmacy: If your plan has a preferred pharmacy and you’re not using it, then you’re wasting money. Change plans or pharmacies.

- Explore prescription savings cards: Look into savings cards, such as GoodRx or SingleCare. Sometimes using these discount cards can reduce the cost of your medications more than your Part D plan.

- Look for generic or lower-cost alternatives: If you’re currently prescribed brand-name drugs from manufacturers that don’t provide prescription coupons, speak to your health care provider or pharmacist about potential generic or lower-cost options.

Family Car Gap: Is Your Coverage Enough?

You may want to see also

Frequently asked questions

There is a gap in your prescription insurance because you have reached the limit of what your insurance plan will cover for drugs. This is often referred to as the "donut hole".

Not everyone will enter the "donut hole". In 2024, you will enter the "donut hole" when your total drug costs, including what you and your plan have paid, reach $5,030.

When you enter the "donut hole", you will be responsible for a percentage of the cost of your drugs. In 2023, this was a maximum of 25% of the cost.

To leave the "donut hole", your total out-of-pocket costs must reach $8,000. At this point, you will enter the catastrophic payment stage, where your plan pays most of the cost of your drugs.