Navigating the complexities of insurance coverage can be challenging, especially when trying to determine the status of your insurance. This guide aims to provide a comprehensive overview of how to effectively track the status of your insurance, ensuring you have the necessary information to manage your coverage. Whether you're checking on a policy, verifying coverage details, or seeking to understand the claims process, this resource will offer practical steps and tips to help you stay informed and confident in managing your insurance.

What You'll Learn

- Understand Your Policy: Review your insurance documents to identify coverage details and exclusions

- Contact Your Insurer: Reach out to your insurance provider for policy information and claims assistance

- Check Policy Status Online: Utilize online tools to verify policy status, coverage, and claim progress

- Review Billing Statements: Examine billing statements for accurate insurance information and payments

- Consult a Broker: Seek guidance from an insurance broker for policy management and claims support

Understand Your Policy: Review your insurance documents to identify coverage details and exclusions

To determine the status of your insurance coverage, it's essential to start by understanding your policy. This process involves a thorough review of your insurance documents, which typically include the policy statement, coverage summary, and any additional riders or endorsements. These documents provide a comprehensive overview of what is covered and what is not.

Begin by carefully reading through the entire policy. Pay close attention to the definitions of terms, especially those related to coverage, exclusions, and limitations. Insurance policies often use technical language, so it's crucial to understand the context in which each term is used. Look for sections that outline the scope of coverage, such as property damage, liability, medical expenses, or any specific endorsements you may have added.

Identify the coverage limits and deductibles. These are critical aspects of your policy as they determine the financial responsibility you have in the event of a claim. Coverage limits specify the maximum amount the insurance company will pay for a covered loss, while deductibles are the amount you must pay out of pocket before the insurance coverage kicks in. Understanding these limits and deductibles will help you assess the potential financial impact of any claims you might file.

Exclusions are another vital part of your policy. These are specific events or circumstances that are not covered by your insurance. Common exclusions include acts of war, intentional damage, or certain natural disasters. It's important to know what is not covered to manage your expectations and understand the potential risks you may need to mitigate.

Additionally, review any additional coverage or riders you may have added to your policy. These could include riders for valuable items, rental income coverage, or increased liability limits. Understanding these additional provisions can help you ensure that your policy provides the level of coverage you require. By thoroughly reviewing your insurance documents, you can gain a clear understanding of your coverage, identify any gaps, and make informed decisions regarding your insurance needs.

The Chopping Block: Understanding the Impact of the New Bill on Insurance Coverage

You may want to see also

Contact Your Insurer: Reach out to your insurance provider for policy information and claims assistance

If you're wondering about the status of your insurance coverage, the first step is to contact your insurance provider directly. This is the most reliable way to get accurate and up-to-date information about your policy. Insurance companies have dedicated customer service teams that can provide you with details about your coverage, including the status of any outstanding claims.

When reaching out to your insurer, have your policy number ready. This unique identifier is essential for them to access your specific account and provide the necessary information. You can usually find this number on your insurance documents or on any recent correspondence you've received from the company. Providing this number will ensure that the insurer can quickly locate your policy and assist you effectively.

Explain your situation clearly to the customer service representative. Whether you're inquiring about a recent claim, checking the status of a payment, or seeking clarification on your coverage, being specific will help the representative understand your needs. They can then guide you through the process and provide the relevant details. For example, if you've filed a claim, they can inform you about the current processing stage, estimated timelines, and any required documentation.

In addition to policy information, insurers can also assist with claims-related matters. If you've experienced a covered event and need to file a claim, contact your insurer as soon as possible. They will provide you with the necessary steps and documentation required to initiate the claims process. This may include submitting reports, gathering supporting evidence, and providing relevant details about the incident.

Remember, insurance providers are there to help you navigate any inquiries or concerns you may have about your policy. By contacting them directly, you can ensure that your questions are answered promptly and accurately. This proactive approach will give you peace of mind, knowing that you have the necessary information and support when it comes to your insurance coverage.

The Mystery of "Cap" in Insurance: Unraveling the Industry's Unique Terminology

You may want to see also

Check Policy Status Online: Utilize online tools to verify policy status, coverage, and claim progress

In today's digital age, many insurance companies offer online platforms and tools to provide policyholders with easy access to their insurance information. If you're wondering about the status of your insurance policy, one of the most efficient ways to find out is by checking it online. Here's a step-by-step guide on how to do this:

First, locate the official website of your insurance provider. Most companies have a dedicated section for customers to manage their policies. Look for a 'Customer Login' or 'Policyholder Portal' option on the homepage. You might need to create an account if you don't have one already. During the registration process, ensure you provide accurate personal and policy details. Once logged in, you'll typically find a dashboard or a summary page that displays your policy information. Here, you can view the policy number, coverage details, premium payments, and any recent changes or updates.

Online portals often provide a comprehensive overview of your policy, including the policy term, coverage limits, exclusions, and any add-ons or riders you've chosen. You can also check the status of your claims and track their progress. If you've recently filed a claim, the portal might show the current stage of the process, such as 'under review,' 'pending approval,' or 'settled.' This feature allows you to stay informed about the outcome of your claim without having to contact the insurance company directly.

Additionally, these online tools often offer the convenience of making payments, updating personal details, and even downloading important documents like policy documents and statements. By regularly checking your policy status online, you can ensure that your insurance coverage remains up-to-date and that any changes or additions are promptly reflected in your records.

Remember, while online tools provide a convenient way to access your insurance information, it's always a good idea to verify the accuracy of the data. If you notice any discrepancies or have concerns, contact your insurance provider's customer support for clarification.

Updating Your Address: A Guide to Mercury Insurance Address Changes

You may want to see also

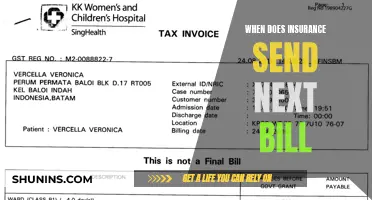

Review Billing Statements: Examine billing statements for accurate insurance information and payments

To determine the status of your insurance coverage, it's essential to review your billing statements carefully. This process can help you identify any discrepancies or missing information regarding your insurance acceptance. Here's a step-by-step guide on how to review billing statements effectively:

- Obtain Your Billing Statements: Start by gathering all relevant billing statements from your healthcare providers, dentists, or any other service providers you've interacted with. These statements typically include details about the services rendered, the associated costs, and the insurance coverage applied. Ensure you have statements for the relevant time periods you want to review.

- Verify Insurance Information: Carefully examine the billing statements for the following insurance-related details:

- Insurance Provider: Check if the correct insurance company or plan is listed. This information should match the one you provided during registration or enrollment.

- Policy Number: Look for your unique policy number, which is a crucial identifier for your insurance coverage. It is often included in the billing statement to ensure proper billing and claims processing.

- Coverage Details: Review the statement to ensure that the services provided are covered under your insurance plan. This includes checking the coverage limits, copayments, and any specific exclusions or inclusions mentioned.

- Cross-Reference Payments: Compare the payments made by the insurance company with the amounts charged by the service provider. Ensure that the insurance has made the necessary payments or reimbursements. If there are any discrepancies, it might indicate a delay or an issue with insurance acceptance.

- Look for Missing Information: In some cases, billing statements may not include all the necessary insurance details. If you notice that your insurance information is missing or incomplete, contact the service provider and request a revised statement. This step ensures that you have accurate and up-to-date information regarding your insurance coverage.

- Stay Informed: Regularly review your billing statements to catch any potential issues early on. Insurance coverage and billing processes can be complex, and staying proactive in reviewing your statements can help you identify and address problems promptly. If you have any doubts or concerns, don't hesitate to contact your insurance provider or the service provider for clarification.

By following these steps, you can take control of your insurance coverage and ensure that your billing statements accurately reflect your insurance information and payments. It is a proactive approach to managing your healthcare expenses and staying informed about your insurance acceptance.

USPS Value vs. Insurance: Unlocking the Difference

You may want to see also

Consult a Broker: Seek guidance from an insurance broker for policy management and claims support

When it comes to managing your insurance policies and ensuring you're covered, consulting a broker can be an invaluable step. Insurance brokers are professionals who act as intermediaries between you and insurance companies, providing expert guidance and support throughout the entire process. They can help you navigate the complex world of insurance and ensure that you have the right coverage in place.

One of the primary benefits of consulting a broker is their ability to provide personalized advice. They will take the time to understand your unique needs, assess your current coverage, and offer tailored solutions. By analyzing your insurance portfolio, they can identify gaps in your coverage and suggest appropriate adjustments. This personalized approach ensures that your insurance policies are aligned with your specific requirements, providing comprehensive protection without unnecessary extras.

Brokers also play a crucial role in policy management. They can assist with the administration of your policies, including premium payments, policy renewals, and making changes to your coverage. By handling these administrative tasks, brokers save you time and effort, allowing you to focus on other priorities. They can also provide valuable insights into different insurance products, helping you make informed decisions about your coverage options.

In the event of a claim, insurance brokers become your trusted advocates. They guide you through the claims process, ensuring that you understand your rights and responsibilities. Brokers will assist in gathering the necessary documentation, communicating with the insurance company, and helping you navigate any potential complexities. Their expertise can significantly streamline the claims process, potentially saving you time and hassle during a challenging period.

Furthermore, brokers often have access to a wide range of insurance providers and products. They can compare policies from various companies, helping you find the best coverage at competitive prices. This extensive knowledge and network enable brokers to negotiate on your behalf, securing favorable terms and rates that might not be available directly through an insurance company. By leveraging their industry connections, brokers can provide you with comprehensive coverage tailored to your needs.

Protect Your Lease: Understanding Mobile Phone Insurance

You may want to see also

Frequently asked questions

To determine if your insurance is accepted by a particular healthcare provider, you can contact the provider's office directly. Their staff can verify your insurance coverage and inform you of any specific requirements or procedures for utilizing your insurance benefits.

If you have doubts about the specifics of your insurance plan, it's best to review your insurance documents thoroughly. These documents should outline the coverage details, including accepted providers, copayments, deductibles, and any exclusions. If you still need clarification, contact your insurance company's customer service for assistance.

Yes, many insurance companies provide online tools or databases to help you find in-network providers. These resources often allow you to search for healthcare facilities, doctors, or specialists and check if they are part of your insurance network. You can usually find these tools on the insurance company's website or through their mobile app.

Absolutely! Your current healthcare provider can provide valuable information about their insurance acceptance. They may have partnerships with specific insurance companies and can guide you on the coverage options available to you. It's a good idea to inquire about any unique policies or requirements they have for insurance patients.