The insurance industry is a complex and often misunderstood sector, and a new book aims to shed light on some of the secrets it doesn't want you to know. What the Insurance Industry Doesn't Want You to Know promises to reveal hidden truths about how insurance companies operate, from the ways they can manipulate policies to the strategies they use to keep premiums high. This book is a call to action for consumers to become more informed and empowered, ensuring they get the best possible coverage and value for their money.

What You'll Learn

- Hidden Costs: How insurance companies profit from your premiums

- Policy Loopholes: Common gaps in coverage that insurers exploit

- Medical Billing Secrets: How to avoid overpaying for healthcare

- Legal Tactics: Strategies to win insurance claims disputes

- Consumer Rights: Your power to demand transparency and fair treatment

Hidden Costs: How insurance companies profit from your premiums

The insurance industry has long been criticized for its complex and often opaque practices, and a closer look at the hidden costs associated with insurance premiums reveals a system that can be both costly and profitable for insurance companies. While the primary purpose of insurance is to provide financial protection against unforeseen events, the reality is that insurance providers have various ways to generate revenue beyond the premiums they collect.

One of the most significant hidden costs is the administrative overhead. Insurance companies spend a considerable amount of money on managing claims, processing paperwork, and maintaining extensive networks of agents and brokers. These operational costs are typically passed on to policyholders in the form of higher premiums. For instance, the processing of a claim can involve multiple layers of bureaucracy, with each step contributing to the overall expense. From the initial assessment to the final settlement, the administrative burden can be substantial, and insurance firms often have to absorb these costs, which they then recover through premium adjustments.

Another aspect that contributes to hidden costs is the use of complex policy structures and exclusions. Insurance policies are often laden with fine print, including various exclusions and limitations. These provisions allow insurance companies to avoid paying out claims in certain situations, thereby reducing their liabilities. For example, a health insurance policy might exclude pre-existing conditions or specific types of injuries, ensuring that the insurer doesn't have to cover these expenses. While such exclusions are legally permissible, they can lead to unexpected financial burdens for policyholders when they need coverage the most.

Furthermore, the insurance industry's profit margins are often significantly higher than what is commonly perceived. Insurance companies invest a substantial portion of the premiums collected in various financial instruments, such as stocks, bonds, and real estate. These investments generate returns that contribute to the company's overall profitability. Additionally, insurance providers often employ sophisticated actuarial models to predict and manage risks, allowing them to set premiums at levels that ensure a steady income stream. This strategic pricing ensures that insurance companies can maintain their financial health while providing a safety net for policyholders.

In summary, the insurance industry's hidden costs and profit-making strategies are multifaceted. From administrative overheads to complex policy structures and strategic investments, insurance companies have various avenues to generate revenue. While they provide a valuable service by offering financial protection, the intricate nature of the industry often results in higher costs for consumers. Understanding these hidden expenses is crucial for policyholders to make informed decisions and potentially negotiate better terms with insurance providers.

When Will GEICO Insurance Withdraw Funds from My Account?

You may want to see also

Policy Loopholes: Common gaps in coverage that insurers exploit

The insurance industry often employs various tactics to maximize profits, and one of the key strategies involves exploiting policy loopholes and gaps in coverage. These loopholes can lead to significant financial losses for policyholders, especially when they are not aware of the limitations and exclusions in their insurance policies. Here's an overview of some common policy loopholes that insurers frequently use:

- Exclusions and Limitations: Insurance policies often contain numerous exclusions and limitations that restrict coverage. For instance, many home insurance policies exclude damage caused by earthquakes, floods, or acts of war. Similarly, health insurance plans may have limitations on pre-existing conditions, annual coverage limits, or exclusions for specific treatments. Insurers rely on these exclusions to avoid paying out claims, leaving policyholders to bear the financial burden. It is crucial for consumers to thoroughly review and understand these exclusions to ensure they are adequately protected.

- Policy Conditions and Requirements: Insurance companies may impose specific conditions and requirements that policyholders must meet to receive full coverage. For example, a life insurance policy might require regular medical exams and health declarations. If a policyholder fails to meet these conditions, their coverage could be reduced or even canceled. Insurers use these conditions to selectively approve or deny claims, often benefiting from the premiums paid by those who meet the requirements.

- Delaying or Denying Claims: Insurers sometimes employ tactics to delay or deny claims, taking advantage of policy loopholes. They may request additional documentation, dispute the cause of loss, or argue about the policyholder's responsibility. These tactics can result in prolonged claim settlements, causing financial strain for the policyholder. Understanding the claims process and your rights as a policyholder is essential to prevent insurers from exploiting these loopholes.

- Misleading or Complex Language: Insurance policies are often filled with complex jargon and language that is difficult for the average consumer to comprehend. Insurers may use this complexity to their advantage, hiding important details or exclusions. For instance, a policy might use vague terms like "reasonable and customary charges" for medical coverage, allowing insurers to deny claims based on their interpretation of these terms. Reading policies carefully and seeking professional advice can help policyholders navigate these loopholes.

Being aware of these policy loopholes is the first step in protecting yourself as a policyholder. It is essential to read and understand your insurance policies thoroughly, ask questions, and seek clarification when needed. Additionally, staying informed about industry practices and regulations can empower consumers to make better decisions and hold insurers accountable for their actions.

Becoming a Property Insurance Risk Management Consultant

You may want to see also

Medical Billing Secrets: How to avoid overpaying for healthcare

The healthcare system can be a complex and often confusing maze for patients, and medical billing is a critical aspect that can lead to financial strain if not navigated carefully. Many individuals find themselves overpaying for healthcare services due to a lack of understanding of the billing process and the various factors that influence costs. This is where "Medical Billing Secrets: How to Avoid Overpaying for Healthcare" comes into play, offering valuable insights to empower patients and ensure they receive fair and transparent medical care.

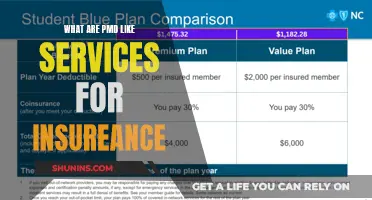

One of the primary secrets revealed in this book is the importance of verifying insurance coverage before any medical procedure. Insurance plans often have specific guidelines and limitations, and what is covered may not always be apparent to patients. By thoroughly reviewing your insurance policy, you can identify what services are included and what out-of-pocket expenses you might incur. This proactive approach can prevent unexpected bills and financial burdens. For instance, understanding the difference between in-network and out-of-network providers is crucial, as in-network services typically result in lower costs for patients.

Another critical aspect covered in the book is the art of negotiating medical bills. Many healthcare providers and facilities are open to negotiations, especially if patients can provide evidence of lower rates or alternative payment options. Patients can request itemized bills to identify any discrepancies or unnecessary charges. Armed with this knowledge, individuals can negotiate with providers to reduce costs, especially for services that might be covered by insurance but still result in significant out-of-pocket expenses. This negotiation strategy can significantly impact the overall financial burden of healthcare.

Furthermore, the book emphasizes the significance of staying informed about healthcare pricing. Medical billing often involves various charges, including facility fees, physician fees, and ancillary services. Patients should inquire about these charges and understand the breakdown of costs. By being proactive and asking the right questions, individuals can ensure that they are not overcharged for services they may not even need. This knowledge is particularly beneficial when making decisions about elective procedures or when seeking second opinions.

In summary, "Medical Billing Secrets: How to Avoid Overpaying for Healthcare" is a comprehensive guide that equips patients with the tools to navigate the intricate world of medical billing. By understanding insurance coverage, negotiating bills, and staying informed about pricing, individuals can take control of their healthcare expenses. This knowledge is a powerful asset, ensuring that patients receive the best possible care without incurring unnecessary financial strain. It empowers individuals to make informed decisions and advocate for themselves in the complex healthcare system.

Maui's Fire Insurance: Prepared for the Worst

You may want to see also

Legal Tactics: Strategies to win insurance claims disputes

The insurance industry is a complex web of policies, regulations, and legal loopholes, and it's no secret that they often have their own interests at heart. When it comes to insurance claims disputes, the battle can be fierce, and knowing the legal tactics to win can make all the difference. Here are some strategies to help you navigate the legal maze and secure the compensation you deserve.

One of the most powerful tools in your arsenal is understanding the policy itself. Insurance policies are often lengthy and filled with technical jargon, making it easy for insurance companies to avoid paying out. Start by thoroughly reading and comprehending the policy. Pay close attention to the coverage limits, exclusions, and conditions. Identify any loopholes or ambiguities that could be used to your advantage. For instance, some policies might have specific time frames for reporting losses, and being aware of these deadlines can prevent your claim from being denied.

Documentation is key. Gather and organize all relevant evidence and records related to your claim. This includes medical reports, repair estimates, witness statements, and any correspondence with the insurance company. Keep a detailed log of all interactions, including dates, names of representatives, and the nature of the conversation. This documentation will not only help you stay organized but also provide concrete evidence to support your case. If there are any discrepancies or misunderstandings, having comprehensive records can help clarify the facts and strengthen your position.

In insurance claims disputes, the burden of proof often lies with the policyholder. This means you need to provide sufficient evidence to prove your case. Be proactive in gathering this evidence and consider hiring experts in relevant fields. For example, if your claim involves property damage, consult engineers or architects who can provide independent assessments and reports. These experts can offer valuable insights and opinions that might not be readily available to the insurance company. Their involvement can significantly enhance the credibility of your case.

Negotiation is an art, and in insurance disputes, it can be a powerful strategy. When negotiating with the insurance company, remain calm, professional, and persistent. Present your case clearly and provide all the necessary documentation to support your claims. Be prepared to negotiate and compromise, but also know your limits. If the insurance company offers a settlement that is far below what you deserve, consider seeking legal advice to determine if you should accept or counter-offer. Remember, the goal is to reach a fair agreement, and sometimes, legal intervention can help tip the scales in your favor.

In some cases, taking your dispute to court might be necessary. If the insurance company refuses to cooperate or offer a fair settlement, consult a legal professional who specializes in insurance law. They can guide you through the legal process, ensuring your rights are protected. Court proceedings can be complex and time-consuming, but they provide a formal platform to present your case and seek a favorable judgment. A skilled attorney can help you navigate the legal system, build a strong case, and increase the chances of a successful outcome.

The Core Concept of Insurance: Protecting What Matters

You may want to see also

Consumer Rights: Your power to demand transparency and fair treatment

The insurance industry often operates in a gray area, and it's easy for consumers to feel like they are at a disadvantage when it comes to their rights and protections. However, it is crucial to remember that you, as a consumer, have the power to demand transparency and fair treatment. Here's how you can exercise your rights and navigate the complex world of insurance with confidence.

Firstly, educate yourself about your rights. Many insurance companies may not disclose all the details about their policies, especially the fine print that could significantly impact your coverage. Take the time to read and understand your policy thoroughly. Look for any hidden clauses, exclusions, or limitations that might affect your claims. Knowing what is covered and what is not is essential to making informed decisions and avoiding unexpected surprises.

Secondly, don't be afraid to ask questions and seek clarification. Insurance agents or representatives should be transparent and provide clear explanations of any policy-related matters. If you encounter vague responses or feel that important information is being withheld, it's your right to insist on a detailed breakdown. For instance, inquire about the claims process, the steps involved, and the expected timeline. A reputable insurance company should be able to provide you with a comprehensive guide or FAQ document to ensure you are well-informed.

Another powerful tool in your arsenal is to compare different insurance providers. Market competition often drives companies to improve their services and policies to attract and retain customers. By shopping around and comparing offers, you can identify the most transparent and customer-friendly policies. Look for companies that provide clear communication, easy accessibility, and fair pricing. Online reviews and independent ratings can also give you valuable insights into how a company treats its customers.

Lastly, remember that you have the right to file a complaint if you feel that your rights have been violated. Insurance regulators and consumer protection agencies are in place to ensure fair practices. If you encounter delays in claims processing, denials without proper justification, or any form of unfair treatment, document your experiences and file a complaint. This not only helps you get the resolution you deserve but also contributes to holding the industry accountable.

In summary, demanding transparency and fair treatment in the insurance industry is within your reach. By educating yourself, asking questions, comparing options, and knowing your rights, you can navigate the complex world of insurance with confidence. Stay informed, stay proactive, and don't be afraid to stand up for your rights as a consumer.

Join Insurance Networks: Steps to Take for Coverage

You may want to see also

Frequently asked questions

The book delves into the often-hidden practices and strategies of the insurance industry, exposing potential pitfalls and providing insights that can help consumers make more informed decisions. It aims to empower individuals to navigate the complex world of insurance and protect their interests.

It highlights the prevalence of insurance fraud and the ways in which fraudulent activities can impact policyholders. The author provides examples of common fraud schemes and offers tips on how to recognize and report suspicious activities, ensuring a fair and transparent insurance environment.

The book emphasizes the importance of reading and comprehending insurance policies. It suggests that a thorough understanding of the policy can lead to better coverage, faster claims processing, and cost savings. By knowing the fine print, individuals can make choices that align with their specific needs and avoid unexpected surprises.