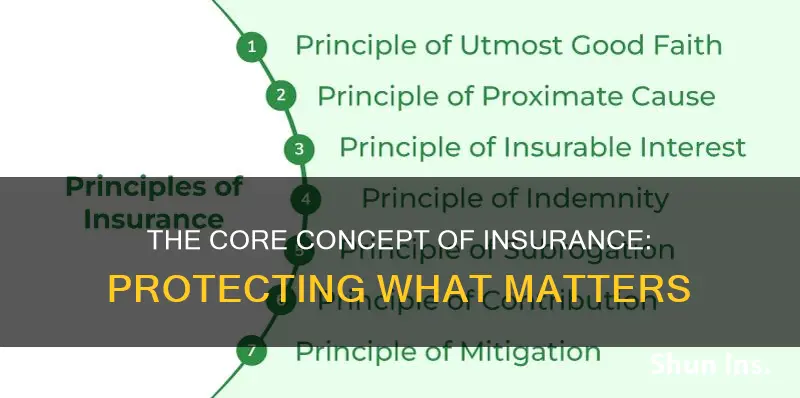

Insurance is a form of protection from financial losses. It is a contract, or policy, between an individual or organisation and an insurance company, where the former receives financial reimbursement from the latter for any damage or loss. This contract is based on seven principles of insurance that both parties must uphold. These principles include the idea that the insured must disclose all relevant facts to the insurer, and that the insurer must provide a level of security to the insured. The principles also outline the ways in which compensation is calculated and paid out, and how ownership of insured property can be transferred.

| Characteristics | Values |

|---|---|

| Number of Principles | 7 |

| Nature of the Relationship | Contract |

| Purpose of Insurance | Financial security and protection from future uncertainty |

| Principle of Utmost Good Faith | Both parties act in good faith and provide clear and concise information |

| Principle of Insurable Interest | The insured must have an insurable interest in the subject matter |

| Principle of Proximate Cause | The nearest cause of loss is considered when calculating claims |

| Principle of Indemnity | Insurance covers only the loss that has occurred |

| Principle of Subrogation | The insurance company can stand in for the insured to recover losses from a third party |

| Principle of Contribution | If the insured has multiple policies, insurers share the loss in proportion to their respective coverage |

| Principle of Loss Minimization | The insured must take all necessary steps to minimise losses |

Explore related products

$104.94 $308.85

What You'll Learn

The principle of utmost good faith

This principle, also known as uberrimae fidei in Latin, dictates that both the insurer and the insured must act with absolute honesty and good faith towards each other before signing an insurance policy. It requires full disclosure of all material facts, meaning that both parties must reveal all relevant information that may influence the decision of the other party.

For the insurer, this means disclosing all critical terms and conditions, including exclusions, investment strategies, and premium-setting factors. For the insured, it involves disclosing personal information such as medical history, lifestyle choices, and existing insurance policies.

The violation of this principle, through non-disclosure or misrepresentation of material facts, can result in legal consequences such as the voiding of the insurance contract or the denial of claims.

Overall, the principle of utmost good faith is essential for maintaining fairness and trust in the insurance sector, protecting both insurers and policyholders by ensuring that all relevant information is disclosed.

The Intricacies of Copay: Unraveling the Insurance Jargon

You may want to see also

The principle of insurable interest

Insurable interest exists when an insured person can obtain a financial or other type of benefit from the continued existence of the object of interest. For example, a person has an insurable interest in their own home or family, but not in a random home or family. This interest can arise through ownership, possession, or a direct relationship with the object or individual.

In an insurance contract, the party must have an insurable interest in the property, goods, or life insured. This interest is typically a financial stake, and any damage to the insured item will result in financial loss. In the case of life insurance, a policyholder must demonstrate insurable interest when naming beneficiaries in the policy. For example, surviving spouses, parents, or children will suffer a financial and emotional loss if the breadwinner passes away.

The requirement of insurable interest is essential for all insurance contracts to be valid. Without it, the insurance policy is not a legal contract and is therefore not enforceable. The principle of insurable interest helps to prevent moral hazards, where a policyholder might have an incentive to cause damage to the property and claim insurance.

Updating Term Insurance: Changing Nominees and Ensuring Peace of Mind

You may want to see also

The principle of indemnity

In other words, the principle of indemnity ensures that the insured is compensated for their loss but will not benefit, gain, or profit from an accident or claim. Nor will they receive less than what is necessary to restore them to their pre-loss financial position. This principle applies to most policies, except personal accident, life insurance, and other similar policies. This is because it is impossible to accurately quantify a human life in monetary terms.

The Unspoken Truths: Term Insurance's Limitations Revealed

You may want to see also

Explore related products

The principle of contribution

Insurance is a financial safety net that provides individuals and businesses with protection against unexpected events. It is a contract between two parties: the insurer (the insurance company) and the insured (the policyholder). The insurer promises to help with the losses of the insured, and the insured pays a premium in return.

For example, let's say Kapil has two health insurance providers, A and B, with coverage amounts of Rs 5 Lakh each. Now, suppose he gets admitted and the total claim is Rs 2 lakhs. Kapil decides to use the policy from insurance A and gets paid Rs 2 lakhs. Kapil cannot then go to insurance B and demand another claim. However, Company A can claim Rs 1 lakh from Company B.

To summarise, the principle of contribution in insurance states that if an individual has multiple insurance policies covering the same risk or property, they can only claim up to the actual amount of their loss. This principle helps to prevent over-insurance and ensures fair allocation of costs among insurers.

Understanding Level Term Insurance: Unlocking the Benefits of Level Term V Policies

You may want to see also

The principle of subrogation

Subrogation is most commonly applied in auto insurance policies but also occurs in property, casualty, and healthcare policy claims. For example, if an insured driver's car is totalled due to the fault of another driver, the insurance company reimburses the insured driver under the terms of the policy. The insurance company then pursues legal action against the at-fault driver to recover the costs of the claim. If successful, the insurance company must divide the amount recovered, after expenses, with the insured driver to repay any deductible paid.

Cigna's Individual Term Insurance Plans: Exploring Personalized Coverage Options

You may want to see also

Frequently asked questions

The basic principle of insurance is that an entity will choose to spend small periodic amounts of money to protect against the possibility of a huge unexpected loss. All the policyholders pool their risks together, and any loss they suffer will be paid out of the premiums they pay.

This principle states that both parties involved in an insurance contract should act in good faith towards one another. In other words, both parties should respect one another and not seek unjust funds or insurance claims. The policyholder must disclose all relevant facts about the subject of the insurance, and the insurer must disclose all features of the policy.

This principle states that the policyholder must have an insurable interest in the life that is insured. In other words, they will suffer some type of financial loss if anything happens to the object or person they are insuring.

The principle of indemnity states that an insurance contract is not meant to make a profit. The purpose of insurance is to compensate a policyholder for losses incurred, putting them back in the same financial position they were in before the loss.

The principle of contribution applies when a policyholder has taken out multiple policies on the same item. It states that each policy must pay their portion of the loss incurred in proportion to their respective coverage.