The wildfires in Maui, Hawaii, have brought devastation to the island, with thousands of homes destroyed and billions of dollars worth of damage. The impact of the fires will be felt across all aspects of life, from homes and businesses to vehicles and travel. As residents begin to pick up the pieces, insurance is at the forefront of everyone's minds. The state's insurance commissioner has asked insurance companies to extend their coverage to give fire victims more time to process their claims.

| Characteristics | Values |

|---|---|

| Insurance rates in Hawaii | Lowest in the nation |

| Reason for low insurance rates | Few natural disasters |

| Impact of the Maui fires | Billions of dollars |

| Insurance companies' response | Ready to help policyholders |

| Insurance claim process | Contact insurance company, discuss temporary housing, work with an adjuster |

| Insurance coverage | Home, boat, vehicle, business, property, medical, renters, travel |

| Maui fire victims | Denied home insurance claims |

| Reason for denial of claims | Hurricane Dora not covered in policy |

| Average price of a single-family home in Hawaii | $450,000 |

What You'll Learn

The impact of the Maui fires on insurance rates

The 2023 wildfires in Maui, Hawaii, have had a devastating impact on the lives of residents, with thousands of homes destroyed and billions of dollars worth of damage. The impact of the fires will be felt across all aspects of life, from homes and vehicles to businesses and travel.

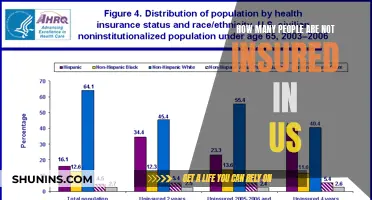

As a result of the fires, insurance rates are expected to rise for Hawaii residents. Before the fires, Hawaii had the nation's lowest rates for homeowner coverage because the state had not suffered many natural disasters. However, the deadly blazes in Maui may cause insurance companies to reconsider their policy rates and coverage.

The state's insurance commissioner, Gordon Ito, has expressed concern that insurers may pull out of the state or limit coverage in certain areas, as has been seen in other states like Florida and California. This could lead to a situation where homeowners struggle to find insurance or face significantly higher premiums.

Industry experts have noted that insurance rates were already rising before the Maui fires, but the disaster has exacerbated the problem. CJ Paet, Vice President of Operations for Cadmus Properties, commented that the reduced number of carriers in the market is causing premiums to increase. Additionally, Kainoa Scheer, a Producer with ACW Group, pointed out that Hawaii policyholders now have to compete with other states and even foreign countries, as disasters worldwide drive up prices.

Family Pact: Insurance or Not?

You may want to see also

The insurance claims process

The impact of the Maui fires will be felt across all aspects of life, from homes to vehicles, businesses, and travel. The first step towards recovery is to file an insurance claim. Here is a detailed guide on the insurance claims process:

- Contact your insurer: Reach out to your insurance provider as soon as possible to initiate the claims process. Most policies require policyholders to notify the insurance company promptly after an incident. Contact them via their toll-free numbers, app, or website.

- Secure your property: Take steps to prevent further damage to your property. This includes contacting the fire department, boarding up destroyed buildings to keep out vandals, and taking necessary measures to ensure your safety.

- File your insurance claim: Submit a "proof of loss claim" to your insurance company, where you itemize your losses and list their value. Be meticulous in documenting your losses, as you will need this documentation to receive compensation.

- Request an advance: If you have lost essential items, you can request an advance on your insurance payout. Send a written letter to your insurance company outlining your request. Any advance received will be deducted from your final payout.

- Track your expenses: Keep a record of your daily living expenses while you are unable to live in your home. Your insurance policy should cover the difference between your usual expenses and your current costs. For example, if you are spending more on food due to a lack of kitchen facilities, you can claim the difference.

- Check for hidden damage: Fire can cause extensive damage behind walls, below floors, and above ceilings. Have professionals inspect your property thoroughly to identify any hidden damage and include it in your claim.

- Communicate with the adjuster: Once your claim is submitted, the insurance company will likely send an adjuster to assess the damage and estimate repair costs. Be courteous and cooperative with the adjuster, but remember that their goal is to minimize the payout. You are under no obligation to accept their initial offer, and you can negotiate for a proper settlement.

- Review the adjuster's estimate: After the adjuster has assessed the damage and determined what is covered by your policy, they will provide a written estimate of the costs. Review this estimate with your insurance company, and once you agree on the amount, they will issue a check.

- Stay in close contact with your insurer: The insurance claims process can be time-consuming and complicated. Maintain regular communication with your insurance company to ensure your claim is processed as promptly as possible.

- Consult a public adjuster or attorney: If you encounter any issues or confusion during the claims process, consider hiring a public adjuster or an attorney specializing in fire insurance claims. They can help you navigate the process, maximize your settlement, and protect your rights.

Most fire insurance claims, when handled correctly, should settle within 90 to 120 days. It is important to be organized, thorough, and patient throughout the process to ensure a smooth and timely resolution.

Hurricanes: Windstorm Insurance Claims

You may want to see also

The role of insurance companies in disaster recovery

The wildfires in Maui, Hawaii, have brought to light the critical role of insurance companies in disaster recovery. While Hawaii has historically enjoyed low homeowner insurance rates due to a lack of natural disasters, the recent fires have destroyed thousands of homes and will incur billions of dollars in rebuilding costs. This event underscores the importance of insurance in providing financial protection and promoting disaster resilience.

Insurance companies play a crucial role in disaster recovery by offering financial protection to their customers, helping to prevent economic hardship, and speeding up the rebuilding process by providing funding soon after a disaster strikes. In the case of the Maui wildfires, insurance companies are encouraging policyholders to initiate their claims and begin the recovery process as soon as possible. This includes various types of insurance, such as home, boat, vehicle, business, property, medical, renters, and travel insurance.

The impact of disasters, such as the Maui wildfires, can be devastating and far-reaching. It affects not just homes but also businesses, vehicles, and personal property. Insurance companies can provide essential support by offering different types of coverage to help policyholders get back on their feet. For example, homeowners and renters insurance can help cover the costs of temporary housing if a home is damaged or destroyed. Business interruption coverage can assist businesses that have been forced to close due to wildfires or power loss.

Additionally, insurance companies can promote risk reduction and hazard mitigation. They can offer financial incentives for implementing vulnerability reduction measures, such as strengthening building components to better withstand natural disasters. These measures not only reduce the potential for loss but also allow for the continued use of structures through successive catastrophe events. By encouraging safer development practices and adopting hazard mitigation roles, insurance companies can play a proactive role in enhancing community resilience.

However, it is important to note that insurance companies do not operate in a vacuum. Their ability to deliver on these benefits depends on a broader landscape of risk management, supported by governments and other stakeholders. As natural disasters become more frequent and severe due to climate change, understanding hazard risks and the role of insurance becomes increasingly crucial in the overall disaster recovery process.

The Ethical and Legal Conundrum of Retroactive Insurance Billing

You may want to see also

The possibility of insurance companies pulling out of high-risk areas

Hawaii has historically enjoyed the lowest rates for homeowner coverage in the nation due to a lack of natural disasters. However, the recent wildfires, which destroyed thousands of homes and caused billions of dollars in damage, may prompt insurance companies to reconsider their rates and coverage. This could have a significant impact on residents and businesses in the affected areas, as they struggle to rebuild and recover.

Insurance companies have been known to retreat from high-risk, high-loss markets following catastrophic events. For example, Hurricane Andrew in Florida in 1992 resulted in US$16 billion in insured losses, setting off alarm bells in the industry. Similar events have left some insurers insolvent and caused others to reevaluate their exposure to risk.

The increasing frequency and severity of natural disasters, such as floods and wildfires, have made it challenging for insurance companies to turn a profit in certain areas. As a result, some insurers are choosing to leave these markets altogether. State Farm, the largest homeowner insurance provider in California, announced in May that it would no longer sell coverage in the state. Similarly, in Florida, homeowners have struggled to find storm coverage as insurers have pulled out due to the risks associated with climate change.

The impact of insurance companies pulling out of high-risk areas can be significant. Residents and businesses without access to insurance may have to bear the full cost of rebuilding and recovering from disasters. This can lead to a slower recovery process, as those without insurance rely on donations, loans, or federal assistance, which may not fully meet their needs.

To address the gap in coverage, some states have created private or public insurance options of last resort. However, these options often come with very high premiums, placing a financial burden on those in high-risk areas. The challenge of balancing exposure and keeping premiums affordable is a complex one, and it remains to be seen how insurance companies and state legislators will address this issue in the future.

Antitheft Devices: What Car Insurers Reward

You may want to see also

The effect of climate change on insurance rates and coverage

The impact of climate change on insurance rates and coverage has been significant, with a rise in natural disasters such as hurricanes, floods, and wildfires, leading to increased claims and financial losses for insurers. In turn, this has caused insurance companies to reconsider their rates, coverage, and availability, with some insurers even retreating from certain markets.

The Impact on Insurance Rates

The frequency and severity of natural disasters have increased due to climate change, resulting in higher insurance claims and losses. For example, the 2019-2020 Australian bushfires caused over $4.4 billion in damage, while Hurricane Harvey in 2017 led to $125 billion in economic damage. As a result, insurance companies are facing greater financial pressures, which are likely to be passed on to consumers in the form of higher insurance rates and premiums. This has already been observed in Florida, where homeowners have struggled to find affordable storm coverage due to the increased risks arising from climate change.

The Impact on Insurance Coverage

In addition to rate increases, insurance companies are also re-evaluating the types of coverage they offer. Some insurers have stopped offering certain types of insurance altogether, while others have limited their coverage options. This reduction in coverage options has left some consumers underinsured or unable to afford adequate insurance coverage. Furthermore, insurers are also considering the impact of climate change on their investment portfolios, particularly in carbon-intensive industries, which may lead to further changes in coverage options and rates.

The Impact on Insurance Availability

The increasing frequency and severity of natural disasters have also led to concerns about the availability of insurance in certain areas. In California, for example, State Farm, the largest homeowner insurance provider, announced it would no longer sell coverage in the state. This decision was likely influenced by the increased risks and costs associated with wildfires and other extreme weather events in the state. Similar trends are expected to continue, particularly in areas highly vulnerable to the effects of climate change, as insurers seek to mitigate their exposure to climate-related risks.

The Impact on the Insurance Industry

The insurance industry is facing significant challenges due to climate change, and companies are having to adapt their business models. Insurers are incorporating climate risk considerations into their product offerings and underwriting processes, and some are even committing to reducing their exposure to carbon-intensive industries. However, there is a risk that the industry may not be acting quickly enough, with some experts arguing that the response so far has been inadequate. As the effects of climate change continue to intensify, the insurance industry will need to play a crucial role in mitigating the financial impacts on individuals, businesses, and communities.

Understanding Term Life Insurance: A Guide to This Essential Coverage

You may want to see also

Frequently asked questions

Yes, as the recent wildfires in Maui have shown, fire insurance is necessary for residents of the island.

Fire insurance in Maui can cover a range of things, including homes, boats, vehicles, businesses, properties, medical, renters, and travel.

To file a fire insurance claim in Maui, you should first contact your insurer through their toll-free contact numbers, app, or website. They will guide you through the claims process.