Changing homeowner's insurance is a straightforward process, but there are a few things to keep in mind to ensure a smooth transition. Firstly, it's important to understand that you can switch insurance providers at any time, but there may be penalties or fees for terminating your current policy early. Therefore, it is often easier to switch closer to your policy's renewal date to avoid these fees. Before making any changes, review your current policy's terms and conditions, including coverage limits, exclusions, and deductibles, to identify any gaps or areas where you may need more or less coverage. This will help you when comparing quotes from different insurance companies, as it's essential to get quotes with matching coverages, limits, and deductibles.

In addition to price, consider other factors such as the insurance carrier's reputation and customer service availability. Once you've found a new policy that meets your needs and offers a better rate or improved coverage, purchase it before cancelling your old policy to avoid a lapse in coverage. Inform your existing insurance company of the cancellation, providing the cancellation date and, if necessary, signing a form to authorize it. Finally, if you have a mortgage, be sure to notify your lender of the change, as they may need to direct payments from your escrow account to the new insurance company.

| Characteristics | Values |

|---|---|

| Can I switch at any time? | Yes, but you may have to pay a cancellation fee if your policy hasn't expired. |

| Should I switch? | If you're unhappy with your current provider, you want to save money, or your coverage needs have changed. |

| When is the best time to switch? | Closer to your policy's renewal date, to avoid cancellation fees. |

| How do I switch? | 1. Assess your insurance needs. 2. Figure out the timing. 3. Compare quotes and purchase new coverage. 4. Cancel your old policy. 5. Notify your lender. |

| What do I need to switch? | Personal details, home details, security features, building details, insurance history, fire protection information, and additional coverage needs. |

What You'll Learn

Check the terms and conditions of your existing policy

Before changing your homeowner's insurance, it is important to check the terms and conditions of your existing policy. This is because there may be penalties for terminating your policy early. By reviewing the terms and conditions, you can understand any potential consequences of switching insurance providers. Here are some key points to consider:

Early Termination Fees

Your current policy may include a penalty or fee for cancelling before the end of the policy term. Check the terms and conditions for details regarding early termination. Understand the financial implications of switching before your current policy expires. In some cases, you may be charged a cancellation fee or incur other costs.

Coverage Lapse

It is essential to ensure that you do not have a lapse in coverage. If your new policy starts after your old policy ends, you may face higher insurance premiums in the future. Insurance providers may view a lapse in coverage as a sign of financial instability. Moreover, if something happens to your home during a coverage gap, you will have to pay for repairs or replacements out of pocket. To avoid this, carefully plan the timing of your switch, ensuring that your new policy starts on the same day your current policy ends.

Refund Eligibility

If you have paid your current policy in advance and cancel before the term expires, you may be eligible for a refund. Review your policy's terms and conditions to understand if you can get a full or partial refund of your remaining payments. Contact your insurance provider to discuss the specifics of your situation.

Policy Details

Familiarize yourself with the specifics of your current coverage, including the policy limits, exclusions, deductibles, and endorsements. This information will be crucial when comparing your existing policy with potential new policies. Understand the types of incidents covered, such as interior and exterior damage, loss or damage of personal belongings, and injuries that occur on the property. Check for any exclusions or hazards that may not be covered in your current policy.

Renewal Dates

Review your current policy's effective dates and renewal process. Understanding when your coverage ends can help you time the switch appropriately. If you have a renewal date approaching, it may be more beneficial to wait until then to avoid early termination fees.

Escrow Account

If you have an escrow account, there may be additional considerations when changing your homeowner's insurance. Contact your lender or mortgage company to discuss how changing insurance providers will impact your escrow payments and overall financial situation. Ensure that you understand the process and any potential complications.

In conclusion, checking the terms and conditions of your existing policy is a crucial step when considering changing your homeowner's insurance. By reviewing the details of your current coverage, you can make an informed decision about switching providers and avoid potential penalties or coverage gaps.

The Hidden Meaning of Riders: Unlocking the Full Potential of Your Insurance Policy

You may want to see also

Think about your coverage needs

Thinking about your coverage needs is an important step in changing your homeowner's insurance. Here are some key points to consider:

- Review your current coverage: Understand your existing policy's terms, conditions, coverages, limits, and deductibles. Evaluate if your coverage needs have changed since you signed up for your last policy. Informing your insurer about any upgrades may even get you a discount on your premium.

- Determine your desired coverage: Consider what you want from your new coverage. Review the limits, exclusions, and deductibles of your current policy and think about what you want to add or remove. For instance, if you've acquired valuable art or jewelry, you may want to add scheduled personal property coverage to raise your payout limits for these items.

- Research and compare different insurers: Obtain multiple quotes from various insurance companies, ensuring that the coverages, limits, and deductibles match your desired coverage. Don't focus solely on price; consider other crucial factors like the insurance carrier's reputation, customer satisfaction ratings, customer service availability, and financial strength.

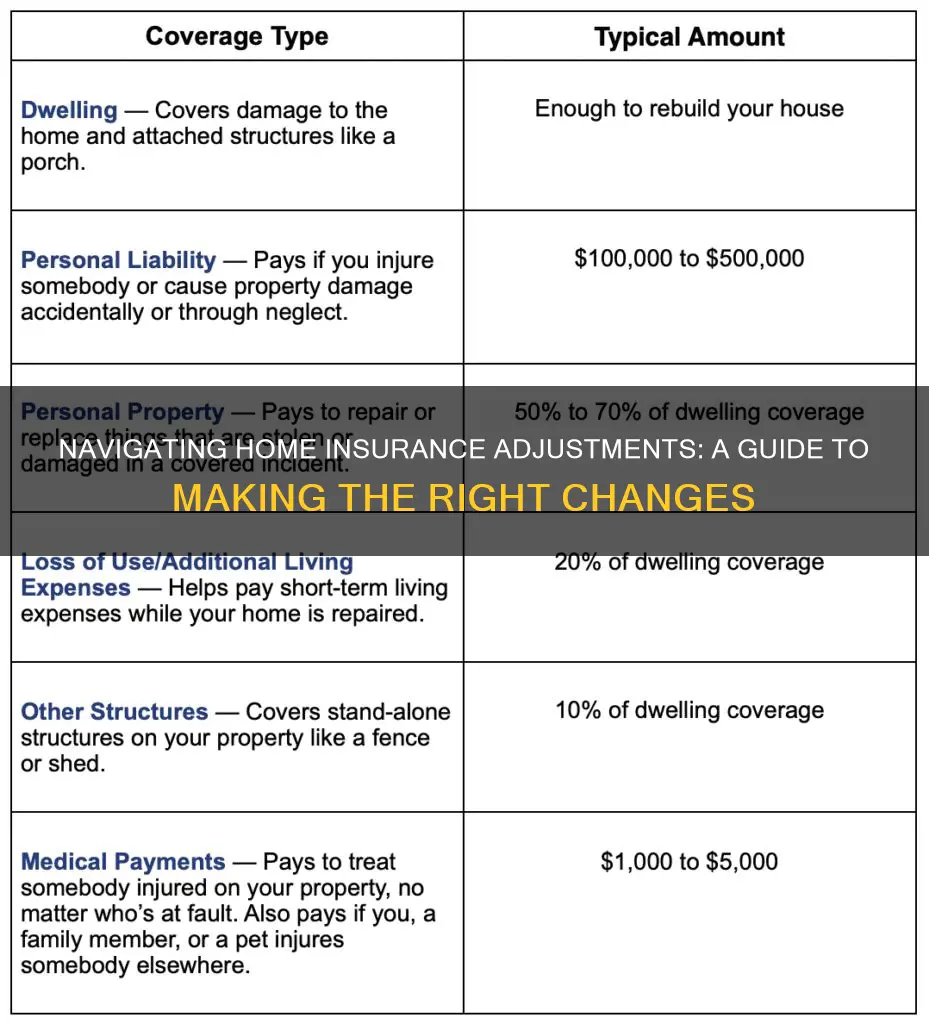

- Understand the different types of coverage: Familiarize yourself with the different levels of coverage offered by insurance companies. These typically include actual cash value, replacement cost, and extended replacement cost/value. Choose the option that best suits your needs and provides adequate protection for your home and belongings.

- Assess your personal and home-related information: When comparing quotes and purchasing a new policy, have relevant personal and home-related information on hand. This includes personal details (name, property address, birth date), home details (number of residents, whether it's your main residence, security features), building details (square footage, year built, flooring, unique features), insurance history, fire protection information, and any additional coverage needs.

Maximizing Insurance Claims: Navigating the Art of the Rebuttal Letter

You may want to see also

Research different insurance companies

Researching different insurance companies is a crucial step in changing your homeowner's insurance. Here are some tips to help you get started:

- Assess your insurance needs: Before you switch insurance providers, it's important to understand what you want from your new coverage. Review your current policy, including its limits, exclusions, and deductibles. This will help you determine if you want your new policy to be similar or if you want to add or remove certain coverages. For example, if you've acquired valuable art or jewelry, you may want to add extra coverage for these items.

- Pick a few companies to research: You can ask family and friends which insurance companies they use or refer to online lists of top-rated insurance providers. Look for companies that offer the specific coverages you need and compare their rates.

- Look into various ratings: In addition to cost, consider other important factors like the insurance carrier's reputation and customer service availability. You can also check customer satisfaction ratings from J.D. Power, the Complaint Index from the National Association of Insurance Commissioners (NAIC), and financial strength ratings from companies like AM Best and Standard & Poor's (S&P).

- Get quotes: Once you've narrowed down your options, start contacting the insurance companies to get quotes. Make sure to get quotes with matching coverages, limits, and deductibles so you can make accurate comparisons. Remember that bundling your home and auto insurance policies can often result in savings.

- Review the fine print: When comparing quotes, pay close attention to the details of each policy. Check for exclusions, endorsements (add-ons that increase or broaden your coverage), deductibles, and coverage types. Understanding the fine print will help you make an informed decision about which policy best suits your needs.

Term Insurance and the Question of Maturity Benefits: Unraveling the Mystery

You may want to see also

Buy the new policy, then cancel the old one

Once you have found a new policy that suits your needs, you can go ahead and purchase it. It is recommended to set the start date of your new policy to be the same day your current policy ends. This will ensure you do not pay for overlapping coverage and that there is no lapse in coverage.

After purchasing your new policy, contact your previous insurer to cancel your current policy. You will need to provide a cancellation date, which should be on or after your new policy's start date. You may also need to sign a form to authorise the cancellation. If you cancel your policy mid-term, you may be entitled to a refund for the remaining months on your policy.

If you have an escrow account, you will need to inform your lender that you are switching insurers. They will need to know the details of your new policy, including the start date, so that they can ensure escrow payments go to the right company.

Finally, although your insurance companies should send your lender the required documents, it is a good idea to contact your lender yourself to inform them of the change.

The Surprising Link Between Cavities and Insurance: Understanding the Unexpected Connection

You may want to see also

Let your lender know

If you have a mortgage, you will likely need to keep your lender in the loop about your new insurance policy. If you pay for your homeowners insurance directly, you should call your lender to notify them that you have switched insurance companies. You may need to email your mortgage company a copy of your new homeowners insurance declarations page.

If you have an escrow account, the process of changing your homeowners insurance policy is a little different. Escrow accounts are third-party accounts that hold funds earmarked for specific purposes. In this case, your escrow account holds onto your homeowners insurance and property tax funds. Your lender will set aside a portion of your monthly payment into this account and, when an annual bill like your homeowners insurance premium is due, the lender will pay the insurance company directly out of the escrow account.

If you have an escrow account, you will need to verify the mortgagee clause for your lender. Your new policy should have the correct information; some companies have a specific mailing address for insurance-related documents. Then, purchase your new policy, ensuring the mortgagee clause is correct.

After that, cancel your old policy, making sure the cancellation date aligns with the effective date of your new policy to avoid a lapse in coverage. Inform your mortgage lender about the change, providing all necessary details about your new policy. The lender should receive a cancellation notice from your prior insurer and a declaration page from the new insurer, but letting your mortgage company know directly about the change might help forestall any complications.

If you receive a refund on your premium, redirect it to your new escrow account to avoid any escrow shortage that could increase your mortgage payments. If you do not repay your escrow, your mortgage lender may not have sufficient funds to pay the new policy, which could result in an increase in your monthly mortgage payment to rebuild the escrow account.

Keeping both your mortgage company and insurance providers well-informed ensures a smooth transition.

The Intricacies of Reciprocal Insurance: Unraveling the Unique Concept in the Industry

You may want to see also

Frequently asked questions

Yes, you can switch homeowner's insurance at any time. However, you may have to pay a cancellation fee if you switch before your current policy expires.

If you have an escrow account, you need to inform your lender that you are switching insurance providers. You will also need to provide them with the details of your new policy.

To compare quotes, you will need to gather personal information, such as your name, property address, birth date, and desired coverage amount. You will also need details about your home, including the square footage, year built, safety features, and any renovations.

It is recommended to review and reassess your homeowner's insurance policy every one to two years, especially if there have been any changes to your coverage needs or personal circumstances.