Life insurance is a way to ensure your loved ones are financially secure in the event of your death. It's a safety net for those who depend on you, helping to cover end-of-life expenses and ongoing costs such as a mortgage or tuition. While you can't take out life insurance on just anyone, it is possible to insure a family member if certain criteria are met. Here's what you need to know about getting life insurance for a family member.

| Characteristics | Values |

|---|---|

| Who can you get life insurance for? | Spouse, child, parent, grandparent, business partner, former spouse, key employee |

| What is insurable interest? | Financial dependence on the insured, or serious financial hardship without them |

| Who qualifies as the insured party? | Family members, business partners, former spouses |

| What are the types of life insurance plans? | Term, permanent, whole, universal, indexed universal, variable universal |

| What are the challenges of buying life insurance for someone else? | Asking for consent, explaining your reasoning, multiple conversations may be needed |

What You'll Learn

Proving insurable interest

To get life insurance on a family member, you must prove insurable interest. Insurable interest is a type of investment that protects anything subject to financial loss. In the context of life insurance, insurable interest means that the policyholder would suffer a financial loss or hardship if the insured person died.

Insurable interest can be proven in several ways, depending on the relationship between the policyholder and the insured. Here are some common scenarios:

- Spouse: If one spouse is a stay-at-home parent or does not earn an income, the other spouse would likely have an insurable interest in them. The working spouse would face financial hardship if the stay-at-home spouse died, as they would need to pay for childcare, housekeeping, and other services.

- Parents: If you rely on your parents financially or expect to be responsible for their final expenses, you may have an insurable interest in them. Life insurance can help cover funeral costs and other expenses.

- Children: While you may not rely on your children for financial support, you can still have an insurable interest in them. For example, if your child has a known health issue or is at risk of developing one, you may want to get them life insurance early to guarantee their insurability as adults.

- Siblings, grandparents, and grandchildren: Insurable interest is generally present in these blood relationships, but you may need to prove financial dependence if the relationship is more distant, such as with stepchildren or stepparents.

- Business partners: If you own a business with someone, you may have an insurable interest in them. Their death could result in a loss of business profits or leave your venture in a difficult position.

It's important to note that you must obtain consent from the insured person and prove insurable interest to the insurance company to purchase a life insurance policy on another person. The insurance company will typically conduct interviews with the policy owner, insured, and beneficiary to confirm their relationship and determine if there is a valid financial interest.

American Equity Life Insurance: Annuity Salesmen Compensation Secrets

You may want to see also

Getting consent from the insured

- Understanding the Insurable Interest: Before seeking consent, it is essential to understand the concept of "insurable interest." This interest exists when you can demonstrate to the insurance provider that the death of the insured person would cause you significant financial harm. In other words, you must prove that you rely on the insured person financially and that their death would result in financial hardship for you. Examples of relationships that typically have an insurable interest include spouses, business partners, parents, and children.

- Discussing the Need for Life Insurance: Approach the family member you wish to insure and explain your reasons for wanting to take out a life insurance policy on them. Emphasize the financial impact their death could have on you and how the policy would provide financial protection. Be sensitive and respectful during this conversation, as discussing life insurance can be a delicate matter.

- Involving the Insured in the Process: Ensure that the insured family member is involved in every step of the application process. They will need to actively provide consent and participate in the necessary procedures. This includes signing the application form and giving their consent for any required medical examinations or interviews.

- Obtaining Necessary Information: The application process will require personal information about the insured, such as their height, weight, lifestyle habits, medical history, and sensitive identification details. Depending on your relationship with the family member, you may need to ask them for this information. Be transparent about the details required and respect their privacy.

- Understanding the Policy Details: Before obtaining the insured's consent, ensure that both you and they fully understand the details of the life insurance policy. This includes the type of policy (term or permanent), the coverage amount, the beneficiaries, and any other relevant terms and conditions. Make sure the insured family member has all the information they need to make an informed decision about consenting to the policy.

- Signed Consent and Legal Considerations: To give their consent, the insured family member will typically be required to sign the application form and any other relevant consent forms. Forging a signature is illegal and can lead to legal consequences. Make sure the consent process adheres to the legal requirements of the insurance company and your local regulations.

- Addressing Any Concerns: Be open to addressing any concerns or questions the insured family member may have about the life insurance policy. Provide them with the necessary support and guidance throughout the process. Remember that their consent should be voluntary and based on a full understanding of the policy's implications.

- Seeking Professional Guidance: If you have any doubts or concerns about the consent process, don't hesitate to seek professional guidance. Consult a qualified insurance agent, financial advisor, or legal professional who can provide you with specific instructions and advice regarding obtaining consent from the insured family member.

Remember, obtaining consent from the insured is a fundamental requirement when taking out a life insurance policy on a family member. By following these instructions and considerations, you can ensure that you navigate this process ethically and effectively.

Cashing Out Whole Life Insurance: What You Need to Know

You may want to see also

Determining the insurable need

In order to buy life insurance for a family member, you must prove that you have an insurable interest in that person. Insurable interest means that you would suffer a financial or other type of loss if the insured person were to die. In other words, you are financially dependent on them or would experience significant financial hardship without them.

Insurable interest can be proven in several ways. Firstly, you can demonstrate that you rely on the family member financially and would suffer financial loss if they were to pass away. This could include situations where the insured person is a primary income earner, and their income contributes to essential expenses such as mortgage payments, college fees, or childcare costs.

Secondly, insurable interest can also be based on sentimental value, love, and affection. This typically applies to relationships by blood or marriage, such as spouses, parents, children, or grandparents. In these cases, it is presumed that the policyholder wants the insured person to live a long and healthy life, and therefore, financial dependence does not need to be proven.

It's important to note that insurable interest must be proven and consented to by the insured person before the life insurance policy can be approved and issued. Additionally, the insurance company will usually conduct interviews with the policy owner, insured, and beneficiary to confirm their relationship and determine the validity of the financial interest in the insured's life.

When determining the insurable need for life insurance on a family member, it is crucial to consider the specific financial obligations and resources within your family dynamic. This includes taking into account factors such as income, existing assets, future expenses, and the potential impact of losing the insured person's contribution.

In summary, by understanding the concept of insurable interest and how it applies to your specific situation, you can effectively determine the insurable need for life insurance on a family member and ensure that your loved ones are financially protected.

Zyn and Life Insurance: What's the Connection?

You may want to see also

Policy ownership and beneficiary designations

When taking out a life insurance policy, it's important to understand the difference between the policyowner, the insured, and the beneficiary. The policyowner has certain rights and responsibilities, including the right to transfer ownership, change beneficiaries, and cancel the policy. The insured is the person whose life is insured, and they have the right to be aware of all policies that list them as the insured. Finally, the beneficiary is the person or entity named to receive the death benefit when the insured person dies.

Policy Ownership

As the policyowner, you have purchased a contract that provides financial protection to your designated beneficiaries at the time of the insured's death. You pay premiums to the insurance company, and in exchange, they agree to pay out a death benefit. You have the right to choose the type of policy that best fits your needs and select the beneficiaries who will receive the proceeds. You also have the right to change the beneficiaries at any time, access the cash value of certain policies, cancel the policy, and request policy loans.

It's important to note that the policyowner is often also the insured, but this is not a requirement. The policyowner can be a different entity, such as a business owner insuring a key employee or a spouse insuring their partner.

Beneficiary Designations

The beneficiary is the person or entity named to receive the death benefit when the insured person dies. There are two types of beneficiaries: primary and contingent. The primary beneficiary is the first in line to receive the death benefit, typically a spouse or family member. The contingent beneficiary is named to receive the benefit if the primary beneficiary is unable to or dies at the same time as the insured.

As a policyowner, you have the right to change beneficiaries at any time. However, if you designate an irrevocable beneficiary, you cannot change it without their consent. It's important to keep your beneficiary designations up to date, especially after major life changes such as marriage, divorce, or the birth of a child.

Life Insurance: Understanding Conversion Clause Benefits

You may want to see also

Premium payments and policy maintenance

Once you've purchased a life insurance policy, you'll need to make regular premium payments to keep it active. The policyholder is responsible for making these payments, and they can be made monthly, annually, or in a lump sum. Most companies accept payments via electronic bank transfer or check, and some may accept credit card payments for the first payment or with an added fee. It's important to set up a reliable payment method to avoid missing payments, as this can lead to lapsed coverage.

For term life insurance, you'll typically pay a premium for a specific period, such as 10, 15, 20, or 30 years. The premium amount and coverage remain the same during this term. After the initial term, you may be able to extend the coverage, but the premium cost will likely increase.

Whole life insurance policies offer permanent coverage and have premiums that are paid until the policyholder reaches a certain age, such as 100. The premium payments and coverage amount remain the same throughout the policy. Some whole life insurance policies also have a cash value component, which functions like a savings account and can be used to pay premiums or take out loans.

If you face financial difficulties and are unable to pay your premiums, most policies include a grace period of around 30 days after the due date. However, if you don't pay within this grace period, your policy will lapse, and you may need to reapply for coverage.

To maintain your life insurance policy, it's important to review it periodically, especially after significant life events such as marriage, divorce, the birth or adoption of a child, or major purchases. You may need to update the policy's beneficiaries, increase or decrease coverage, or make other adjustments to ensure it continues to meet your needs.

Medicare Advantage: Life Insurance Coverage and Benefits Explained

You may want to see also

Frequently asked questions

No, you cannot get life insurance on a family member without their consent. The insured person will need to sign the application and be aware of what they are signing. They must be willing to cooperate throughout the application process.

Insurable interest is when you can prove to an insurance provider that it would be financially harmful to you if the person you aim to take a policy out for passes away. In other words, you must prove that you rely on someone else while they are alive and would suffer financially if that person died.

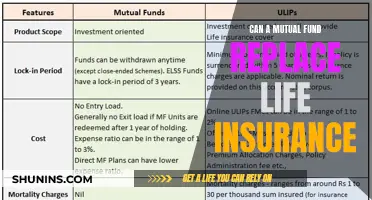

There are two types of coverage available: term and permanent life insurance. Term life insurance is typically sufficient for most families, whereas permanent life insurance policies are generally more expensive.