Knowing if you are insurance credentialed is an important step in ensuring you can provide your services to insurance companies and their clients. This process involves verifying your credentials and ensuring you meet the specific requirements set by insurance providers. It's a crucial step for healthcare professionals, consultants, and other service providers who want to work with insurance companies. Understanding the credentialing process can help you navigate the complex world of insurance billing and ensure you are properly recognized and compensated for your services.

What You'll Learn

- Understand Credentials: Check if your insurance provider offers credentialing for your specific role and expertise

- Review Requirements: Familiarize yourself with the necessary education, experience, and certification criteria

- Verify Credentials: Ensure your credentials meet or exceed the insurance company's standards and guidelines

- Check Recognition: Confirm if your credentials are recognized and accepted by the insurance provider

- Contact Provider: Reach out to the insurance company for clarification on their credentialing process and requirements

Understand Credentials: Check if your insurance provider offers credentialing for your specific role and expertise

To determine if you are insurance credentialed, it's essential to understand the credentials your insurance provider offers and how they apply to your specific role and expertise. Here's a step-by-step guide to help you navigate this process:

- Research Your Insurance Provider's Credentialing Programs: Start by thoroughly researching your insurance company's website or contacting their customer support. Many insurance providers have dedicated sections or pages outlining their credentialing processes and the credentials they offer. Look for information on recognized credentials, certification programs, and any specific requirements or benefits associated with each.

- Identify Your Professional Role and Expertise: Clearly define your professional role and the expertise you bring to the insurance industry. Are you a licensed agent, a specialist in a particular field like health or life insurance, or do you have advanced knowledge in risk management? Understanding your role will help you identify the relevant credentialing options.

- Evaluate the Credentials: Once you have a list of potential credentials, evaluate them based on your expertise and goals. Consider the following:

- Relevance: Does the credential align with your professional expertise and the services you provide?

- Recognition: Are these credentials widely recognized in the insurance industry? Check with industry associations or regulatory bodies to ensure their credibility.

- Benefits: What advantages or incentives do these credentials offer? Do they provide access to specific markets, enhance your professional reputation, or open doors to advanced career opportunities?

- Verify Credential Requirements: Insurance credentialing often involves specific requirements that must be met. These may include educational qualifications, practical experience, passing relevant exams, or completing training programs. Review the requirements for each credential to ensure you meet the necessary criteria. If you have any doubts, reach out to your insurance provider or industry experts for clarification.

- Stay Informed and Updated: Insurance credentialing is an evolving field, with new programs and requirements emerging regularly. Stay updated by regularly checking your insurance provider's website, industry publications, and professional networks. Being proactive in your research will ensure you are aware of any changes that might affect your credentialed status.

By following these steps, you can effectively assess whether your insurance provider offers credentialing that matches your role and expertise. Understanding the credentials available will empower you to make informed decisions about your professional development and career advancement in the insurance industry.

Dropping Phone Insurance: A Guide to Unlocking Your Boost Freedom

You may want to see also

Review Requirements: Familiarize yourself with the necessary education, experience, and certification criteria

To determine if you are insurance credentialed, it's essential to review the specific requirements set by the insurance industry and the governing bodies in your region. Here's a detailed breakdown of the key areas you should focus on:

Education: Insurance professionals typically need a strong educational foundation. This often includes a bachelor's degree in fields related to insurance, finance, business, or a related discipline. Some roles may require advanced degrees, such as a Master's in Business Administration (MBA) or a specialized insurance-related master's program. When reviewing your credentials, ensure you meet the minimum educational standards for the specific insurance role you are interested in.

Experience: Practical experience is another critical factor. Insurance companies often seek candidates with a certain number of years of experience in the industry. This experience can be gained through various roles, such as customer service, sales, claims handling, or underwriting. It's important to document and highlight your relevant work history, as it demonstrates your understanding of the insurance landscape and your ability to apply knowledge in real-world scenarios.

Certification: Insurance certification is a vital aspect of credentialing. There are numerous certifications available, each with its own set of requirements. For instance, the Certified Insurance Counselor (CIC) or the Certified Insurance Underwriter (CIU) are widely recognized certifications. These certifications often require a combination of education, experience, and passing comprehensive exams. Research the specific certifications relevant to your desired insurance field and ensure you meet the eligibility criteria.

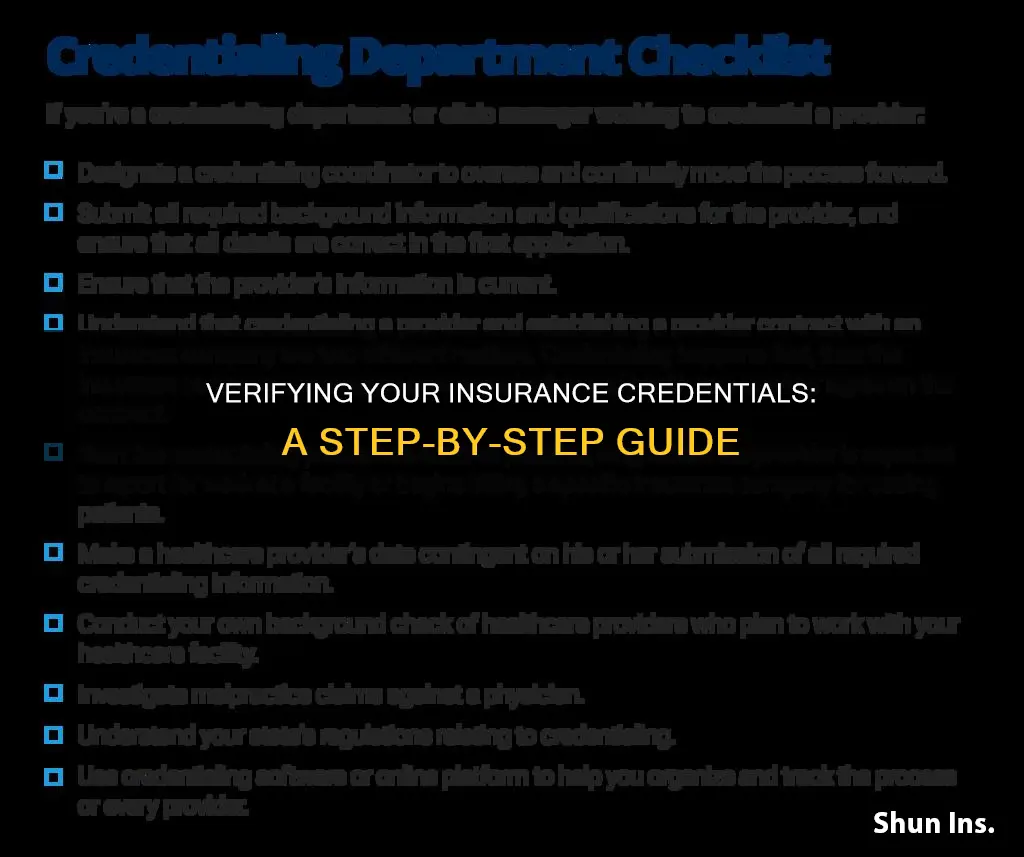

When preparing to become insurance credentialed, it's crucial to thoroughly review and understand these requirements. This includes gathering the necessary educational transcripts, employment records, and certification documents. Additionally, consider seeking guidance from industry professionals or mentors who can provide insights into the specific credentialing process and help you navigate any challenges you may encounter.

Cold-Calling Insurance: Are Consumers Really Listening?

You may want to see also

Verify Credentials: Ensure your credentials meet or exceed the insurance company's standards and guidelines

Verifying your credentials is a crucial step in ensuring that you meet the insurance company's requirements and can provide the necessary documentation to support your professional status. Here's a guide on how to approach this process:

Research the Insurance Company's Requirements: Begin by thoroughly researching the specific insurance company you are working with or applying to. Insurance companies often have detailed guidelines and standards for credentialing. Visit their official website and look for sections related to provider networks, credentialing, or member resources. These areas typically provide information on the criteria they use to verify credentials. You might find a list of required documents, such as licenses, certifications, and education transcripts, along with instructions on how to submit them.

Gather and Organize Your Credentials: Collect all the necessary documents that prove your professional qualifications. This may include your educational degrees or certificates, licenses, certifications, and any relevant experience or training. Ensure that your credentials are up-to-date and valid. Organize them in a clear and logical manner, making it easier to present them to the insurance company. Create a portfolio or a digital folder that highlights your achievements and meets their specific requirements.

Submit the Required Documentation: Follow the insurance company's instructions for submitting your credentials. This could involve filling out an online form, sending physical documents via mail, or uploading them through a secure portal. Pay attention to any deadlines and ensure that you provide all the necessary information. Double-check your submission to avoid any errors or omissions, as this might lead to delays or rejection.

Maintain Currency and Relevance: Insurance companies often have ongoing credentialing processes to ensure that providers remain up-to-date with the latest standards and practices. Stay informed about any changes in regulations or requirements. Regularly review and update your credentials to ensure they meet or exceed the insurance company's current standards. This might involve completing additional training, obtaining new certifications, or renewing existing licenses.

By following these steps, you can effectively verify your credentials and demonstrate your compliance with the insurance company's guidelines. It is essential to stay proactive and keep your professional documentation current to maintain a strong working relationship with insurance providers. Remember, each insurance company may have unique requirements, so always refer to their specific instructions for the most accurate and relevant information.

Federal Insurance Reform: Navigating the Path to Change

You may want to see also

Check Recognition: Confirm if your credentials are recognized and accepted by the insurance provider

To determine if your credentials are recognized and accepted by an insurance provider, you need to verify the following:

- Review the Insurance Provider's Website: Start by visiting the official website of the insurance company you are interested in. Many insurance providers have a dedicated section for 'Provider Network' or 'Network of Caregivers'. This section typically lists the credentials and qualifications that are accepted by the insurance company. Look for a search function or a directory where you can input your credentials to check their recognition status.

- Contact the Insurance Provider: If you cannot find the information on their website, reach out to the insurance company directly. Contact their customer support or provider relations department and inquire about the recognition of your credentials. Provide them with the necessary details, such as your professional license number, certification, or any other relevant documentation. They should be able to confirm whether your credentials meet their requirements.

- Check State or Regulatory Websites: Insurance regulations often vary by state or region. Visit the website of your state's insurance department or the relevant regulatory body. These websites usually provide resources and guidelines for insurance credentialing. You can search for your credentials and find out if they are recognized and accepted in your area.

- Verify with Professional Organizations: Professional associations and certification bodies often have agreements with insurance companies. Contact the organizations that oversee your profession or certification. They can provide information on whether your credentials are recognized by insurance providers and may offer guidance on the verification process.

- Understand the Insurance Plan's Requirements: Different insurance plans may have specific credentialing requirements. If you have access to the insurance plan's documentation, review the details to understand what credentials are accepted. This information is crucial, especially if you are considering a specific insurance plan for your services.

By following these steps, you can ensure that your credentials are recognized and accepted by the insurance provider, allowing you to offer your services with confidence and peace of mind. It is essential to stay updated with any changes in insurance regulations and credential requirements to maintain compliance.

Pediatrician: Specialist or Primary Care?

You may want to see also

Contact Provider: Reach out to the insurance company for clarification on their credentialing process and requirements

If you're unsure about your insurance credentialing status, the most direct way to find out is to contact the insurance provider directly. Here's a step-by-step guide on how to do this effectively:

Gather Your Information: Before reaching out, have the following details readily available:

- Your Personal Information: Name, address, contact information (phone number, email).

- Professional Information: Your license number (if applicable), certification details, and the specific insurance specialties you hold.

- Provider Information: The name of the insurance company you're inquiring about, and if possible, the name of the specific representative you want to speak with.

Contact the Insurance Provider:

- Phone: Call the insurance company's customer service number. Be prepared to provide the requested information and ask directly about your credentialing status.

- Email: Send an email to the appropriate department or representative. Clearly state your request for credentialing verification and include all relevant details.

- Online Portal: Some insurance companies offer online portals where you can access your account information. Check if this option is available and use it to inquire about your credentialing.

Ask Specific Questions:

- "Is my [license/certification] currently active and credentialed with your company?"

- "What specific criteria do you use to determine credentialing?"

- "Can you provide a list of the documents and information I need to submit for credentialing?"

- "Are there any ongoing requirements or updates I need to be aware of regarding my credentialing?"

Follow Up:

- If you don't receive a response within a reasonable timeframe, follow up with the insurance provider.

- Be persistent but professional in your communication.

Consider a Third-Party Verification:

If the insurance company is unresponsive or unclear, consider seeking verification from a third-party credentialing service or professional association.

Remember, clear and direct communication is key. Don't be afraid to ask for clarification and follow up until you receive the information you need.

Aetna Prescription Insurance: User Reviews

You may want to see also

Frequently asked questions

To confirm your insurance credentials, you can contact the insurance company directly. They will have a dedicated department or team that handles credentialing and verification. Provide them with your name, the specific insurance plan you are enrolled in, and any relevant identification. They will then verify your coverage and credentials, ensuring that you have access to the benefits as per your policy.

The required documents for insurance credentialing may vary depending on the insurance provider and the type of coverage. Typically, you will need to submit proof of identity, such as a government-issued ID or passport, along with proof of residence. This could include a utility bill, bank statement, or lease agreement. Additionally, you might need to provide medical records or a physician's statement to validate your health status and any pre-existing conditions.

Yes, many insurance companies offer online portals or websites where you can access your account and view your insurance details. Log in to your online account using your credentials, and navigate to the 'Coverage' or 'Benefits' section. Here, you should be able to find information about your insurance plan, including coverage details, network providers, and any specific requirements for credentialing. If you encounter any issues or need further assistance, you can also reach out to their customer support team for guidance.