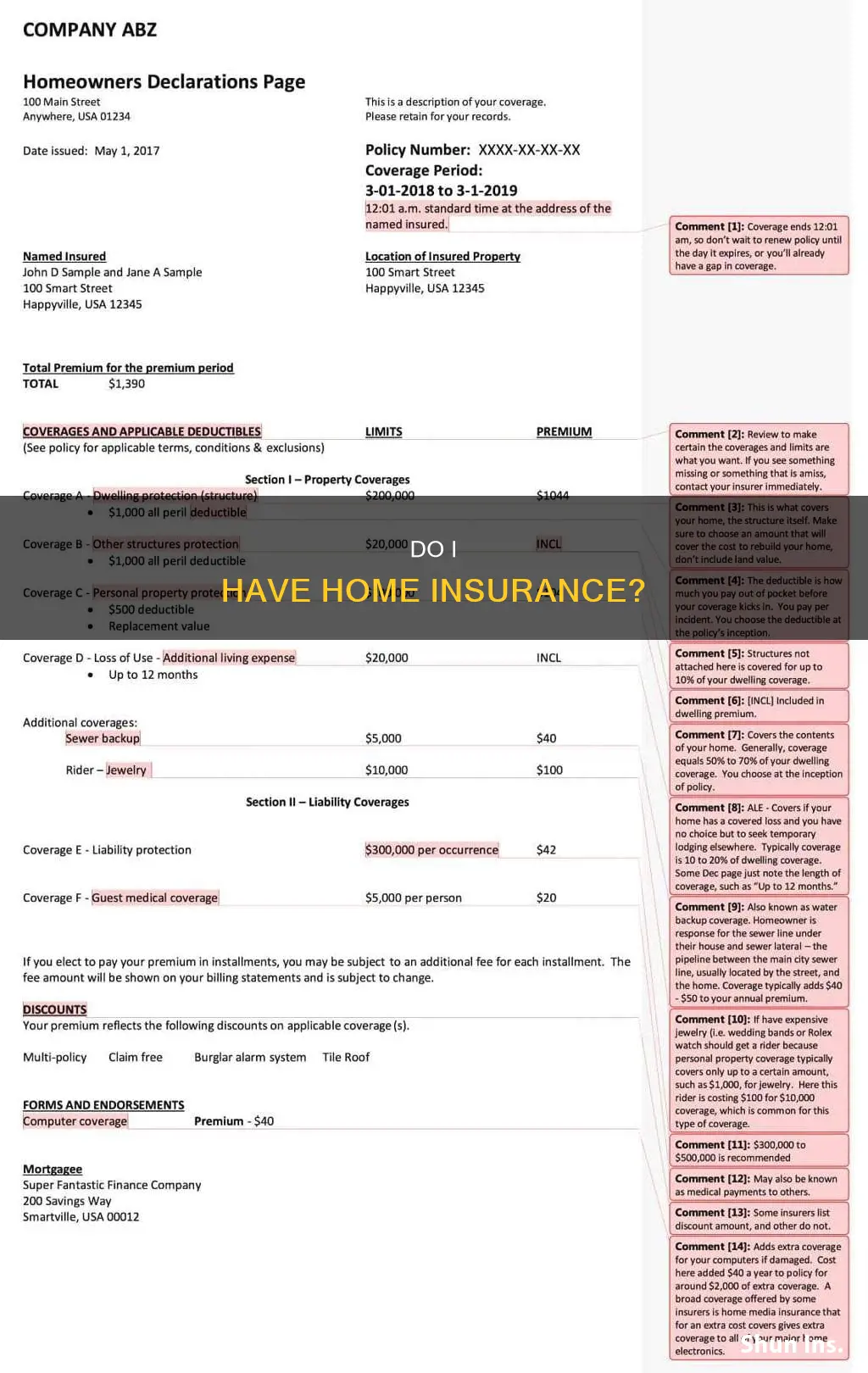

There are several ways to find out if your house is insured. If you own your home, it will only be insured if you've insured it yourself. If you have a mortgage, your mortgage provider will usually require you to have buildings insurance. If you've paid off your mortgage, it's up to you to ensure you have insurance in place. If you live in a leasehold property, your freeholder or building manager may have taken out buildings insurance, but it's important to ask them to confirm. Similarly, if you rent, it is your landlord's responsibility to sort out building insurance, but there is no legal requirement for them to do so. To find out your insurance provider, you can check your bank statements, emails, phone records, or physical copies of your policy.

| Characteristics | Values |

|---|---|

| Finding your insurance company | Check your bank statements, email, phone records, physical documents, or contact your mortgage lender |

| Finding your insurance policy number | Check your hard copy and digital insurance documents, billing statements, or log in to your insurer's website or app |

| Finding out if your home is insured | Check bank statements, email, contact your financial advisor or broker, or your mortgage lender |

What You'll Learn

Check bank statements for insurance payments

If you're unsure whether you have house insurance, one of the best ways to find out is to check your bank statements for insurance payments. This is a quick and easy way to confirm whether you have a policy in place and, if so, which company you are insured with. If you're making regular payments, these should show up on your bank statements with the name of the insurance company.

Checking your bank statements for insurance payments is a straightforward process. Log in to your online banking or refer to your paper statements and look for any outgoing payments to insurance providers. The name of the company should be listed, along with the amount and date of the payment. You can then contact the insurance company directly to confirm the details of your policy.

It's worth noting that insurance payments may appear on your bank statements under the name of the parent company or a subsidiary, so keep an eye out for any transactions that seem related to insurance. If you're unsure, you can always contact your bank to clarify the details of a particular payment.

In addition to checking your bank statements, you can also review your credit card statements for evidence of insurance payments. Insurance payments may appear on your credit card bill, especially if you have set up automatic payments or paid for your policy in instalments. So, be sure to check both your bank and credit card statements to cover all your bases.

If you have a mortgage, your lender may also require you to have buildings insurance in place as a condition of your mortgage. In this case, reviewing your mortgage paperwork can provide valuable information about your insurance provider and policy details. Your mortgage provider should have this information on file, so don't hesitate to reach out and request these details if needed.

Insuring Your Home: A Guide

You may want to see also

Check emails for policy details

If you're unsure whether you have house insurance, checking your emails is a good place to start. Most insurance companies send policy details, renewal reminders, and other information electronically.

Begin by searching your email inbox, including the promotions and spam folders, for terms like "home insurance" or "policy renewal". You could also try searching for the name or email address of your insurance provider, if you know it. If you can't find any emails from your insurance provider, try searching for emails from your insurance agent, who should be able to provide you with a copy of your policy.

If you use an email client like Gmail or Outlook, you could also try using the search tools to narrow down your search. For example, you could try searching for emails from a specific time period, such as when you bought your house or took out the insurance policy. You could also try searching for emails that contain specific words or combinations of words, such as "policy" or "insurance".

If you have more than one email address, be sure to check all of them. It's also worth checking any shared email inboxes that you might have access to, such as a family email address.

If you're still having trouble finding your policy details, try contacting your insurance provider or agent directly. They should be able to help you locate the information you need.

Home Insurance: Annual Premium Hikes

You may want to see also

Contact mortgage lender for insurer details

If you're unsure whether you have house insurance, one of the best things to do is to contact your mortgage lender. They will have the insurer's information on file and will be able to provide you with the details you need.

When you take out a mortgage, your mortgage provider will usually require you to have buildings insurance in place as a condition of the mortgage. This is because they want to protect their investment in your property. Therefore, your mortgage lender will have the details of your home insurance provider and your policy number.

If you have a mortgage on your home, your lender will likely require you to have a certain level of home insurance. This is to ensure that their investment is protected in the event of any damage to the property. As a result, they will have this information readily available and will be able to provide it to you if needed.

You can contact your mortgage lender by phone or email and request the details of your home insurance policy. They may ask for some information from you to verify your identity and locate your specific policy, but they should be able to provide you with the information you need.

It is also a good idea to keep your own records of your home insurance policy. You can do this by keeping a physical copy of your policy documents in a safe place or by storing them electronically in a secure location, such as cloud storage. That way, you can easily access the information if you need to file a claim or make any changes to your policy.

Exploring the Unexpected: The Farmers Insurance Museum

You may want to see also

Check with freeholder or building manager

If you live in a leasehold property, such as a flat, maisonette, or house, the responsibility of insuring the building may fall on the freeholder or the building manager. In such cases, it is important to contact the freeholder or building manager to confirm whether building insurance is in place. You are well within your rights to ask to see the policy documents.

If you are a leaseholder, your freeholder should take care of building insurance for the whole building. If you jointly own the freehold with other leaseholders, you are collectively responsible for ensuring that the entire building is insured. In this case, it is better to take out one policy for the entire building, rather than individual policies, to eliminate the risk of problems arising from some flats being uninsured or insured on a different basis.

Building insurance covers the cost of repairs to the fabric of your building in the event of damage. This includes repairs to the bricks, roof, and windows. It may also cover the full cost of rebuilding your home in the worst-case scenario, as well as loss of rent or alternative accommodation if your home is uninhabitable due to repairs.

It is also important to note that building insurance does not cover your personal possessions. For that, you will need to obtain contents insurance separately. Contents insurance is always your responsibility, regardless of whether you are a leaseholder or a freeholder.

Dustin Johnson's Participation in the Farmers Insurance Open: Will He Compete?

You may want to see also

Contact landlord to confirm insurance

If you're renting, it's important to check with your landlord to confirm whether buildings insurance is in place. Sorting out this type of insurance is the responsibility of your landlord, but there's no legal requirement for them to do so.

If you're a leaseholder, you may be unsure about your insurance responsibilities. In this case, it's important to ask the freeholder or building manager whether buildings insurance is in place. You are within your rights to ask to see the policy documents.

If you're renting a property, landlords or property managers will often require tenants to purchase renters insurance, which usually means showing proof of insurance before moving in. This is to protect both the landlord and the tenant.

There are several ways to show proof of renters insurance to a landlord:

- Provide the declarations page to your landlord: Every renters insurance policy will have a declarations page outlining the details of your coverage, including your name, the policy number, and how much coverage you purchased. You can send a digital or physical copy directly to your landlord as proof.

- Share a digital file with the landlord: You can show digital proof of your insurance by emailing the landlord a copy of the entire policy or the declarations page.

- Show them the physical copy of the renters insurance policy: If you prefer, you can print out a physical copy of the policy as a way of showing proof of coverage.

- Have your insurance agent contact your landlord to confirm: If your landlord accepts verbal confirmation, you can ask the insurance company to call the landlord directly to confirm your coverage.

- Add the landlord as an interested party to the policy: On any insurance policy, you can add an interested party. This means that your landlord will be notified if the policy changes or is canceled, but they won't be added to any of the policy coverage.

- Share the policy number and insurance agency details with your landlord: Share details of the policy with your landlord, such as the policy number, the name of the insurance company, and the amount of coverage purchased.

- Give verbal assurances of your renters insurance policy: Depending on the landlord or property manager, a verbal confirmation may be enough proof. However, keep in mind that there's often no digital or written record of verbal assurances, so it's not the most secure way to show proof of insurance.

Remember, if you own a house, you will only have insurance if you've insured it yourself. If you have a mortgage, your mortgage provider usually requires that you have buildings insurance. If you've paid off your mortgage, it's up to you to ensure you have insurance in place.

Unveiling Farmers Insurance Signal: A Revolutionary Approach to Safe Driving

You may want to see also

Frequently asked questions

If you own your home, it is only insured if you have insured it yourself. If you have a mortgage, your mortgage provider will require you to have buildings insurance. If you've paid off your mortgage, it's up to you to ensure you have insurance in place.

If you live in a leasehold property, such as a flat, maisonette, or house, the freeholder or building manager is usually responsible for buildings insurance. However, this isn't always the case, so it's important to ask them if buildings insurance is in place.

If you rent, it is the landlord's responsibility to sort out building insurance. However, there is no legal requirement for them to do so. It is also your responsibility to insure your own possessions if you want financial protection for any loss, damage, or theft.

To find your home insurance policy and provider, you can check your bank/credit card statements, call your insurance broker or financial advisor, ask your mortgage provider, or check your email history and paperwork for correspondence.