Understanding whether you have PIP (Personal Injury Protection) insurance can be crucial for managing your healthcare costs and rights. PIP insurance is a type of auto insurance coverage that provides financial protection for medical expenses and lost wages resulting from a car accident, regardless of who is at fault. Knowing if you have PIP coverage is essential to ensure you can access the necessary medical care and financial support after an accident. This knowledge can help you navigate the complexities of insurance claims and ensure you receive the benefits you are entitled to. Knowing the details of your PIP coverage can also help you understand your rights and responsibilities in the event of an accident.

What You'll Learn

- Understanding PIP Coverage: Learn what PIP insurance covers and how it benefits you

- Checking Policy Documents: Review your insurance policy to identify PIP coverage details

- Contacting Your Insurer: Reach out to your insurance provider for PIP information

- Reviewing Claims Process: Understand how to file and manage PIP claims

- Comparing with Other Insurance: Compare PIP coverage with other insurance policies you hold

Understanding PIP Coverage: Learn what PIP insurance covers and how it benefits you

Understanding Personal Injury Protection (PIP) coverage is essential for anyone looking to ensure they are adequately protected in the event of an accident. PIP insurance is a type of coverage that provides financial protection for medical expenses, lost wages, and other related costs following an accident, regardless of who is at fault. This insurance is designed to offer immediate relief and support during a challenging time, ensuring that policyholders can focus on their recovery without the added stress of financial burdens.

When it comes to what PIP insurance covers, it typically includes a range of benefits. Firstly, it covers medical expenses incurred as a result of the accident, including hospital stays, surgeries, doctor visits, and prescription medications. This ensures that policyholders can access the necessary healthcare without worrying about the financial implications. Additionally, PIP insurance often provides compensation for lost wages, which can be a significant financial burden during an extended recovery period. It also covers other expenses, such as rehabilitation costs, home healthcare services, and even funeral expenses if the accident results in a fatal outcome.

The benefits of having PIP coverage are numerous. Firstly, it provides peace of mind, knowing that you have a safety net in place should you ever be involved in an accident. This coverage ensures that you can access the necessary medical treatment and financial support without incurring substantial out-of-pocket expenses. PIP insurance also encourages timely medical care, as policyholders are more likely to seek treatment promptly, knowing that the costs will be covered. Furthermore, PIP coverage can help speed up the recovery process by providing financial relief, allowing individuals to focus on their health and well-being.

It is important to note that PIP insurance policies can vary in terms of coverage and benefits. Some policies may offer more comprehensive coverage, including additional expenses like transportation costs to medical appointments or rental car coverage during repairs. Others might have specific limitations, such as a maximum payout for medical expenses or a time frame for claiming lost wages. Therefore, it is crucial to carefully review your policy and understand the extent of your coverage.

In summary, PIP insurance is a valuable asset for anyone seeking financial protection and peace of mind. By understanding what PIP covers, from medical expenses to lost wages, individuals can make informed decisions about their insurance needs. The benefits of having this coverage are clear, offering support during accidents and ensuring that policyholders can access the necessary healthcare and financial assistance. Remember, when it comes to insurance, knowledge is power, and being aware of your PIP coverage can provide significant advantages in the event of an unexpected accident.

Understanding the Mystery of Insurance Bill Subsidies: Unraveling the Financial Aid Enigma

You may want to see also

Checking Policy Documents: Review your insurance policy to identify PIP coverage details

To determine if you have Personal Injury Protection (PIP) insurance, a crucial step is to review your insurance policy documents thoroughly. PIP coverage is a type of auto insurance that provides financial protection for medical expenses, lost wages, and other related costs for you and your passengers after an accident, regardless of who is at fault. Here's a detailed guide on how to check your policy for PIP coverage:

- Locate Your Policy Documents: Start by gathering all your insurance policy documents. These typically include your auto insurance policy, any endorsements or riders, and the declarations page. These documents should be readily available in your insurance binder or accessible through your insurance provider's online portal.

- Understand the Policy Language: PIP coverage is often included as part of a broader auto insurance policy. Carefully read through the policy to locate the section that discusses coverage types and limits. Look for terms like "Medical Payments," "No-Fault Benefits," or "Personal Injury Protection." The policy should clearly state whether PIP is included and, if so, the coverage amount.

- Identify Coverage Limits and Exclusions: PIP policies usually have specific coverage limits, which determine the maximum amount your insurance will pay for PIP-related expenses. These limits can vary widely, and it's essential to understand what is covered and what is not. Some policies may exclude certain expenses, such as non-medical costs or pre-existing conditions. Review the policy to ensure you know the extent of your coverage.

- Check for Endorsements or Riders: Sometimes, PIP coverage can be added as an endorsement or rider to your policy. These additional provisions provide extra coverage for specific situations. Review all endorsements and riders to see if PIP is included and under what conditions. This step is crucial as it can provide additional benefits that are not part of the standard policy.

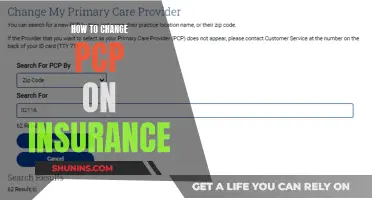

- Contact Your Insurance Provider: If you're still unsure about the presence or details of your PIP coverage, don't hesitate to reach out to your insurance company. Their customer service representatives can provide clarification and answer any questions you may have. They can also assist in reviewing your policy and ensuring that all coverage aspects are clear.

By thoroughly checking your policy documents, you can accurately determine the extent of your PIP coverage and ensure that you are adequately protected in the event of an accident. It is always advisable to keep your insurance policy information organized and easily accessible to facilitate quick reference when needed.

AT&T Phone Insurance: What You Need to Know

You may want to see also

Contacting Your Insurer: Reach out to your insurance provider for PIP information

If you're unsure about your Personal Injury Protection (PIP) insurance coverage, the most direct way to find out is by contacting your insurance provider. PIP is a type of insurance that covers medical expenses and lost wages for you and your passengers if you're involved in a car accident, regardless of who is at fault. This coverage is typically included in auto insurance policies in many states, but it's essential to verify the specifics.

When you reach out to your insurer, you can ask about the following:

- Coverage Details: Inquire about the extent of your PIP coverage. This includes understanding the limits (how much the insurer will pay) and the types of expenses covered, such as medical bills, hospital stays, and rehabilitation costs.

- Policy Documents: Request a copy of your insurance policy or a summary of the coverage. This document will outline all the terms and conditions, including PIP-related provisions.

- Claims Process: Ask about the process for filing a PIP claim. Understanding this process will help you know what to do if you ever need to make a claim.

- Contact Information: Obtain the correct contact details for your insurer, including phone numbers, email addresses, and any relevant departments or representatives.

Here's a step-by-step guide to the process:

- Locate Your Insurer's Contact Information: You can usually find this on your insurance card or in the policy documents you received when you purchased the insurance.

- Call or Email: Reach out to your insurer using the provided contact details. Explain that you are seeking information about your PIP coverage.

- Ask Specific Questions: Be clear and direct in your inquiries. For example, "Can you confirm if my PIP coverage includes [specific medical expense]?" or "What is the procedure for filing a PIP claim?"

- Request Documentation: If needed, ask for any additional documents or explanations to ensure you fully understand your coverage.

Remember, insurance providers are there to assist you, so don't hesitate to ask for clarification if you don't understand something. Knowing your PIP coverage is crucial for financial protection and peace of mind, especially in the event of an accident.

Becoming an Insurance Underwriter: Texas TDI Requirements

You may want to see also

Reviewing Claims Process: Understand how to file and manage PIP claims

Understanding the claims process for Personal Injury Protection (PIP) insurance is crucial for anyone involved in a covered accident. PIP insurance is designed to cover medical expenses and lost wages resulting from a car accident, regardless of who was at fault. Knowing how to file and manage a PIP claim can significantly impact your recovery and financial well-being. Here's a step-by-step guide to help you navigate the process:

- Document Your Injuries and Expenses: After an accident, it's essential to document all your injuries and related expenses. Keep records of medical bills, prescriptions, and any other costs associated with your treatment. Additionally, if you've missed work due to your injuries, collect pay stubs or other documentation to prove your lost wages. The more comprehensive your records, the smoother the claims process will be.

- Contact Your Insurance Company: As soon as possible after the accident, notify your insurance provider. They will guide you through the initial steps of filing a claim. Provide them with the necessary details, including the date and location of the accident, the other party's information (if available), and a brief description of what happened. Be honest and accurate in your reporting to ensure a fair assessment of your claim.

- File a PIP Claim: Your insurance company will provide you with the specific requirements and forms needed to file a PIP claim. This process typically involves submitting the documented evidence of your injuries and expenses, along with any supporting documentation, such as police reports or witness statements. The insurance adjuster will review your claim and may request additional information to verify the details.

- Understand Coverage and Benefits: PIP insurance policies can vary in terms of coverage and benefits. Review your policy documents to understand what is covered and what is not. Common PIP benefits include medical expenses, lost wages, and, in some cases, reimbursement for household services or funeral expenses. Knowing your coverage will help you manage expectations and ensure you receive the full extent of your benefits.

- Follow Up and Communicate: Don't be afraid to follow up with your insurance company during the claims process. If you have questions or concerns, reach out to your adjuster or policyholder service representative. They can provide updates on the status of your claim and address any issues that may arise. Regular communication ensures that your claim is processed efficiently and that you are aware of any changes or developments.

- Seek Legal Advice if Necessary: In complex or disputed cases, consider consulting a personal injury attorney who specializes in PIP claims. An attorney can provide valuable guidance, ensure your rights are protected, and help negotiate a fair settlement. They can also assist in filing a lawsuit if the insurance company fails to provide the necessary benefits.

Remember, the claims process can vary depending on your insurance company and state regulations. Always refer to your policy and seek professional advice when needed. Being proactive and well-informed will contribute to a smoother experience when filing and managing your PIP claims.

Understanding Public Enrollment Services: A Guide to Insurance Access

You may want to see also

Comparing with Other Insurance: Compare PIP coverage with other insurance policies you hold

When comparing Personal Injury Protection (PIP) insurance with other insurance policies, it's essential to understand the unique aspects of PIP coverage and how it differs from other types of insurance. PIP insurance is designed to provide financial protection for medical expenses, lost wages, and other related costs following an accident, regardless of who is at fault. This sets it apart from liability insurance, which primarily covers damages and injuries to others.

One key difference is the scope of coverage. PIP policies typically offer more comprehensive protection, often including medical expenses, lost wages, and sometimes even rehabilitation costs. This is in contrast to liability-only policies, which usually cover damages and injuries to others but may not provide extensive benefits for the policyholder's own medical expenses. For instance, if you have a liability-only policy and are involved in an accident, your coverage might not cover your own medical bills, whereas PIP would.

Another aspect to consider is the no-fault principle. PIP insurance operates under a no-fault system, meaning you can file a claim regardless of who caused the accident. This is a significant advantage, especially in states with no-fault insurance laws, as it ensures financial protection even if you are not at fault. In contrast, traditional insurance policies often require proof of fault to make a claim.

When comparing PIP with other insurance policies, it's crucial to review the coverage limits and exclusions. PIP policies usually have higher coverage limits compared to liability-only policies, providing more extensive financial protection. However, it's essential to understand any limitations or exclusions, such as the potential impact of a deductible or the coverage period. For instance, some PIP policies may have a deductible that you must pay out of pocket before coverage begins.

Additionally, consider the overall insurance portfolio you have. If you have multiple insurance policies, such as health insurance, auto insurance, and homeowners' insurance, it's essential to understand how PIP fits into this picture. PIP insurance can complement other policies by providing additional financial protection for accident-related expenses, ensuring a more comprehensive safety net.

California Insurance Reps: Unveiling Salary Insights for Certified Professionals

You may want to see also