A subsidy on an insurance bill is financial assistance from the government to help pay for health insurance coverage. The Affordable Care Act (ACA) requires everyone to have health insurance. If you're not insured through your employer or eligible for programs like Medicare or Medicaid, you may qualify for a health insurance subsidy. This subsidy is not a loan and does not need to be paid back. The amount of subsidy received depends on your income and household size. There are two types of health insurance subsidies: the Advance Premium Tax Credit (APTC) and Cost-Sharing Reductions (CSRs). The APTC lowers your monthly health insurance payment, while CSRs reduce out-of-pocket costs for care, such as deductibles, coinsurance, and copays.

| Characteristics | Values |

|---|---|

| Definition | Financial assistance from the government to help pay for health insurance |

| Eligibility | People who are not insured through their employer or eligible for Medicare or Medicaid |

| Types | Advance Premium Tax Credit (APTC), Cost-Sharing Reductions (CSRs) |

| Income Requirements | Income must be between 100% and 400% of the Federal Poverty Level (FPL) |

| Application Process | Apply through state's health insurance exchange or Healthcare.gov |

| Calculation | Difference between the premium for the second-lowest-cost Silver plan and the premium cap set by the state |

| Repayment | No repayment required; any excess subsidy will not be returned, and any shortfall will not be penalised |

What You'll Learn

The Affordable Care Act (ACA) and eligibility

The Affordable Care Act (ACA) was signed into law by President Barack Obama in March 2010. It is also known as Obamacare, and its primary goals are to make affordable health insurance available to more people and expand Medicaid to cover more adults. The ACA requires most Americans to have health insurance, and those who are not insured through their employer or government programs like Medicare or Medicaid must purchase their own insurance or pay a penalty.

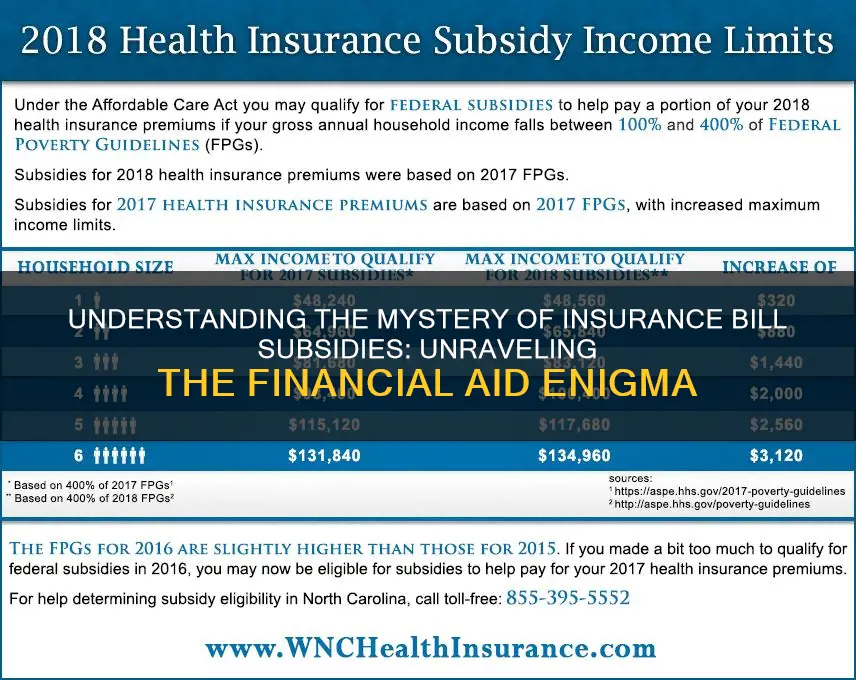

The ACA offers subsidies to help people pay for their health insurance coverage. These subsidies are available to those whose income is between 100% and 400% of the federal poverty level (FPL). However, if your income is above 400% FPL, you may still qualify for the premium tax credit. The FPL is adjusted annually, and the amount of subsidy you can receive depends on your income relative to the FPL.

There are two types of subsidies available under the ACA: the Advance Premium Tax Credit (APTC) and Cost-Sharing Reductions (CSRs). The APTC helps lower the monthly premium payment for health coverage, while CSRs reduce out-of-pocket costs for care by lowering deductibles, coinsurance, copays, and out-of-pocket maximums.

To qualify for an ACA subsidy, your eligibility depends on your income compared to the FPL, the number of people in your household, and the cost of health coverage in your state. If your household income is between 100% and 250% of the FPL, you may be eligible for both the APTC and CSRs. If your income is above 250% of the FPL, you may still be eligible for the APTC, and you will not have to pay more than 8.5% of your expected annual income toward premiums.

The ACA has continued to evolve, and in 2021, President Biden signed an executive order to focus on rules and policies that limit Americans' access to healthcare. This led to the American Rescue Plan Act (ARPA), which extended eligibility for ACA health insurance subsidies to those with incomes over 400% of the poverty level. Additionally, the Inflation Reduction Act of 2022 extended the expanded ACA for three years, through 2025, and allowed more middle-class citizens to receive premium assistance.

Understanding Contracted Discounts in Insurance Billing: Unraveling the Complexities

You may want to see also

The two types of health insurance subsidies

Health insurance subsidies are financial assistance provided by the government to help individuals and families pay for their health coverage. The amount of money paid by the government depends on the individual's income. There are two types of health insurance subsidies: the premium tax credit subsidy and the cost-sharing subsidy.

Premium Tax Credit Subsidy

The premium tax credit subsidy, also known as the Advance Premium Tax Credit (APTC), covers a portion of an individual's monthly health insurance payment, known as the premium. Depending on eligibility, an individual may pay as little as $0 in premiums if the plan does not cover abortion services that cannot be paid for with federal dollars (non-Hyde abortion services). The premium tax credit is available for any metal tier plan, including Bronze, Silver, Gold, and Platinum.

Cost-Sharing Subsidy

The cost-sharing subsidy, also known as Cost-Sharing Reductions (CSRs), makes using a health plan more affordable by lowering out-of-pocket expenses such as deductibles, copayments/coinsurance, and sometimes the out-of-pocket maximum. CSRs are only available if an individual selects a Silver plan.

It is important to note that individuals may qualify for both types of subsidies. In fact, if an individual qualifies for a cost-sharing subsidy, they automatically become eligible for a premium subsidy as well.

Term Insurance: Navigating the Fine Print to Avoid Crashes

You may want to see also

How to apply for health care

There are several ways to apply for health care, and the method you choose will depend on your personal circumstances. Here are some of the most common ways to apply:

- Online: Using HealthCare.gov is the fastest way to apply for health insurance. You can log in or create an account to get started.

- By Phone: Contact the Marketplace Call Center to ask a question, start or finish an application, compare plans, or enroll. They are available every day, except certain holidays.

- In-Person: Find local help by searching for people and organizations in your community who can assist you with the application process. Some offer help in languages other than English and in-person assistance.

- By Mail: Fill out and mail in a paper application. You will receive eligibility results in the mail within 2 weeks.

- Through an Agent/Broker: A trained insurance professional can help you enroll in a health insurance plan. Agents may work for a single health insurance company, while brokers may represent several companies.

- Through an Enrollment Partner: Apply for and enroll in a Marketplace plan through an approved enrollment partner, such as an insurance company or online health insurance seller.

Applying for Health Care as a Veteran

If you are a veteran or service member, you can apply for VA health care benefits by filling out an Application for Health Benefits (VA Form 10-10EZ). You will need to provide the following information:

- Social Security numbers for you, your spouse, and your qualified dependents.

- Your military discharge papers (DD214 or other separation documents), military service history information, and details about exposure to any toxins or hazards.

- Insurance card information for all insurance companies that cover you, including any coverage provided through a spouse or partner.

- Gross household income from the previous calendar year for you, your spouse, and your dependents.

- Your deductible expenses for the past year, including certain health care and education costs.

You can apply by phone, mail, in person, or with the help of a trained professional such as an accredited attorney or claims agent.

The Many Faces of Term Insurance: Unraveling the Five Distinct Forms

You may want to see also

Medicaid and other programs

Medicaid is a joint federal and state program that provides free or low-cost health coverage to eligible individuals. It is the single largest source of health coverage in the United States, with 76.9 million people covered as of January 2024.

Medicaid is funded by both the federal government and individual states, and it is administered by the states according to federal requirements. The program provides health coverage to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities.

Eligibility for Medicaid is based on financial and non-financial criteria. Financially, eligibility is determined by an individual's income and family size. Non-financial eligibility criteria include citizenship or qualified non-citizen status, residency in the state where one is applying, and, in some cases, age, pregnancy, or parenting status.

In addition to the Medicaid program, there are other programs that can help individuals with the cost of health insurance. These include:

- The Children's Health Insurance Program (CHIP): This program provides health coverage to children and is administered by states, with joint funding from the federal government.

- Premium Tax Credit: This subsidy helps pay for monthly health insurance premiums and is based on income and household size.

- Cost-Sharing Reductions: These subsidies reduce out-of-pocket costs for care by lowering deductibles, coinsurance, and copays.

Maximizing Insurance Reimbursement for Massage Therapy: A Guide to Efficient Billing

You may want to see also

How much a subsidy is worth

The value of a health insurance subsidy depends on your income and the second-lowest-cost Silver plan available to you on the marketplace. The amount of subsidy you can get will depend on which state you live in, your income, and the cost of the second-lowest-cost Silver plan.

The biggest determinant of how much of a subsidy you can get is how your income compares to the federal poverty level. You should be able to get a subsidy if your income is worth 400% or less of the poverty level. However, each state may also have its own guidelines around how much aid they can offer and who qualifies.

Based on your income, your state will determine the maximum amount that it thinks you should reasonably be paying on your health insurance premiums. This maximum spending level is known as the premium cap. The premium cap is written as a percentage of your income. For example, a state may say that someone with an income of $40,000 shouldn’t be spending any more than 9% of their income on insurance premiums.

In order to standardize how much a premium is for a marketplace plan, the government uses the premium of the second-lowest-cost Silver plan. The subsidy you receive is the difference between the premium for the second-lowest-cost Silver plan and your premium cap, which your state has set for your income level.

There are two types of health insurance subsidies available: the advance premium tax credit (APTC) and cost-sharing reductions (CSRs).

The advance premium tax credit is a tax credit that helps lower the costs of monthly health insurance premiums. You may qualify for the credit if your household income is between 100% and 400% of the federal poverty level.

Cost-sharing reductions, sometimes called extra savings, work similarly to the premium tax credit, with a couple of key differences. They only apply to Silver plans, unlike the tax credit, which you can apply to any health insurance plan. However, you do calculate the value of your subsidy in the same way, by using the second-lowest-cost Silver plan.

**Billing Insurance for Couples Counseling: Navigating the Process Together**

You may want to see also

Frequently asked questions

A subsidy is financial assistance from the government to help cover the costs of your health insurance. It is not a loan and does not need to be paid back.

Your eligibility for a health coverage subsidy depends on your income, family size, citizenship status, and location. Your income is the most important factor, and you can qualify for a subsidy if you make up to four times the Federal Poverty Level (FPL).

You can find out if you qualify for subsidies when you enroll through Stride, HealthCare.gov, or your state exchange.

There are two types of health insurance subsidies available: the Advance Premium Tax Credit (APTC) and Cost-Sharing Reductions (CSRs).